April 2025

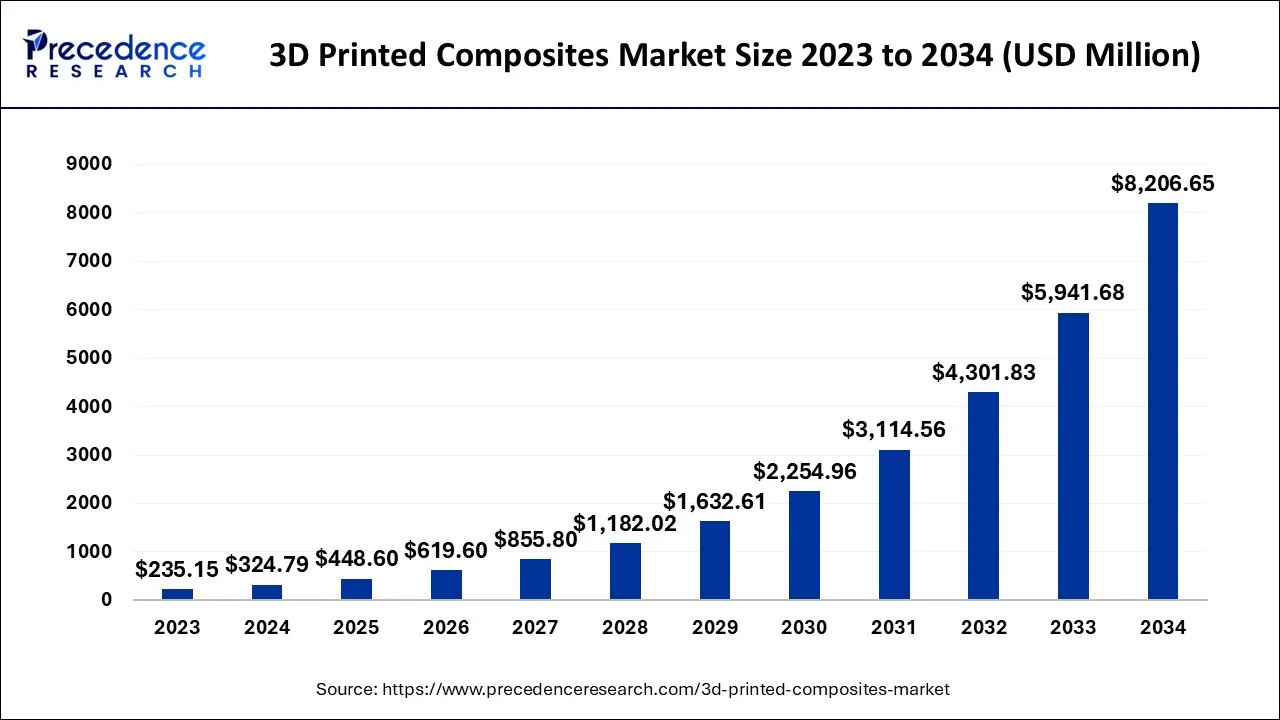

The global 3D printed composites market size accounted for USD 324.79 million in 2024, grew to USD 448.60 million in 2025, and is expected to be worth around USD 8,206.65 million by 2034, poised to grow at a CAGR of 38.12% between 2024 and 2034.

The global 3D printed composites market size is expected to be valued at USD 324.79 million in 2024 and is anticipated to reach around USD 8,206.65 million by 2034, expanding at a CAGR of 38.12% over the forecast period from 2024 to 2034.

The 3D printed composites market is a rapidly growing industry that involves the production of composite materials using additive manufacturing technology. Composites are materials that are made up of two or more different materials that combine to create a new material with improved properties. In the 3D printed composites market, composite materials are created using a combination of reinforcing material (such as carbon fiber, glass fiber, or Kevlar) and a thermoplastic or thermosetting polymer.

The use of 3D printing technology allows for the precise placement of the reinforcing material within the polymer matrix, resulting in composites with superior strength, stiffness, and durability. The 3D printed composites market is being driven by the increasing demand for lightweight and high-performance materials in industries like aerospace, automotive, and defense. These industries are looking to reduce weight and improve fuel efficiency while maintaining or improving the strength and durability of their products.

The market is anticipated to grow due to increasing demand for prototyping tools from various sectors and competitive research & development in 3D printing, mainly in the healthcare, aerospace, automotive, and defense sectors. The application of 3D printing in the industrial sector is described by the term additive manufacturing (AM). This process includes the incorporation of material to generate a 3D file. Composites have replaced metals and other components in a variety of applications due to their superior characteristics at a reduced weight.

| Report Coverage | Details |

| Market Size in 2024 | USD 324.79 Million |

| Market Size by 2034 | USD 8,206.65 Million |

| Growth Rate from 2024 to 2034 | CAGR of 38.12% |

| Largest Market | North America |

| fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Composite Type, End-User, Technology Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cost-effective

3D printing technology has revolutionized the manufacturing industry by reducing the overall cost of production. Using 3D printing, manufacturers are able to produce complex parts and structures in a single process, reducing the need for multiple components and assembly steps. The production cost of 3D printing is around 5.5 times less than PMMA and 10.2 times EM. The initial equipment cost for the additive manufacturing method is lower. Mainly in the aerospace industry, costly raw materials are used which have low weight and high performance. These high-performance materials are costly to machine down by using conventional manufacturing methods and are also costly to purchase.

Lightweight materials for aircraft

3D printed composites are lightweight and have high strength-to-weight ratios, making them ideal for use in aerospace, automotive, and other industries where weight is a critical factor. Engineering mostly opts for alternatives to reduce the consumption of fuel and enhance energy efficiency while building and designing aircraft. The implementation of 3D printing techniques assists in reducing the mass of aircraft by testing various high-strength and lightweight materials. Industrial 3D printers are mainly used to produce parts and components with minimal waste. Additionally, 3D printing technology assists in evaluating lightweight materials by printing various components on demand.

High cost

The cost of 3D printing technology is high, and the cost of 3D-printed composites is even higher. This is a significant constraint for small and medium-sized enterprises that may not have the financial resources to invest in technology. The production cost is increased due to high-end instruments. The cost was a major hindrance during the COVID-19 period due to strict regulations and a lack of raw materials.

Limited materials and limited size

The range of materials that are used for 3D printing is limited. While some composite materials are used, the range of available options still needs to be narrow compared to traditional manufacturing processes. The size of the components that are 3D printed is currently limited, which is a constraint for industries including aerospace, where large components are required.

Aerospace and defense

The aerospace and defense industries are significant consumers of composite materials, and 3D-printed composites offer an efficient and cost-effective way to produce parts with high strength and low weight. 3D printing for composite materials in this industry helps reduce production time, minimize waste, and enable the creation of more precise and customized parts. For instance, companies such as NASA and SpaceX are working to develop societies by using 3D printing technology on other planets like Mars.

Construction industry

The construction industry is starting to explore the use of 3D-printed composites for building structures. Composite materials offer improved strength, durability, and resistance to environmental factors. 3D printing also enables the creation of complex geometries that improve building performance and reduce material waste.

Based on the composite type, the market is segmented into glass fiber composite, aramid & graphene fiber composite, and carbon fiber composite. The carbon fiber composite is anticipated to expand at the fastest CAGR from 2024 to 2034. The growth is due to the rising demand in the defense and aerospace sector. 3D printing with composites enables the production of lightweight parts with complex geometries, which significantly reduce the weight of aircraft and vehicles, leading to improved fuel efficiency and performance. Arevo developed a laser-based technique for 3D printing using carbon fiber.

The fiberglass sector is anticipated to grow at a remarkable pace from 2024 to 2034. Fiberglass is a strong, low-cost reinforcing substance with some flexibility. It increases the strength of parts over that of plastics and is an excellent starting place for printing with strengthening.

On the basis of the end-user, the 3D printed composite market is segmented into healthcare, automotive, aerospace & defense, as well as others. The aerospace & defense sector is anticipated to grow at the highest CAGR from 2024 to 2034. The aerospace and defense sector adopted composite materials for various uses, including interiors, engine components, body components, and others. The physical characteristics of components of aircraft have the advantage of decreasing the payload of aircraft.

The use of 3D printing techniques has enhanced the efficiency of generating components with high precision and low waste. Various 3D printing companies, such as Boeing and GE, are utilizing the technology to develop small parts with complex geometries, which is costly and time-consuming.

Furthermore, the healthcare sector is anticipated to grow at the fastest CAGR from 2024 to 2034. 3D-printed composites are used to create lightweight and durable prosthetic limbs, which are customized to fit the unique needs of each patient.

3D-printed composites are also used to create customized surgical tools, such as surgical guides, jigs, and fixtures. These tools are designed to fit the specific anatomy of a patient, which improves the accuracy and efficiency of surgeries. 3D-printed composites are used to create customized orthotics, such as braces and splints. These orthotics are designed to fit the specific needs of each patient, which improves their comfort and mobility.

Based on technology, the 3D-Printed Composites market is segmented into powder bed infusion, material extrusion technology, and others. The material extrusion technology sector is anticipated to grow at the fastest rate from 2024 to 2034. Material extrusion technique has been extensively used in a variety of applications, including 3D printing composite materials. Furthermore, the material available for this sector is diverse, making it one of the most popular methods for printing composites. The use of powder bed infusion technology for composite material applications has seen major advancements recently.

The Fusion Bed Infusion sector is anticipated to grow at the fastest CAGR from 2024 to 2034. Fusion Bed Infusion (FBI) is a manufacturing process that combines 3D printing with a composite material infusion. In FBI, the 3D printed part acts as a mold into which a liquid composite material is infused, and the infused material then hardens and forms a solid composite part. The FBI process has several advantages over traditional composite manufacturing methods:

In 2023, North America held the largest share of the worldwide 3D printed composite materials market during the projected period. The North American 3D printing composite market has grown steadily in recent years due to the increasing adoption of 3D printing technology across various industries, including aerospace, automotive, healthcare, and consumer goods. The market is driven by the demand for lightweight, high-strength, and complex-shaped parts which are able to be produced using 3D printing with composites. The healthcare sector is also driving the demand for 3D printing composites in North America, particularly in the production of customized implants and prosthetics. The ability to produce patient-specific parts with complex geometries and high precision using 3D printing with composites has revolutionized the medical field, leading to better patient outcomes and reduced costs.

Asia-Pacific, on the other hand, is projected to grow at the fastest CAGR during the forecast period. Increasing spending on infrastructure as well as novel construction is anticipated to propel the market growth. The region has a booming manufacturing industry, including the automotive, aerospace, and electronics sectors, adopting 3D printing composites for various applications. The increasing investment in research and development and the growing awareness of 3D printing technology is expected to drive the market for 3D printing composites in Asia-Pacific.

Segments Covered in the Report

By Composite Type

By End-User

By Technology Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

December 2024

October 2024