May 2025

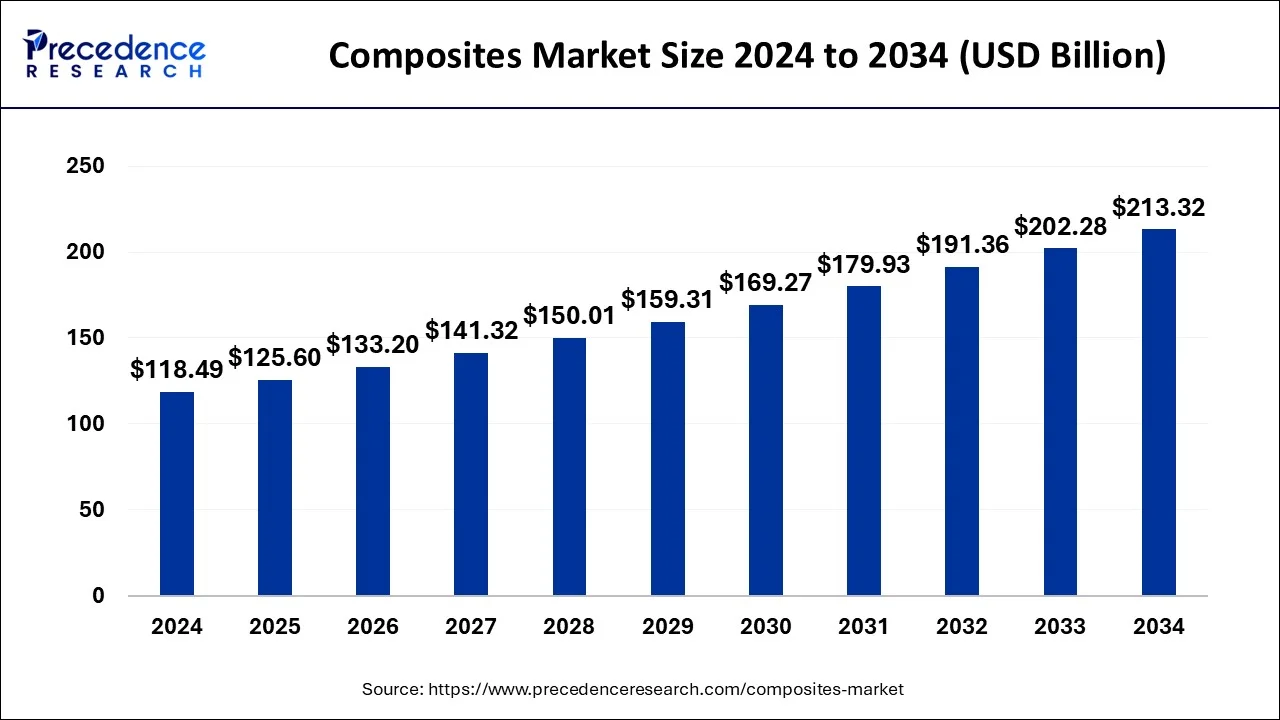

The global composites market size was accounted for USD 118.49 billion in 2024, grew to USD 125.60 billion in 2025 and is predicted to surpass around USD 213.32 billion by 2034, representing a healthy CAGR of 6.05% between 2025 and 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global composites market size was accounted for USD 118.49 billion in 2024 and is anticipated to reach around USD 213.32 billion by 2034, growing at a CAGR of 6.05% from 2025 to 2034. The composites market is driven by the increasing demand for lightweight materials in industries such as aerospace, automotive, and construction.

By predicting material properties using machine learning algorithms, data-driven approaches for material optimization, and generative models for exploring novel material compositions. AI algorithms can help researchers evaluate many variables more efficiently, reducing the time and costs associated with experimental testing.

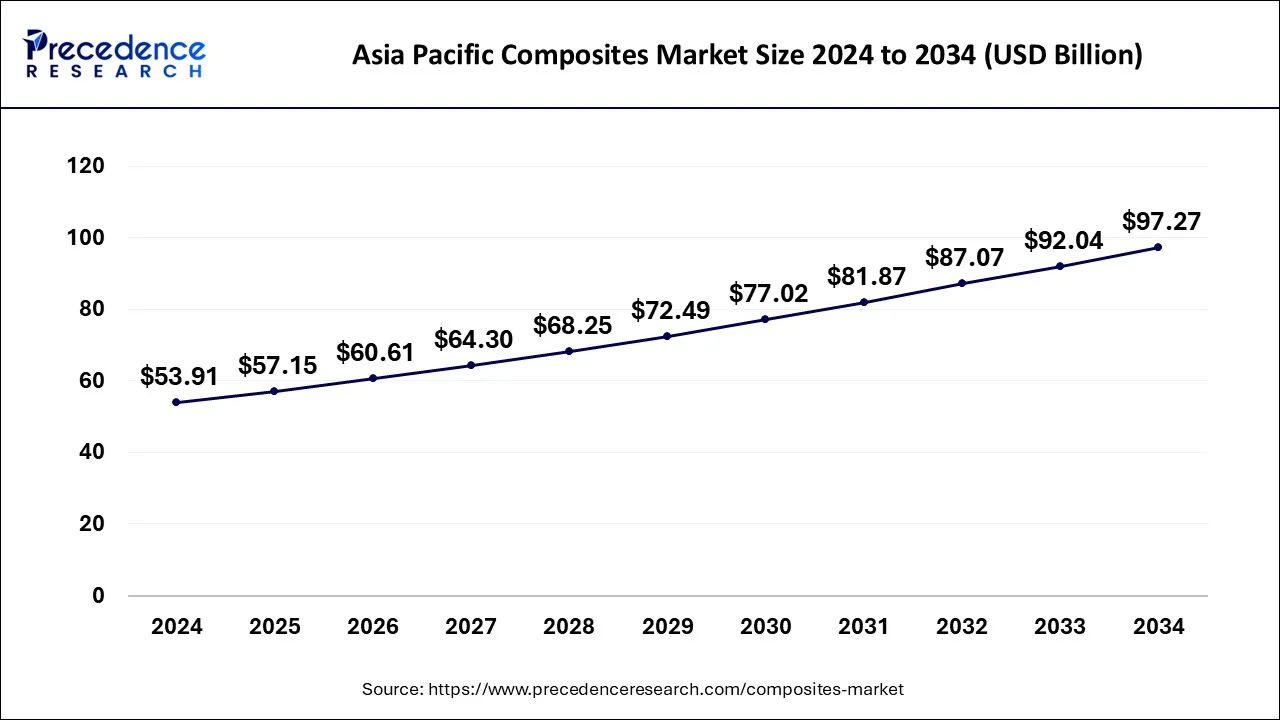

The Asia Pacific composites market size was evaluated at USD 53.91 billion in 2024 and is predicted to be worth around USD 97.27 billion by 2034, rising at a CAGR of 6.07% from 2025 to 2034.

The composites sector is an economic force that energies the American economy. This industry contributes around USD 22 billion to the U.S. economy annually. Further, as per 2016 UK Composites Strategy, the UK composites product market with nearby 1500 British companies engaged was assessed at around Euro 2.3 billion in 2015, and is projected to reach around Euro 12 billion by 2030.

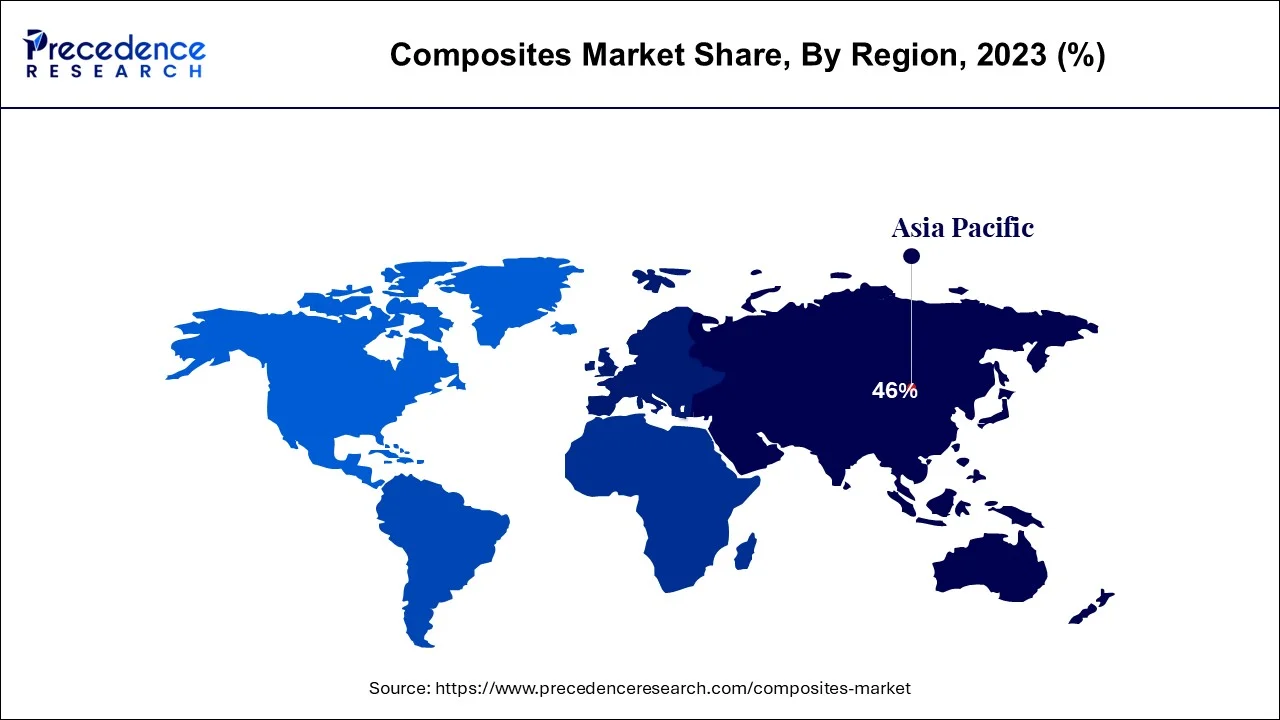

Due to the strong demand from end-user sectors like construction, automotive, electrical & electronics, aerospace & defense, industrial, etc., the Asia-Pacific region holds the largest share of the global composite material market. As a result of the fast industrialization taking place in nations like China, India, and Japan, the demand for composite materials in the Asia-Pacific area is increasing at an astounding rate.

With more and more sectors using composites, demand them is rising annually. For instance, CompositesWorld estimates that China's supply of Carbon fibre, an advanced composite fibre, will be roughly 19,250 metric tonnes in past years. The International Organization of Motor Vehicle Manufacturers estimates that in 2021 when production was at about 25.22 million units, China's automobile production climbed by 3% annually. During the examined period, the composite market would rise due to the automotive industry's consistent growth.

The total domestic medical device output in Japan, according to the International Trade Administration, was estimated to be over USD 24 billion in 2021 because of the country's growing reliance on medical technology in the aftermath of COVID-19. Furthermore, due to demand and OEM adoption, India has a significant impact on the penetration of thermoplastics and thermoset composites in the automotive industry. Additionally, according to Indian government regulations, suppliers in the aerospace industry are required to source around 30% of their components domestically. Consequently, this element encourages the expansion of the composite market.

Asia Pacific dominated the composites market with the largest market share of 46% in 2024. This dominance is due to proliferating demand from different end-use sectors of major countries such as Japan, India and China. Governments of various nations such as Canada, Japan, the U.S., South Korea, China, India Mexico, and Brazil have suggested greenhouse gas emission and fuel economy standards for light commercial vehicles/light trucks and passenger vehicles. These suggested regulations in these nations are likely to support the requirement for composites from the automotive segment.

North America shows a significant growth in the composites market during the forecast period.

The increasing need for lightweight materials is one of the primary drivers for the composites market in the United States. In the aerospace and defense industry, the demand for composites is propelled by factors such as the growth in air passenger traffic and expanding commercial space aircraft manufacturing activities for space exploration missions. Carbon fiber reinforced polymer is formed by molding carbon fiber with plastic resin. In the aircraft field, sandwich structures made of carbon fiber-reinforced polymer composite materials are extensively used for interior and exterior applications.

United States

| Report Highlights | Details |

| Market Size in 2024 | USD 118.49 Billion |

| Market Size in 2025 | USD 125.60 Billion |

| Market Size by 2034 | USD 213.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.05% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Resin, Manufacturing Process, Region |

Easy Production of Composites:

Previously, engineers had to create composites via a complicated lay-up procedure, which was time-consuming and limited the design geometry. This has been altered via Digital Composite Manufacturing (DCM). A unique manufacturing method called DCM creates composite parts devoid of physical labor. With DCM, composites can be locally or globally customized in three dimensions to produce the ideal strength, density, and flexibility for the project. Engineers may now design with the freedom of 3D printing and the high performance of composites thanks to DCM. As a result, this factor will likely contribute to growth in the composites market.

Demand for new design opportunities:

Design alternatives are available with composites that are difficult to attain with conventional materials. Item consolidation is possible with composites; a single composite part can take the place of an entire assembly of metal parts. Any finish, from smooth to textured, can be imitated by changing the surface texture. Because fibreglass can be moulded into a variety of boat designs, composite materials make up over 90% of recreational boat hulls. These advantages, which can be used in numerous industries, shorten manufacturing times and lower maintenance costs over time.

High Cost of Composites:

Compared to other structural building materials that are utilized for similar tasks, carbon fibre products are more expensive. However, initially less expensive materials like aluminum and steel demand more labor due to their weight. Additionally, carbon fibre carries heat and electricity, making it a poor choice for building projects involving either of these substances. Consequently, this might hamper the market for composites.

Increase in the Production of eVTOLs:

Electric vertical takeoff and landing (eVTOL) aircraft are not the only application for composites in the transportation sector. It is no secret that composites are successful in the aerospace, automotive, and marine end sectors. An advantage for the composites industry is the eVTOL sector. For instance, the Boeing 787, which served as a trailblazer for the use of composites in aircraft, contains almost 50% composite material in its structure. The figures are substantially lower for the automotive sector, with composite materials making up 8–12% of the weight of light automobiles. However, regardless of the manufacturer, that percentage increases to an average of 70% of the material mix for eVTOLs.

Since battery power will be used by the majority of eVTOLs, lightweight is required in several ways, i.e., making lighter components and choosing designs that require fewer components. Additionally, eVTOLs have stringent structural specifications. Composites are a logical solution for eVTOL producers as a result. Composites will be used in every cubic meter of an eVTOL, from large secondary components like clips and brackets to small secondary structures like fuselages and wings. As a result, the composites industry will experience lucrative growth in the near future.

Among different product type segmentation, in 2024, The glass fiber segment contributed the highest market share of 61% in 2024. This tremendous growth is attributed to its large requirement demand in construction, electronics and electrical, wind energy and transportation sector. Glass fiber also names as fiberglass, is prepared from fine fibers of glass. It provides improved properties like lightweight, high durability, high strength and weather-resistant among others. Such superior qualities propel their demand in countless application sectors.

Increased acceptance of more environment-friendly construction materials is a result of the widespread implementation of strict environmental rules in both developed and developing nations. Carbon fibers and the related composites they are made of can reduce weight and improve fuel efficiency. As a result, the market for premium and sports cars is driving up demand for activated carbon fiber. For the production of 3D-printed car parts, carbon fibre is widely used in the automotive sector. Since carbon fibre is so powerful, it makes the filament stronger and more rigid. As a result, the 3D-printed parts will be significantly lighter and more dimensionally stable since the fibre will help stop the object from shrinking as it cools. The market for composites is growing in segments thanks to these most recent trends.

The automotive and transportation segment accounted the highest market share of 22% in 2024. The outlook of the global composites market seems eye-catching with alluring prospects in numerous end-use sectors such as wind energy, electrical and electronics, construction, pipe & tank, marine, transportation, consumer goods, and aerospace among others. Transportation sector that includes commercial vehicles, coaches, buses and automobiles, is projected emerge as one of the major U.S. markets in during coming few years. At present several prominent vehicle manufacturers are spending in composite materials technology in order to decrease weight and address the targets of authorized carbon emission reduction.

Composites also find great demand in construction industry. It finds application in GFRP include paneling, shower stalls, bathrooms, windows and doors. Growth of construction sector is mainly compelled by low mortgage rates, continuous surge in employment, and reducing house price inflation.

Around the world, composites are used to build and repair a wide range of infrastructure applications, including roads, bridges, buildings, and railroads. Because of their great strength, resistance to rust and corrosion, and low maintenance requirements, these applications endure lengthier. To increase the tensile strength and longevity of concrete buildings and construction components, several polymers are used. The composites can be utilized for both new construction and retrofit circumstances and can be applied prefabricated or on-site. Additionally, composite materials are used more frequently for new and renovated bridge construction. The benefits include excellent strength-to-weight ratios, noncorrosive characteristics, prefabrication possibilities, and design freedom.

In 2024, among various resins type segment of global composites market, thermosetting resin segment lead the market. This considerable growth is attributed to climbing demand in aerospace, transportation and defense sector. Thermoset composite is typically based on glass, carbon, aramid fibers, and commonly combined with resins such as vinyl esters, epoxies, phenolics, cyanate esters, polyesters, and polyimides.

Thermoplastics are non-toxic in nature, weldable, recyclable for other processes, and have augmented toughness and are less expensive. A comprehensive range of thermoplastic resins are employed in composites including PET, PVC and polypropylene. Thermoplastics resins are preferably utilized on account of their improved impact resistance and capacity to reform than thermosetting resins.

Out of various manufacturing process involved in the global composites market, The layup process segment has held the largest market share of 36% in 2024. This method is very frequently employed for manufacturing of composite. This process includes insertion of layers of composite fiber in an order with the help of matrix of resin and hardener. Then layup is permitted to cool at room temperature. At present, rising production of boats, wind turbine blades and architectural moldings is expected to spur substantially the demand of layup process segment.

The process of filament winding is typically applied to the production of hollow, prismatic, or spherical objects, such as pipes and tanks. A customized winding machine is used to wound continuous fibre tows onto a rotating mandrel. The aerospace, energy, and consumer product industries frequently use filament wound parts. The cost of the fibre is further reduced because there is no additional process needed to turn the fibre into the fabric before usage, making this technique of material application incredibly quick and cost-effective. Since straight fibres can be put in a complicated arrangement to match the applied loads, laminates' structural qualities can be quite good.

Multiple initiatives including research and development, technology innovations, partnerships, acquisitions, and merger in order to produce economical and lightweight composite products have been commenced by many prominent players. Some of the significant players in the composites market include:

By Product Type

By Resin Type

By Manufacturing Process Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

December 2024

October 2024

December 2024