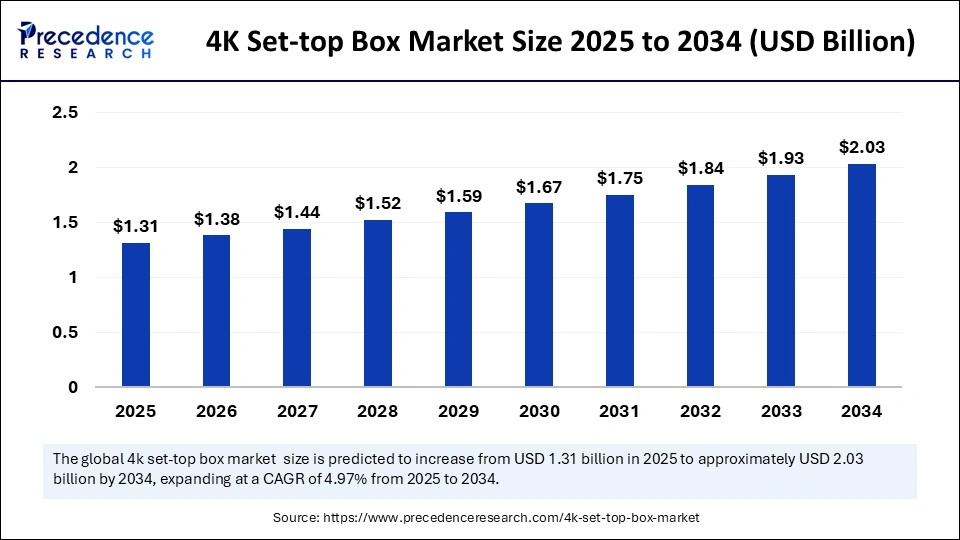

The global 4K set-top box market size is calculated at USD 1.31 billion in 2025 and is forecasted to reach around USD 2.03 billion by 2034, accelerating at a CAGR of 4.97% from 2025 to 2034. The North America market size surpassed USD 437.5 million in 2024 and is expanding at a CAGR of 5.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global 4K set-top box market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.31 billion in 2025 to approximately USD 2.03 billion by 2034, expanding at a CAGR of 4.97% from 2025 to 2034. The market grows because consumers continue to require HD content and streaming platforms.

The implementation of artificial intelligence enhances the 4K set-top box market experience through multiple intelligent features. AI algorithms optimize picture settings in real-time using environmental information and content types to deliver the absolute best visual quality. Through artificial intelligence, users can access intelligent features that automatically arrange content, improve search capabilities, and activate voice-controlled virtual assistants that learn from user interactions.

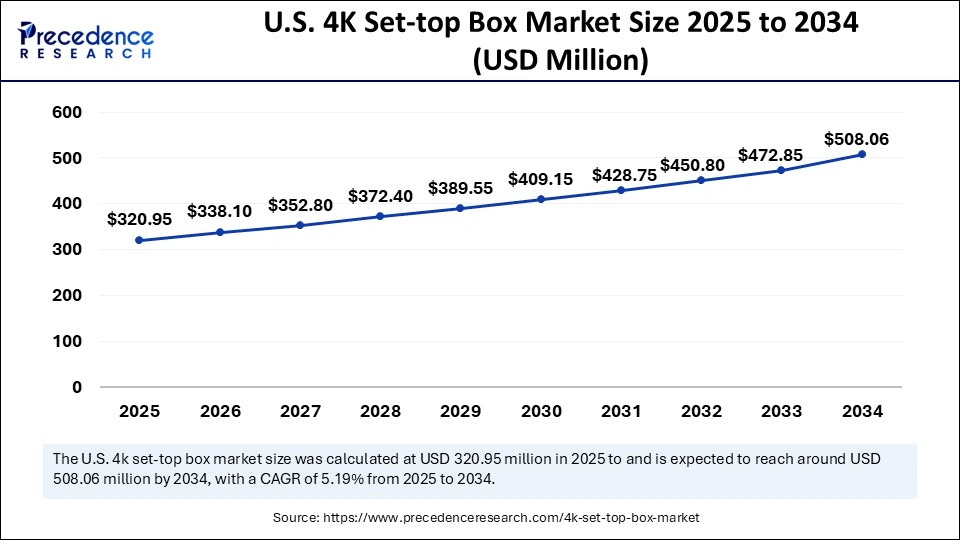

The U.S. 4K set-top box market size was exhibited at USD 306.25 million in 2024 and is projected to be worth around USD 508.06 million by 2034, growing at a CAGR of 5.19% from 2025 to 2034.

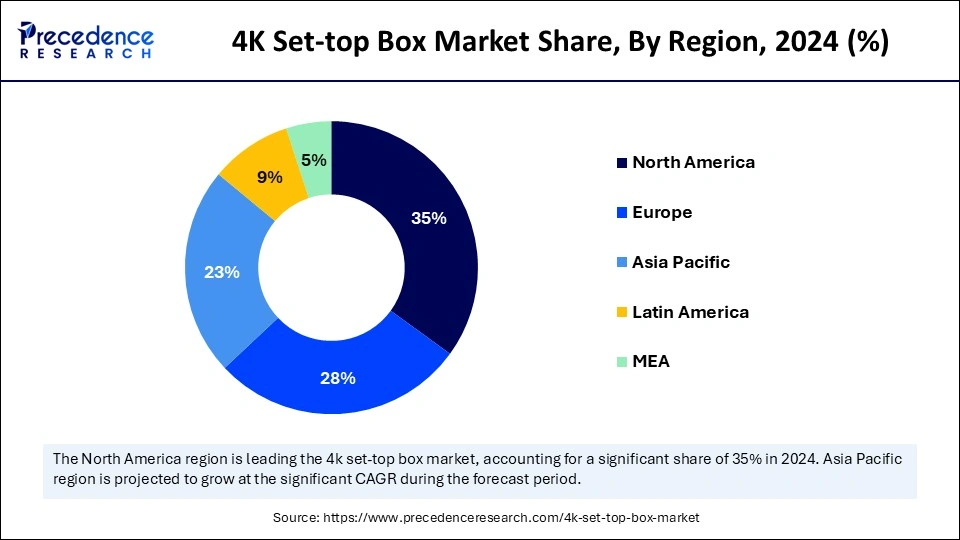

North America accounted for the largest share of the 4K set-top box market in 2024. Enhanced household income levels in the United States and Canada drive citizens to purchase high-end entertainment systems. This region benefits from rapid internet because its people rapidly embrace modern technology. This widespread internet access enables 4K streaming capabilities.

The market demand for high-quality video content, as well as advanced technological interfaces, motivates customers to upgrade their devices to 4K standards. Broadcast service providers across the region enhance their content offerings with 4K programming, which drives up the market demand for set-top boxes. The adoption of 4K technology has received additional momentum since government digital TV broadcasting initiatives have been established.

The Asia Pacific 4K set-top box market is anticipated to witness the fastest growth during the forecasted years. There are several factors driving demand for high-quality entertainment in this region, such as high population size, growing purchasing power, and rapid urbanization. The rising middle class and cheap smart TV costs have led to widespread use of 4K set-top boxes in the market.

The market continues expanding rapidly because viewers demand better ultra-HD channels with high-quality video content, especially in the emerging markets. Modern digital technology improvements and improved broadband infrastructure indicate that the Asia Pacific market will experience ongoing growth throughout the years.

Europe emerged as a significant player in the global 4K set-top box market because the digital infrastructure developed, and consumer preferences changed. The region observes an important trend where streaming services have been directly added to set-top boxes to meet the growing consumer need for on-demand streaming options with traditional broadcast services. Public initiatives from government entities continue to spur digital broadcast progress and increase internet speed networks throughout the city and countryside areas

The 4K set-top box enables users to stream television content at a UHD resolution level of 3840 x 2160 pixels for an excellent viewing experience. Users benefit from online streaming platform accessibility through their Ethernet or Wi-Fi internet connection. The foundation of contemporary home entertainment systems depends on 4K set-top-boxes since these devices present features including voice command through virtual assistants, and they offer both gaming entertainment and live TV service at high definition resolutions. The increasing adoption of smart home technology, along with consumer interest in advanced tech systems, leads to a surge in 4K STB demand across the market.

The demand in the market for high-quality audio-visual entertainment is the primary force attracting modern viewers. The expansion of the 4K set-top box market stems from rapid urbanization and improved living standards in different areas because consumers now possess enough money to buy advanced technology products. The rising number of connected home devices and smart devices results in a growing system that makes 4K STBs seamlessly integrate with household environments.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.03 Billion |

| Market Size in 2025 | USD 1.31 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product , Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing digitisation of cable TV networks

The digital broadcasting technology continues advancing while DTH service adoption and smart TV penetration spread across the market landscape. Consumers are moving towards digital TV services as a result of fast-paced urban growth, rising personal financial capabilities, and a better way of living. Advanced 4K STBs experience increased demand because consumers want on-demand entertainment content such as movies, music, and OTT media platforms. Manufacturers provide consumers with products that have flexible storage capabilities that offer streaming service access and social media utilization. Modern digital entertainment requires 4K STBs because of their features, such as web browsing, video calling, and cost-effective subscription plans.

Growing demand for high-quality content

The market is driven because users seek premium video entertainment that delivers superior visual quality. Users obtain better home entertainment value from 4K picture quality, so they replace their existing entertainment systems with upgraded versions. Modern fast internet availability through broadband infrastructure eliminates buffering frustrations so users can access 4K content smoothly. This market shows quick global expansion because of better content standards and enhanced user needs, combined with improving telecommunications networks.

Higher cost

The 4K set-top box market expansion faces significant challenges from 4K technology since it carries a high price tag. Modern operational costs remain high because 4K content production and distribution demand greater bandwidth resources throughout the process. Cost-sensitive consumers remain excluded from 4K STB products as well as subscription services due to their high initial prices. A reliable, high-speed internet connection in rural areas prohibits customers from purchasing 4K streaming devices because reliable 4K connectivity is a fundamental prerequisite for streaming 4K content fluidly.

Developing markets and technological advancements

Ultra-HD content demand is increasing in emerging economies to create a strong market potential for the 4K set-top box market. The combination of cheap 4K TVs and advanced internet networks creates new market opportunities for 4K STBs since content creators and streaming platforms develop and invest in local 4K content. The government’s support for digital technology advancement and network improvements has made the 4K STB market more favorable, leading customers to choose these products due to their AI recommendation features, along with voice assistance and smart home capabilities.

The DTT segment dominated the 4K set-top box market in 2024. Users can access 4K broadcasts through their antenna by using a 4K DTT set-top box that converts digital signals into superior resolution images and enhanced audio. The need for high-definition content from consumers drives viewers to switch from standard-definition to 4K DTT set-top boxes because these devices deliver an improved viewing experience.

The number of customers interested in DTT set-top boxes rises because broadcasters are presenting more 4K content, thus leading to better customer satisfaction and increased adoption of digital television services. Governments worldwide continue to support digital broadcast expansion, thus increasing superior digital television delivery across the globe.

The satellite segment is anticipated to show substantial growth in the forecast period. Users connect satellite STB systems to watch brand-new programs from various worldwide sources through multiple domestic and international channels. Advanced satellite set-top boxes provide consumers with multiple features, including live program recording, video on demand, and interactive multimedia services, which increases their market appeal.

The segment grows because enhanced satellite technology brings improvements to signal quality, with more available channels and enhanced performance capabilities. The satellite technology improvements and multiple external factors will fuel the growth of the satellite STB market while attracting increasing demand from end users

The residential segment held a significant 4K set-top box market share in 2024 due to the high number of television access in households as audiences opted for digital entertainment like films and television series. As households increasingly favored digital media such as films and television programs, the adoption of 4K set-top box devices rose significantly. The market grew as governments supported digital TV broadcasting, making high-quality services more accessible. During long periods of staying home, more people chose digital TV, which led to a big rise in the sales of set-top boxes.

The commercial segment is anticipated to show considerable growth over the forecast period. The market growth stems from growing commercial adoption of these devices by restaurants, bars, hotels, and entertainment facilities. The economic advantages of STB installations influence their popularity in commercial environments since they present a budget-friendly solution to stream content throughout multiple displays equally effectively. Businesses offering high-definition sports, movies, and live events. Companies can gain an edge by providing premium options that attract more viewers and more customers. This enables commercial settings to develop competitive advantages by providing premium service options to attract more customers.

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client