Smart Home Market Size and Forecast 2025 to 2034

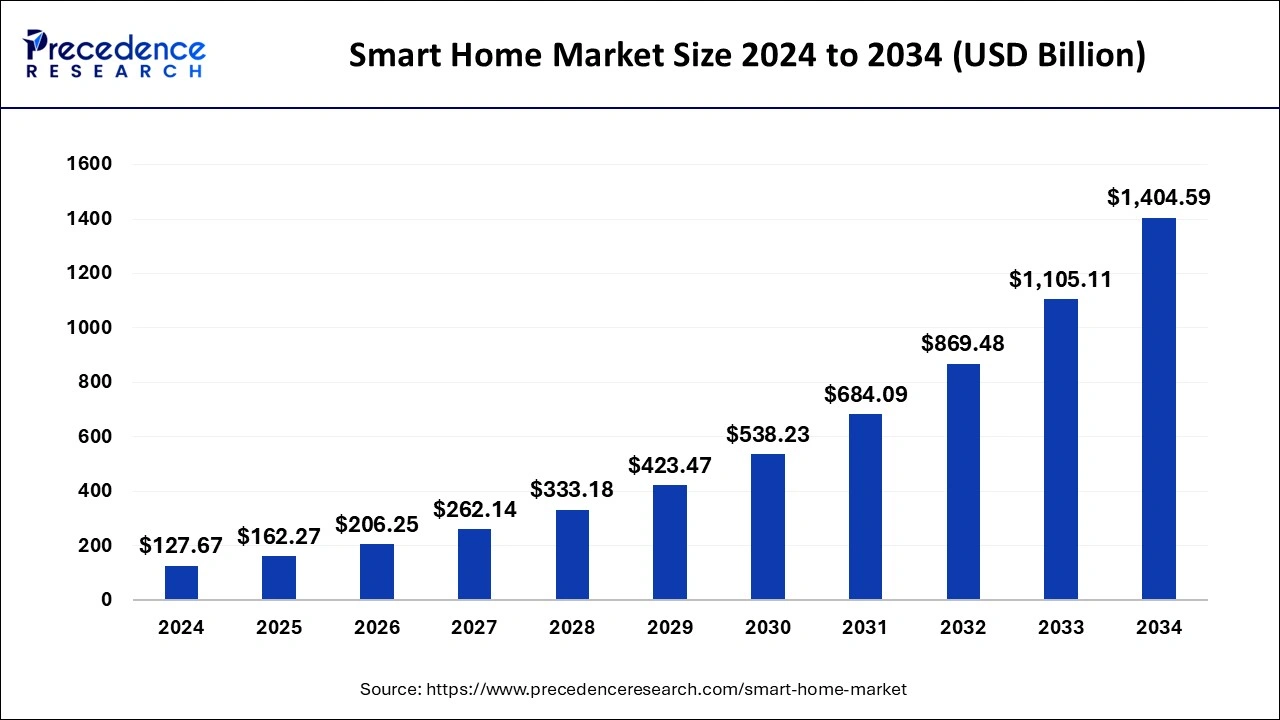

The global smart home market size was estimated at USD 127.67 billion in 2024 and is anticipated to reach around USD 1,404.59 billion by 2034, expanding at a CAGR of 27.10% from 2025 to 2034.

KeyTakeaways

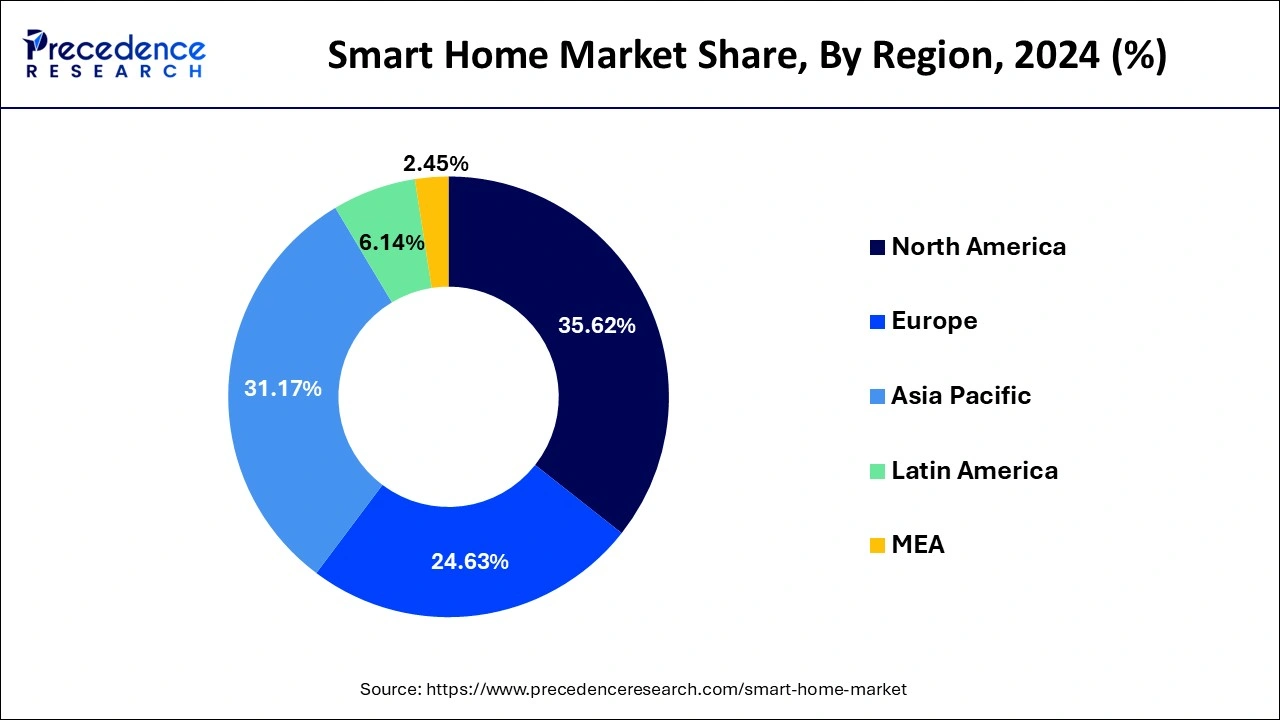

- North America dominated the global market with the largest market share of 35.62% in 2024.

- Asia pacific is projected to expand at the notable CAGR during the forecast period.

- By application, the new construction segment contributed the highest market share in 2024.

- By product, the security and access control segment captured the biggest market share in 2024.

- By sales channels, the indirect sales channel segment has held the largest market share in 2024.

Integration of AI in the Smart Home Market

AI is revolutionizing smart homes with sophisticated and perceptive technologies. AI makes judgments that are comfortable for humans by taking into account human preferences and tastes, comprehending directions, and reacting accordingly. Products for smart homes that are AI-enabled are quite helpful. Home appliances and security systems are undergoing a change thanks to smart assistants like Google Assistant, Apple's Siri, and Amazon's Alexa. They comprehend voice instructions and carry out the work; by determining the user's preferences, it may automate processes.

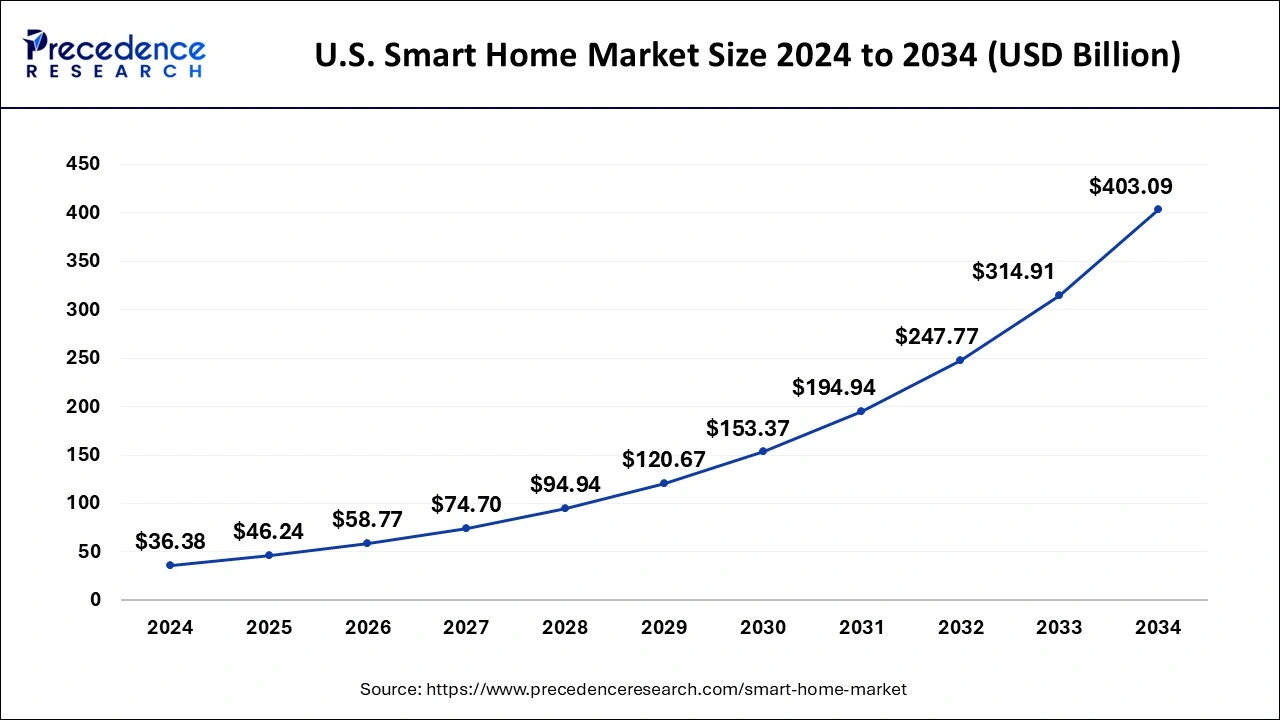

U.S. Smart Home Market Size and Growth 2025 to 2034

The U.S. smart home market size was exhibited at USD 36.38 billion in 2024 and is projected to be worth around USD 403.09 billion by 2034, growing at a CAGR of 27.19% from 2025 to 2034.

North America holds the largest revenue share of the global smart home market. The rapid technological advancements, along with the fast adoption of smart devices, are seen as a significant driving factor for the development of the smart home market in North America. Factors such as changing lifestyles, rising dependency on smart devices and increasing security concerns have fueled the market's growth in recent years. The market in North America is expected to maintain growth during the forecast period owing to the rising number of regional vendors in the smart home market.

Asia Pacific is the fastest-growing region in the global smart home market. The rising standard of living and more disposable income in the area is responsible for the market expansion. The region's market is anticipated to be driven by the quick uptake of smartphones, the internet, and other technologically advanced devices. Europe is considered one of the world's most significant marketplaces for smart home devices. The region is expected to register a noticeable revenue growth during the forecast period.

- The rising Government Initiatives for the development of smart cities are anticipated to contribute to the overall growth of the smart home market in the region. For instance, according to the article published by the Ministry of Housing & Urban Affairs in December 2024, as of 15.11.2024, under the Smart Cities Mission (SCM), work orders have been issued in 8,066 projects amounting to ₹1,64,669 crore, of which 7,352 projects (i.e. 91% of total projects) amounting to ₹1,47,366 crore have been completed, as per the data provided by 100 Smart Cities

Emerging economies, the rising use of smart devices and the presence of local players are expected to show a rise in the smart home market of Latin America. Rising investments in smart city development are expected to boost the market's growth in the gulf countries of the Middle East. Due to a growing number of internet users, an increase in the demand for smart devices, and an increase in the demand for smart homes, the United Arab Emirates (UAE) holds the most outstanding market share. Moreover, the rising number of domestic players, facilities and increasing population are considered to propel the market's growth in Africa during the estimated period. However, the region currently shows steady growth due to the limited adoption of smart devices.

Market Overview

A home integrated with numerous systems and technologies enabling homeowners to control various parts of the house is called a smart home. Thermostats that regulate the temperature based on your preferences, lights that turn on when you enter the room, and locks that can be accessed with a press of a button are features that may be found in smart homes. Some smart home systems can monitor even home security or energy use. Installing a smart home system has a number of advantages, and the ease and security of automating home systems are among the most obvious benefits. With a smart home, one can directly control lights, locks, thermostats, and security systems from the smartphone.

Smart Home Market Growth Factors

The popularity of digital assistants like Alexa and Siri has made it possible to operate smart devices via voice commands. The new features of these digital assistants, such as Bluetooth speaker control, drive the demand for smart home products. Consumers also enjoy tailored devices since they are more convenient and offer a better user experience. The rapid adoption of contemporary technologies, including artificial intelligence (AI), the internet of things (IoT) and others, significantly impacts market expansion. The market for smart homes has grown due to an increased acceptance rate of IoTs in both established and emerging nations.

Additionally, growing urbanization, globalization and a rise in disposable income in many countries have boosted the market's growth. Growing public concerns about home security also boost market expansion during the anticipated timeframe. Additionally, consumers may use their smartphones or tablets to remotely operate and monitor business equipment and home appliances due to smart connected devices at home, which propels the industry. Along with home safety concerns, rising concerns about child safety have fueled the demand for 360� smart security cameras in recent years.

- Integration of Digital Assistants: The popularity of digital assistants like Alexa and Siri has made it possible to operate smart devices via voice commands. The new features of these digital assistants, such as Bluetooth speaker control, drive the demand for smart home products. Consumers also enjoy tailored devices since they are more convenient and offer a better user experience.

- Adoption of Advanced Technologies: The rapid adoption of contemporary technologies, including artificial intelligence (AI), the internet of things (IoT) and others, significantly impacts market expansion. The market for smart homes has grown due to an increased acceptance rate of IoTs in both established and emerging nations.

- Growing Urbanization & Globalization: Additionally, growing urbanization, globalization and a rise in disposable income in many countries have boosted the market's growth.

- Safety Concerns: Growing public concerns about home security also boost market expansion during the anticipated timeframe. Along with home safety concerns, rising concerns about child safety have fueled the demand for 360� smart security cameras in recent years.

- Remote Control: Additionally, consumers may use their smartphones or tablets to remotely operate and monitor business equipment and home appliances due to smart connected devices at home, which propels the industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 162.27 Billion |

| Market Size by 2034 | USD 1,404.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Product, Sales Channel, Protocol, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Smart Home Market Dynamics

Driver

Rising construction activities in developing countries

Rapidly growing industrialization in developing countries has increased the demand for new commercial buildings. Moreover, the rising population and urban infrastructure are other factors that boost the demand for new construction activities. China, U.S. and India are expected to drive the global construction market during the forecast period. Few areas of residence, such as the bathroom and kitchen, allow fewer renovation options once constructed. Thus, construction companies and people prefer installing smart home devices during construction.

Along with this, many construction companies have started offering smart security cameras, lock systems, smart lighting systems and smart lock access systems with newly constructed buildings in order to attract consumers. Furthermore, the rapid adoption of advanced technology has propelled the demand for smart home devices, especially in living rooms and kitchens.

- According to the United States Census Bureau, Total U.S. construction spending reached $486 billion in Q1 2025, up 3% from $472 billion in Q1 2024. Private construction spending grew 2% year-over-year to $384 billion, with residential up 3% to $205 billion.

Restraint

Costly smart home devices

The deployment of advanced technology, engineering and manufacturing, and the set-up or installation cost of smart home devices collectively make it expensive. Moreover, additional routine maintenance and servicing costs limit the purchasing capacity for many. Thus, costly home devices hinder the market's growth by acting as a restraining factor.

Opportunity

Development of advanced monitoring devices for child safety

Child safety concerns have raised the demand for smart security cameras in urban locations. The deployment of 360� security cameras, monitoring devices, intelligent sensors and alarming devices has increased with rising technology. This provides opportunities for the market players to boost revenue and market share by developing smart devices dedicated to child safety. For instance, Fuhu, a company prominently working on children's products, has decided to develop child monitoring devices to monitor their activities around the clock.

- In January 2025, Arlo Technologies, a US security camera company, announced a partnership with Origin AI, which has pioneered AI Sensing technology. Under the partnership, Arlo will have exclusive worldwide rights to market and sell Origin AI's products, TruShield and Allos, which deliver Verified Human Presence detection through radio frequency (RF) signals emitted by existing WiFi devices in homes or businesses.

Application Insights

Based on application, the global smart home market is segmented into new construction and retrofit. The new construction segment is dominating the global smart home market. The segment is predicted to maintain its dominance in the market during the estimated period due to rising demand for smart home devices during the construction period. Homeowners prefer not to tear down any walls or tiles, and installation is done safely and effectively, which creates demand for smart home devices.

Additionally, as smart security and access features become more popular, an increase in the building of new houses is anticipated to fuel the need for smart homes. Due to the convenience of fixing gadgets, owners of new construction projects are also inclined to install various smart home goods. Rising construction activities in developing countries are seen as another driving factor for the segment's growth.

Product Insights

Based on product, the global smart home market is segmented into light control, security and access control, HVAC Control, entertainment control, smart speaker, home healthcare, smart kitchen, home appliances and home furniture. The security and access control products segment dominated the market in 2022 and is anticipated to dominate the market during the forecast period. The expansion of the security and access control segment is attributable to the increased value placed on security and the requirement to limit access to areas or safes containing priceless commodities and objects. By utilizing live feed playback, personalized PINs, fingerprint scanners, and other features, smart locks and security cameras assist in monitoring and authorizing access only to authorized personnel. These features have recently forced prominent players to develop smart home security devices.

For instance, in January 2023, The EZVIZ company launched EZVIZ C6N home security camera via Amazon. One of the most recent home security cameras from EZVIZ delivers two-way conversation and 360-degree coverage in FHD. The OEM claims that its Smart Night Vision, created to address some possible issues with its current IR-enabled competitors, sets it apart. Furthermore, rising awareness about self-healthcare after the Covid-19 pandemic is predicted to boost the home healthcare product segment during the forecast period.

Sales Channel Insights

Based on sales channels, the global smart home market is segmented direct and indirect. The indirect sales channel segment will dominate the global smart home market during the forecast period. The rising spending on online shopping is one of the significant factors behind the growth of the indirect sales channel segment. The indirect sales channel segment carries out the company's distribution tasks. Indirect distribution relieves the manufacturer of some initial expenses and duties that could reduce the amount of time needed for business operations. Additionally, an indirect distribution route can be considerably easier to manage than a direct distribution channel with the correct vendor relationships.

A business that makes direct consumer sales organizes and controls a direct distribution channel. In the direct sales channel segment, the business handles all parts of delivery internally (rather than using vendors). It is entirely in charge of making sure that customers successfully receive their orders. The direct sales channel might be more expensive to set up and involve more labor. In fact, they might necessitate substantial capital expenditure. It is necessary to set up warehouses, logistics programs and delivery personnel.

Protocol Insights

The global smart home market is segmented into wired, wireless and hybrid. The wireless segment will dominate the global smart home market during the forecast period. Wireless smart home devices offer convenient user interfaces, and cost reduction is another factor behind the rapid adoption of wireless devices across the globe. The rising trend of wireless communication is boosting the demand for wireless smart home devices in the market. Wireless smart home devices such as wireless Wi-Fi stations, charging pads, air purifiers, home theatre, Bluetooth speakers, HD security cameras, and numerous other products have increased consumer interest owing to the improved flexibility and easy installation process.

At the same time, the adoption of faster internet services with a Wi-Fi router at home increased the demand for wired routers that are connected with ethernet cables. Since shielded cables are often used in wired systems and nothing interferes with the signals that move through them, wired systems are significantly more dependable. Wired devices such as Wi-Fi routers, audio systems, gaming stations and numerous kitchen devices are still in the global smart home market trend. However, the trend is likely to change with rapidly evolving technology.

Smart Home Market Companies

Recent Developments

- In May 2025, Brilliant NextGen, a leader in smart home innovation, unveiled its second-generation smart home products. It is designed to set a new benchmark in home automation. These user-friendly controls are engineered to deliver advanced functionality while integrating effortlessly with Brilliant's existing product family, which includes smart dimmer switches, plugs, a mobile app, and a robust multifamily platform.

- In May 2025, Gopalan Enterprises proudly announced the launch of an AI-powered smart home project, catering to the growing demand from millennial buyers. The company plans to build 3,000 units by 2025, with an investment of ₹500 crore.

- In November 2024, Apple unveiled its plan for a smart home security camera in 2026, according to Ming-Chi Kuo. Apple's planned smart home camera will integrate seamlessly with other Apple hardware products via wireless connectivity, offering a competitive advantage over rival camera makers. The company is making its first foray into the smart home IP camera market with mass production scheduled for 2026, targeting annual shipments in the tens of millions

- In January 2025, at the forthcoming International Consumer Electronics Show (CES) in Las Vegas, Universal Electronics Inc. (UEI), a pioneer in smart home technology worldwide, is thrilled to launch the QuickSet Widget Pro line-up, which will expand the QuickSet Widget family.

- In January 2025, Samsung Electronics declared that "Ballie," their first AI household robot, will be available for purchase in the first half of 2025. The announcement was made during the Consumer Electronics Show (CES), a major tech event where firms display their newest technologies, in Las Vegas, Nevada, on January 6 (local time).

- In January 2025, at CES 2025, Shelly Group, a leader in smart home innovation, will introduce its Gen4 Series smart home product portfolio, promising to revolutionize home automation and interoperability.

Segments Covered in the Report

By Application

- New Construction

- Retrofit

By Product

- Light Control

- Security And Access Control

- HVAC Control

- Entertainment Control

- Smart Speaker

- Home Healthcare

- Smart Kitchen

- Home Appliances

- Home Furniture

By Sales Channel

- Direct

- Indirect

By Protocol

- Wired

- Wireless

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content