February 2025

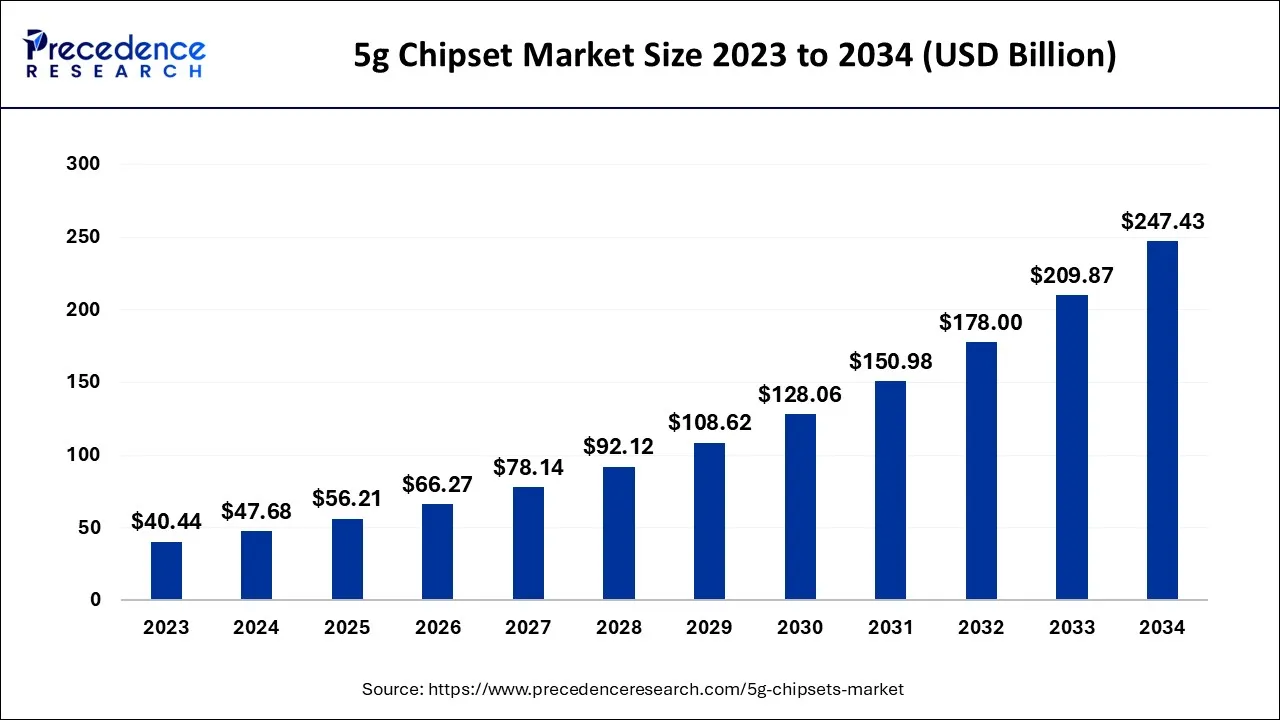

The global 5G chipset market size accounted for USD 47.68 billion in 2024, grew to USD 56.21 billion in 2025, and is expected to be worth around USD 247.43 billion by 2034, registering a healthy CAGR of 17.9% between 2024 and 2034. The Asia Pacific 5G chipset market size is predicted to increase from USD 22.89 billion in 2024 and is estimated to grow at the fastest CAGR of 18.02% during the forecast year.

The global 5G chipset market size is expected to be valued at USD 47.68 billion in 2024 and is anticipated to reach around USD 247.43 billion by 2034, expanding at a CAGR of 17.9% over the forecast period 2024 to 2034. The 5G chipset market depends highly on the growth of the demand for Internet at higher speed, vast coverage, increase in IoT connection, and smart city projects.

The Asia Pacific 5G chipset market size is exhibited at USD 22.89 billion in 2024 and is projected to be worth around USD 120 billion by 2034, growing at a CAGR of 18.02% from 2024 to 2034.

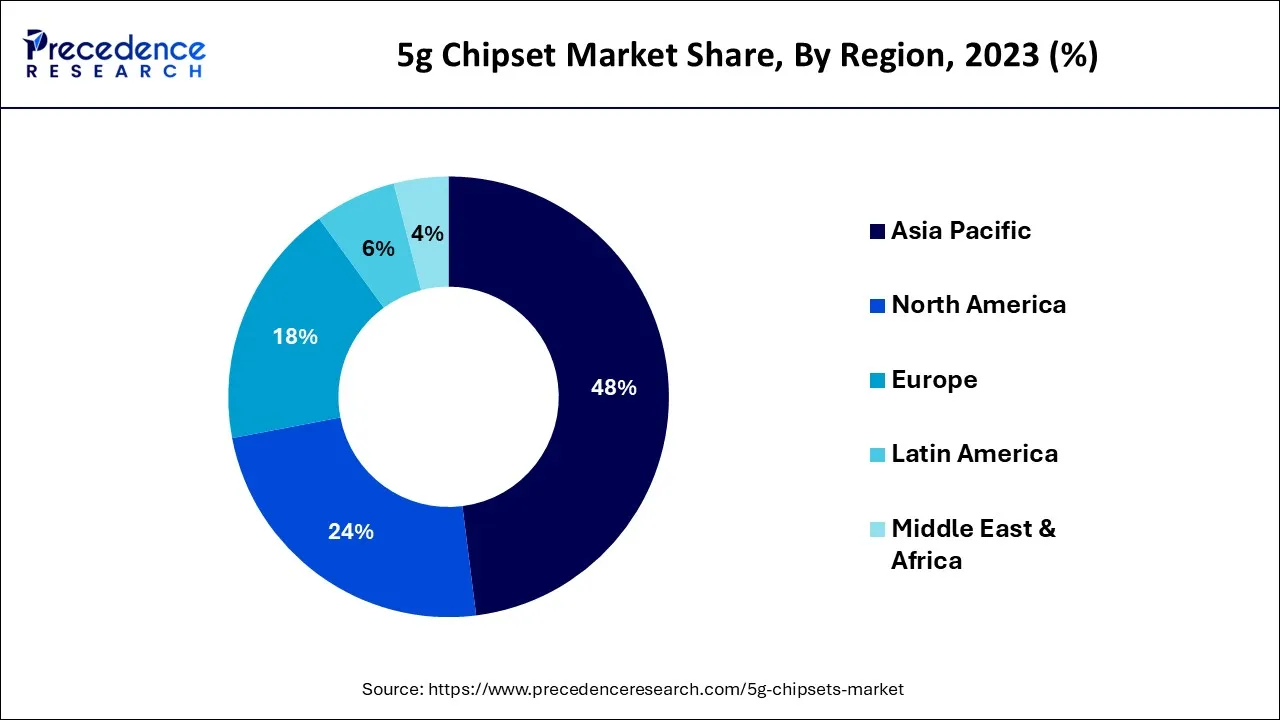

In 2023, Asia Pacific held the majority of the market, with a share of around 48%. This is due to the quick increase in expenditures made in base stations that support 5G New Radio (NR) frequencies and handsets that support 5G technology. Important regional businesses including Huawei Technologies Co. Ltd. and Samsung Electronics Co., Ltd. are spending heavily in the creation of 5G chipset modules.

A rising need for smart manufacturing in developing nations like China and India is anticipated to increase the use of 5G chipset components throughout the forecasted period. The market in the United States is expected to expand dramatically during the next years. Significant investment is being attracted to the creation of smart cities, smart industries, and home automation in the US. Online gaming with advanced visuals is becoming more and more popular with American players. The country is also becoming a pioneer in the usage of autonomous vehicles and smart transportation infrastructure. All of these developments are expected to boost demand for 5G chipset components in the US.

Market Overview

The goal of a 5G chipset is to enable the end user to create a wireless network that adheres to 5G network requirements. It is an improved part of customer premises equipment and network equipment. The proliferation of devices with internet access has increased the need for 5G, a brand-new wireless infrastructure. After the current 4G LTE mobile network, 5th wireless (5G) is the following generation of smart mobile networks. These networks provide a perceived total global connectivity by extending broadband wireless operating frequency (Operational Frequency) beyond mobile broadband to the Internet of Things (IoT) and important communications segments. The lowest 5G chipset solution for the upcoming generation is also anticipated to bring new levels of efficiency and performance, allowing novel user experiences and the connecting of brand-new industries. In addition, the expansion of the 5G chipset business is fueled by the increased demand for 5G network infrastructure solutions, which makes it possible to link new sectors and maximize efficiency while minimizing cost.

Due to the widespread use of M2M and IoT connectivity, the 5G chipset market is anticipated to expand significantly over the course of the forecast period. The industry is expanding as a result of the rising demand for high-speed internet and extensive network coverage. Additionally, throughout the anticipated period, a rise in demand for mobile broadband operating frequency is anticipated to fuel the expansion of the 5G chipset market.

However, high investment costs, difficulties implementing the 5G network in terms of technology and infrastructure, and privacy and security concerns are some of the key reasons limiting industry development. On the other hand, increased government efforts in Asia-Pacific to develop smart cities are anticipated to create attractive chances for the market for 5G chipsets to expand over the projected period.

How does AI impact on 5G Chipset Market?

AI-driven 5G chipsets will offer better control and utilization of resources to devices that are connected to such networks and influence the enhanced efficiency of the network. AI and 5G are critical to building intelligent infrastructure, for apps such as facial recognition, contactless ticketing, surveillance, and plane instrumentation. AI algorithms can use information to recommend that network resources should be better allocated.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.68 Billion |

| Market Size by 2034 | USD 247.43 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Frequency Type, Processing Node Type, Deployment Type, End Use, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The sub-6GHz sector led the industry in terms of value in 2023. This is a result of major market participants initially releasing 5G chipset components that enable the sub-6GHz spectrum for laptops, linked automobiles, and smartphones.

Due to the ongoing release of cutting-edge chipset components that support both the sub-6GHz and mmWave frequencies in a single module, the sub-6GHz + mmWave category is anticipated to see a discernible CAGR throughout the projection period.

In 2023, the 7 nm category dominated the market in terms of value. This is a result of major players first concentrating on building 5G chipset components using a 7nm processor node. MediaTek Inc., Huawei Technologies Co. Ltd., Intel, and Qualcomm Incorporated, among other well-known industry participants, are concentrating first on building 5G chipset components using a 7nm processing node. Additionally, in order to enable high band frequencies, these market participants are presently concentrating on producing 7 nm and 10 nm processor nodes of the chipset.

However, given that they will need to support several applications at once, modern communication networks are anticipated to experience increased demands. The creation of a new chipset with faster processing rates would be required as a result. As a result, the 10 nm category is anticipated to post a sizable CAGR throughout the projection period. Additionally, if autonomous vehicles become more prevalent, a bigger number of processing nodes would need to be implemented in order to create 5G chipsets in order to ensure smooth connection between vehicles.

In value terms in 2023, the smartphones/tablets sector led the market. This can be attributable to the rising demand for smartphones with 5G capabilities for applications such as video chatting, online gaming, and watching Ultra High Definition (UHD) videos. The demand for 5G chipsets has been rising across a range of devices and equipment, including broadband access gateway equipment, smartphones and tablets, connected cars, and linked gadgets. Additionally, the demand for components for next-generation chipsets has expanded as a result of ongoing expenditures in the deployment of next-generation telecom network infrastructure.

Market Segmentation

By Type

By Frequency Type

By Processing Node Type

By Deployment Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025