March 2025

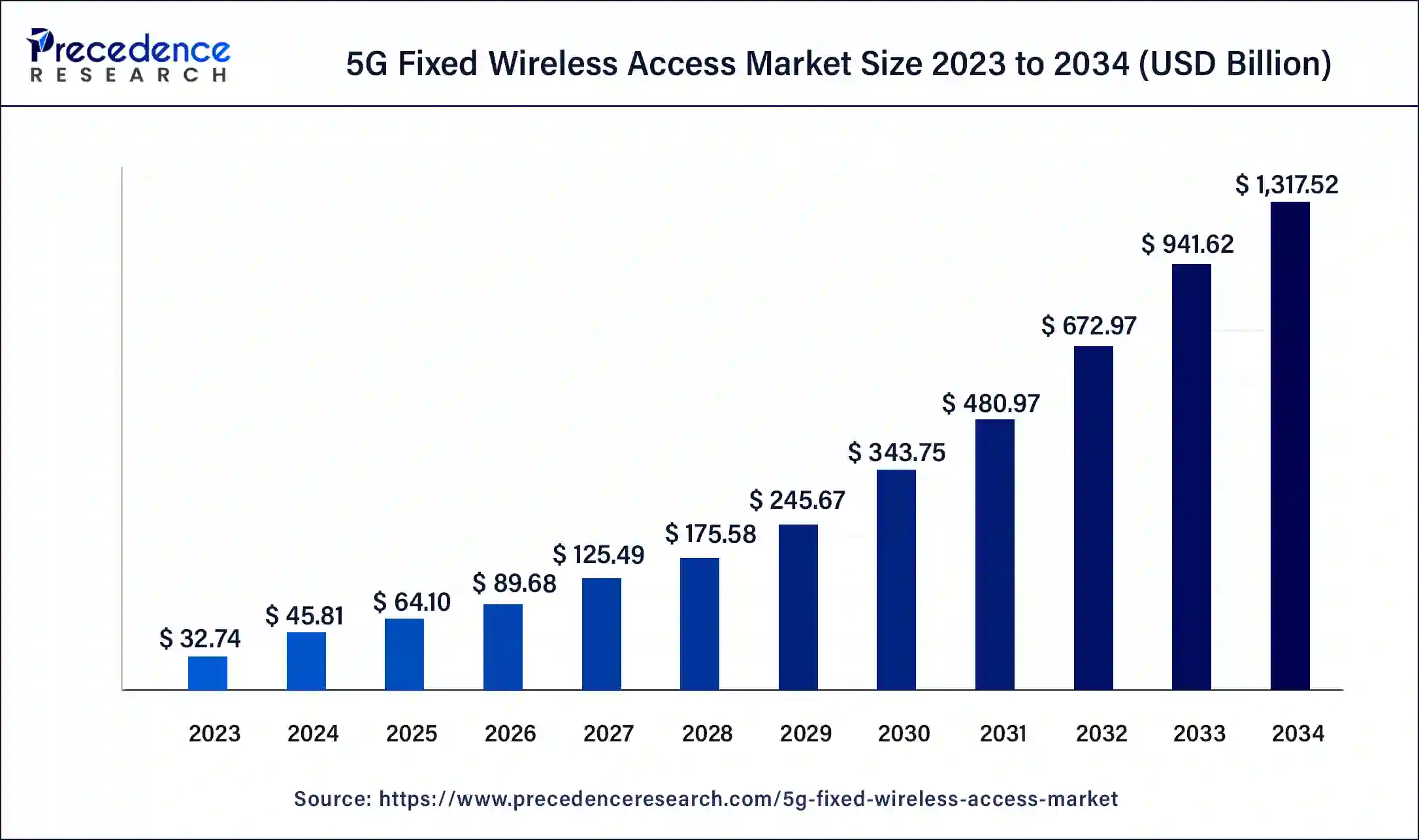

The global 5G fixed wireless access market size was USD 32.74 billion in 2023, calculated at USD 45.81 billion in 2024 and is expected to be worth around USD 1,317.52 billion by 2034. The market is slated to expand at 39.92% CAGR from 2024 to 2034.

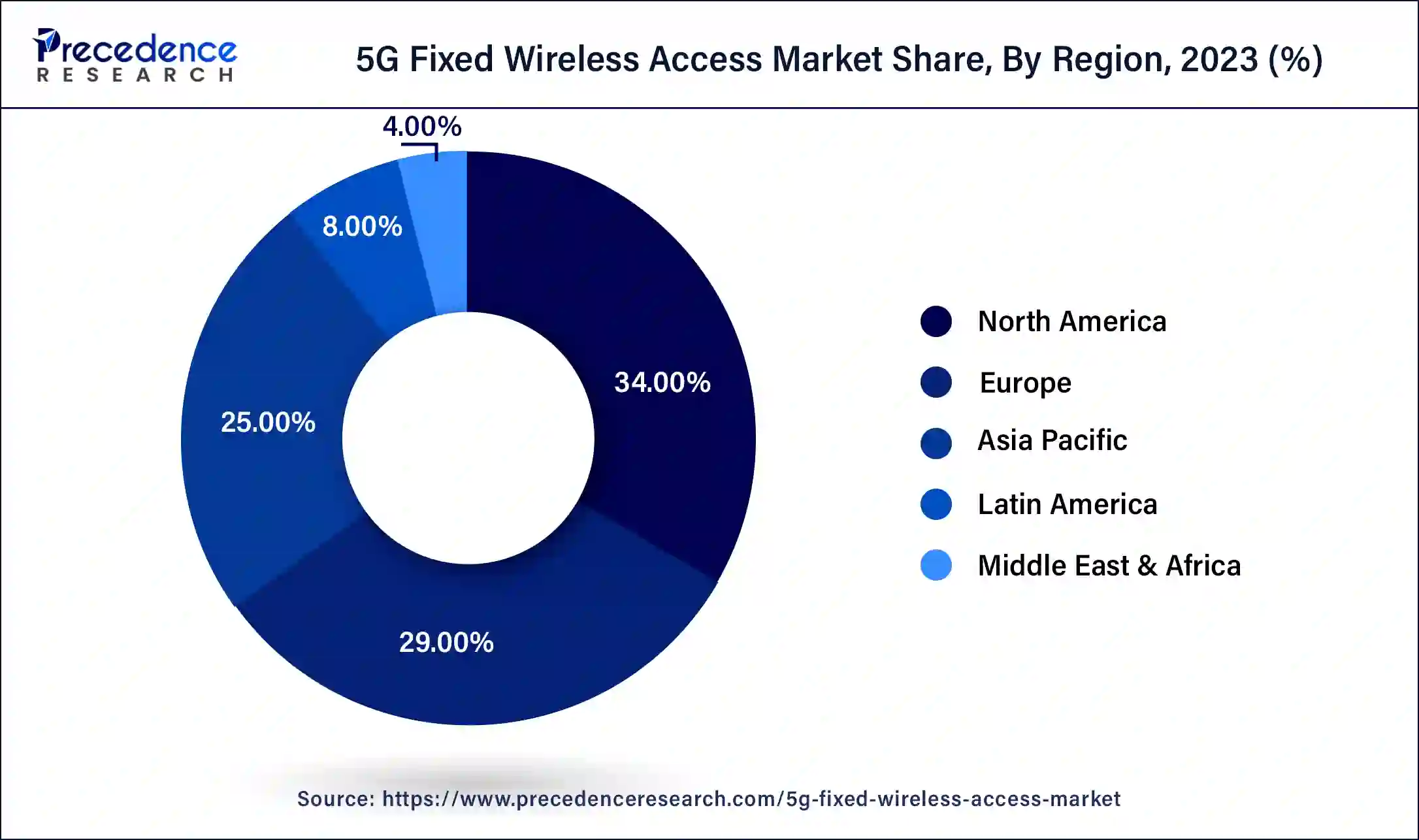

The global 5G fixed wireless access market size is projected to be worth around USD 1,317.52 billion by 2034 from USD 45.81 billion in 2024, at a CAGR of 39.92% from 2024 to 2034. The North America 5G fixed wireless access market size reached USD 11.13 billion in 2023. The 5G fixed wireless access market is driven by the rising demand for high-speed internet, and cost efficiency compared to traditional networks.

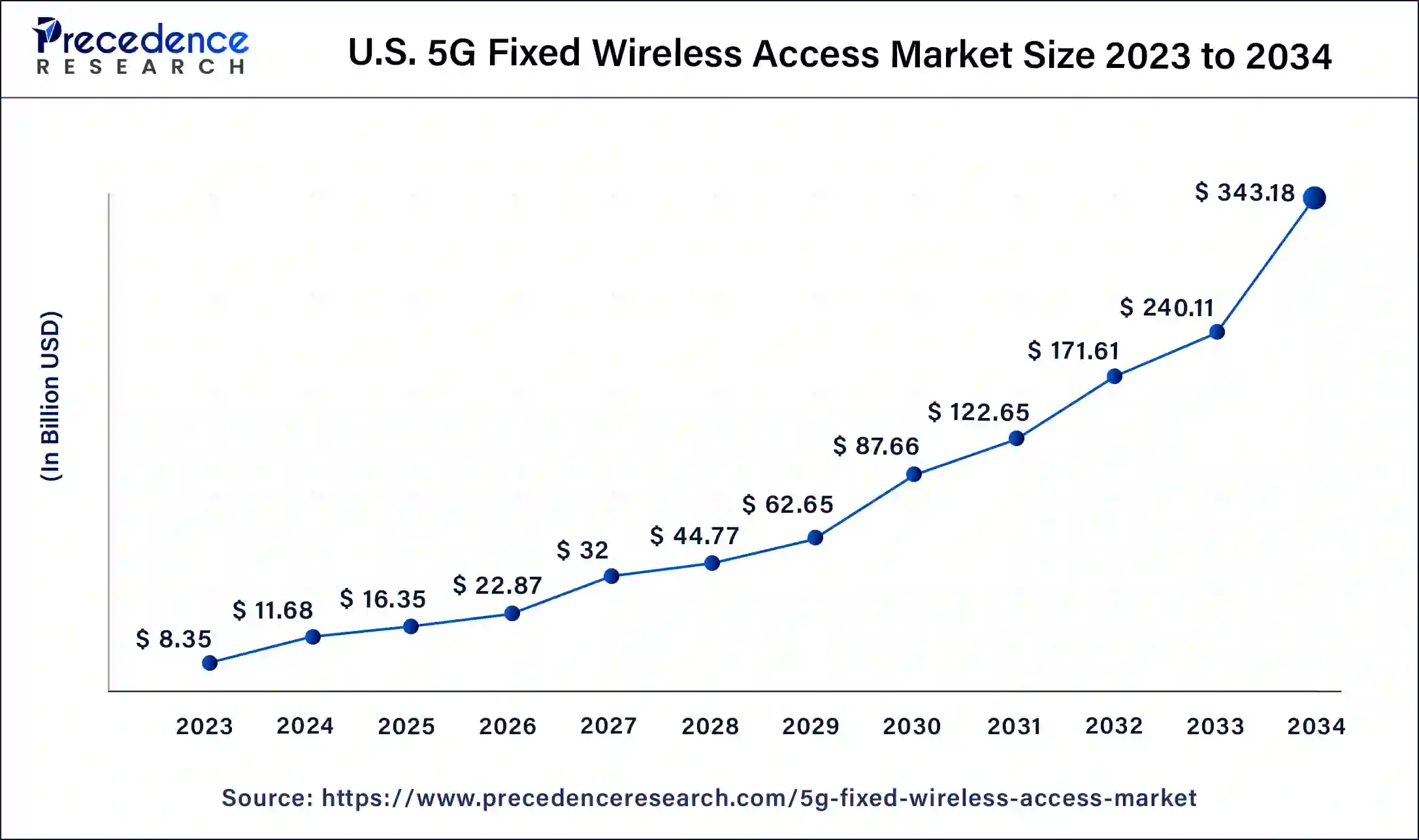

The U.S. 5G fixed wireless access market size was exhibited at USD 8.35 billion in 2023 and is projected to be worth around USD 343.18 billion by 2034, poised to grow at a CAGR of 40.18% from 2024 to 2034.

North America held the largest share of the 5G fixed wireless access market in 2023. The United States is replicating the private-sector-driven approach that saw the country to the 4G dominance to maintain this leadership in the 5G world. The method allows operators to make their own decisions about deployment which fuels competition and ultimately drives the innovations as well as investment.

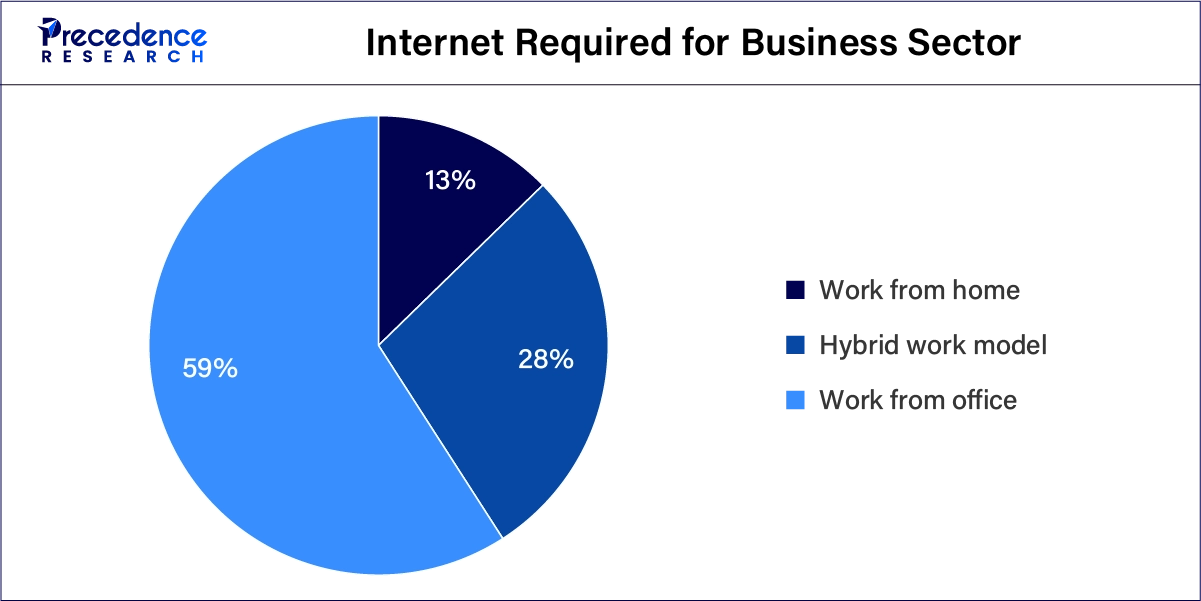

There is a strong investment in 5G infrastructure by the dominant telecom players including Verizon, and T-Mobile which tend to FWA adoption and fill the internet availability divide. Besides this, the consumer demand for faster and more reliable Internet services is noted as more people stay and work from home.

Asia Pacific is observed to witness the fastest rate of growth in the 5G fixed wireless access market during the forecast period. In developed markets such as China, South Korea, and Japan, the demand for high-speed internet is met through FWA since there is a high enthusiasm for adopting new technologies. Likewise, in emerging markets such as India and the rest of Southeast Asia, FWA is used to extend broadband internet to remote areas as a cheaper substitute for fixed broadband.

China is the largest mobile market in the world and is forecasted to overtake all the other markets and become the largest 5G connections market by 2025. In India, fast growth and the incredibly massive size of its connectivity market will be even more of a benefit with the rise of 5G, which makes it one of the most crucial areas for connectivity players.

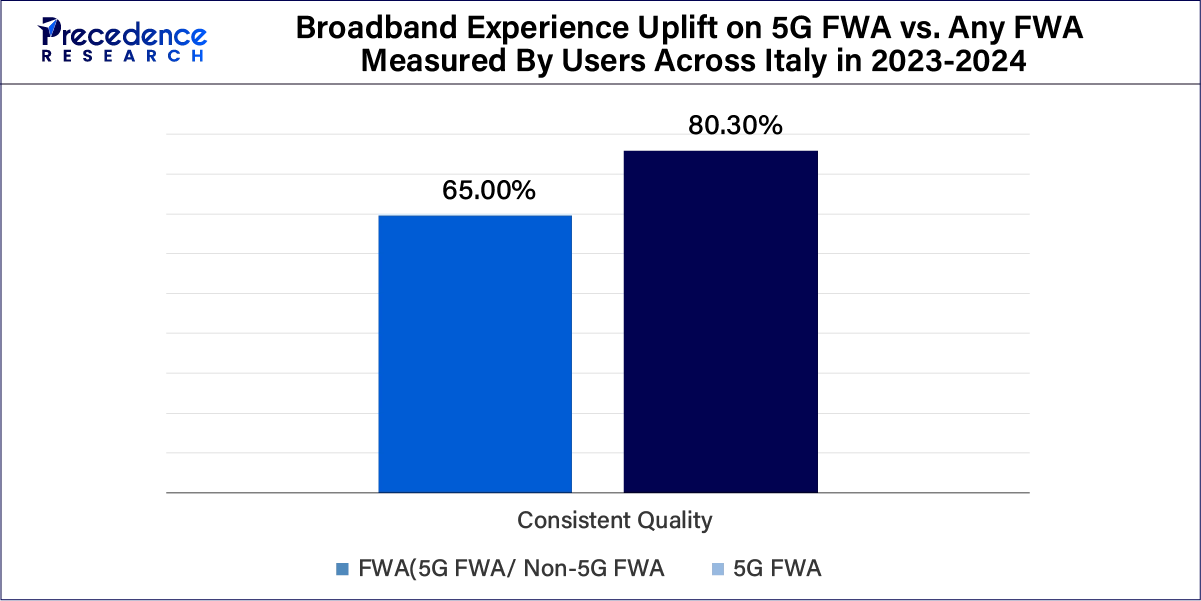

Fixed wireless access, which can support 5G technology, is the next generation of wireless connectivity, offering the potential for ultra-high speeds, low latency, and massive capacity. FWA broadband technology is an essential tool in connecting the digital divide. Broadband connectivity is recognized as a vital enabler of economic and societal well-being and, increasingly, a significant contributor to environmental sustainability targets.

How Can AI Help the 5G Fixed Wireless Access Market?

AI is leveraged to tackle the network traffic of the 5G fixed wireless access market and predict some simple working such as intelligent inferences for finding cell outages, which assist the network system configuration change, etc. It will also increase the proactive handover needed to supervise life-threatening emergencies where patients are treated through video conferencing/voice communications and avoid service disruption or at time of switchover connections from one cell tower onto another while care professionals aboard an ambulance on their way towards hospitals.

The 5G fixed wireless access market will help develop an eco-system, where the cloud-enabled processes and devices are driven by data-driven algorithms using cutting-edge AI and 5G technologies to deliver a mesmerizing experience to its consumers. 5G wireless networks can provide a superior Quality Experience 24/7 but will need to leverage AI. The 5G network boosts the performance of AI playing analysis, reasoning, and data fitting and clustering to improve outcomes in terms of consistency and success.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,317.52 Billion |

| Market Size in 2023 | USD 32.74 Billion |

| Market Size in 2024 | USD 45.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 39.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Offering, Operating Frequency, Demography, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for high-speed connectivity

5G FWA provides high-speed internet comparable to traditional fixed-line broadband, thus making it an attractive option for urban as well as rural areas where laying down fiber infrastructure could be costly or time-consuming. Helped by the increase in remote workers and online tools for collaboration, reliable internet has been front of mind as employees need quick, low-latency connections to remotely access corporate networks and participate in video conferences. With technology advancing and businesses relying heavily on the internet, it appears likely that high-speed connectivity will only increase in demand. This drives the growth of the 5G fixed wireless access market.

Limited Coverage

5G wireless access points can have limited reach and may face interference, requiring them to be placed closer together than previous wireless technologies. This is because 5G wavelengths cannot penetrate walls. The high-frequency millimeter waves used in 5G have a narrow range and can be obstructed by buildings and other physical barriers. Fixed wireless access (FWA) units require line-of-sight connectivity to each other or the tower. The coverage will also be consistent since the router remains stationary, limiting the growth of the 5G fixed wireless access market.

Strategic partnerships

As in most industries, especially the information and communications technology (ICT) sector, the relationship between 5G FWA market players is mutually beneficial and based on the joint expansion of possibilities and networks. This means that telecom operators can lease the required consumer access from the ISPs to push high-speed services and coverage into the presently uncovered regions, and the technology vendors and equipment manufacturers could join efforts to key in the required structures. The real estate developers, the 5G FWA, can be incorporated into new buildings, making the properties attractive and connected. These create new opportunities for players in the 5G fixed wireless access market.

Further, affiliations with cloud service providers can provide the companies with bundled services involving internet connectivity and cloud services, and local governments can engage 5G providers to advance smart cities and improve the digital divide. These collaborations are effective at advancing technology and improving the effective use of resources and customer service at lower costs. This opens an opportunity for the growth of the 5G fixed wireless access market.

The services segment has contributed the largest share of the 5G fixed wireless access market in 2023. With 5G wireless home broadband, homes and small businesses can avail of media-rich services, with a very low latency. 5G makes available a level of performance that will facilitate demanding fixed connections to perform over cellular and IoT traffic to increase significantly. 5G can be used for connected services, which are of three types Enhanced mobile broadband, massive IoT, and mission-critical communications.

The hardware segment is anticipated to show considerable growth in the 5G fixed wireless access market over the forecast period. 5G FWA is generally offered by operators. It can be a device, router, or modem, integrated with 5G FWA. 5G CPE is a terminal device used for access and connection to the 5G network. It can be a router, modem, or mobile device that supports 5G.

The sub-6 GHz segment accounted for the largest share of the 5G fixed wireless access market in 2023. 5G networks are mainly focused on sub-6GHz bands, because of the shorter transmission distance and lower penetration of mmWave. Sub-6GHz bands will continue as the most popular choices for most telecom operators, while mmWave will be mostly utilized for data-showering hotspots such as packed stadiums or the real-time streaming and uploading of 4K/8K videos. 5G in mid-band spectrum (2 GHz to 6GHz) is considered to be ideal for FWA service and it gives 10 times the capacity to that of 4G.

The 24-39 GHz segment is projected to witness significant growth in the 5G fixed wireless access market over the forecast period. 5G mmWave bands provide high-bandwidth capacities, which is useful in settings with a lot of users, such as in stadiums. In telecommunications, mmWaves are used for high-bandwidth WLANs and short-range personal area networks.

The urban segment dominated the 5G fixed wireless access market in 2023. Urban areas are characterized by high population density and residential, commercial, and other non-residential urban land uses. It is a place where the majority of national governments and countries house the biggest cultural, political, and economic centers are located. Urban environments have a relatively higher cable and fiber presence leading to speed differentials compared to rural.

The semi-urban segment shows notable growth in the 5G fixed wireless access market during the forecast period. The major benefit of FWA it does not require any cables or wires to be installed. This means that it can be installed rapidly and easily, even in remote areas, making it an excellent option for semi-urban areas. Additionally, fixed wireless internet can provide high-speed internet connectivity, with speeds that allow users to stream, work, and play games. Since it does not require any cables or wires to be installed, it is generally cheaper than DSL Internet.

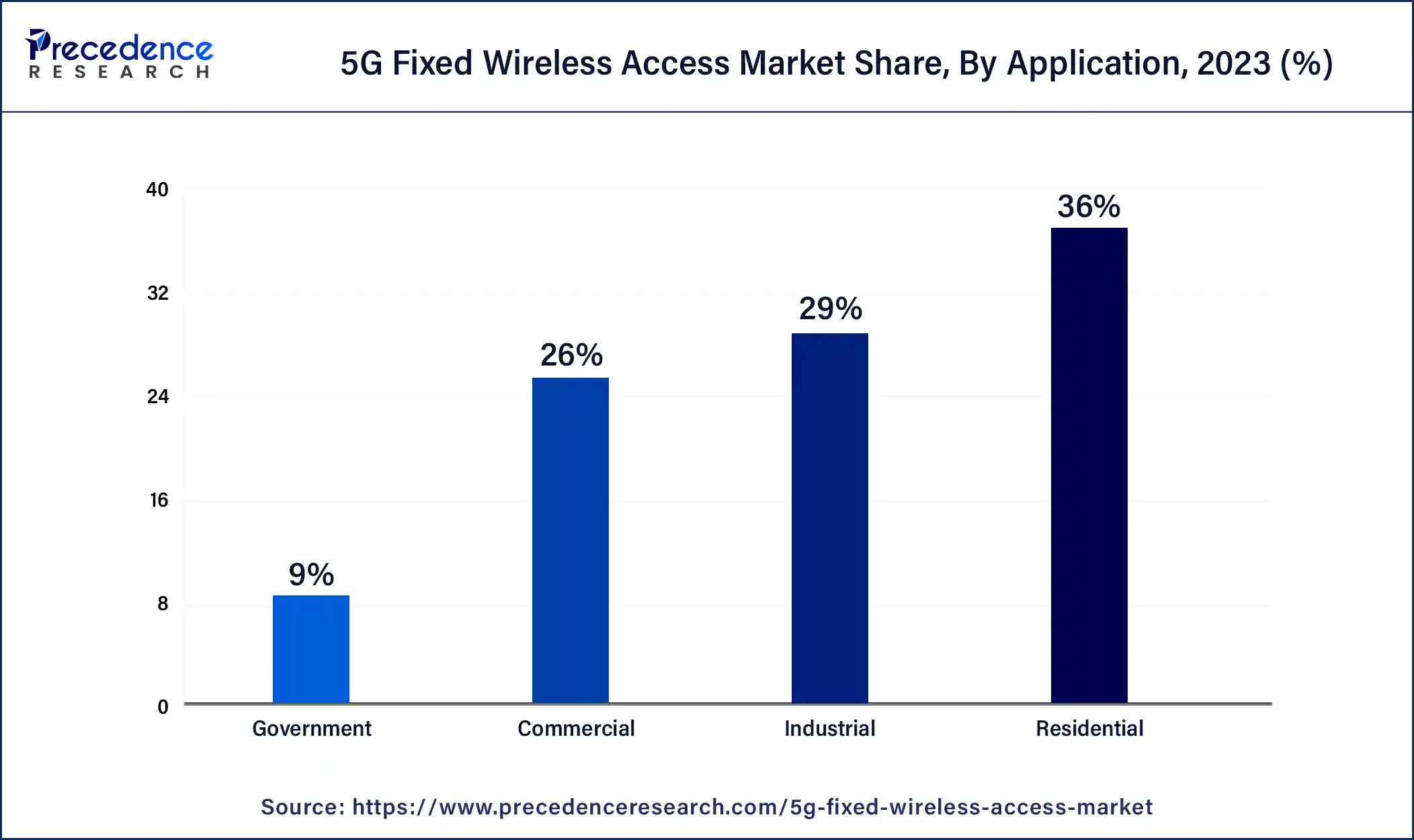

The residential segment held the highest share of the 5G fixed wireless access market in 2023. The need to provide low-cost, high-speed internet to resident users has created a way of developing FWA technologies over 5G. Telephone and broadband services can be made available to a household using an indoor or outdoor subscriber unit and by running new 5G technology to connect the subscriber unit to the wireless network. Led by the development of mobile internet, online video, HD video, voice, home broadband, smart homes, and other entertainment. The enterprise segment is also anticipated to grow at a very high rate due to the use of 5G FWA for enterprise broadband, especially for remote working, industrial uses, and cloud services.

The commercial segment is projected to grow at the fastest rate in the 5G fixed wireless access market during the forecast period. As for the consumers, the need for fast Internet connection for online gaming, video streaming, and smart home applications is driving the adoption of 5G FWA as a reliable and fast Internet option. In the business segment, several industries like manufacturing, logistics, transport & healthcare are leveraging 5G FWA for the required connectivity to support the next level of application and improve operational efficiency.

Segments Covered in the Report

By Offering

By Operating Frequency

By Demography

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

October 2024

February 2025