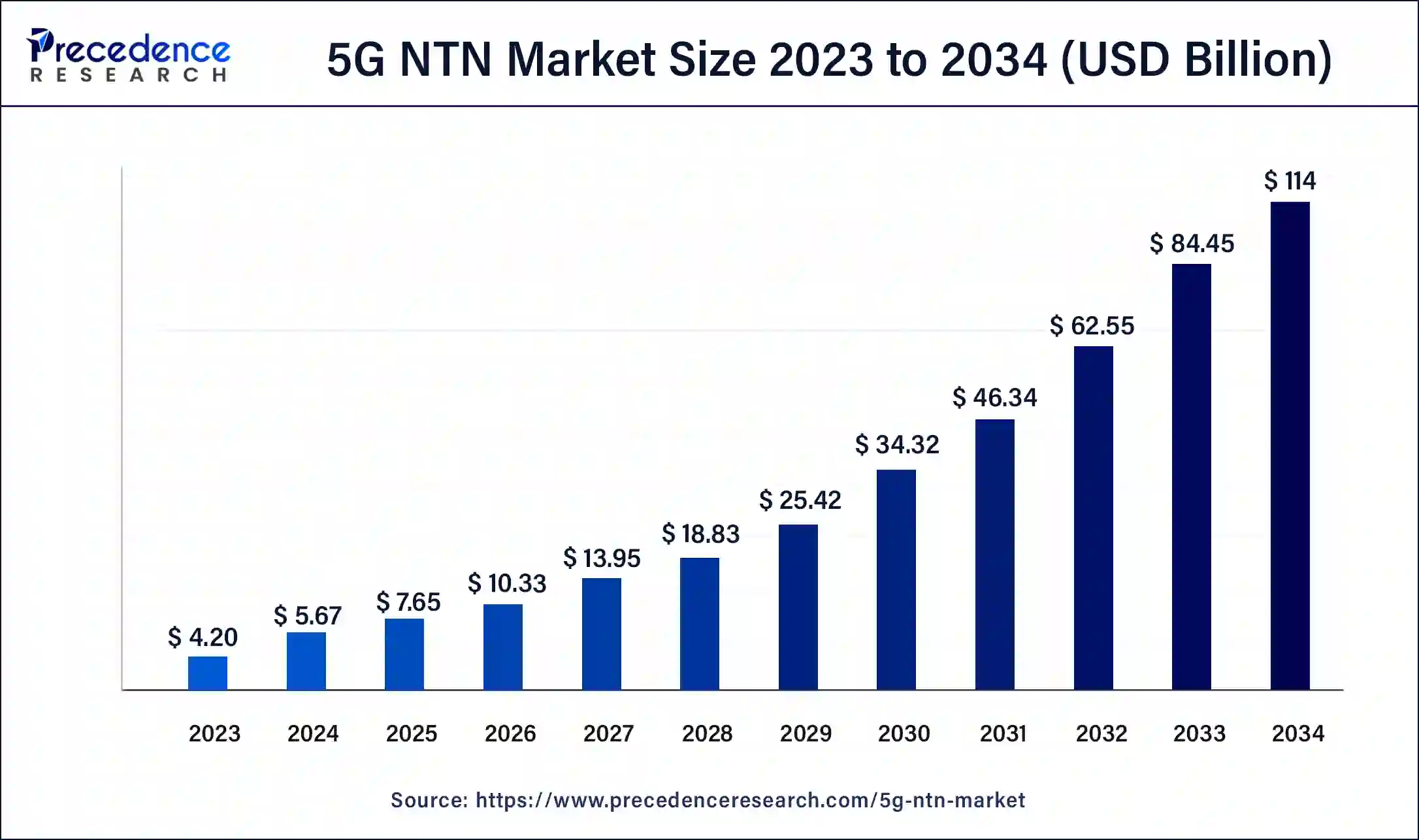

The global 5G NTN market size was USD 4.20 billion in 2023, calculated at USD 5.67 billion in 2024 and is projected to surpass around USD 114 billion by 2034, expanding at a CAGR of 35% from 2024 to 2034.

The global 5G NTN market size accounted for USD 5.67 billion in 2024 and is expected to be worth around USD 114 billion by 2034, at a CAGR of 35% from 2024 to 2034.The North America intelligent power module market size reached USD 1.47 billion in 2023.

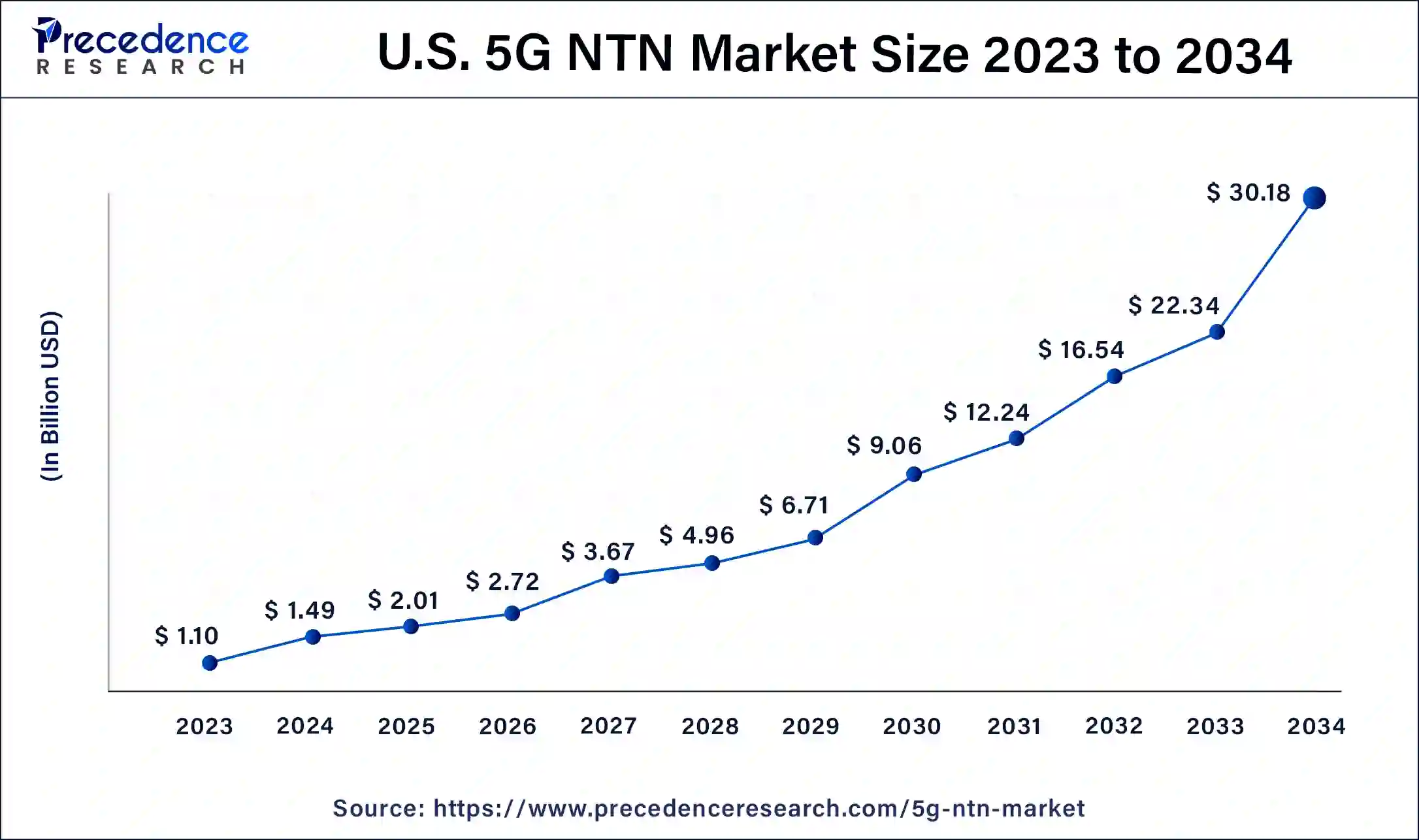

The U.S. 5G NTN market size was estimated at USD 1.10 billion in 2023 and is predicted to be worth around USD 30.18 billion by 2034, at a CAGR of 35.1% from 2024 to 2034.

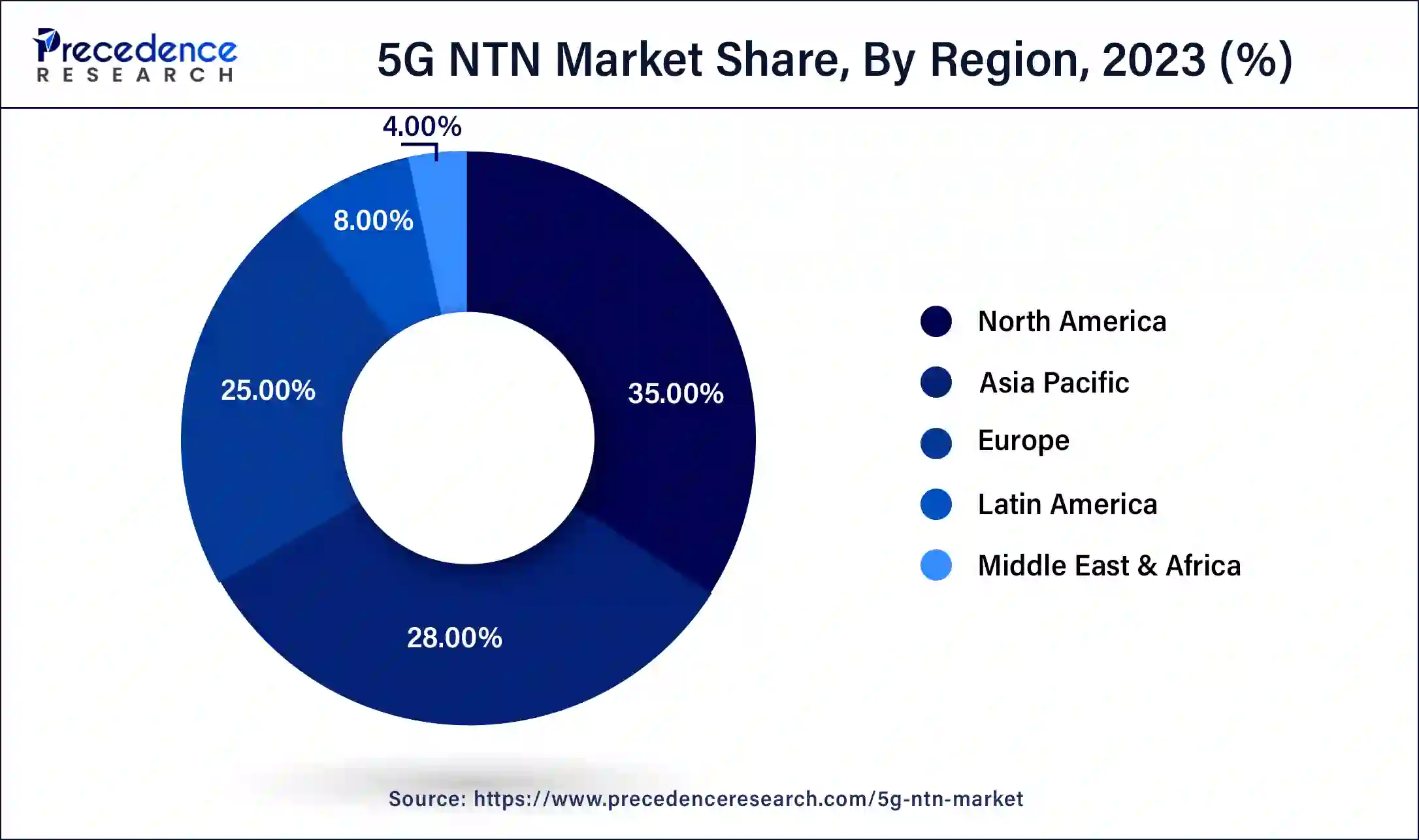

North America led the 5G NTN market with the largest share of 35.0% in 2023. The growing demand for high-speed connectivity, particularly in remote and underserved areas, has propelled the adoption of NTN solutions. North American telecommunications providers are leveraging satellite communication to enhance network coverage, ensuring that even the most challenging terrains can access 5G services.

A big population, expanding infrastructure, and emerging technologies all contribute substantially to the expansion of the 5G NTN market in the Asia Pacific region. A significant factor in this region's deployment of 5G NTN technologies is the necessity to increase public safety in emergency and disaster circumstances.

There is a growing demand for public security and safety technologies like surveillance technology, scanning and screening devices, and essential communication networks as a result of the region's boom in smart infrastructures, such as initiatives for smart cities.

To improve network coverage in various areas, a number of industries, including aerospace, maritime, defense, and others, are implementing integrated 5G networking and satellite-based solutions. The maritime sector has embraced maritime satellite technology to make use of cutting-edge communication networks to connect with staff members working in far-flung offshore sites.

5G Non-Terrestrial Networks (NTN) refer to the use of satellite or high-altitude platforms, such as drones or balloons, to provide 5G wireless connectivity to users. These networks are being developed to address the challenges of providing connectivity in remote or hard-to-reach areas where traditional terrestrial networks are not practical. 5G NTN is expected to provide a wide range of benefits, including improved coverage and capacity, reduced latency, and increased reliability. It is also expected to support a wide range of applications, including internet of things (IoT) devices, autonomous vehicles, and remote healthcare services.

5G Non-Terrestrial Networks (NTN) can also have potential applications in mining operations. In the mining industry, remote areas are often difficult to reach and traditional terrestrial networks may not be available or reliable. NTN can be used to provide high-speed and reliable wireless communication to mining sites, enabling real-time monitoring, control, and communication between workers, equipment, and operations.

To enhance operations, mining companies are integrating the most recent automation technologies. The swedish mine operator boliden, for instance, collaborated with Ericsson to build an autonomous gold mine, where ericsson installed the 5G network. The demand for 5G NTN solutions is also rising as more vessels are required to support high data rates for applications like video and data file transfer.

The integration of the terrestrial network with LEO satellite to create a 5G networking system is being supported by governments in numerous nations. The government of Canada and telesat agreed to a deal for USD 600 million in July 2019 to use Telesat's LEO satellite constellation to close the connectivity gap across Canada.

In August 2022, MediaTek and Rohde & Schwarz worked together to execute a NodeB network (gNB) test over an LEO satellite to show off the ability of 5G NTN to give a more dependable and quick connection. By using a 5G network connection to power a smartphone for the first time, the business has reached a new 5G milestone.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.20 Billion |

| Market Size in 2024 | USD 5.67 Billion |

| Market Size by 2034 | USD 114 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By End-Use and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Excessive coverage expansion must be addressed.

The fifth generation (5G) Revolution mobile network technologies aim to ultimately increase coverage such that wireless services are accessible everywhere since connectivity in the future are going to be prevalent. Present a new 5G Evolution architecture that incorporates extraterrestrial networks in order to achieve that goal (NTN).

The cooperative NTN design that has been developed is interesting since it allows for greater cost efficiency through equipment sharing and frequency resource conservation through shared frequencies. Also, consumers may connect to 5G networks everywhere without knowing the connection destination by fully utilizing wireless technologies including handover, available bandwidth, and dual connection between Sites.

Meeting demand on ground stations.

Ground stations are necessary to communicate with the satellite or high-altitude platform, and a sufficient number of ground stations must be deployed to ensure reliable communication coverage. One way to address this challenge is to use a combination of NTN and traditional terrestrial networks. Terrestrial networks can be used to provide connectivity in areas where ground stations for NTN are not available or practical.

This hybrid approach can ensure that reliable connectivity is available throughout the coverage area. Additionally, it is important to consider the regulatory and logistical challenges associated with deploying ground stations for NTN. Governments and regulatory bodies may have restrictions on the use of certain frequencies and may require permits or licenses for the deployment of ground stations. Logistics such as power, internet connectivity, and maintenance also need to be addressed.

Need for NTN in the evolution toward 5G and 6G.

Worldwide, 5G networks have been installed in several locations. So far, these commercial networks have provided foundational knowledge. Also, the 3GPP has started standardization linked to 5G Accelerated systems due to the requirement for the continued growth of 5G networks by embracing innovative verticals and use cases. Moreover, 5G advanced offers stepping stones for the future 6G network, connecting 5G and 6G.

The growing expectations have set a clear goal for the business and research communities: 6G should use constantly available intelligent communication to support an effective, humane, and sustainable society. Nonetheless, some of the aforementioned 5G advanced technological elements can be considered as forerunners to some of the 6G fundamentals.

In order to deliver an even better experience, XR, for instance, may progressively develop into immersive interaction for human-machine interaction, which may place additional demands on 6G.

The growing use of the internet throughout the world will support industry expansion. The expanding telecom and broadband sectors have increased access to reasonably priced internet connectivity options. Nearly 4.9 billion people worldwide utilized the internet in 2021, up from 4.1 billion in 2019, based on the International Telecommunication Union (ITU).

More people will have access to e-learning platforms as more people are using the internet and taking courses or finishing degrees on them. Corporations have been pushed to adopt work-from-home policies to maintain daily operational activities in response to the growing personnel safety concerns.

Practices for working remotely to maintain everyday operations. Several businesses are concentrating on providing specialized learning solutions to meet the growing demand. For instance, LinkedIn Corporation said in April 2021 that it had plans to create an online site for businesses to offer their staff video tutorials & materials on topics like effective management and machine learning.

Manufacturers of smartphones are concentrating on baseband development to expand their 5G portfolio. As an illustration, Huawei and Samsung have been creating their own baseband for their own devices to lessen their reliance on other chip producers and boost their ability to differentiate their products through the integration of software and hardware. Vivo stated that the Exynos 980 5G chipset from Samsung would power its x30 smartphone in November 2019.

The production of 5G smartphones reached a significant peak in 2019. Samsung has revealed that it shipped more than 6.8 million Galaxy 5G phones globally in 2019, enabling users to enjoy the utmost in speed and efficiency. With five Galaxy 5G devices available to customers worldwide, such as the Galaxy Note10 5G, Galaxy s11 5G, directly addressing+ 5G, as well as the recently introduced Galaxy Fold 5G and Galaxy A90, Samsung currently holds more than 40% of the global market for 5G smartphones.

In order to deliver high bandwidth with reasonable latency, maintain high mobility of about 500 Kmph, and manage 10,000 times more traffic, 5G NTN concentrated on the implementation of eMBB. In release-18, eMBB application cases such as mobility improvement, MIMO, and system power reduction are listed. Some top players are using upgraded mobile broadband to provide LTE-like 5G network connection. On initiatives, such as planes and ships, 5G NTN's eMBB services offer great broadband access in remote and underserved places.

In February 2023, for direct communication between smartphones and satellites, particularly in distant places, Samsung Electronics Co., Ltd., a global leader in advanced semiconductor technology, has acquired standardized 5G non-terrestrial networks (NTN) modem technology. Samsung intends to include this technology into its Exynos modem offerings, speeding up the commercialization of 5G satellite communications and laying the groundwork for the Internet of Everything (IoE) era, which will be driven by 6G.

Segments Covered in the Report:

By Component

By End-Use

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client