January 2025

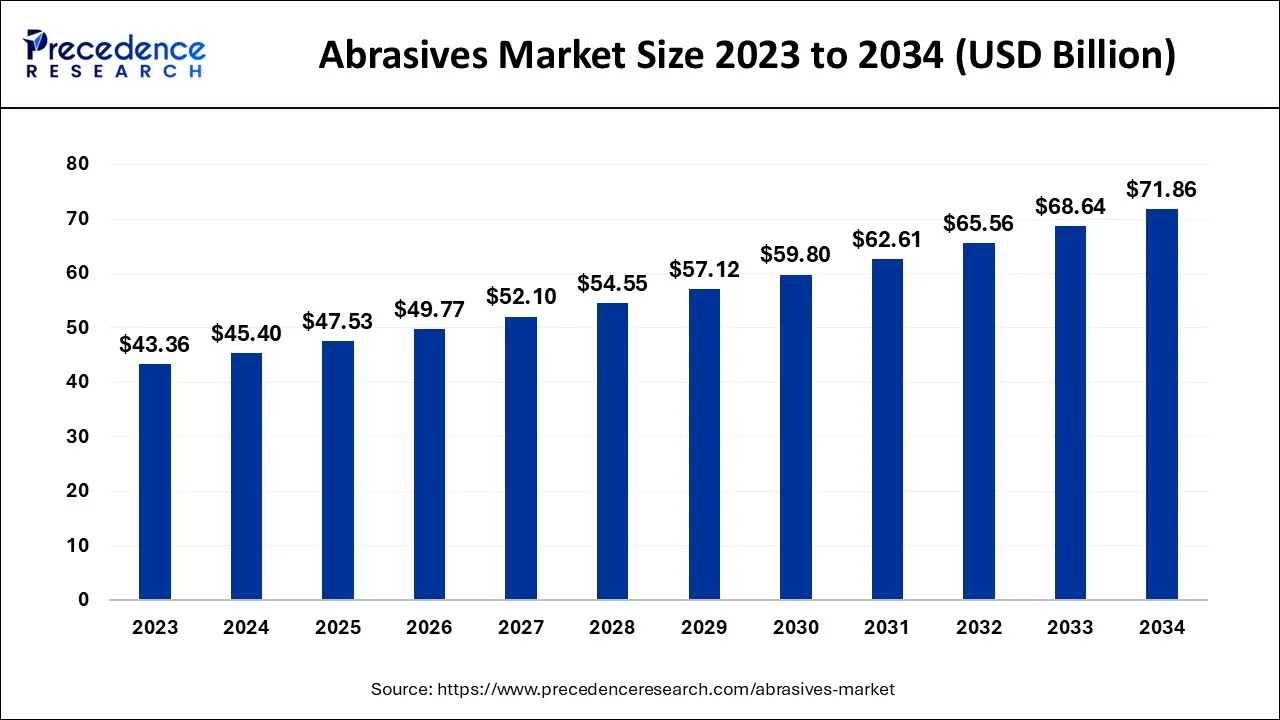

The global abrasives market size accounted for USD 45.40 billion in 2024, grew to USD 47.53 billion in 2025 and is predicted to surpass around USD 71.86 billion by 2034, representing a healthy CAGR of 4.70% between 2024 and 2034.

The global abrasives market size is estimated at USD 45.40 billion in 2024 and is anticipated to reach around USD 71.86 billion by 2034, expanding at a CAGR of 4.70% from 2024 to 2034.

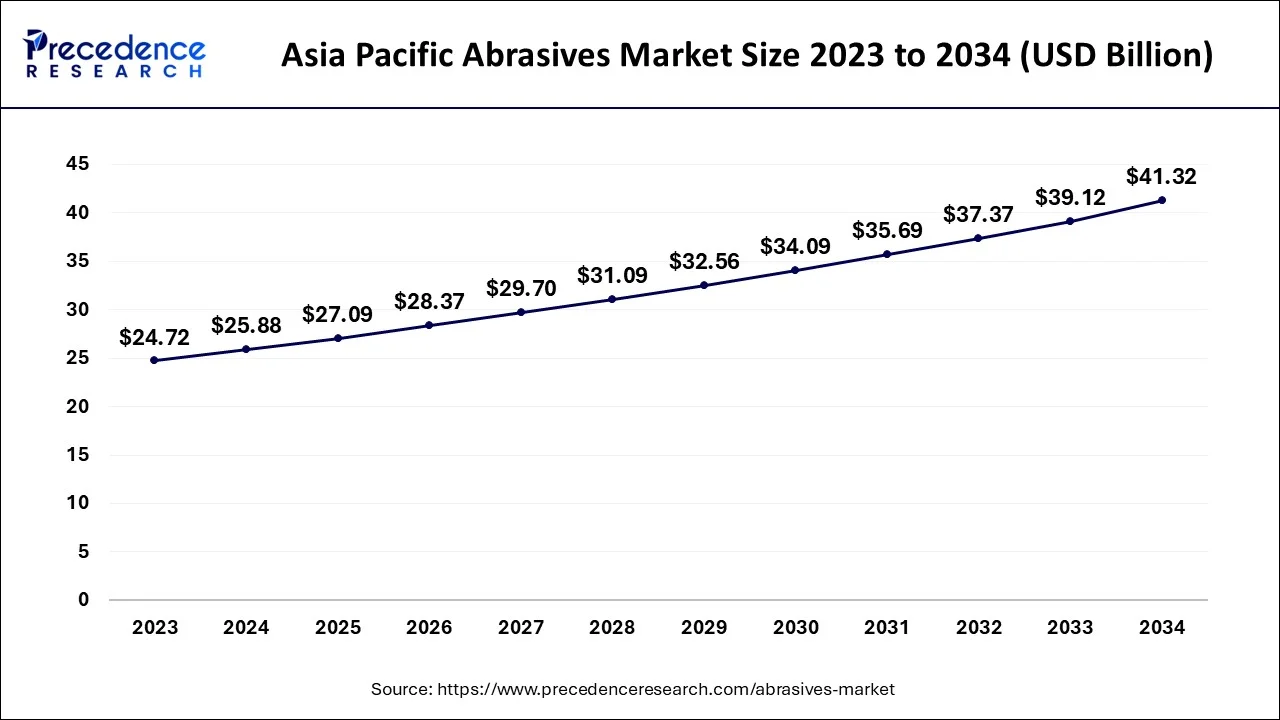

The Asia Pacific abrasives market size is evaluated at USD 25.88 billion in 2024 and is predicted to be worth around USD 41.32 billion by 2034, rising at a CAGR of 4.78% from 2024 to 2034.

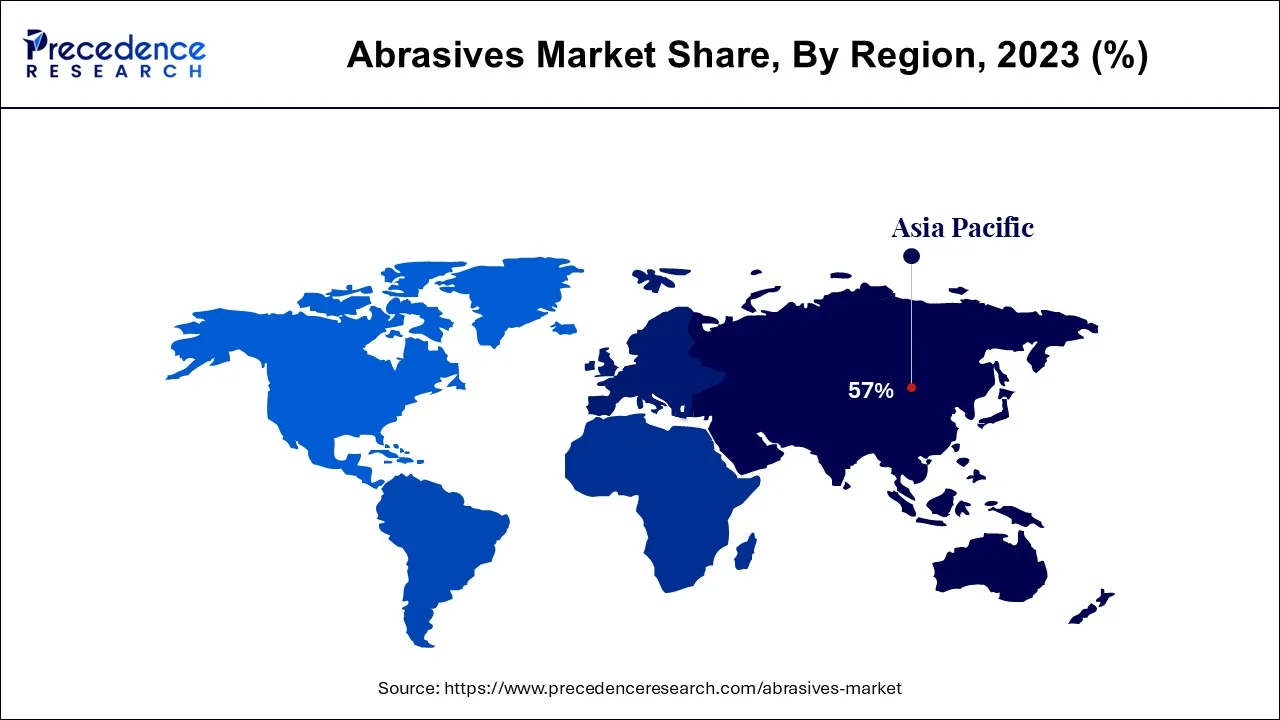

Asia-Pacific dominates the global market in 2023 and accounts for a great revenue share of over 57%. The local market will continue to grow at the fastest CAGR from 2024 to 2034. Infrastructure development increased investment in the manufacturing sector, and growth of electric vehicle production in the developing economies in the area is anticipated to drive market growth during the predicted period.

Southeast Asian countries are possible markets for abrasives. For example, Vietnam's industrial production grew by 2.9% in the first half of 2020 compared to the same period in 2019. The trade war between the United States and China has made Vietnam a popular investment destination in Asia and a solid produce base in the world. The development in the manufacturing region of the country has increased the demand for machines and therefore the demand for products.

North America is expected to experience steady growth over the next few years due to growing demand for automotive, aerospace and defense products. Despite the slowdown in 2020, due to the pandemic, the growing focus on electric vehicle production in the region coupled with resurgence in aircraft manufacturing is expected to benefit the growth of the market in the coming years.

An abrasive is a substance, usually a mineral, that is used to rub parts to finish or acclimate them, causing wear. It is similar to grinding and polishing, which involves roughening a smooth, meditative exterior, as in matte or satin consummate. Abrasives are widely used for scraping, glossing, polishing, sanding, cutting, drilling, grinding, grinding, and sanding; principally materials of mineral origin, obtained naturally or artificial. It works on the principle of hardness diversity between two raw materials, where the abrasive is the harder one. Abrasives are used for hard surface cleaning, grinding, and furbishing in many industries. Polishing composite in abrasive products assists in polishing and shaping the surface of the material. Abrasives come in a diversity of sizes, shapes, and sizes to meet your needs. Norton abrasives use corroding action to stainless, grind, abrade, scrub and take off solid materials.

Increasing demand from the auto industry to drive market growth in the upcoming years. Products used for sizing repair of engine parts, bodywork, and interior and exterior cleaning. These products are also used for cleaning inside pipes, smoothing welds, smoothing edges, and surfaces to be oiled, adjusted, polished, or painted. Coated and nonwoven products are used to finish the bodywork of cars while grinding wheels are habituated for cars. The high demand for various applications in the automotive industry directly supports the growth of the industry. Some abrasive products are used on non-engine parts and adjuncts such as brakes, flywheels, wheels, and axles. Brakes have a special wear layer with a non-directional scratch pattern suitable for collecting tools. It is used to exclude brake squeal and demote staining of heat-sensitive metals, sanding for grinding, and gloss the internal and external of cars. In addition, the increasing volatility of commodity prices and economic form is expected to significantly impact this market.

| Report Coverage | Details |

| Market Size in 2024 | USD 45.40 Billion |

| Market Size by 2034 | USD 71.86 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Increasing use of abrasives in household and commercial applications

Growing application of abrasives in the automotive industry

Growing demand from the construction industry

Synthetic abrasives hold the largest market share of the abrasives market. A synthetic abrasive is a chemical precursor treatment product or raw material. These materials contain artificial diamonds, silicon carbide, and alumina. Due to the booming consumer shift towards organic produce, natural abrasives are widely used in a wide range of household, industrial and technological operations. These include corundum, diamond, and emery which, as they occur inherently, can be mined and prepared for use with less variation. The growing utilization of this type of product in the automotive sector is the major factor driving market growth.

On the basis of product type, the abrasive market is bifurcated into a paste, coated, and super. The coatings segment is expected to generate the highest revenue due to its wide application. The coatings segment holds the leading market share for abrasives by 2022. There is a growing demand for super-abrasives in applications such as precision grinding in automotive, construction, and woodworking tools. These products in the form of grinding wheels or grinding tools are used to shape materials that are too fragile or too hard, such as glass, automotive, and construction industries.

The metal fabrication segment is augmented to experience a significant CAGR due to the increasing demand for metal equipment. Based on applications, the market is segmented into metal fabrication, electrical & electronics, automotive, machinery and others.

The metal fabrication sub-segment is expected to grow at a rapid rate during the forecast period. This fabrication is used to fabricate metal structures through bending, cutting and assembly processes. This product is used as a cutting saw aka a cutting saw, which has a steel cutting disc to cut metal into the desired shape. Other products are flip discs and fiber discs, which are mainly used for metal grinding and surface smoothing.

By Source

By Product Type

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025