November 2024

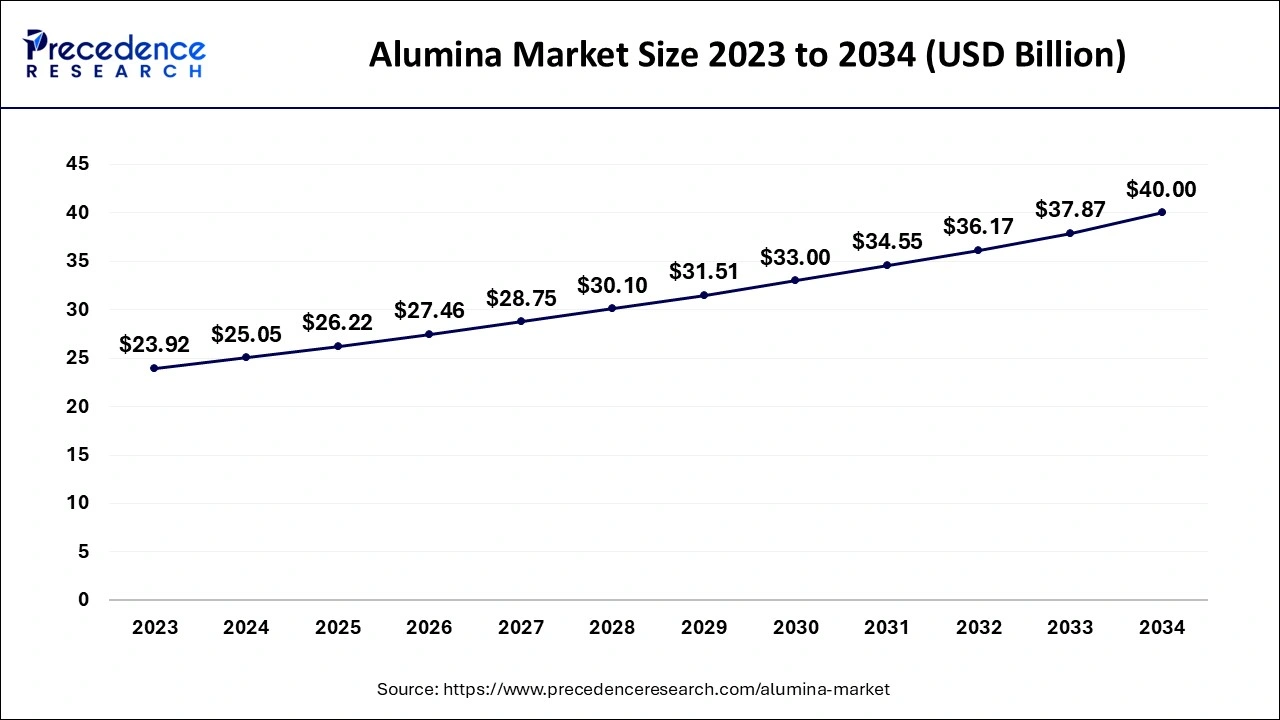

The global alumina market size accounted for USD 44.73 billion in 2024, grew to USD 46.83 billion in 2025 and is predicted to surpass around USD 70.8 billion by 2034, representing a healthy CAGR of 4.70% between 2024 and 2034.

The global alumina market size is estimated at USD 44.73 billion in 2024 and is anticipated to reach around USD 70.8 billion by 2034, expanding at a CAGR of 4.70% from 2024 to 2034.

The Asia Pacific alumina market size is evaluated at USD 25.05 billion in 2024 and is predicted to be worth around USD 40 billion by 2034, rising at a CAGR of 4.79% from 2024 to 2034.

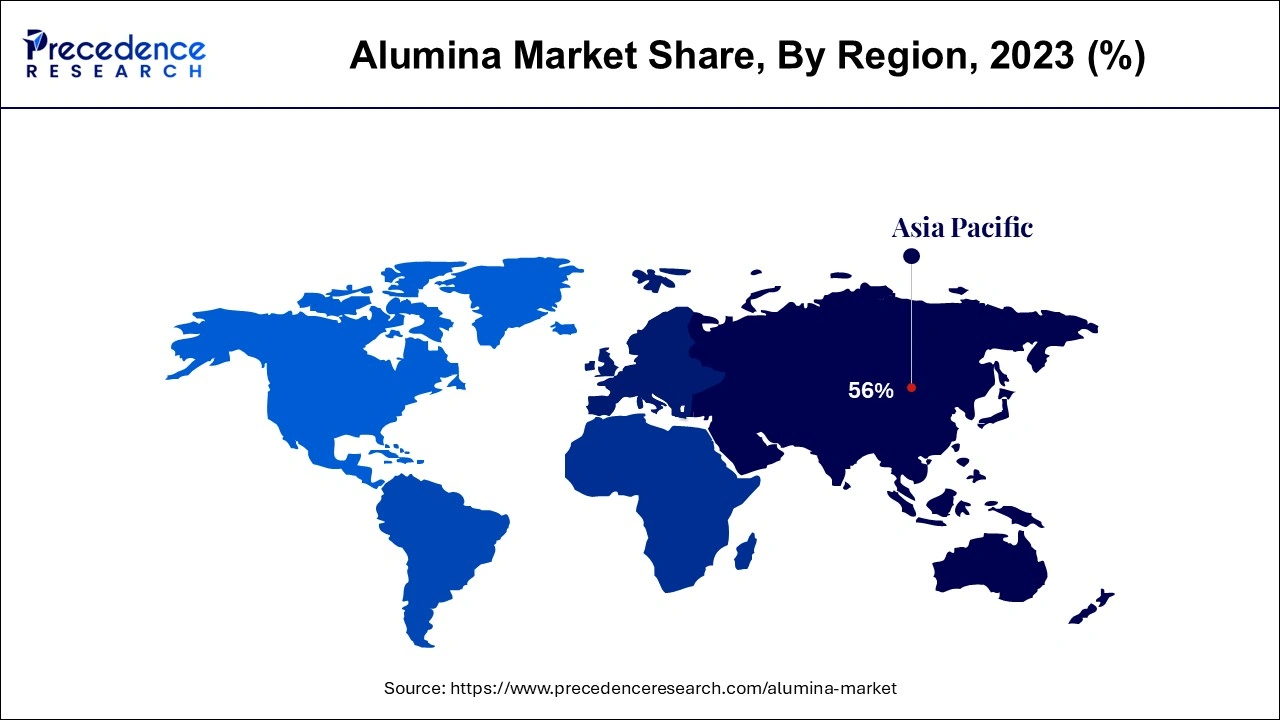

In 2023, the Asia-Pacific region had a primary market share of over 56%. China's domestic market makes a major contribution to the Asian Region and worldwide markets. China is known as the top producer and consumer of high-purity alumina, with more than 55percentage points of the market share by value and capacity. Furthermore, with over 15% of the Asian Region’s highly pure alumina industry, Japan ranks as the second-largest market in the area. The important development factors influencing the highly pure alumina market in the Asia Pacific region are the presence of established businesses, the prevalence of emerging economies, the combined demand from the electronics and automotive sectors, and the growing preference for LED lighting.

Due to the region's expanding use of highly pure alumina within the semiconductor and electronics sectors, North American highly pure alumina maintained the second-largest market share of over 15% in 2023. Due to the ease with which raw materials can be obtained and the growing desire that enterprises have for them as a result of their superior features, the US is predicted to become the region's largest market.

A white crystalline ingredient with the popular name "Alumina," aluminum oxide, is typically made from bauxite. It is extensively utilized in a variety of engineering disciplines, such as those involving anti-corrosion compounds, wear and abrasion-resistant components, and the computer industry. The quality attributes of alumina include great durability, brightness, minimal heat emission, and good stability at high temperatures. Alumina is now an expensive substance.

The automotive industry is continually being dominated by improved alumina components because of their superior performance and safety. Global automakers are changing their tastes by swapping out steel and iron elements with lightweight materials because lighter materials increase fuel efficiency. The market with alumina will increase significantly due to the rising need for lightweight body panels and improved load-bearing capabilities for light-duty commercial vehicles. In the nourishing term, the demand for premium alumina will be impacted by the rapidly expanding automotive sectors in emerging economies.

The consumer devices and building sectors actively create possibilities as a result of the modern standard of living. In recent years, alumina has been widely used for roof and wall cladding, incorporating frames, stairways, and panels. Wall cladding is frequently used in commercial buildings due to its affordability, usefulness, and attractive appearance.

The rising demand from the automobile & building and construction sectors is one of the major reasons behind the expansion of the global alumina industry. The alumina market is anticipated to rise significantly over the projected period as a consequence of high rises in construction investment in industrialized and developing nations as an outcome of rapid urbanization & wealth creation. Furthermore, it is anticipated that throughout the projection period, demand for alumina would increase due to the growing need for lighter and rising components to increase automotive fuel efficiency and lower carbon footprint. Additionally, rising automotive production & sales are anticipated as a result of global economic growth, especially in developing nations, and rising per capita discretionary money. This is anticipated to further support the growth of the global alumina market throughout the forecast period.

The change in the food and beverages sector toward packaged foods, particularly in developing economies like China, India, and Brazil, is also another factor anticipated to fuel the expansion of the global alumina market.

The rapid growth of packaged beverages and food goods in developing nations is predicted to increase the need for alumina in the packaging sector. Nevertheless, it is anticipated that the expansion of the alumina industry would be constrained over the forecast timeframe by severe competition from substitute materials like glass or plastic. Even though the fact that the requirement for alumina is anticipated to rise sharply due to rapid growth from the automobiles, building, and construction industries, the worldwide market is anticipated to face some difficulties due to varying raw material costs and the accessibility of substitute materials like glass as well as plastic materials. But because of its qualities including low weight, good strength, elasticity, good electrical and thermal conductance, resistance to corrosion, and permeability need for alumina are anticipated to rise throughout the projection timeframe.

| Report Coverage | Details |

| Market Size in 2024 | USD 44.73 Billion |

| Market Size by 2034 | USD 70.8 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.70% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Growing alumina use in the medical & defense sectors

Demand for LED lighting is increasing

Increasing lithium-ion battery demand

Demand in the market is being boosted by increasing applications in smart devices

The biggest demand in the alumina market was for commercial alumina. The rising usage of alumina in end-use sectors like transportation, building, packing, and durable goods is to blame for the growing demand for a metallurgy grade. Moreover, it is anticipated that the need for alumina for a variety of product compositions would be drawn by worldwide economic progress along with strong prosperity projections for these sectors, providing market expansion shortly.

In 2024, the smelting quality alumina sector held over 86% of the market share, and growth is anticipated to be significant through 2034. The increasing demand for alumina from finished sectors is to blame for this sector's expansion. Throughout the course of the research period, the emergence of the automobile sector in emerging nations will increase demand for premium alumina for use in exterior and interior bodywork, engine parts, and other applications. Due to the steady demand for premium aluminum components from the Asian Region and Latin America areas as a result of the expanding applications in finished industries, aluminum manufacturing from alumina will gain a sizable share of the market over the decades and it will create much more USD 48 billion by the end of 2030.

The car industry's increased use of aluminum components for interior and exterior components will increase the market share for alumina. 80% of the weight of contemporary commercial aircraft is made up of aluminum. Additionally, the construction industry in emerging nations will grow quickly, which will increase demand for aluminum.

In the alumina industry, the market for oxide for ceramics is anticipated to rise at the highest CAGR. Calcined alumina is primarily used in the creation of advanced ceramics. Due to its simplicity in blending with the other batch preparations, ability to regulate and distribute particle size, excellent power insulation, high strength, dielectric loss continuous, and superior corrosion resistance, the substance is preferred as the material of selection for ceramic production. Additionally, alumina components are simple to work with and machine using a variety of chemical and physical techniques, expanding its potential utilization base.

By Product

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2024