January 2025

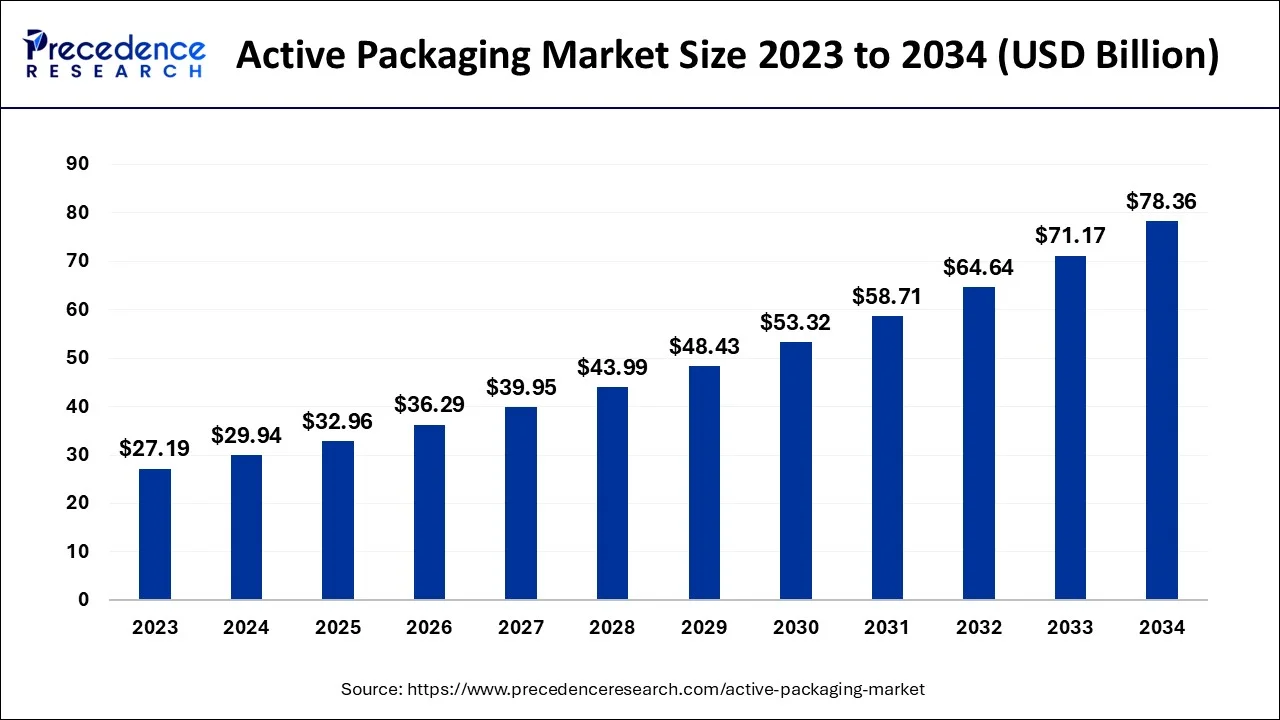

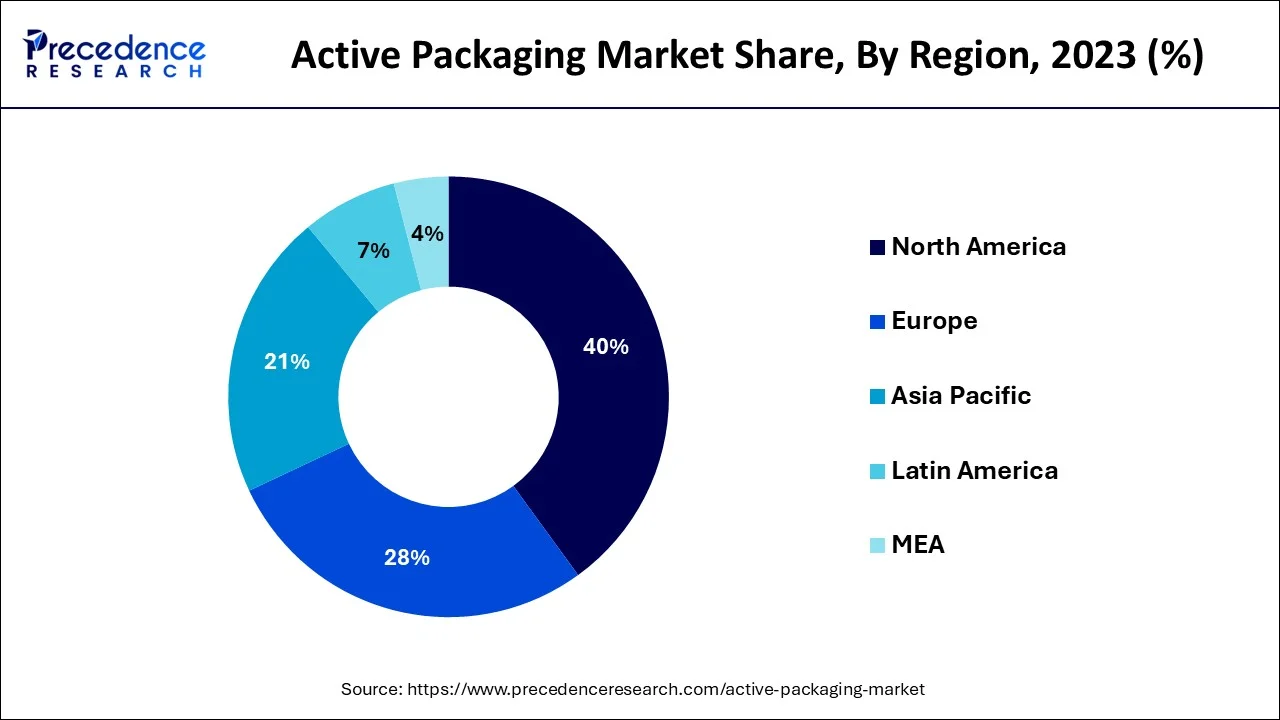

The global active packaging market size accounted for USD 29.94 billion in 2024, grew to USD 32.96 billion in 2025 and is predicted to surpass around USD 78.36 billion by 2034, representing a healthy CAGR of 10.10% between 2024 and 2034. The North America active packaging market size is calculated at USD 11.98 billion in 2024 and is expected to grow at a fastest CAGR of 10.22% during the forecast year.

The global active packaging market size is estimated at USD 29.94 billion in 2024 and is anticipated to reach around USD 78.36 billion by 2034, expanding at a CAGR of 10.10% from 2024 to 2034.

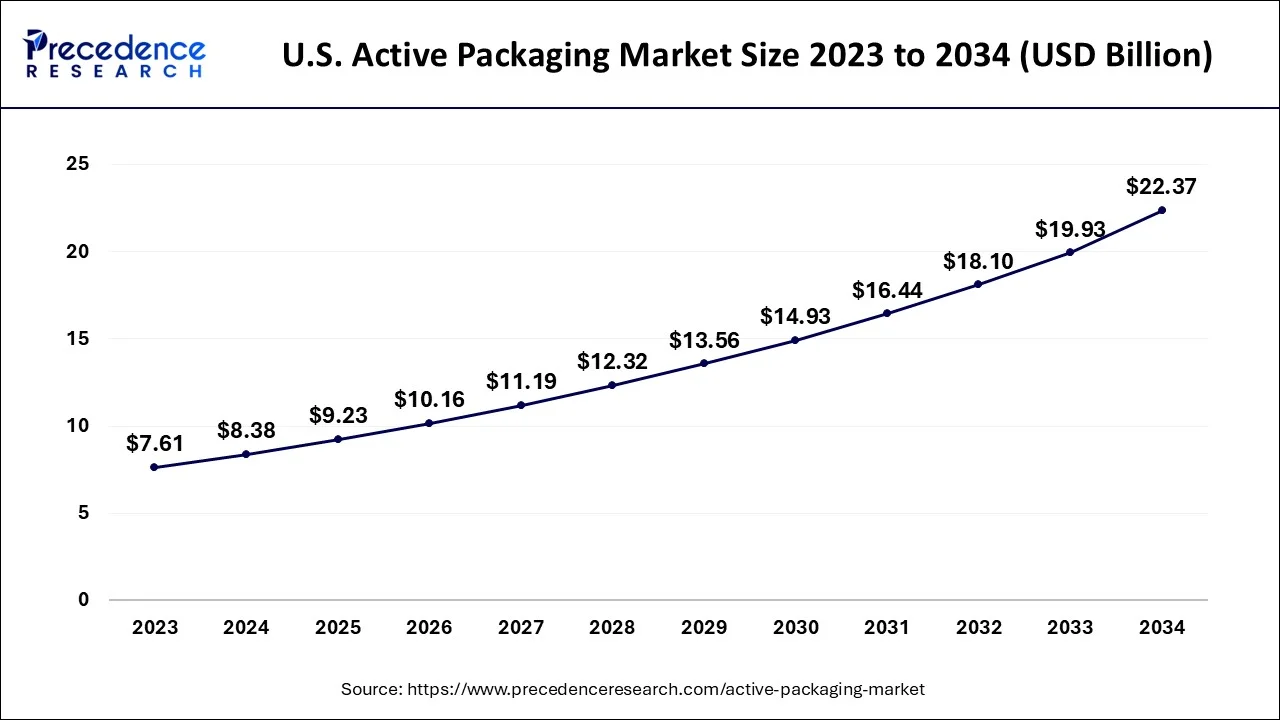

The U.S. active packaging market size is evaluated at USD 8.38 billion in 2024 and is predicted to be worth around USD 22.37 billion by 2034, rising at a CAGR of 10.30% from 2024 to 2034.

Given the strict regulations regarding beverage and food packaging and the ensuing increase in demand for cutting-edge solutions, North America may be expected to lead the market in the upcoming years. Given the growing consumer knowledge and choice for sustainable packaging technologies, Europe is growing at about the same rate as North America. The active packaging market in North America is continuing to emphasize product innovation. Companies are being drawn in by the quick transition from traditional to smart wrapping methods, which is pushing them to enter the industry. This drives the established firms to provide affordable and effective wrapping solutions in order to stay competitive in the local market.

According to the European Federation of Pharmaceutical Industries and Association, more than 1.18 billion vaccinations are produced in the area annually, with Germany leading the way in pharmaceutical supply development. The need for active packaging has increased in Germany due to the country's significant expansion in pharmaceutical pharmaceuticals and vaccine development. The government's strict measures to enforce accurate labeling of every medicine to stop drug fraud in the pharmaceutical industry benefit the market as well. Due to increased consumer disposable income and shifting lifestyles, particularly in China and India, Asia Pacific may see the highest development in the coming years. The active packaging business will be greatly impacted by the enormous food demand due to the growing population.

A product's quality and shelf life are maintained by adding specific additives to the packaging systems, a practice known as active packaging. While being transported and stored, packaged food is monitored by intelligent packaging systems, which provide information about the quality of the food. Therefore, using active packaging helps increase safety & convenience, monitor freshness, provide information on quality, and extend shelf life. In addition to other product categories, food and pharmaceuticals utilize active packaging. Factors that contribute to the growth include the expansion of the packaged food sector and the rise in the usage of active packaging in convenience shops. However, strict government regulations against plastic packaging are anticipated to impede industry expansion in the years to come.

The aging population increased chronic illness rates and expanding OTC medicine demand are all contributing to the healthcare sector's expansion. Investments in active packaging solutions are increasing as a result of rigorous rules regarding the packaging of medicinal items. The market for active packages is expected to grow over the course of the forecast period because to the increasing complexity of items that must be kept or delivered to remote locations even though keeping their integrity.

The industry is seeing an increase in demand for active packaging due to the rising popularity of packaged or ready-to-eat foods. The beverage business, which includes pouches for beverages and bottled water among other products, is also anticipated to have a favorable effect on this market. The expansion of packaged products is being driven by the increase in disposable income.

The COVID-19 epidemic has affected a lot of enterprises globally. Governments all across the world implemented strict lockdown protocols and social segregation norms to limit the pandemic's quick spread. The industrial roll-out of the Active Packaging Market may also be significantly delayed as a result of the economic crisis that followed the epidemic. As a result of the supply chain interruptions, market participants faced several difficulties. However, when additional supplies come online in the second half of 2023, things will get better.

A product's quality and shelf life are maintained by adding specific additives to the packaging systems, a practice known as active packaging. While being transported and stored, packaged food is monitored by active packaging systems, which provide information about the quality of the food. Therefore, using active packaging helps increase safety & convenience, monitor freshness, provide information on quality, and extend shelf life. In addition to other product categories, food and pharmaceuticals utilize active packaging. The packaged food industry's expansion and convenience shops' rising usage of active packaging are two elements that are fueling the increase.

| Report Coverage | Details |

| Market Size in 2024 | USD 29.94 Billion |

| Market Size by 2034 | USD 78.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.10% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Geography |

The market share for smart packaging will likely be the largest in the sub-segment for food and beverages. There are a few reasons for this. The first is that more people throughout the world want to eat food that they are aware is healthy. The second is that consumers prefer eating food that is assured to be fresh. This is a promise made by smart packaging. They also like to buy food that is always available, always accessible, and has a long shelf life. Once more, careful packing may make this happen. Since it makes it easier for them to comply with the most recent and stringent food safety laws, the majority of enterprises in the food and beverage sub-segment are driven to use smart packaging.

Additionally, consumers like as much clarity as possible in the information on their boxes. Businesses claim that smart packaging gives them the ability to accomplish this while also protecting their trademarks. The world may already be moving toward preferring that food products be covered in smart packaging for reasons of sanitation and transparency. However, this procedure was considerably sped up by COVID-19.

The segment with the biggest market share, oxygen scavengers, is anticipated to continue to lead the market during the projected period. Limiting the quantity of oxygen that might cause deteriorative reactions and reducing the use of many items, including food, metals, and medications, is the goal of oxygen scavenger technology.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025