July 2025

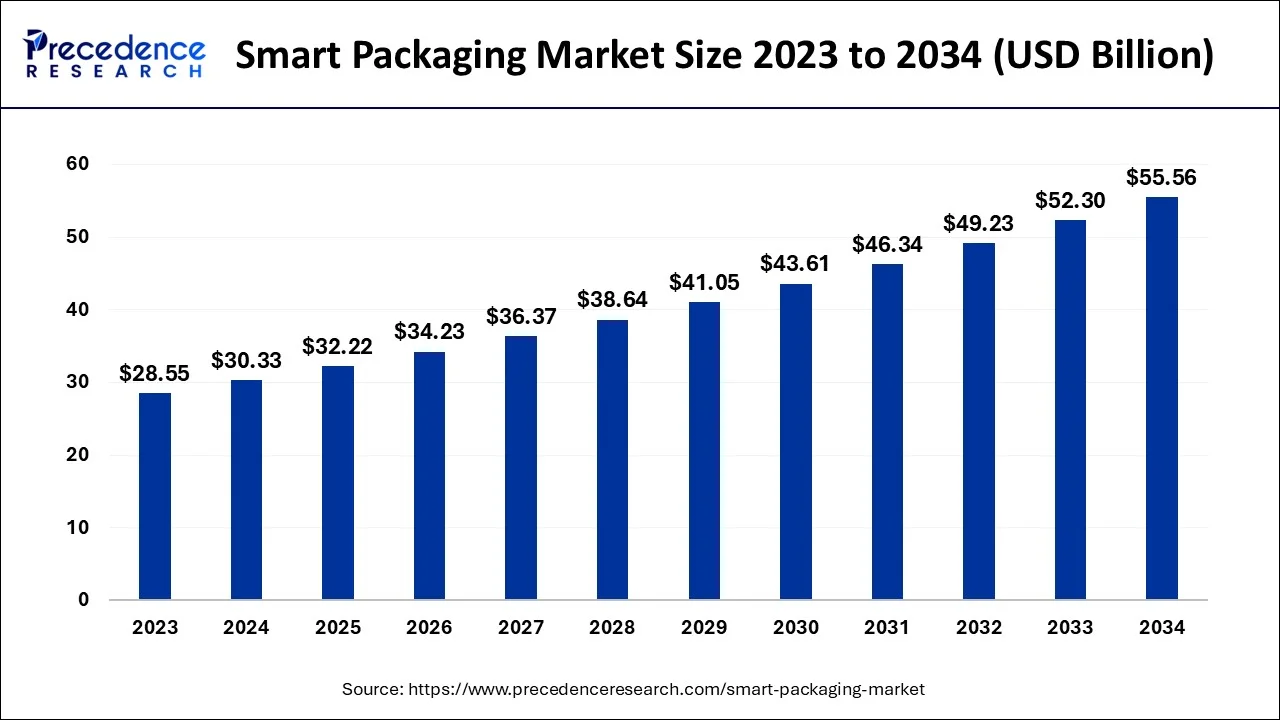

The global smart packaging market size is estimated at USD 30.33 billion in 2024 and is anticipated to reach around USD 55.56 billion by 2034, expanding at a CAGR of 6.24% from 2024 to 2034.

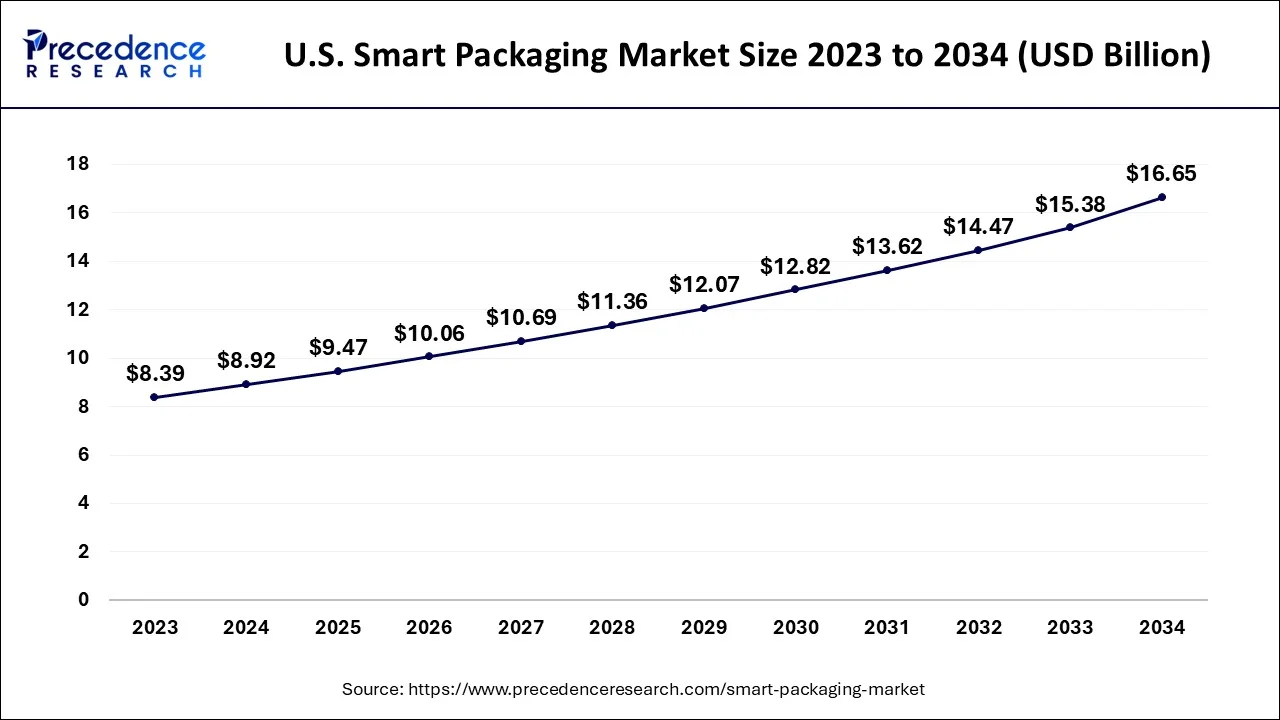

The U.S. smart packaging market size is evaluated at USD 8.92 billion in 2024 and is predicted to be worth around USD 16.65 billion by 2034, rising at a CAGR of 6.43% from 2024 to 2034.

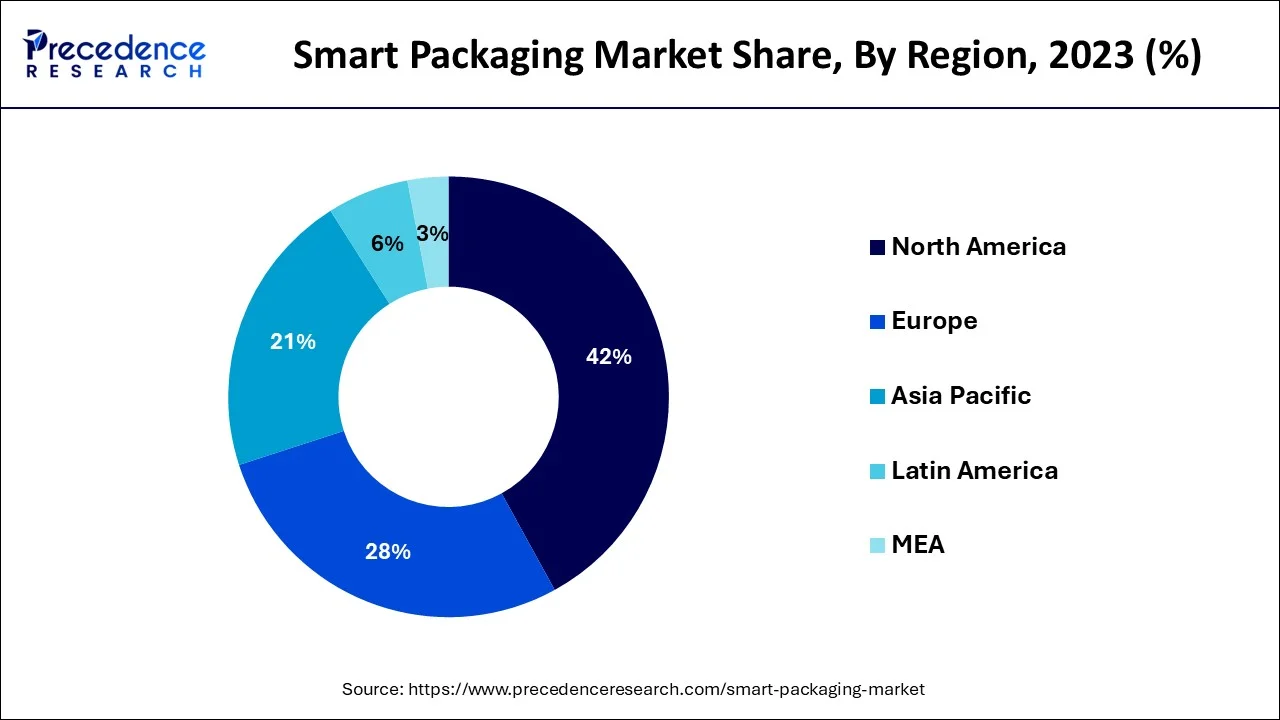

For the period that this research covers, the smart packaging market is anticipated to develop at the greatest rate in the Asia-Pacific region. This is due to a few factors. The first is that Asians nowadays are, on the whole, significantly better educated than Asians in past generations. The second is that they are becoming lot more health-conscious as a result of the first reason. They are curious about the packaging of the meals they eat. Additionally, they inquire about the packaging these goods come in. The widespread consensus is that hygienic packaging results in safer food as well. In this area, people are likewise getting wealthy. As a result, people are able to afford to purchase products (food, pharmaceuticals) that are packed in clever packaging. Asians' growing desire for their food and medications to be wrapped in ecologically friendly packaging is another factor in this.

For the time frame covered, the North American region is anticipated to have the largest market share for smart packaging. People's concern over food waste is one factor for this. Many Americans want to ensure that as little food is wasted as possible due to the fact that many Americans are hungry and that hunger is an increasing concern in America. If extra food is wrapped well to keep it fresh for as long as possible, this is achievable.

Smart packaging is a kind of device that boosts the engine's effectiveness and power. The term "smart packaging" refers to a particular kind of sensor-equipped packaging system used for a variety of goods, including food and pharmaceuticals. The smart packaging technology contributes to improving product quality, shelf life, freshness monitoring, and customer and product safety. These intelligent systems offer information on the product's quality and freshness when it is packaged with intelligent technology.

Due to restrictions on industrial operations during the COVID-19 epidemic, which also impeded the installation of new smart packaging systems, the market for smart packaging was hindered. Additionally, during the lockdown, the smart packaging solutions could not be efficiently sold through OEMs. The main drivers propelling the growth of this market are the increased need for sophisticated packaging solutions from the food processing and pharmaceutical industries, rising consumer concern for reducing food waste, and rising demand for smart & functional packaging. Additionally, the expanding E-commerce industry, increased industrialization, and high demand for excellent supply chain management are projected to provide up attractive potential for market participants.

The costs of the sensors and radio frequency identification (RFID) utilized for packaging applications, which are leading to the failures over the mass applications for packaging systems, make better packaging more expensive than traditional forms of packaging. Additionally, it results in the gathering of client data, which, in the manufacturers' opinion, might eventually create manipulative and tense situations that constrain the market.

Additionally, the COVID-19 epidemic had a significant impact on the hotel, tourist, industrial, and construction sectors. Manufacturing operations were suspended or limited. Globally, supply networks for the construction and transportation industries were disrupted. This reduced the production of smart packaging as well as the market's demand for them, which hindered the market's expansion for smart packaging. On the other hand, businesses gradually began providing their usual goods and services. The smart packaging businesses were able to resume operations at full capacity as a result, which assisted in the market's recovery by the end of 2021.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.33 Billion |

| Market Size by 2034 | USD 55.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.24% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Material, and Geography |

The sub-segment for food and drinks is probably going to have the highest market share for smart packaging. This is due to a few factors. The first is that more people desire to consume food that they are aware is healthy across the world. The second is that people like to consume food that is guaranteed to be fresh. Smart packaging makes this promise. Additionally, they prefer to purchase food that is constantly accessible, readily available, and has a lengthy shelf life. Once more, intelligent packing may ensure this. The majority of businesses in the food and beverage sub-segment are motivated to employ smart packaging since it makes it simpler for them to adhere to the most current and strict food safety regulations. Additionally, consumers want the information on their packaging to be as clear as possible. Smart packaging, according to businesses, enables them to do this while also safeguarding their brands. For reasons of sanitation and transparency, the world may already be trending toward preferring that food goods be wrapped in smart packaging. However, COVID-19 significantly sped up this process.

According to type, the intelligent packaging segment is anticipated to develop at the greatest CAGR throughout the forecast period, while the modified atmosphere packaging segment held the market's largest revenue share in 2023. According to end users, the food and beverage sector dominated the smart packaging market in 2023. However, the others category is anticipated to grow at the fastest rate over the next few years. In terms of revenue, the solid category dominated the market in 2023 and is predicted to experience the greatest CAGR throughout the projected period. North America generated the most revenue regionally in 2023, while LAMEA is predicted to have the best CAGR over the projection period.

Based on material, the solid category commanded more than two-thirds of the market in 2023, and it is anticipated that it would maintain its dominance during the projected period. Additionally, from 2024 to 2034, the liquid category is anticipated to have the greatest CAGR of 6%.

By Type

By Application

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

June 2025

January 2025

August 2025