January 2025

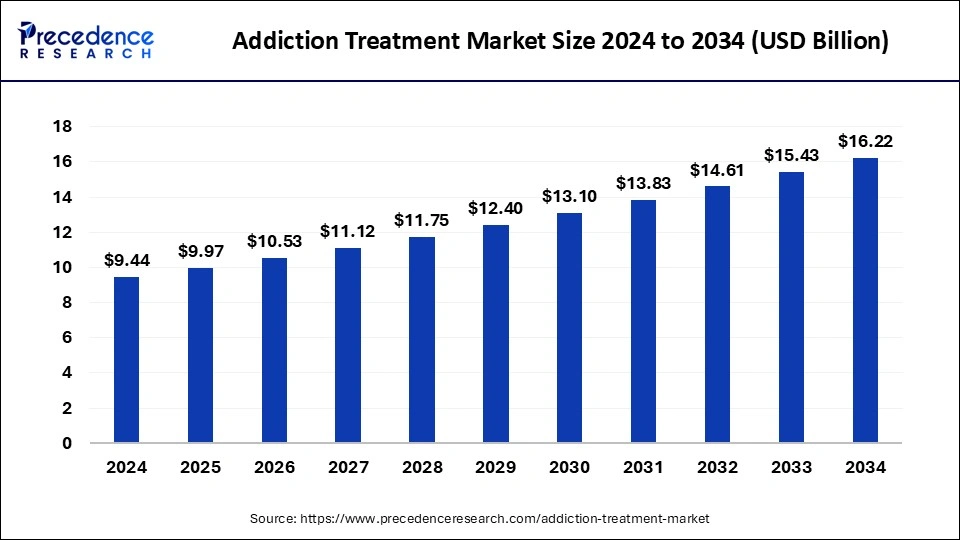

The global addiction treatment market size is calculated at USD 9.97 billion in 2025 and is forecasted to reach around USD 16.22 billion by 2034, accelerating at a CAGR of 5.56% from 2025 to 2034. The North America market size surpassed USD 3.49 billion in 2024 and is expanding at a CAGR of 5.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global addiction treatment market size accounted for USD 9.44 billion in 2024 and is predicted to increase from USD 9.97 billion in 2025 to approximately USD 16.22 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034. The need for efficient treatment options is being driven by the increased prevalence of substance misuse and addiction, including addiction to alcohol, opioids, and other narcotics.

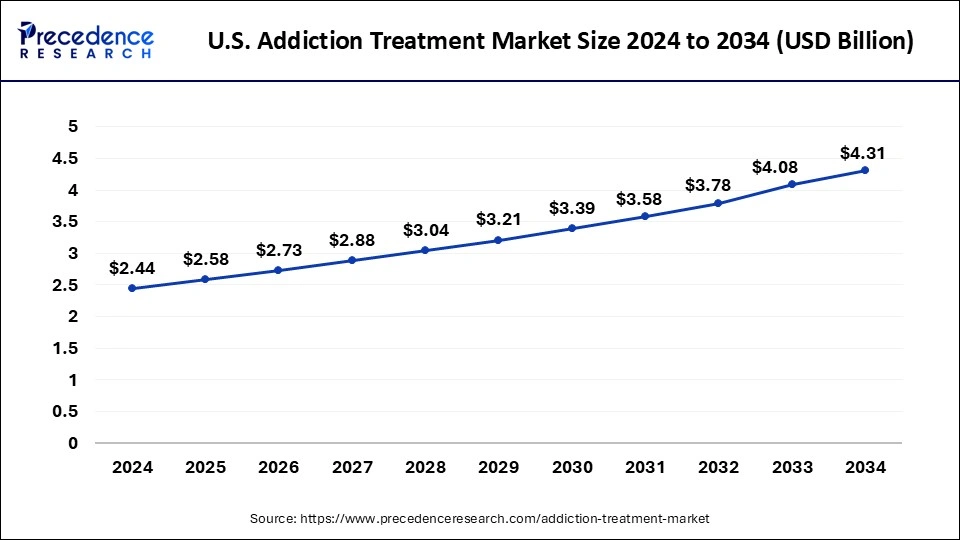

The U.S. addiction treatment market size was exhibited at USD 2.44 billion in 2024 and is projected to be worth around USD 4.31 billion by 2034, growing at a CAGR of 5.85% from 2025 to 2034.

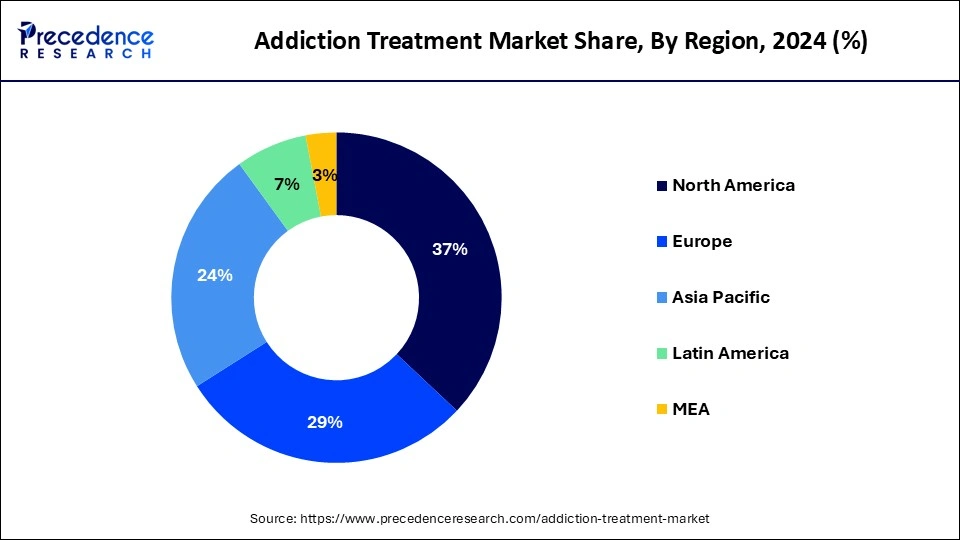

North America held the dominating share of the addiction treatment market in 2024. The growing prevalence of substance misuse, including alcohol, illegal drugs, and opioids, is a major factor propelling the need for addiction treatment services. The industry is growing as a result of several government programs and initiatives designed to stop substance usage and assist addiction recovery. The United States, for example, has put initiatives such as the National Opioid Action Plan in place.

Asia Pacific is observed to grow at the fastest rate in the addiction treatment market during the forecast period. The Asia Pacific addiction treatment market is impacted by a number of variables, such as growing public awareness of substance usage, governmental initiatives, and the expansion of treatment centers. Effective treatment alternatives are increasingly needed as the prevalence of substance misuse, including abuse of alcohol, tobacco, and illicit drugs, is on the rise in many Asia Pacific countries. Asia Pacific’s market is anticipated to expand rapidly as a result of rising awareness, government assistance, and improvements in available treatments. However, optimizing the effectiveness of addiction treatment programs would require tackling issues like stigma, expense, and accessibility.

A wide range of therapies, prescription drugs, and support services are available in the addiction treatment market, all of which are intended to treat substance misuse and addiction problems. Growing awareness, an increase in drug abuse cases, and better access to treatment have all contributed to the market's steady growth in addiction therapy. Both behavioral therapy and pharmaceutical interventions (medications) are available in the market.

To treat withdrawal symptoms and lessen cravings related to substance use disorders, a variety of medications are employed. Methadone, buprenorphine, naltrexone, and disulfiram are a few examples. To treat the underlying behavioral patterns that contribute to addiction, family therapy, contingency management, motivational interviewing, and cognitive-behavioral therapy (CBT) are frequently utilized.

The addiction treatment market can be divided into segments according to the therapeutic approaches used, the types of addiction addressed (such as alcohol, opioids, and nicotine), and the treatment settings (inpatient, outpatient, and residential). Due to cultural differences, disparities in the availability of healthcare, and high rates of substance misuse, the need for addiction treatment differs by location. The stigma attached to addiction, the availability of cost-effective treatment choices, relapse prevention, and the combination of mental health and addiction treatment are among the issues facing the addiction treatment industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.22 Billion |

| Market Size in 2025 | USD 9.97 Billion |

| Market Size in 2024 | USD 9.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Treatment Centers, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise of digital health solutions

One important development that is revolutionizing the addiction treatment market is the emergence of digital health solutions in the addiction treatment sector. Treatment is now easier and more accessible because of the growth of telehealth platforms, which enable remote consultations, therapy sessions, and follow-ups. Medical professionals and patients can access real-time data from devices that track physiological markers of stress or relapse risk.

By providing care and assistance at their convenience, patients' adherence and results are enhanced. Treatment costs can be decreased by using digital health solutions since they eliminate the requirement for physical infrastructure. Patients now have greater access to digital health services since insurers are beginning to cover them.

High treatment costs

Detoxification, inpatient and outpatient rehabilitation, therapy, and aftercare are among the many phases that are frequently included in addiction treatment. Every step necessitates specialist staff and services, which drives up overall expenses. Doctors, nurses, therapists, and counselors are among the highly skilled professionals employed by addiction treatment institutions. Operating costs are raised by the requirement for skilled personnel.

Running an addiction treatment center, particularly an inpatient facility, involves paying a large amount of money for upkeep, lodging, food, and making sure that patients are in a supportive and safe atmosphere. Insurance does not often cover addiction treatment, although it can help with some expenditures. Patients frequently have to pay large out-of-pocket costs as a result of deductibles, co-pays, and limited coverage.

Advancements in medication-assisted treatment

Medication-assisted treatment (MAT) advancements have improved recovery outcomes and decreased relapse rates in the addiction treatment sector. Buprenorphine is released steadily from this long-acting injectable formulation, which decreases the requirement for daily dosage and increases compliance. Genetic testing can assist in customizing MAT for each patient, increasing therapeutic efficacy and minimizing side effects.

Individuals' ability to metabolize drugs such as buprenorphine and methadone may be affected by genetic differences. Treatment outcomes have been demonstrated to be improved when MAT is combined with other evidence-based behavioral therapies, such as contingency management and cognitive-behavioral therapy (CBT). MAT-supporting apps give patients access to support networks, mood monitoring, and medication reminders, all of which improve engagement and adherence.

The tobacco/nicotine addiction segment held the largest share of the addiction treatment market in 2023. Within the addiction treatment industry, the tobacco addiction sector concentrates on treatments and programs meant to assist people in giving up smoking or using tobacco products. This section usually covers a range of techniques, including counseling, prescription drugs (such as varenicline or bupropion), behavioral therapies targeted at the psychological components of addiction, and nicotine replacement therapy (like patches or gum). This market is important in the Asia Pacific because of the high rates of smoking in some nations and the rising public awareness of the harmful effects of tobacco usage. Culturally sensitive tactics are frequently used in treatment techniques in this area, and access to healthcare providers and legal frameworks may present difficulties.

The alcohol addiction segment is expected to grow rapidly in the addiction treatment market over the forecast period. The market for addiction treatment includes a segment dedicated to alcohol addiction that offers a range of therapies and interventions designed to assist people in their recovery from alcoholism. Behavioral therapies, psychotherapy, medication-assisted treatments (MAT), Alcoholics Anonymous (AA) support groups, and occasionally residential recovery programs are some examples of treatment modalities. In order to encourage recovery and avoid relapse, the market concentrates on treating both the physiological and psychological elements of alcohol addiction. Detoxification, behavioral therapies like cognitive-behavioral therapy (CBT), support groups like Alcoholics Anonymous (AA), and occasionally drugs like naltrexone or acamprosate to lessen cravings or deter drinking are some of the treatment options that can be used. Helping people control their alcohol consumption, avoid relapsing, and enhance their general quality of life are frequently the objectives.

The rehabilitation centers segment dominated the addiction treatment market in 2023. Rehab facilities are essential in helping people recover from all kinds of addiction, including drug and alcohol abuse, by offering them all-encompassing care and support. Typically, these facilities provide structured programs that could involve aftercare planning, counseling, individual and group therapy sessions, medical monitoring, detoxification, and instruction on addiction management. The methods used by rehabilitation institutions differ greatly; some may include behavioral and medical therapies, while others may concentrate on holistic therapies. The caliber of the personnel, the breadth of the programs offered, and the degree of individualized attention given to each patient are frequently the determinants of these centers' efficacy.

The inpatient centers segment is expected to grow at the highest CAGR in the addiction treatment market during the forecast period. When it comes to giving people who are battling addiction or substance misuse comprehensive treatment and support, inpatient facilities are essential. These facilities provide a controlled setting where patients can have treatment sessions, medical supervision, and assistance from qualified specialists around the clock. If a patient has a serious addiction or needs more care because of psychological or physiological issues, inpatient therapy is frequently advised. Inpatient facilities offer round-the-clock medical supervision and assistance to treat withdrawal symptoms and guarantee patients' security. Detox programs are provided by many inpatient facilities to assist patients in properly managing their withdrawal symptoms during the first stage of therapy.

The hospital pharmacies segment led the global addiction treatment market in 2023, Hospital pharmacies are essential to the addiction treatment industry because they give patients under treatment access to drugs and support services. They frequently prescribe drugs for maintenance therapy, detoxification, and withdrawal control. Hospital pharmacies make sure that during their recuperation, patients are monitored and given the right dosage. Additionally, they work along with medical professionals to track developments and modify treatment programs as necessary. By addressing the psychological and physical components of addiction, this integration supports long-term wellness and recovery.

The medical stores segment is expected to grow rapidly in the addiction treatment market over the forecast period. Medical supply stores are essential for delivering the drugs and equipment needed for healing. Typically, they provide drugs for opioid use disorders (like methadone or buprenorphine), alcohol use disorders (such as naltrexone or disulfiram), and other drugs used in detoxification and rehabilitation that are utilized in addiction treatment regimens. These shops frequently serve patients directly, as well as hospitals, clinics, and rehabilitation facilities. They greatly contribute to the complete care approach in managing addiction problems by ensuring the availability of pharmaceuticals recommended by medical professionals who specialize in addiction therapy.

By Treatment Type

By Treatment Centers

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

February 2025

September 2024