May 2025

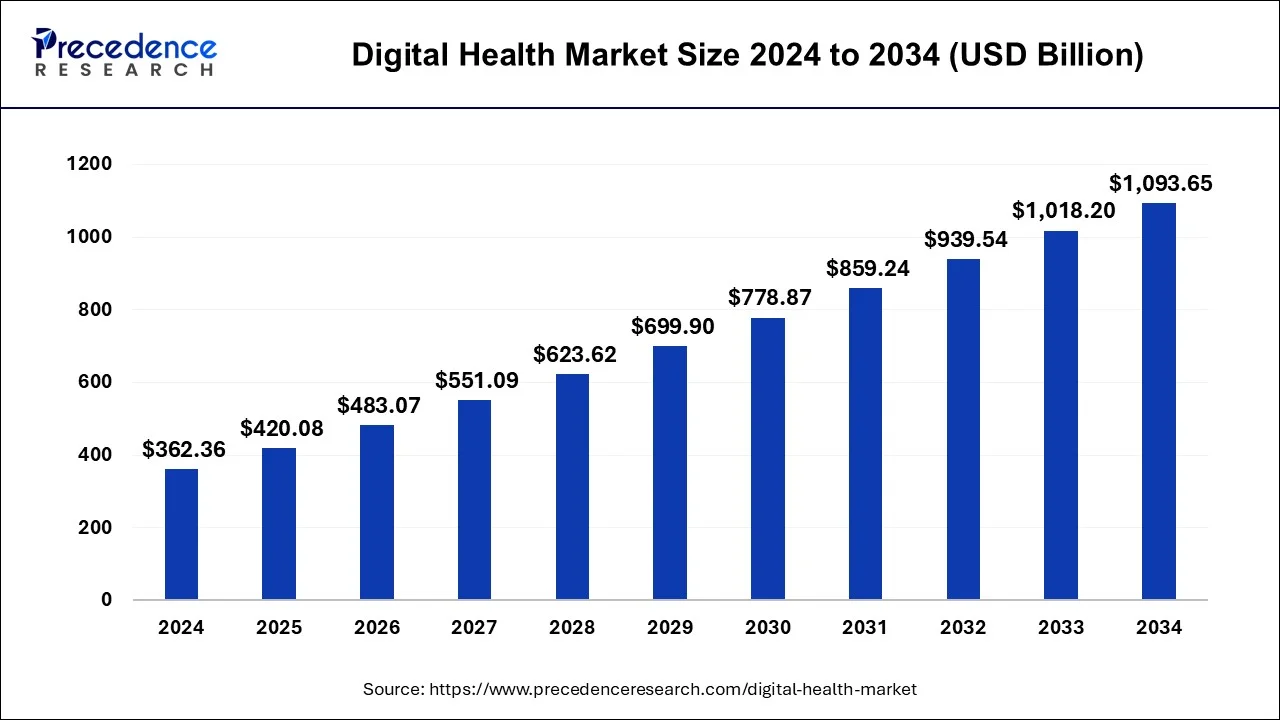

The global digital health market size is calculated at USD 420.08 billion in 2025 and is forecasted to reach around USD 1,093.65 billion by 2034, accelerating at a CAGR of 11.68% from 2025 to 2034. The Europe digital health market size surpassed USD 143.87 billion in 2024 and is expanding at a CAGR of 10.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital health market size surpassed USD 362.36 billion in 2024 and is anticipated to reach around USD 1,019.89 billion by 2034 and expanding at a CAGR of 11.68% over the forecast period 2025 to 2034. The digital health market growth is driven by the ongoing technological advancements in the form of artificial intelligence, emergence of Internet of Things, robotics in the healthcare sector along with remote monitoring devices.

Digital health is a simple concept that uses technology to help people improve their health and wellness. Wearable devices to ingestible sensors, mobile health apps to artificial intelligence, robotic caretakers to electronic records are all examples of digital health. In other words, it's about bringing the digital revolution to the healthcare sector through disruptive technology and cultural change. However, at present, there is no universal definition of digital health.

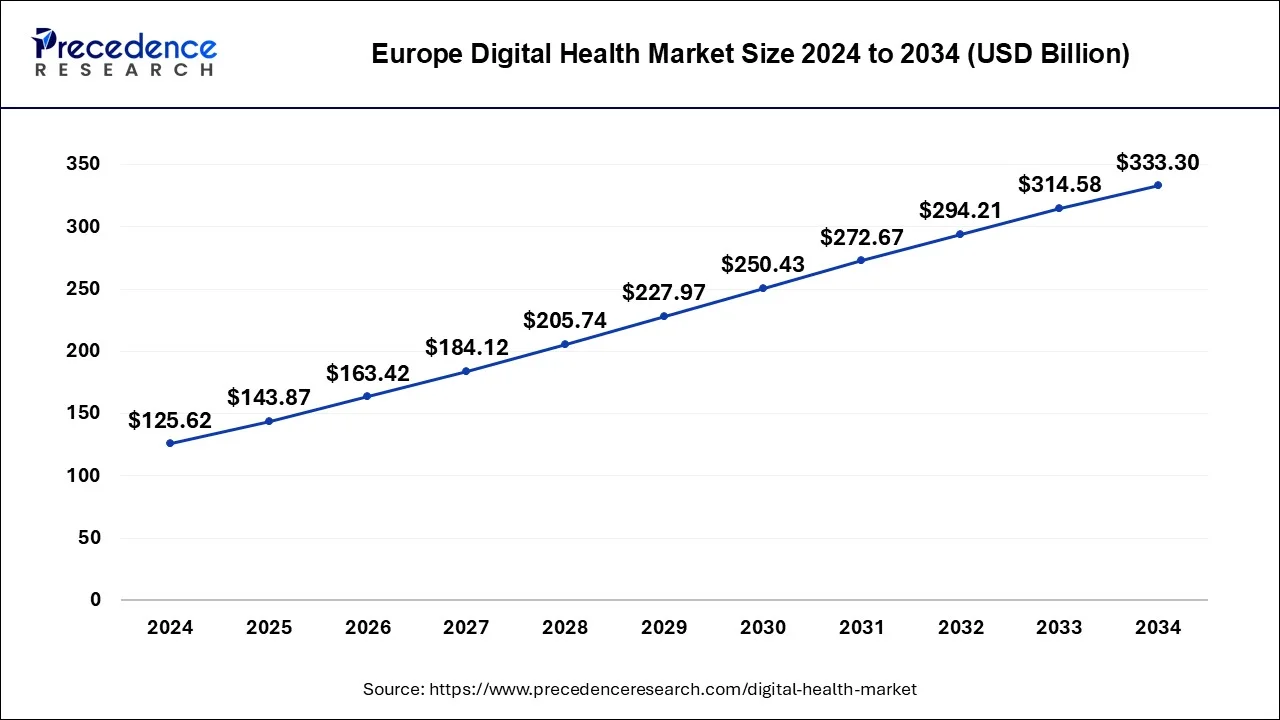

The Europe digital health market size was estimated at USD 125.62 billion in 2024 and is predicted to be worth around USD 333.30 billion by 2034, at a CAGR of 10.25% from 2025 to 2034.

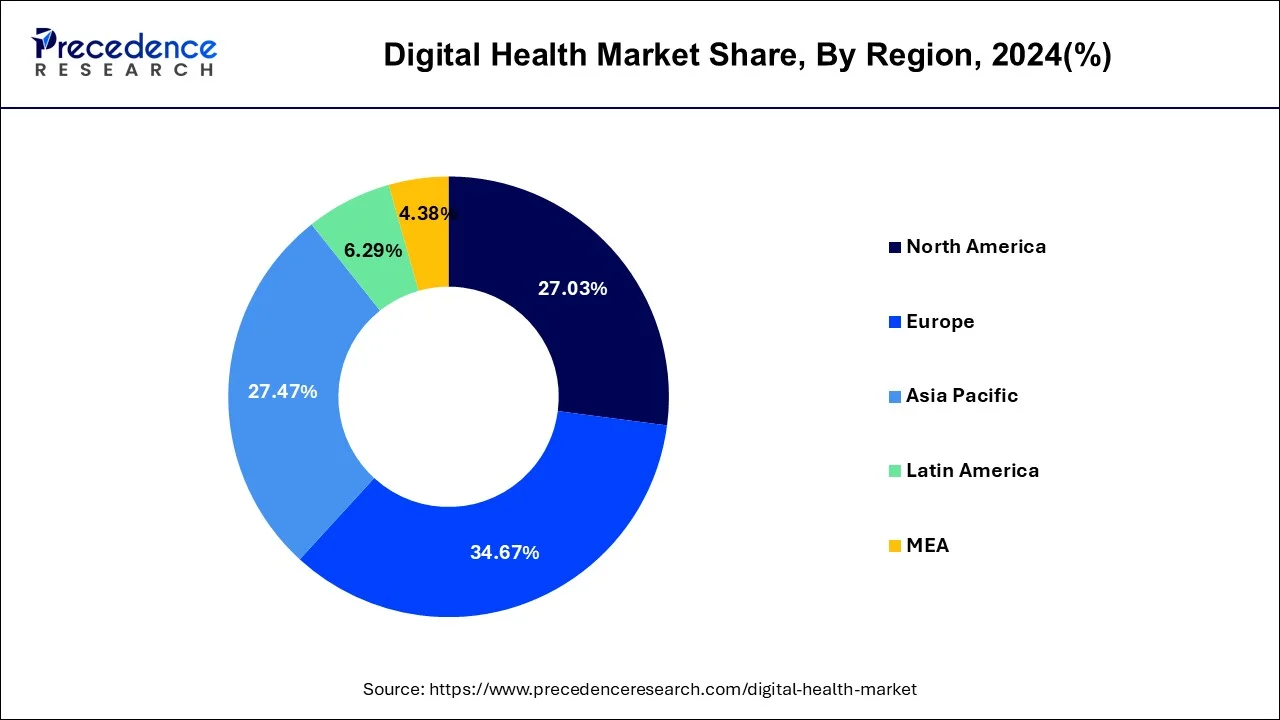

Europe held the largest share of 34.67% in the digital health market. Europe's digital health market has been expanding quickly due to a number of causes, including rising healthcare expenses, an aging population, technological improvements, and government campaigns to support digital healthcare solutions. There has been a notable surge in the European digital health market. The market is expected to continue developing at a solid rate in the upcoming years, with estimates of its size placing it in the billions of euros. Wearable technology has been getting more and more popular; examples of these include smartwatches and fitness trackers. People can monitor a number of health metrics with these devices, such as heart rate, physical activity, and sleep patterns.

Asia Pacific also expected to grow at the fastest CAGR of 14.39% during the forecast period. Asia Pacific's digital health market has grown significantly in recent years due to a number of factors including rising healthcare costs, growing awareness of the value of healthcare management, and government initiatives that are supportive of the industry. Healthcare facilities in the region are increasingly implementing healthcare IT solutions, such as practice management software, hospital information systems (HIS), and electronic health records (EHRs), to enhance patient care and operational effectiveness. Large amounts of healthcare data are being analyzed, actionable insights are being derived, and clinical decision-making is being improved through the use of AI-driven solutions and healthcare analytics. The governments of the Asia-Pacific area are putting supportive laws and regulations in place to encourage the adoption of digital health as they become more and more aware of its significance.

Digital health Market Trends in India

The North America digital health market is fostering due to consumers' preferences for telehealth counseling along with regulatory changes offering better reimbursement. Additionally, the lack of medical professionals needed to serve the growing geriatric population within the region and the growing prevalence of chronic and fatal diseases such as cardiovascular diseases, cancer, neurological disorders due to aging and others, which need quick attention and treatment, further support the digital health market growth in North America.

Additionally, growing penetration of smartphones and easy internet access have relatively improved digital healthcare systems, which again foster virtual connections with healthcare professionals. The healthcare system is also rebounding by adding advanced software, hardware and services for patients who want to get remote treatment.

Increasing penetration of smartphones along with numerous smartphone applications related to health and fitness across the globe expected to be a key factor that drives the digital health market growth. Rapid investment in the healthcare IT infrastructure particularly in the developing and developed nations estimated to be conducive to the market growth. For instance, in April 2020, the Asian Infrastructure Investment Bank (AIIB) awarded its first health infrastructure investment in order to recover the crisis of USD 5 Billion because of COVID-19.This expected to provide aid to the private and public entities that are suffering from the pandemic situation.

Apart from this, the outbreak of COVID-19 has imposed stringent social distancing norms and lockdowns by the governments across the globe. In this situation, digital health technologies for example telehealth provide enormous opportunities for the care service providers to treat patient by following the lockdown measures. This in turn further expected to drive the product adoption along with this also favors the market growth positively in the upcoming years.

Digital health is described as the integration of information technology and electronic communications used for different healthcare processes for overall people’s health and their wellbeing. The revolutionary development in the healthcare industry with the rapid adoption of emerging technologies such as wearable devices, mHealth Apps, ingestible sensors and artificial intelligence among others have added boost to the market growth.

Digital health incorporates digital transformation in the healthcare field wherein software, hardware and services are keenly involved. Under this boarder concept of digital health different technologies are employed such as mobile health (mHealth) apps, wearable devices, electronic health records (EHRs), electronic medical records (EMRs), telemedicine, telehealth along with personalized medicine among others. The need for medical transformation was especially due to the growing aged population, child illness and their mortality, high cost and poverty related issues along with racial discrimination associated to health care access had necessitated the technological advancements. Moreover, epidemics and pandemics have created high level importance to the digital health which still continues to evolve thereby fueling the market growth in the forecast period.

Factors that drive the global digital health market are the growing demand for mobile health apps, increasing demand for remote patient monitoring services, rising adoption of smartphones and tablets have further augmented the market growth. However, security concerns such as cyber-attacks and financial constraint tomaintain digital health related services are the prime factors restraining the market growth to certain extent. Nevertheless, COVID 19 pandemic has added fuel to the ongoing developments in digital health with the transformation in healthcare through online symptom checkers, patient facing tools, remote patient monitoring tools, telehealth and patient portals among others.Consequently, such novel developments in the field of digital health are projected to create lucrative opportunities in the market.

Furthermore, venture capital funding in digital health consisting of both corporate venture capital and private equity had already reached to $14.8 billion in 2020 as compared to $8.9 billion in 2019, showing a total rise of 66%, which is a remarkable funding activity in digital health in a year time. This is primarily driven by the impact of COVID 19 pandemic that has mainstreamed the consumer based digital health technologies in a year time.

| Report Highlights | Details |

| Market Size in 2025 | USD 420.08 Billion |

| Market Size by 2034 | USD 1,093.65 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.68% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Components, and By Products |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for mobile health apps

The potential of mobile apps is being used to improve patient treatment in a variety of ways, including diagnosing illness, employing wearables, and ingestible sensors. We have become increasingly reliant on our smart devices now that we have entered the digital world. We continue to rely on smartphones to manage our calendars, coordinate our work and business operations, keep informed and connected through social media, and arrange doctor visits and healthcare check-ups. Healthcare app development has become both a need and a luxury.

The healthcare industry has seen significant changes as a result of technology advancements and meddling. We can see how mobile app development has aided in the evolution of the healthcare sector in recent years. The COVID-19 pandemic is still ongoing, and healthcare mobile apps have paved the path for great growth during this time of crisis, transforming people's perceptions of the health industry worldwide.

Increasing penetration of digital health in emerging economies

The healthcare ecosystem is witnessing a paradigm shift in the way the services are being delivered and consumed. This is fueled by the urgent need for a healthcare delivery model that is inclusive, high-quality, cost-effective, and decentralized. While these demands contribute to the creation of lofty goals for our society and government, the enterprising side of society is hard at work developing solutions and models to assist us to get there. The digital health model is one such alternative. From birth to death, from well to sick, digital health will dramatically improve the continuum of care by providing solutions that help individuals from birth to end of life.Digital health will aid in the achievement of several goals, including moving healthcare delivery from curative to preventive, increasing accessibility, lowering costs, improving quality, and increasing resource efficiency.

The healthcare sector is moving from a provider-driven to a consumer-driven business as a result of increased earnings, lifestyle changes, and shifting consumer behavior toward wellness. Additionally, efforts are being undertaken to transition healthcare to a consumption-based model due to rising healthcare prices and inadequate healthcare infrastructure. Healthcare is moving toward a proactive “Predict and Prevent Model” that targets the underlying causes of health problems and focuses on preventing future problems through major lifestyle changes, behavioral adjustments, or preventative interventions.The underlying need to provide patients with empowerment, convenience, and a better experience drives these innovations, and their growth is propelled by technology and entrepreneurship.

In emerging nations, the new digital health model will be critical in overcoming many of the issues that currently impede healthcare delivery, such as enhancing access, affordability, quality, and safety. A severe lack of resources and infrastructure has impeded the delivery of healthcare services in many developing countries, particularly in rural areas.

If done in a new way, digitization of health services can help to improve the quality of and access to care while lowering costs. The majority of developed countries have moved away from paper-based healthcare solutions in favor of ‘traditional' digital healthcare models, which they have accepted or are in the process of adopting.

Digital technologies are assisting in the development of novel diagnostic and treatment alternatives, as well as improving process efficiency and lowering costs. Technology developments are also bridging the gap between developed and developing economies, as well as participants throughout the healthcare value chain. This is also shown by the fact that digital health firms in the United States alone raised over USD 4.5 billion in funding over the last year. There were also 302 finance deals in the segment, with an average size of USD 14.8 million.However, as the convergence of healthcare and technology continues, regulatory frameworks are still evolving, and as a result, businesses are rapidly being stuck in a maze of unique legal challenges enforced by unfamiliar authorities, such as patient privacy, consumer protection, fraud, and patient safety.

In recent years, advancements in health technology have increased by leaps and bounds. In the digital space, a plethora of gadgets and technologies have arisen, hastening the rate of expansion in consumer and institutional healthcare delivery.

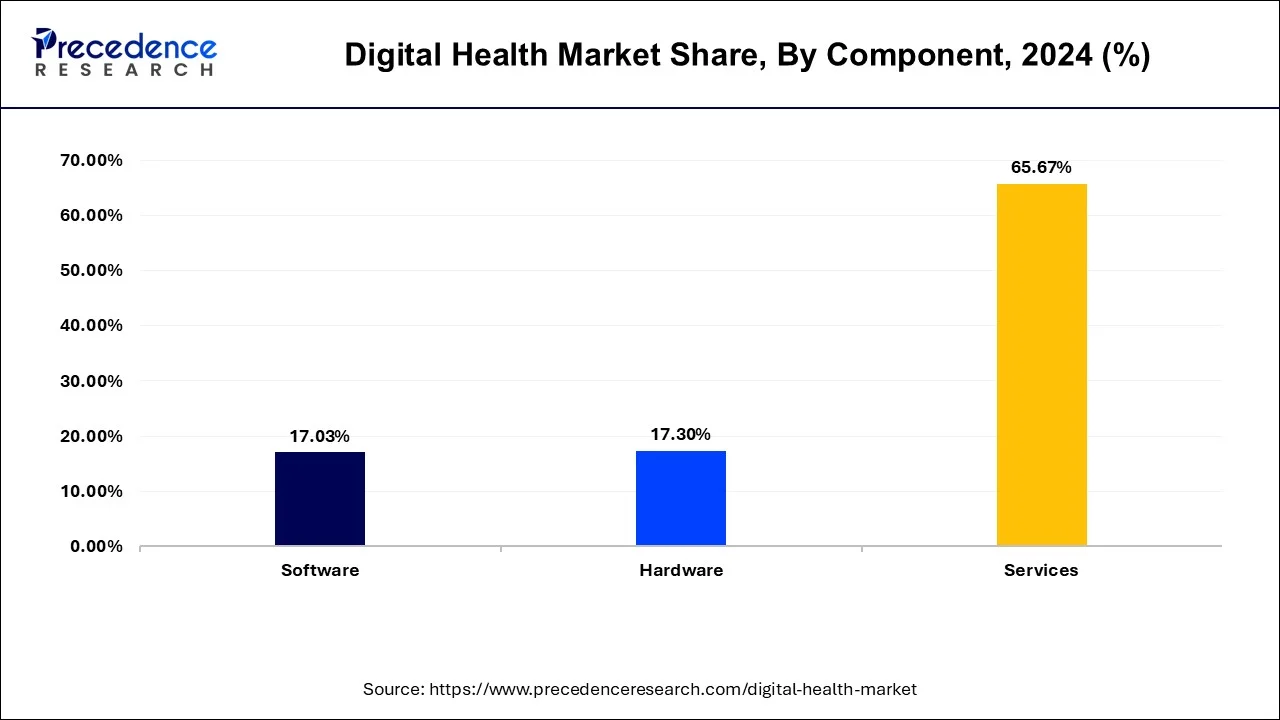

The services segment has accounted highest market share in 2024. This is mainly attributed to the significant rise in the software upgradation along with rapid advancements in various software and hardware. These services include training & integration, installation, and upgradation. Furthermore, the numerous companies are focusing on services based activities such as training & integration, installation, and up-gradation that have augmented the market growth in the study period. Increasing investment on digital healthcare infrastructure predominantly in the developing countries drives the demand for services during the upcoming years. Moreover, increasing demand for platforms such as Electronic Health Records (EHR) that further propels the demand for service as moat of the companies are prominently focusing on acquiring post-installation services such as staffing, optimization, training, and many other services.

Besides this, software segment accounted for nearly 17.3% of the total market value and expected to show robust growth over the forthcoming years. The significant growth of the segment is majorly because of increasing demand for healthcare software, fitness apps, and various healthcare analytics platform. The outbreak of COVID-19 anticipated to have a positive impact on the digital health market as it boosted the need for analytics platform to track and monitor the total number of cases across the globe. In addition to this, lockdown measure adopted by the government to control the corona cases has significantly triggered the demand for personal healthcare solutions and fitness apps that further provides impetus to the growth of the segment.

Digital health has emerged as a significant and promising field for the advancement of healthcare systems. Implementation of advanced technology is currently being used to create a speedier, more efficient, and cost-effective healthcare practice. As a result, an increasing number of businesses are building digital health and wellness software to improve workflow and provide the best possible user experience for contractors and their clients.

The widespread use of smartphones and tablets is the most important factor impacting the worldwide mobile health market. Up to 40% of persons in the United States are already aware of digital health software or have used it at least once, and more than 70% of them are willing to utilize it. These figures will only rise in the future as a result of previous pandemic-related incidents. Wellness living software, health-tracking technologies, wellness coaching applications, and other innovations are projected to improve present healthcare services and boost our society's immune system.

Global Digital Health Market Revenue, by Component, 2022 to 2024 ( USD Million)

| Component | 2022 | 2023 | 2024 |

| Hardware | 45,974.0 | 53,929.3 | 62,673.1 |

| Software | 45,349.4 | 53,157.7 | 61,719.6 |

| Services | 1,71,309.3 | 2,02,843.3 | 2,37,964.6 |

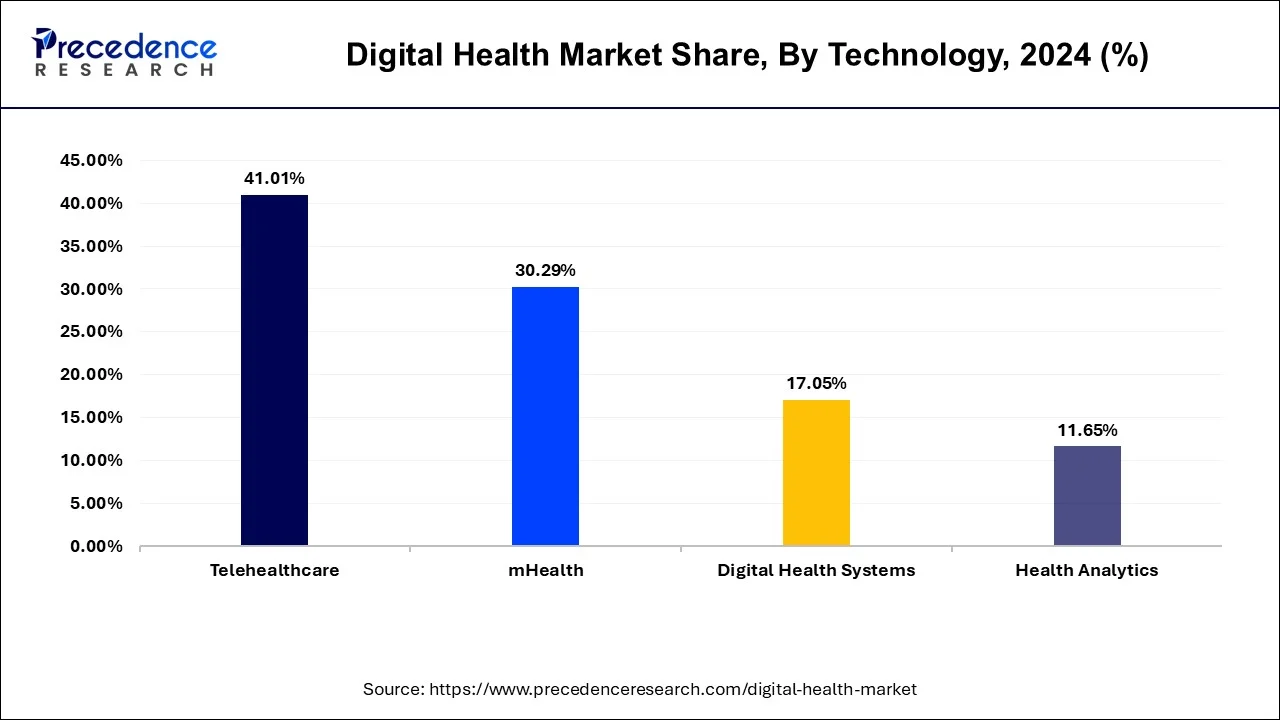

Telehealthcare segment has generated highest revenue share in 2024, owing to the digital transformation in the healthcare sector along with the favorable government support to integrate novel technologies. The prominent growth of the segment is majorly due to the rising penetration of internet and smartphones across the globe along with the availability of large number of health related apps in the market. Furthermore, increasing prevalence of chronic diseases along with the advancements in wearable devices significantly triggers the market growth for mHealth. Telehealthcare is expected to witness the fastest growth between 2025 and 2034.

The mHealth segment is observed to witness the fastest rate of expansion in the digital health market during the forecast period. Advancements in telecommunications infrastructure and the proliferation of high-speed internet connectivity have facilitated seamless access to mHealth solutions, even in remote or underserved areas. mHealth technologies enable remote monitoring of patients' health metrics and facilitate virtual consultations through telemedicine platforms. This allows healthcare providers to deliver timely interventions and personalized care, especially for individuals with chronic conditions or limited mobility.

A new healthcare system organization is desperately needed over the world. The desire for change was dormant, but the need for it became apparent with the COVID-19 issue. Digital solutions are reshaping eHealth, providing value to outdated healthcare systems from the twentieth century. The evolution of eHealth in Portugal is an excellent example of how change may occur both during and after a crisis. Digital healthcare, on the other hand, is both novel and necessary. Its shape and form must be defined, and its citizen core must be revitalized. COVID-19 will be able to exit the crisis and enter the new era with courageous leadership.

A new healthcare system built on a fully digital landscape can benefit citizens in a variety of ways. Several studies have demonstrated the value of digital tools in surveillance, screening programs, awareness campaigns, social media-based behavioral disease therapies, and digital health literacy. There is no shortage of scientific evidence that digital healthcare solutions can help patients. However, the majority of applications have centered on restoring health, with far fewer focusing on prevention or eradication of specific risk factors. Digital tools are utilized in a DHS to decrease the demand for healthcare. Education, the workplace, and play can all benefit from better societal design. Digital-born solutions can lay the groundwork for a healthier society by combining medical and behavioral knowledge with design, engineering, and law.

Global Digital Health Market Revenue, by Technology, 2022 to 2024 ( USD Million)

| Technology | 2022 | 2023 | 2024 |

| Telehealthcare | 1,02,965.6 | 1,02,965.6 | 1,48,618.6 |

| mHealth | 80,610.0 | 80,610.0 | 1,09,741.7 |

| Digital Health Systems | 47,699.6 | 47,699.6 | 61,787.6 |

| Health Analytics | 31,357.5 | 31,357.5 | 42,209.3 |

Key Companies & Market Share Insights

The global digital health market seeks intense competition among the market participants owing to the strategic initiatives adopted by them to gain maximum market share on the global scale. Further, product innovation and regional expansion are the prime motive of these market players for cementing their foothold in the market.

By Component

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

May 2025

December 2024