AdTech Market (By Offering: Solution, Services, Managed Services; By Advertising Type: Programmatic Advertising, Non-Programmatic Advertising; By Advertising Channel: Television Advertising, Radio Advertising, Digital Out-of-Home Advertising, Others; By Advertising Format: Image, Video, Text, Others; By Platform: Mobile, Web, Others; By Enterprise Size; By Industry Vertical) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

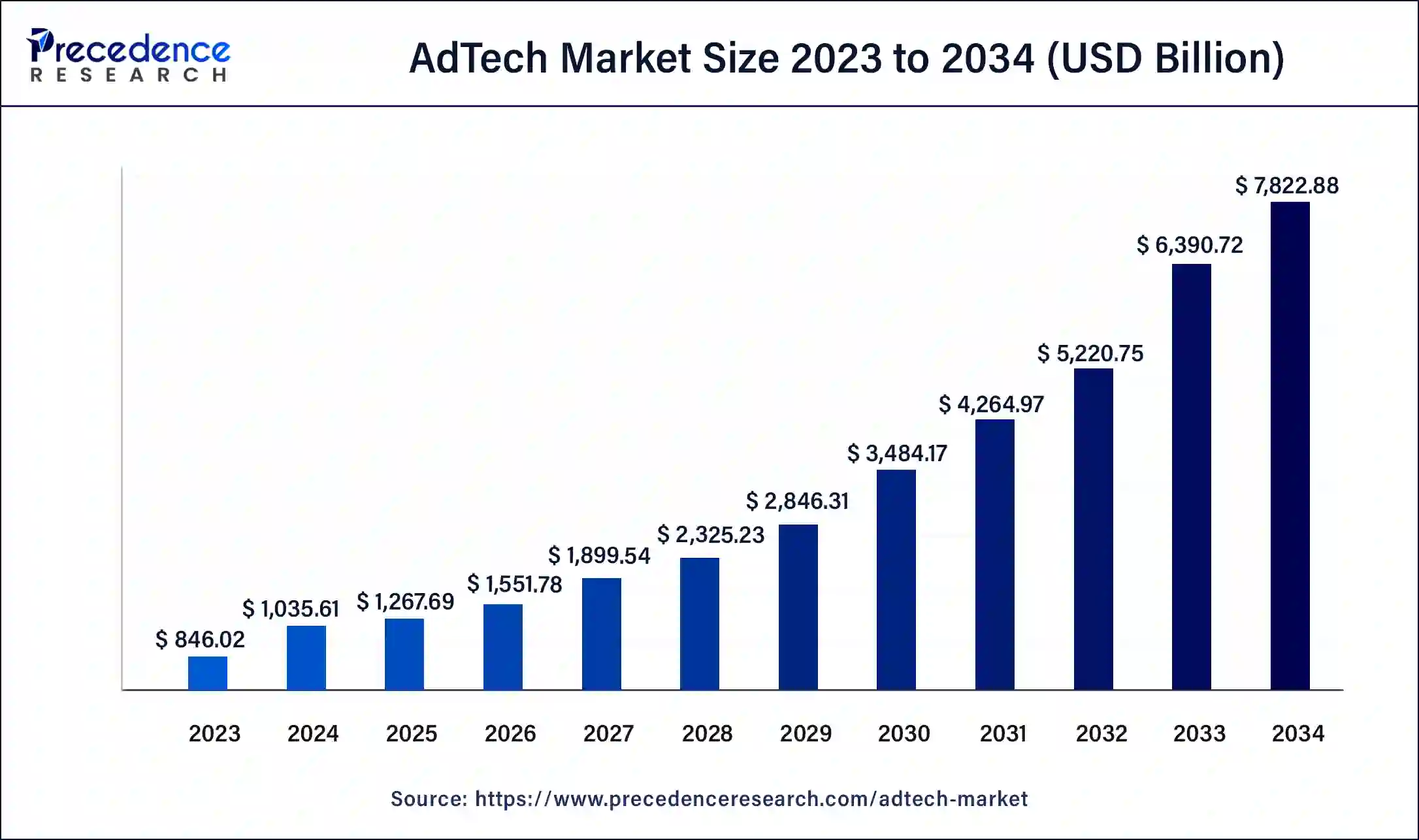

The global AdTech market size was USD 846.02 billion in 2023, calculated at USD 1,035.61 billion in 2024 and is expected to reach around USD 7,822.88 billion by 2034. The market is expanding at a solid CAGR of 22.41% over the forecast period 2024 to 2034. The North America AdTech market size reached USD 304.57 billion in 2023. The proliferation of E-commerce and consumers different choices inclining towards advertisement with message, plus integration of advanced technologies are the major factors fuelling the global AdTech market growth.

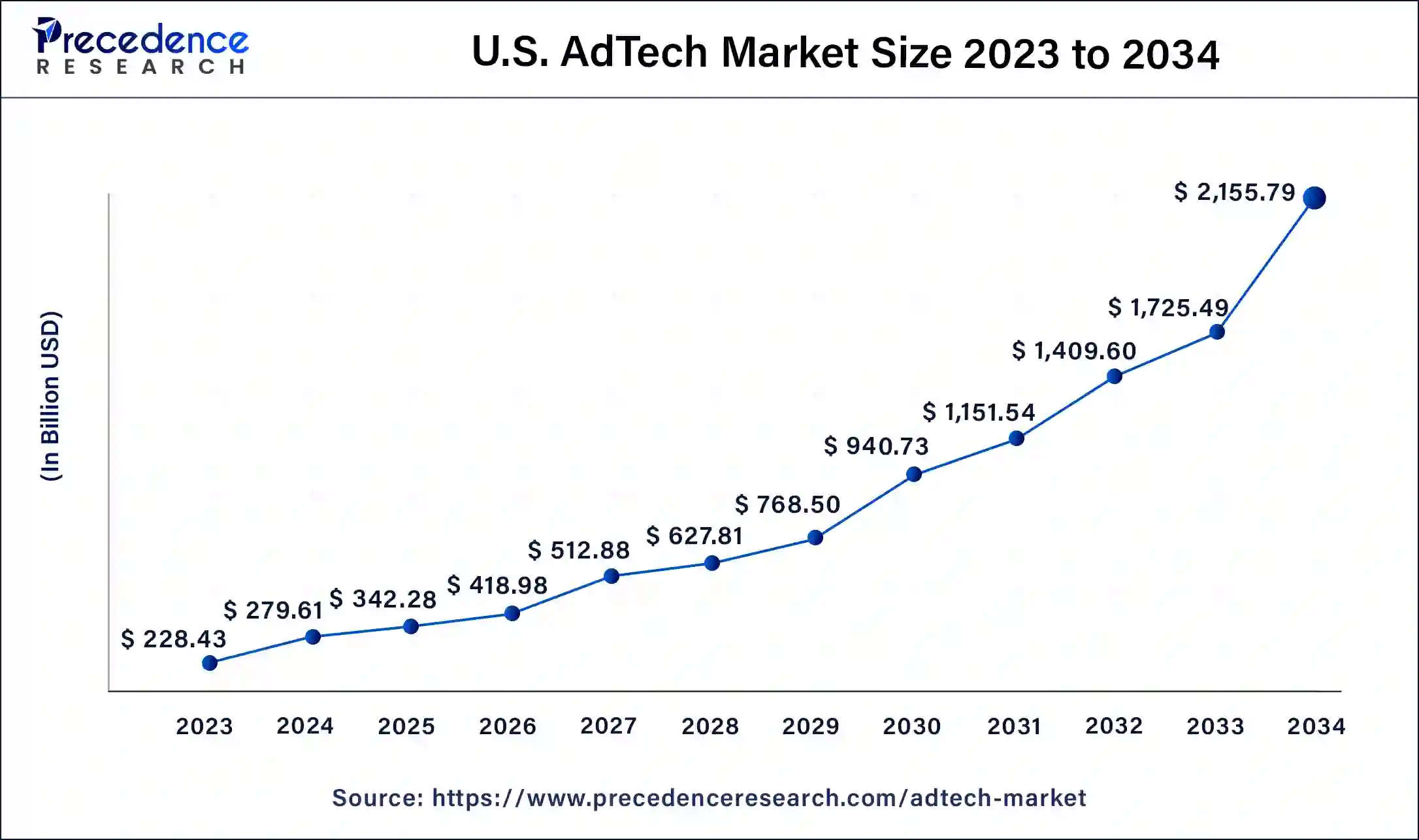

The U.S. AdTech market size was exhibited at USD 228.43 billion in 2023 and is projected to be worth around USD 2,155.79 billion by 2034, poised to grow at a CAGR of 22.63% from 2024 to 2034.

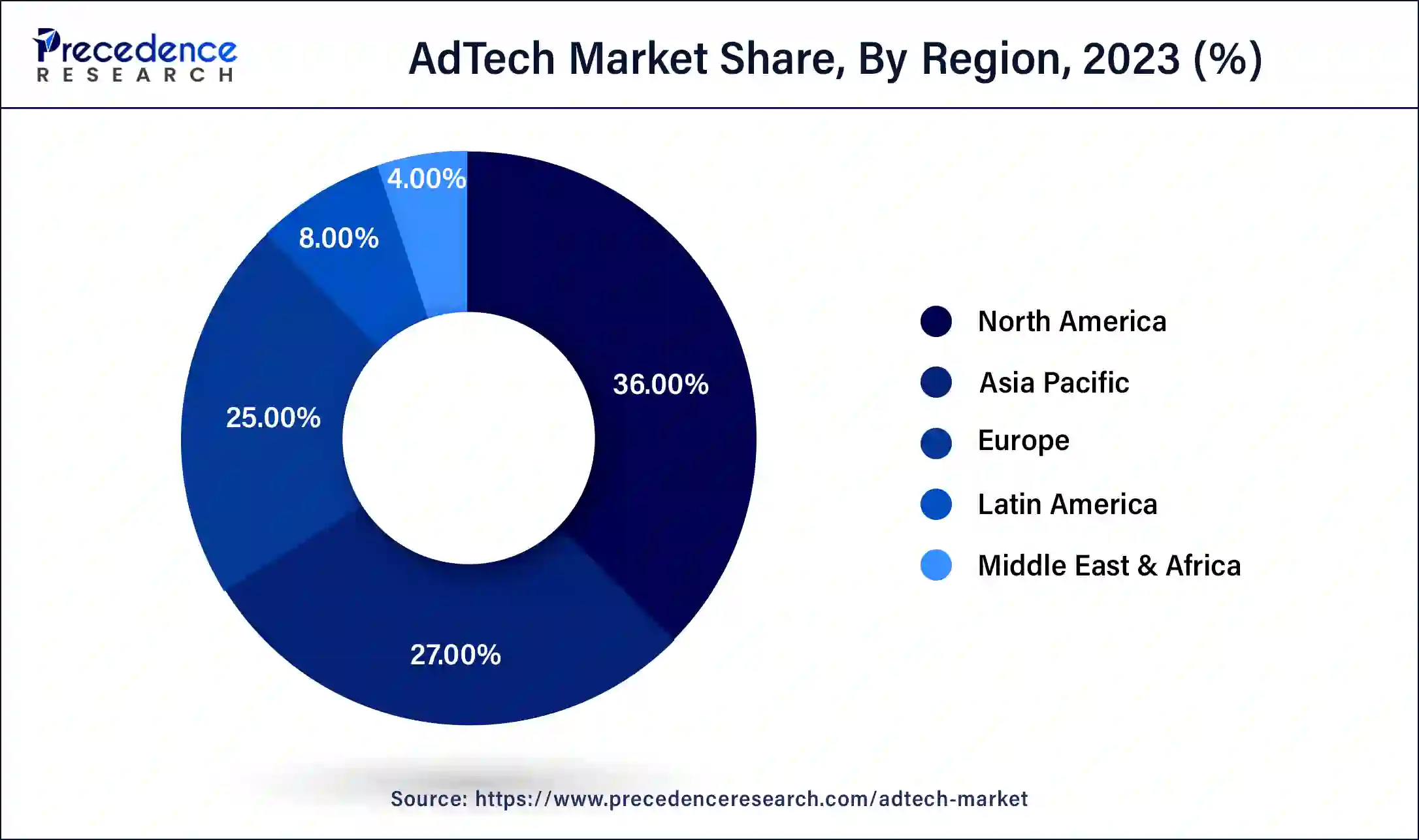

North America dominates the AdTech market due to several key factors.it is home to major industry players like Google, Facebook, Microsoft and Amazon, which lead global digital advertising innovation and spending. These companies not only drive substantial ad revenues but also set industry standards with their cutting-edge technologies and platforms. North America has a highly developed digital infrastructure, with widespread internet and smartphone penetration, enabling advanced digital marketing strategies. The region's mature e-commerce market further fuels demand for sophisticated AdTech solutions to target and engage online shoppers effectively.

Additionally, North America's robust economic environment supports high advertising budgets, allowing brands to invest heavily in advanced AdTech solutions. The region also benefits from a strong ecosystem of tech startups, research institutions, and venture capital, fostering continuous innovation in the AdTech space.

Asia Pacific is the fastest-growing region in the AdTech market due to several compelling factors. the region boasts a rapidly expanding digital ecosystem driven by increasing internet penetration, particularly in populous countries like China, India, and Indonesia. This growth is accompanied by a surge in smartphone adoption and digital media consumption, creating a vast audience for digital advertising. rising disposable incomes in many Asian countries are fuelling consumer spending and e-commerce activities, prompting businesses to invest more in digital advertising to reach these expanding markets effectively.

Furthermore, Asia Pacific is witnessing significant investments in digital infrastructure and technology advancements, facilitating the adoption of programmatic advertising and other sophisticated AdTech solutions. The region's diverse market landscape and cultural nuances also drive demand for localized advertising strategies, prompting AdTech firms to innovate and tailor their offerings to meet diverse consumer preferences. Overall, Asia Pacific's rapid digital transformation, coupled with economic growth and technological advancements, positions it as a dynamic and high-growth market for AdTech investments and expansions.

The global AdTech market, encompassing technologies for managing digital advertising campaigns, is projected to reach at highest growth rate, driven by the shift to online media and the proliferation of data-driven marketing strategies. Key growth drivers include the increasing adoption of programmatic advertising, advancements in AI and machine learning, and the rise of social media and mobile advertising. Challenges include privacy concerns, regulatory changes like GDPR, and the need for transparency in ad spending. Major players include Google, Facebook, and Amazon, with significant innovations emerging from smaller, specialized firms. As digital consumption continues to rise, the AdTech market is poised for sustained expansion and innovation.

| Report Coverage | Details |

| Market Size by 2034 | USD 7,822.88 Billion |

| Market Size in 2023 | USD 846.02 Billion |

| Market Size in 2024 | USD 1,035.61 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Offering, Advertising Type, Advertising Channel, Advertising Format, Platform, Enterprise Size, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Shift towards online media on a global scale

The transition from traditional media to digital platforms is a significant driver of the AdTech market. As consumers increasingly favour online channels for information, entertainment, and shopping, advertisers are following suit. This shift is accelerating investments in digital advertising technologies to better target and engage audiences across web, mobile, and social media. Digital platforms offer more precise metrics and analytics, enabling advertisers to optimize their campaigns in real-time, leading to improved ROI and more effective marketing strategies.

Data-driven marketing strategies

Data-driven marketing leverages big data and analytics to create highly targeted advertising campaigns. By analysing consumer behaviour, preferences, and demographics, advertisers can deliver personalized content that resonates with specific audiences. This approach enhances engagement and conversion rates while reducing wasted ad spend. The ability to measure and adjust campaigns in real-time based on data insights makes data-driven marketing a crucial growth factor in the AdTech market, as it aligns with the increasing demand for measurable and accountable marketing efforts.

Rising programmatic advertising

Programmatic advertising automates the buying and selling of digital ad inventory in real-time, using sophisticated algorithms and AI to make data-driven decisions. This method allows for efficient targeting, budget optimization, and real-time adjustments, leading to higher ad performance and better ROI. The growth of programmatic advertising is driven by its ability to deliver relevant ads to the right audience at the right time, streamlining the ad buying process and reducing manual intervention, which is crucial in the fast-paced digital advertising landscape.

Fraudulent activities

A major restraint in the AdTech market is the rising issue of ad fraud. Ad fraud involves fraudulent activities such as fake clicks, impressions, and conversions, which cost the industry billions of dollars annually. This issue undermines the trust and effectiveness of digital advertising campaigns, as advertisers may pay for non-existent or low-quality traffic. Despite advancements in detection and prevention technologies, fraudsters continuously develop sophisticated methods to evade these measures. This persistent challenge requires ongoing investment in anti-fraud solutions and collaboration across the industry, which can increase costs and complexity for AdTech companies.

The prevalence of ad fraud not only impacts advertisers’ return on investment but also raises concerns about the transparency and reliability of digital advertising, potentially deterring new entrants and slowing market growth.

Expansion of emerging markets and innovative technologies

The expansion into emerging markets presents a significant opportunity for the AdTech industry. Regions like Asia-Pacific, Latin America, and Africa are experiencing rapid digital adoption and increasing internet penetration. As more consumers in these regions come online, there is a growing demand for digital advertising solutions tailored to local markets. AdTech companies can capitalize on this trend by offering region-specific technologies and strategies that address the unique preferences and behaviours of these new digital audiences. Furthermore, with the rise of mobile internet usage in these areas, mobile-focused advertising solutions can drive substantial growth, creating a robust market opportunity for AdTech firms looking to expand globally.

Integration of AR and AI

The integration of advanced technologies such as artificial intelligence (AI), machine learning, augmented reality (AR), and blockchain offers vast opportunities for the AdTech market. AI and machine learning can enhance targeting precision, optimize ad spend, and provide deeper insights into consumer behaviours. AR creates immersive ad experiences, increasing user engagement and interaction.

Again, Blockchain can improve transparency and reduce fraud by providing a secure, decentralized ledger for ad transactions. Leveraging these technologies can help AdTech companies deliver more effective and innovative advertising solutions, meeting the evolving demands of advertisers and consumers, and driving market growth through technological advancement and differentiation.

The service segment held a substantial market share in 2023, thus dominated the global AdTech market. The service segment dominates the global AdTech market due to its critical role in providing end-to-end solutions, including campaign management, analytics, and personalized customer engagement. Companies increasingly rely on these services to optimize their advertising strategies, ensuring higher efficiency and effectiveness. The demand for specialized expertise and continuous support, along with advancements in AI and data analytics, further drives the growth of this segment, making it indispensable for achieving competitive advantage and maximizing return on investment.

The demand-side platforms segment is observed to grow at the fastest rate during the forecast period. The demand side platforms (DSP) segment is rapidly growing due to the increasing need for automated, data-driven advertising solutions that optimize ad placement and spending. DSPs enable advertisers to purchase digital ad inventory efficiently across multiple channels in real-time, using advanced algorithms and data analytics. This enhances targeting precision and campaign performance. The rise in programmatic advertising, along with the shift towards personalized marketing and measurable outcomes, fuels the adoption of DSPs, making them a crucial tool for marketers seeking scalable and cost-effective ad solutions.

The programmatic advertising segment held largest market share, thus dominated the global AdTech market. Programmatic advertising dominates the global market due to its efficiency, precision, and scalability. It automates the buying and selling of ad inventory using advanced algorithms and real-time bidding, which reduces manual effort and human error. This method allows for precise targeting based on user data, ensuring that ads reach the right audience at the right time. Additionally, programmatic advertising offers greater transparency and measurability, enabling advertisers to optimize campaigns and maximize ROI. The growing adoption of AI and machine learning further enhances programmatic capabilities, making it the preferred choice for modern digital marketing strategies.

The non-programmatic segment is considered to be fastest growing segment in the global market. The non-programmatic segment is fast growing due to its emphasis on direct, personalized, and premium ad placements. It offers greater control over where ads appear, ensuring brand safety and alignment with desired content. This segment also supports unique, high-impact formats like sponsorships and native ads, which can be more engaging for audiences. As brands seek to create deeper connections and memorable experiences, non-programmatic advertising gains traction alongside programmatic methods.

The digital-out-of-home (DOOH) advertising segment anticipated to dominate the global market in upcoming period. The digital-out-of-home (DOOH) advertising segment dominates the AdTech market due to its ability to reach large, diverse audiences in real-world environments, providing high visibility and engagement. DOOH leverages advanced technology like digital screens, interactive displays, and location-based targeting to deliver dynamic, contextually relevant content. This adaptability allows advertisers to update and customize messages in real-time, enhancing campaign effectiveness.

Additionally, the integration of data analytics and mobile connectivity enables precise measurement of ad performance. As urbanization and digital infrastructure expand, DOOH offers unique opportunities for impactful, immersive advertising experiences, making it a preferred channel for brands seeking broad reach and innovative engagement.

The TV advertising segment shows notable growth rate and anticipated to grow further in the foreseen period. The TV channel segment is fostering due to its ability to deliver extensive reach and impact through high-quality, engaging content. Television remains a dominant medium in many households, offering advertisers access to a broad, captive audience. Advances in technology, such as smart TVs and addressable TV, enhance targeting capabilities, allowing for more personalized and effective ad placements. Additionally, the integration of TV with digital platforms facilitates cross-channel campaigns, amplifying reach and engagement.

The text format segment held the largest share of the AdTech market in 2023. The text format dominates the market due to its simplicity, cost-effectiveness, and versatility across various digital platforms. Text ads are easy to create, quick to deploy, and compatible with search engines, social media, and websites. They efficiently convey messages, drive engagement through clear calls to action, and are highly adaptable to different audience segments. This makes text ads a fundamental component of digital advertising strategies.

The video format segment is expected to showcase notable growth rate in the upcoming period. The video segment is proliferating due to its ability to capture attention and convey complex messages quickly and effectively. Videos combine visual and auditory elements, making them more engaging and memorable. They are highly shareable on social media, boosting reach and virality. Advances in technology and mobile device usage have made video content more accessible. Additionally, video ads offer robust metrics for performance tracking, making them a valuable tool for marketers aiming to optimize their campaigns.

The mobile segment held substantial market share in 2023, thus dominated the global AdTech market. The mobile segment dominates the AdTech market due to the ubiquitous use of smartphones and the increasing amount of time consumers spend on mobile devices. Mobile advertising offers unparalleled reach, targeting users wherever they are, ensuring continuous engagement. The rise of apps and mobile-optimized websites provides diverse advertising opportunities, from in-app ads to mobile video and social media ads. Mobile platforms also leverage location data for highly targeted, contextually relevant advertising, enhancing effectiveness.

The integration of advanced technologies like AI and machine learning allows for real-time personalization and improved ad performance. Additionally, mobile payments and m-commerce growth further incentivize advertisers to focus on mobile platforms, solidifying their dominance in the AdTech market.

The web segment is expected to proliferate at notable growth rate in the foreseeable future outlook. The web segment is fostering due to its extensive reach and accessibility across various devices, including desktops, laptops, and tablets. It offers a diverse range of ad formats like banners, native ads, and rich media, allowing for creative and engaging campaigns. The web's robust analytics capabilities enable precise targeting and performance measurement. Additionally, advancements in web technologies, such as faster load times and interactive content, enhance user experience, making web advertising increasingly effective and appealing to marketers.

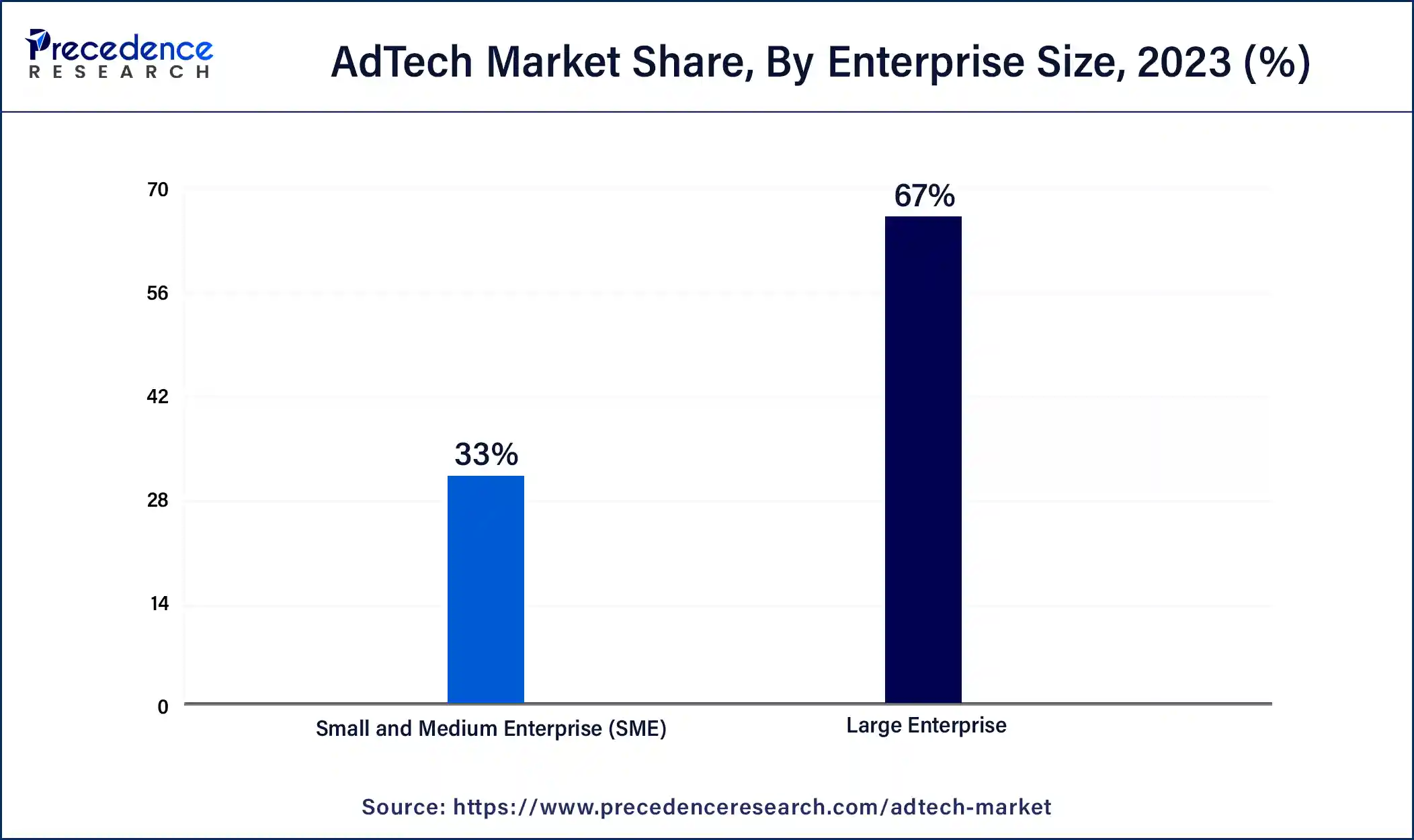

The large enterprise segment held significant market share in 2023, thus, dominated the global market. Large enterprises dominate the global AdTech market due to their substantial budgets, allowing for extensive investment in advanced technologies and comprehensive advertising strategies. They leverage sophisticated data analytics, programmatic advertising, and cross-channel campaigns to achieve broad and targeted reach. Their scale also facilitates partnerships with leading adtech providers and access to premium inventory. Additionally, large enterprises can invest in in-house teams and infrastructure for better campaign management and optimization. This significant financial and operational capacity enables them to drive innovation and set industry trends, reinforcing their dominance in the adtech landscape.

The SMEs segment held a considerable market share, thus expected to grow further in the upcoming period. SMEs show notable growth in the adtech market due to increasing accessibility to cost-effective, scalable advertising solutions. Advances in digital technology and platforms have lowered barriers to entry, enabling SMEs to leverage programmatic ads, social media, and targeted campaigns. This democratization of adtech allows SMEs to compete effectively and expand their reach.

The retail and consumers goods segment registered largest market share in 2023, thus dominated the global AdTach market. The retail and consumer goods segment dominate the AdTech market due to its high demand for targeted, engaging advertising to drive sales and brand loyalty. With the rise of e-commerce and digital shopping, these industries leverage AdTech for personalized campaigns, promotions, and real-time engagement. The need for precise targeting and tracking to optimize ROI and adapt to consumer behaviour trends further drives the adoption of advanced AdTech solutions in these sectors.

The media and entertainment segment is proliferating with significant growth rate, thus anticipated show fastest growth rate in the near future. The media and entertainment segment are the fastest growing in the AdTech market due to its dynamic content and high engagement levels. As digital consumption of video, music, and interactive content surges, media and entertainment companies increasingly rely on advanced AdTech solutions for targeted advertising, personalized experiences, and data-driven insights. The rise of streaming platforms and social media drives demand for innovative ad formats and precise targeting. Additionally, the industry's need to monetize diverse content and track performance in real-time fuels rapid adoption and growth of AdTech tools and strategies.

Segments Covered in the Report

By Offering

By Advertising Type

By Advertising Channel

By Advertising Format

By Platform

By Enterprise Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client