August 2024

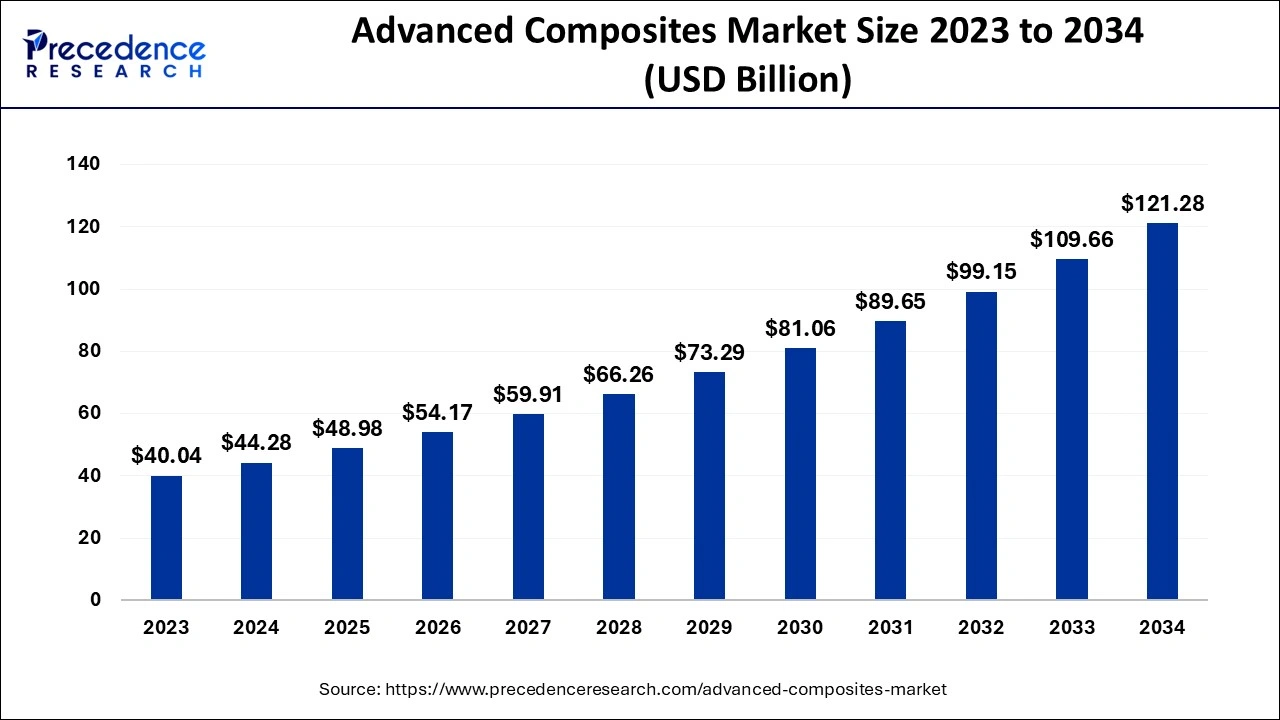

The global advanced composites market size accounted for USD 44.28 billion in 2024, grew to USD 48.98 billion in 2025 and is predicted to surpass around USD 121.28 billion by 2034, representing a healthy CAGR of 10.60% between 2024 and 2034. The North America advanced composites market size is calculated at USD 16.38 billion in 2024 and is expected to grow at a fastest CAGR of 10.74% during the forecast year.

The global advanced composites market size is estimated at USD 44.28 billion in 2024 and is anticipated to reach around USD 121.28 billion by 2034, expanding at a CAGR of 10.60% from 2024 to 2034.

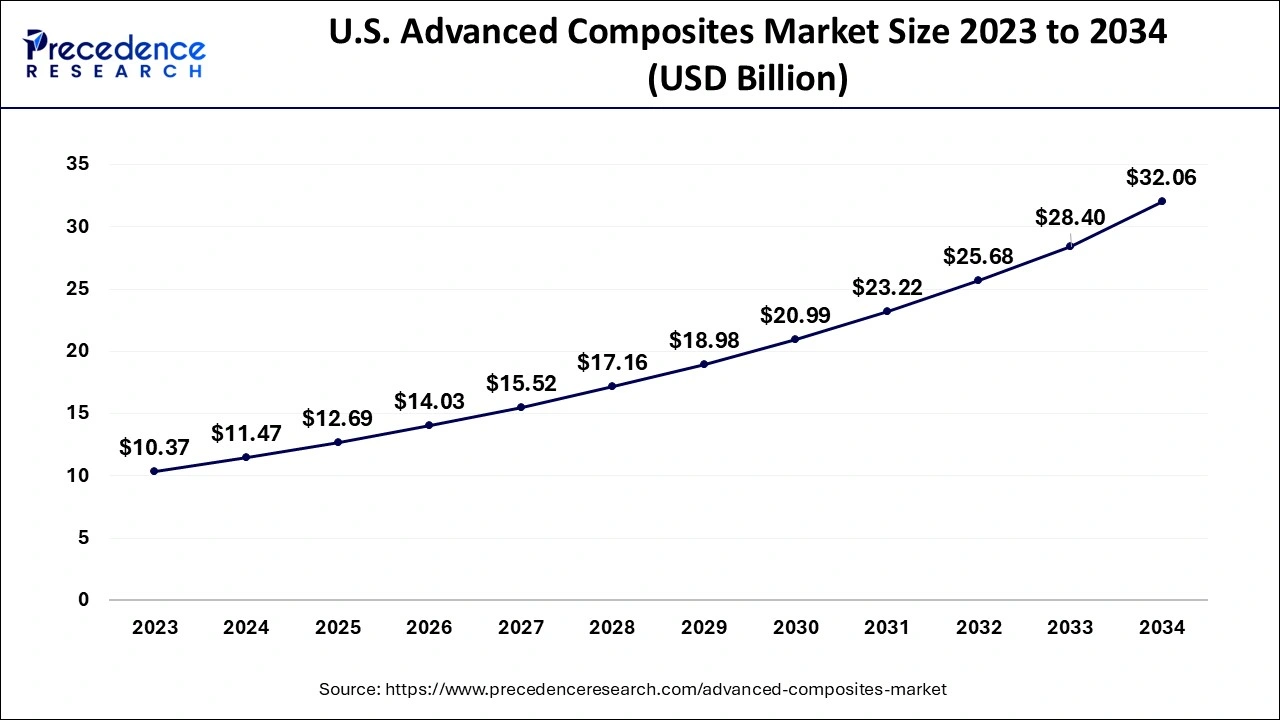

The U.S. advanced composites market size is evaluated at USD 11.47 billion in 2024 and is predicted to be worth around USD 32.06 billion by 2034, rising at a CAGR of 10.81% from 2024 to 2034.

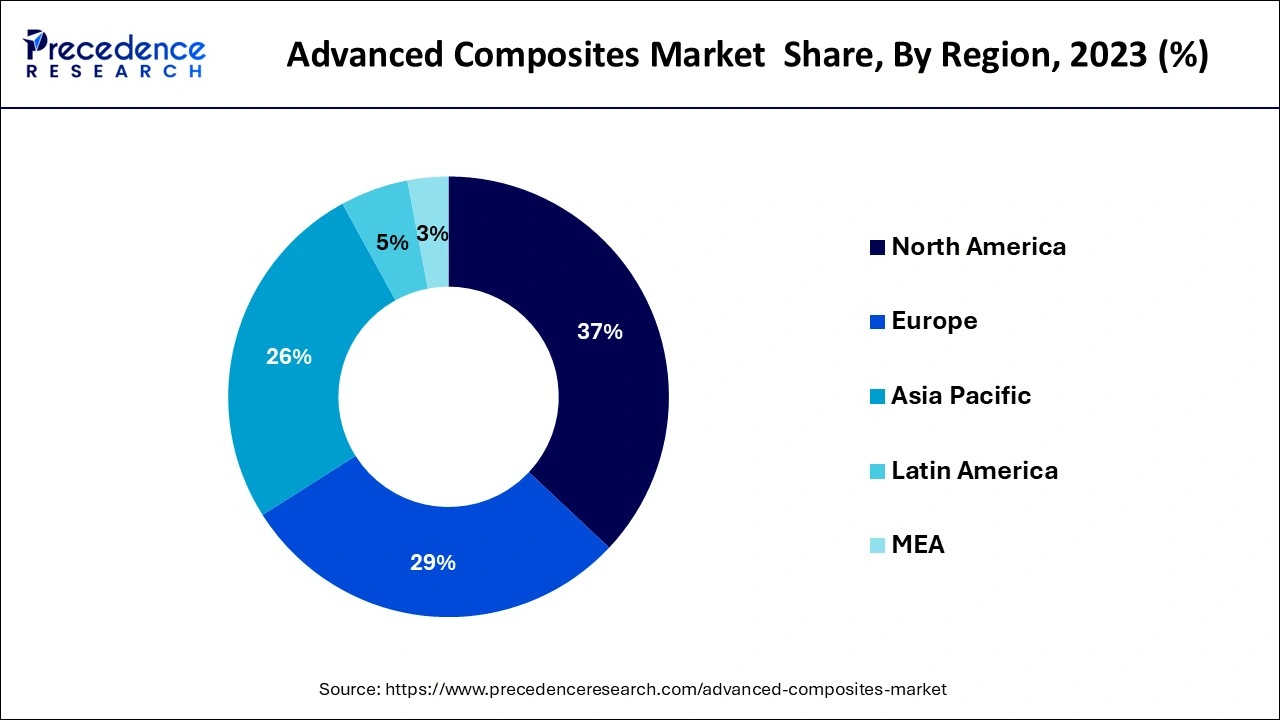

North America dominated the advanced composites market, accounting for more than 37% of sales in 2023. The product's demand in North America was estimated to be worth more than USD 14.81 billion in 2023, owing to rising demand in the automotive, aerospace, and military industries. The automotive industry in North America is one of the largest in the world, with the United States being one of the top vehicle makers. The country's sector has grown due to its large market size and huge disposable income of customers, as well as its capacity to mass produce and provide a wide range of products.

In 2023, the advanced composites market in Europe will account for a large revenue share. The growing demand for sustainable renewable energy, along with the increased installation of wind turbines in Spain, Germany, and the United Kingdom. is anticipated to have a favourable influence on demand. The fast expansion of the sector and the increasing installation of onshore and offshore wind energy facilities are projected to support market growth in the area. After Asia, Europe, and Oceania, North America ranks fourth in the number of wind energy farm installations. The growing wind energy farms, combined with the need for renewable energy sources, are expected to have a positive impact on demand for wind turbine manufacturing, driving the advanced composite market.

The market for advanced composites is likely to be driven by rising demand for the product in the aerospace and military industries, as well as sporting goods. Advanced composites, also known as advanced polymer matrix composites, are lightweight materials with a high modulus of elasticity and strength. These items are made of fibrous material incorporated in various resin matrices. These sophisticated materials are widely used in the aerospace and military industries, as well as the marine, automotive, and wind energy sectors.

The United States has one of the most substantial production bases for aerospace and defence systems. Thus, it is projected that there would be a significant demand for advanced composites, as the aerospace and defence industries see a quick application penetration of the abovementioned materials as they lower the weight of the equipment, resulting in improved performance. The increased need for advanced composites in the construction of turbines is projected to benefit the advanced composites market. Increased wind turbine installations globally are projected to contribute to market growth. The industry's use of carbon and glass advanced composites is predicted to boost demand throughout the forecasted period.

The use of advanced composites is expanding in a variety of industries, including sporting goods, maritime, and construction. However, the product's high price is projected to limit market expansion. Automation, along with the use of pricey high-performance resins, raises the cost of the product, causing demand to fall. The industry for advanced composites is distinguished by integration from the manufacturing stages through the value chain distribution channels. Manufacturing and distribution channel integration results in a cost advantage. Because of the existence of a significant number of prominent manufacturers and suppliers worldwide, the industry is very competitive.

Because of its superior technical qualities such as high strength, stiffness, great fatigue and abrasion resistance, the Advanced Composites Market will be driven by rising product demand in the automotive and aerospace industries. Because of their outstanding strength and low weight, these advanced composites are commonly utilised in the manufacture of high-performance supercar and aircraft parts such as wings, engine nacelles, ailerons, elaborators, floor beams, rudders, landing gear doors, and other components.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10.60% |

| Market Size in 2024 | USD 44.28 Billion |

| Market Size by 2034 | USD 121.28 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application Type, Resin, Manufacturing Process, and Geography |

Growing demand for ceramic matrix composites in developing countries

The growing demand for intricate and compact designs

The carbon fiber composites led the market for advanced composites in 2023, accounting for 64.5% of total sales. The expanding scope of the product in the manufacture of wind turbines and aerospace components is the primary driver of market expansion. Carbon is predicted to be the fastest expanding market over the next eight years as the product gains traction in the aerospace sector. The increasing need for lightweight, fuel-efficient aeroplanes is likely to stimulate demand for improved carbon materials.

The aramid composites category had a market share of 8.6% in 2023 and is expected to rise significantly during the forecast period. This is due to its increasing use in the defence industry. The product's diverse qualities, which include high strength, high heat, low density, and impact resistance, are projected to be a crucial component in fostering growth. Advanced aramid fibers are high-strength, stiff composites with great resistance to heat and impact, and as a result, they are rapidly being used in the automobile industry across the world. The product's use in the production of tires, body armor, and defense vehicle components is likely to drive the market for advanced composites throughout the forecast period.

The aerospace and defense application category led the market for advanced composites, accounting for 42% of sales in 2023. Positive year-on-year expansion in the aerospace sector, combined with increased investment in the industry, is likely to drive composites demand throughout the forecast period. Because of increased product penetration in automobiles, the automotive sector application category is predicted to develop at a CAGR of 8.7%. The increased need in the automotive sector for lightweight, durable, and conductive raw materials is likely to drive the advanced composites market throughout the forecast period.

Growing demand for air travel and the ability to spend are likely to be the driving factors for the sector throughout the forecast period, positively impacting the market. However, because to the restriction of the application of goods in only high-end cars and big ships and aircraft carriers, the penetration of these composites is restricted in these industries. Over the projection period, rising defence spending is likely to boost demand for aramid composites. Growing worldwide political tensions are predicted to raise investment in the defence industry, which is expected to boost demand for the product throughout the forecasted period.

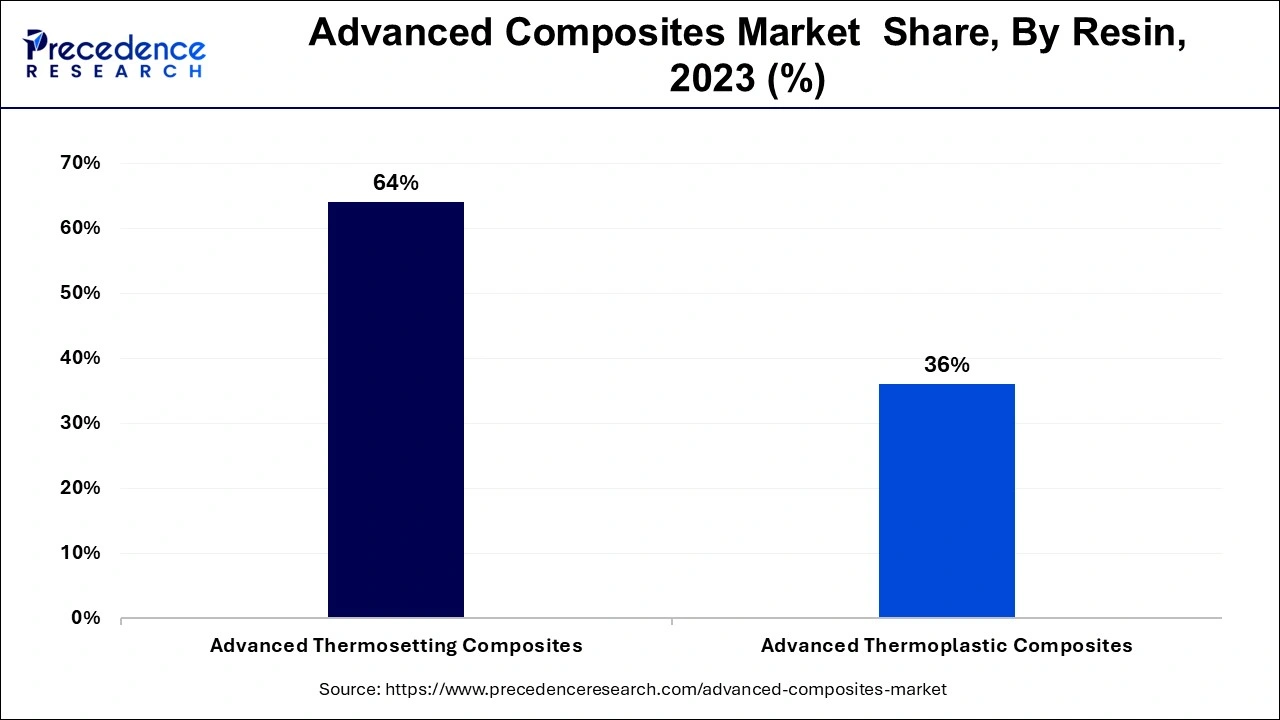

The advanced thermosetting composites category accounted for the biggest proportion of the advanced composite materials market in 2023 and is expected to increase at an 8.3% CAGR from 2024 to 2034. The rising usage of advanced thermosetting composites in aerospace and military, transportation, sports goods, and many other end-use sectors is driving the expansion of this market segment.

Advanced thermosetting composites are used in a variety of end-use sectors because they do not expand in high-heat and damp environments, making them ideal for extremely corrosive and high-temperature applications. For example, the automobile sector aims to produce cars that use less fuel, release less pollution, and have great durability and strength. Using these innovative thermosetting resins to manufacture lightweight and durable materials for vehicles decreases the weight of the automobile components, lowering fuel consumption and emissions.

By Product

By Application Type

By Resin

By Manufacturing Process

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

May 2025

May 2025