January 2025

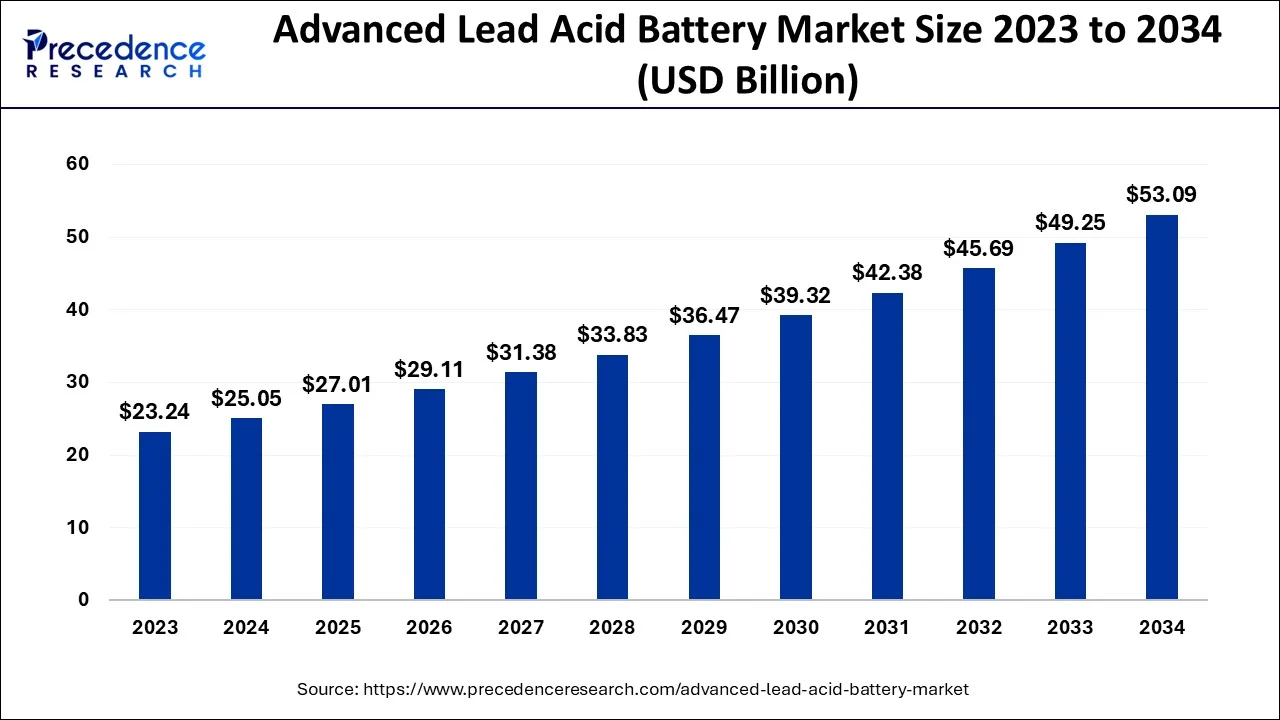

The global advanced lead acid battery market size accounted for USD 25.05 billion in 2024, grew to USD 27.01 billion in 2025 and is predicted to surpass around USD 53.09 billion by 2034, representing a healthy CAGR of 7.80% between 2024 and 2034.

The global advanced lead acid battery market size is estimated at USD 25.05 billion in 2024 and is anticipated to reach around USD 53.09 billion by 2034, expanding at a CAGR of 7.80% from 2024 to 2034.

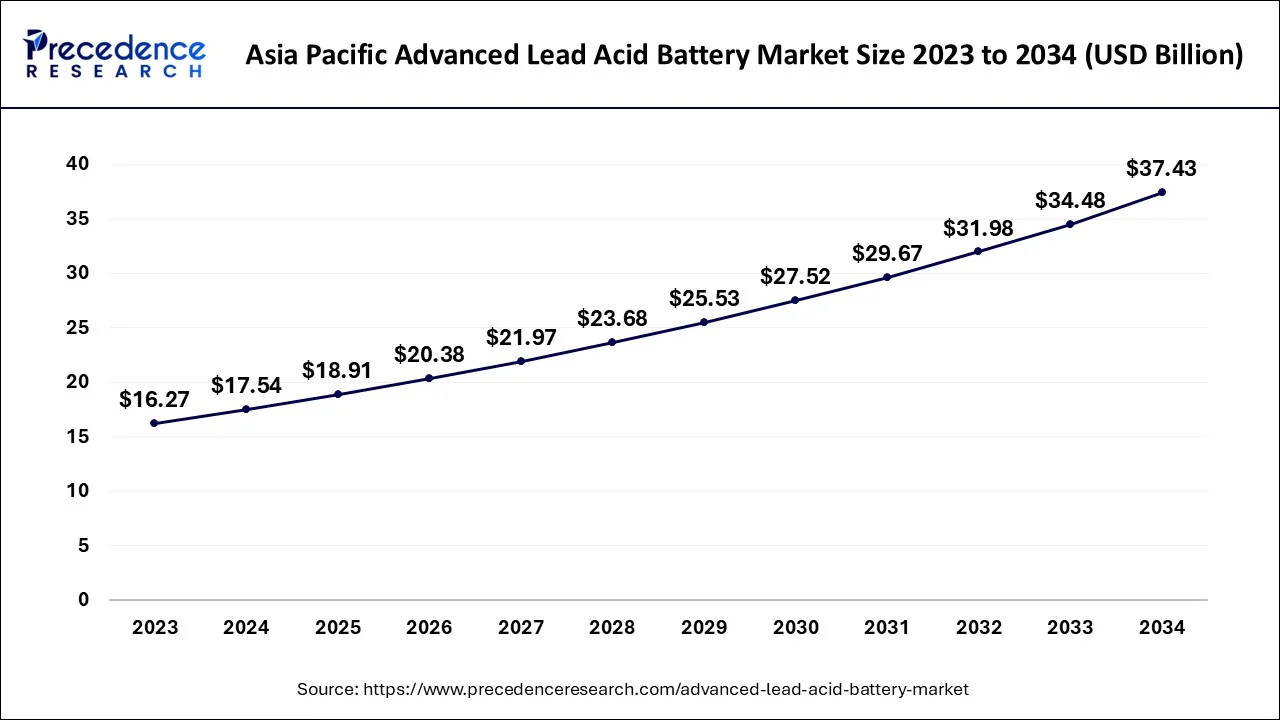

The Asia Pacific advanced lead acid battery market size is evaluated at USD 17.54 billion in 2024 and is predicted to be worth around USD 37.43 billion by 2034, rising at a CAGR of 7.87% from 2024 to 2034.

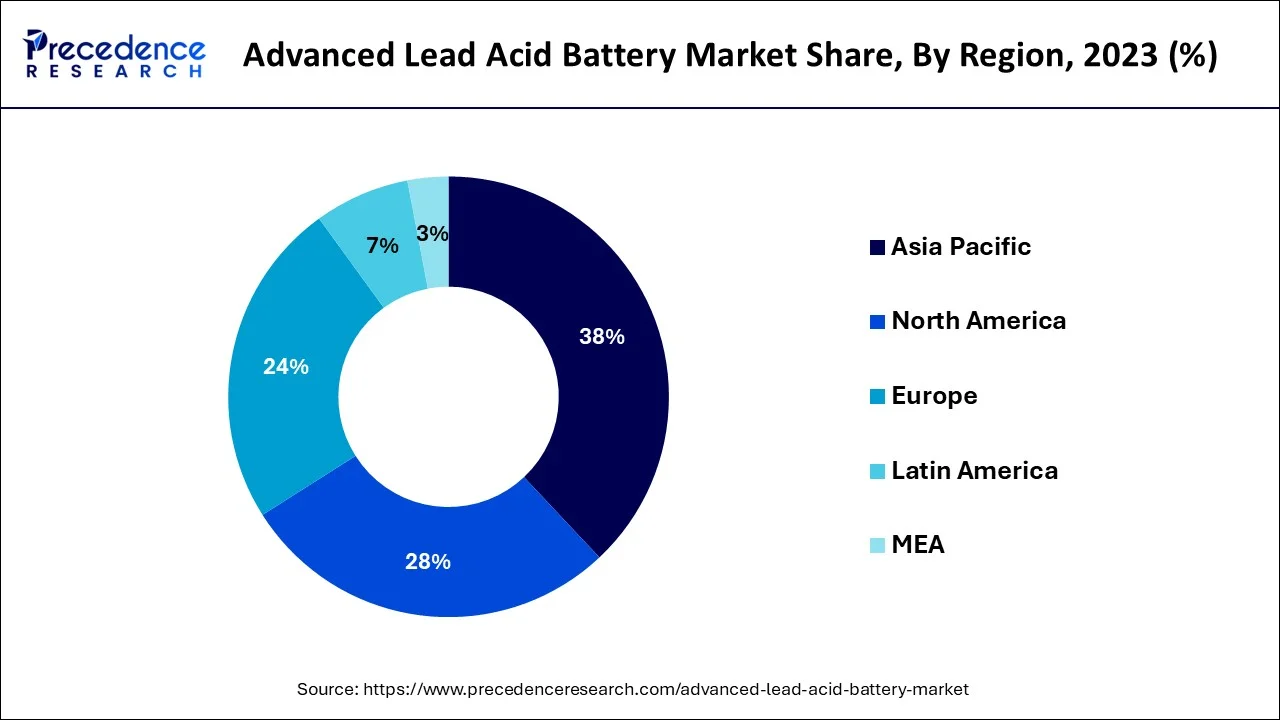

The Asia Pacific market had the largest share followed by the North American region. Asia Pacific market shall have a good growth in terms of value during the forecast period for the advanced lead acid battery market. Increasing population in this region is creating greater demands for energy. There's an increase in the demand for energy across many rural regions in the Asia Pacific area. The countries like China, India, and others countries art focusing on minimizing the adverse effects of the energy sector on the environment. Governments are making policies in order to cut down greenhouse gas emissions.

Many initiatives are taken by the governments of the developing nations to limit the adverse effects of the energy sector. In order to fulfill the demand of energy by the use of fossil fuels it is extremely advisable to store this energy in the battery system. All of these factors are leading to a growth in the deployment of battery energy storage systems across various industries. It is extremely useful for public utility applications as well as the residential application in the Asia Pacific region. China Japan South Korea and India are the key countries in the Asia Pacific region which dominate the region's growth.

Advanced lead acid batteries are cost competitive energy storage solution which can be easily recycled. They are in great demand when compared with lithium-ion batteries. As the advanced lead acid batteries are cost effective, they are driving the market growth. Advanced lead acid batteries are used in various industries. They are used across utility, transportation industries and also in the commercial and residential places. During the pandemic due to a shortage of the workforce and restrictions in the supply chain logistics led to the unavailability of material which had slowed down the growth of the industry. The largest advanced lead acid battery manufacturer is China across the world. China is also a major supplier of the lead acid battery materials and parts across the world. Due to a disruption in the supply chain logistics China has seen a slowdown in the growth of this market.

Advanced lead acid batteries can be easily decomposed compared to other battery systems. The neutralization process helps in turning the acid into water. The acid is also processed and converted into other chemical components. Lead acid batteries are easily recycled into a new battery. About 98% of all the advanced lead acid batteries undergo recycling and reprocessing and hence all these factors are expected to drive the market during the forecast period. Doesn't increasing demand for battery storage across the data centers. Lead acid battery systems are used in UPS. These lead acid batteries cater to the backup power needs of various industries. It is extremely crucial for data centers in case of any power disruptions or inconsistencies. Increased installation of data centers is expected to drive the advanced lead acid battery market in the future.

| Report Coverage | Details |

| Market Size in 2024 | USD 25.05 Billion |

| Market Size by 2034 | USD 53.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.80% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Construction Method, End User, and Geography |

On the basis of the type, the stationary segment of the advanced lead acid battery is expected to have the largest market share during the forecast. these batteries are extensively used as they offer smooth power integration across solar PV systems. With an accurate capacity of the battery bank the system is expected to run well. For energy, telecommunication, hospitals and other industries use stationary batteries as a standby power supply. Due the growth of the telecom sector across the developing as well as the developed nations across the globe is driving the market for this segment. There is rapid industrialization across all the developing countries which are in turn creating a great demand for this segment. Owing to all of these reasons the stationary segment is expected to grow well during the forecast period.

On the basis of the construction method, the valve regulated lead acid battery segment is expected to have the largest market growth during the forecast period. This segment has grown well in the recent years in terms of value. The valve regulated advanced lead acid battery is the improved version of the semi concentric sulfuric acid electrolyte battery. These batteries are zero maintenance batteries and they do not require an addition or water to the cells. These batteries are known as zero maintenance batteries as they do not require any regular maintenance. Due to all of these reasons the VRLA advanced lead acid battery segment is expected to grow well during the forecast period.

On the basis of the end user, the utility segment is the fastest growing market segment. The utility segment shall grow well during the forecast period. As there is an increase in the renewable input and the demand to optimize electricity generated from these renewables the energy storage concept is becoming critical day by day. For all of these concerns advanced lead acid batteries are cost effective solutions which are reliable. Advanced lead acid batteries are also affordable for the utility sector. Therefore there is a growth in the power consumption in various countries across the globe which is driving the demand for these lead acid batteries and the utility segment shall grow well during the forecast period.

By Type

By Construction Method

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

January 2025

January 2025