August 2024

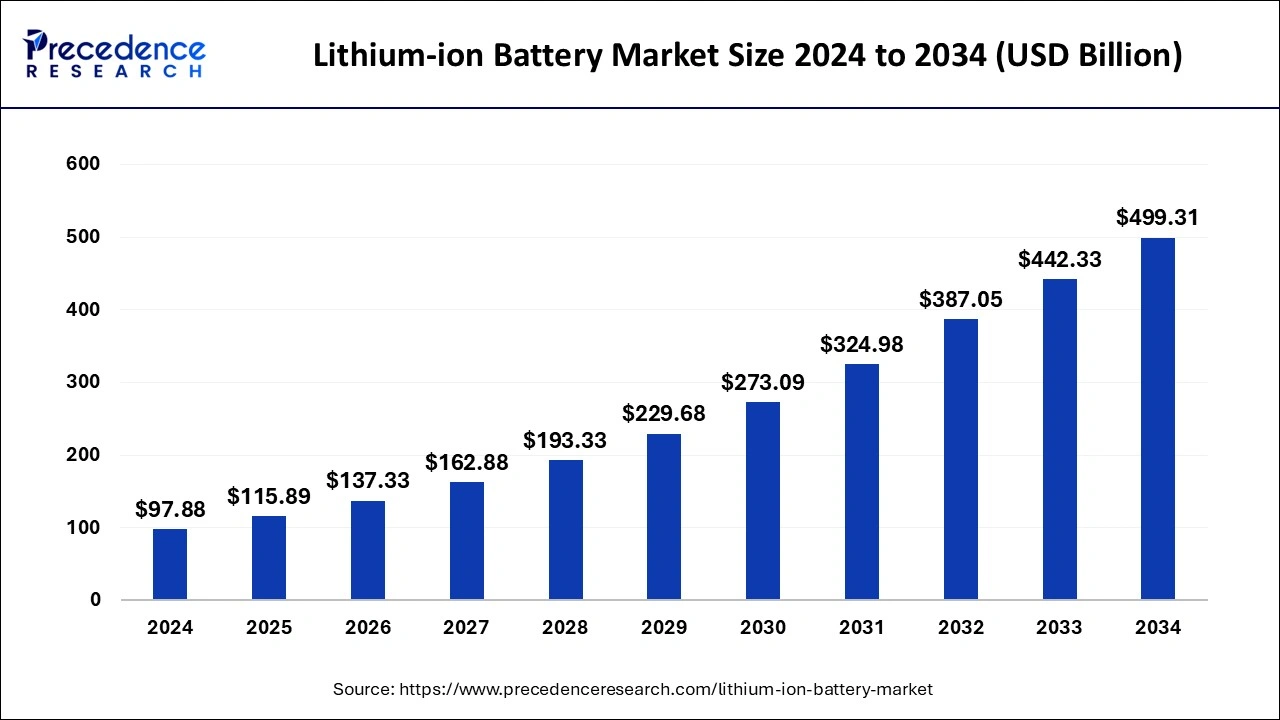

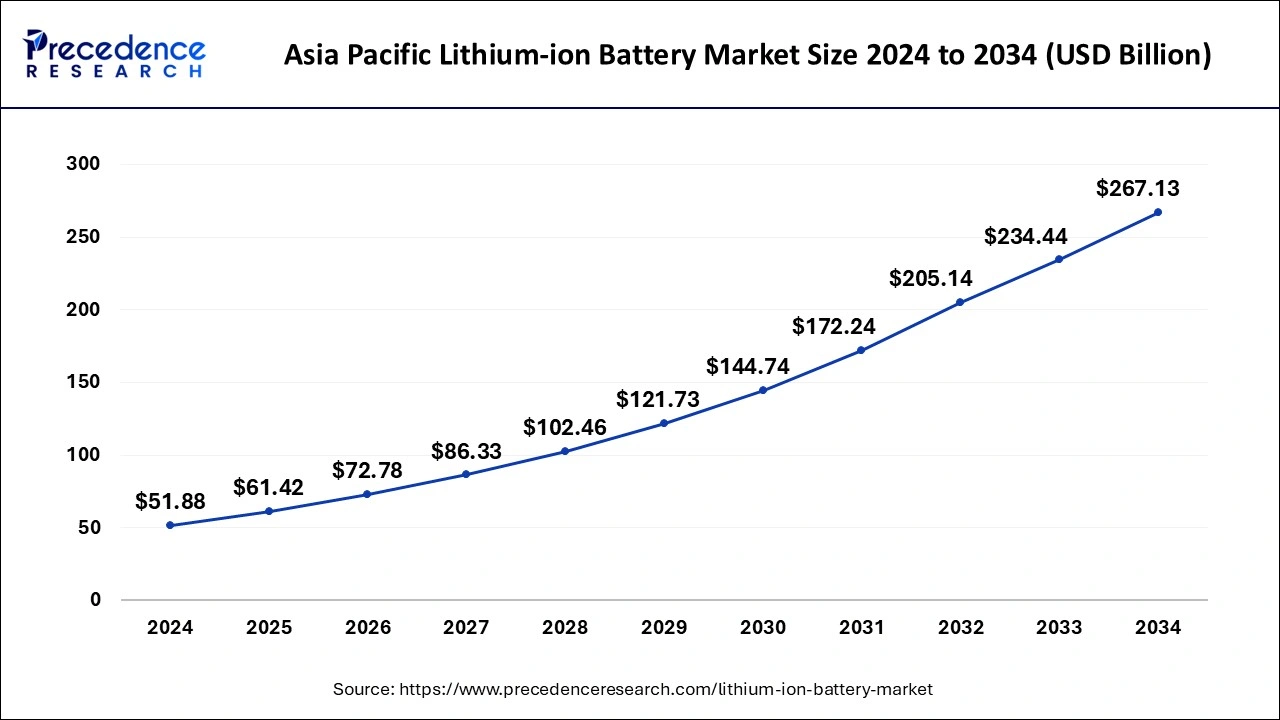

The global lithium-ion battery market size is estimated at USD 115.89 billion in 2025 and is anticipated to reach around USD 499.31 billion by 2034, expanding at a CAGR of 17.69% from 2025 to 2034. The Asia Pacific lithium-ion battery market size surpassed USD 61.42 billion in 2025 and is expanding at a CAGR of 17.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year

The global lithium-ion battery market size was valued at USD 97.88 billion in 2024 and is predicted to surpass around USD 499.31 billion by 2034, expanding at a CAGR of 17.69% from 2025 to 2034. The increasing demand for electric vehicles, the rising adoption of smartphones, and growing disposable income drive the lithium-ion battery market.

Artificial intelligence (AI) has been proven to revolutionize several sectors, including the development of lithium-ion batteries. AI can be used to detect compounds that can be mixed with lithium to enhance its efficiency and optimize its performance. AI can also be used in bulk manufacturing of lithium-ion batteries, improving reproducibility and reducing human intervention. Integrating AI and machine learning (ML) algorithms into conventional battery systems results in smart battery systems. Smart batteries can provide real-time monitoring, predictive maintenance, and adaptive control strategies. AI and ML can also be used to assess the properties of lithium-ion batteries, enhancing transparency and interpretability.

The Asia Pacific lithium-ion battery market size was evaluated at USD 51.88 billion in 2024 and is predicted to be worth around USD 267.13 billion by 2034, rising at a CAGR of 17.80% from 2025 to 2034.

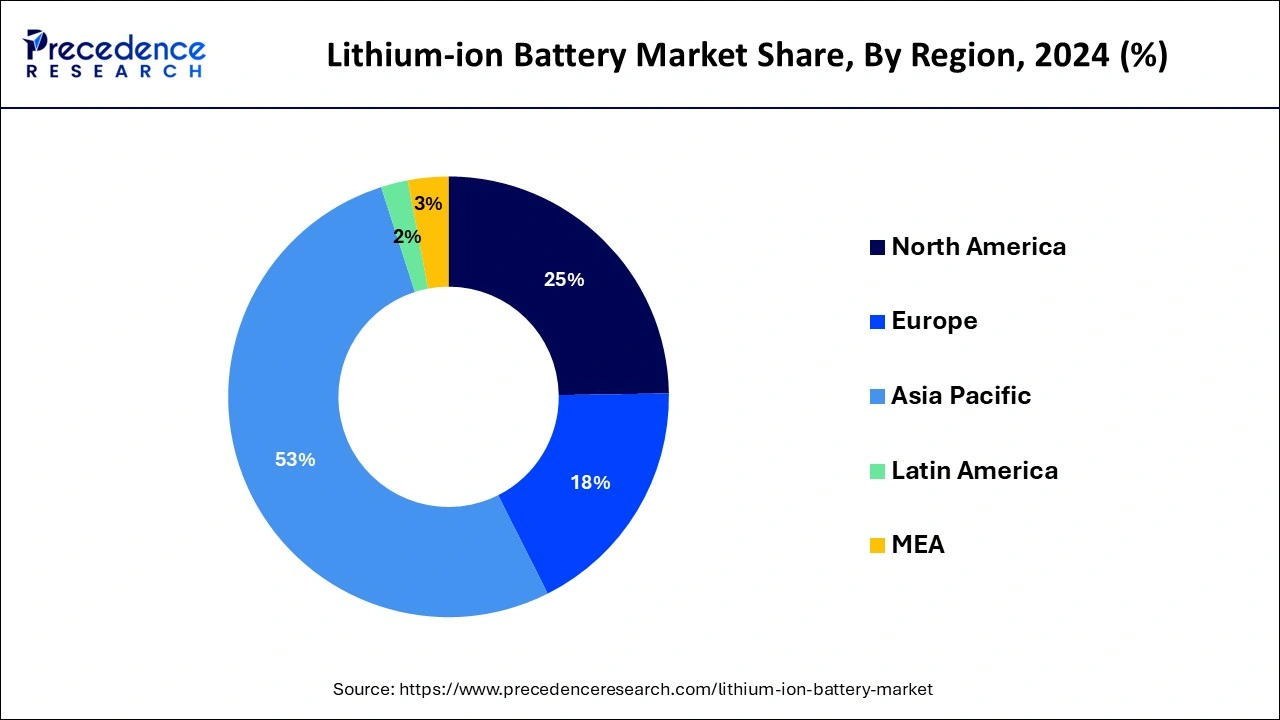

Asia-Pacific dominated the global lithium-ion battery market with the largest market share of 53% in 2024. China leads the lithium-ion battery market in Asia-Pacific region. China is considered as production hub for the lithium-ion battery. The lithium-ion battery market in Asia-Pacific region is being driven by the surge in demand for smartphones and tablets in emerging countries such as China, Japan, and India. Another factor driving the growth of the lithium-ion battery market in the region is rising disposable income and growing consumer awareness regarding lithium-ion battery in the market during the forecast period.

Technological improvements, exploitation of economies of scale through mass production, particularly in China, and increased competition between the manufacturers are the principle reasons behind the price decline. The decline in prices is leading to the widespread use of Li-ion batteries, in turn, driving the Asia-Pacific lithium-ion batteries market.

With increasing lithium-ion battery manufacturing, demand for the principal materials required for manufacturing Li-ion batteries, i.e., lithium and cobalt, is increasing. The lack of production growth and geographical concentration of production of these materials is expected to be a significant restraint for the market in the coming years.

Due to the rapid growth of the EV industry, the automobile sector has become the dominating and fastest-growing consumer of lithium-ion batteries globally, as well as in the Asia-Pacific region. China alone accounted for over 50% of the global EV sales in 2018. A similar trend is expected to continue during the forecast period. Hence, the automobile sector is expected to remain a dominating consumer sector during the forecast period.

China, India, and Malaysia are the biggest three markets for lithium-ion batteries during the forecast period. China alone, accounted for about 44.9% of the Asia-Pacific lithium-ion battery market, in 2018. Asia-Pacific accounted for around 55% market share in the global lithium-ion battery market.

North America is expected to develop at the fastest rate during the forecast period. The U.S. dominated the lithium-ion battery market in North America region. The factors such as the surge in sales of automobiles and electric vehicles all around the region and rising demand for lithium-ion battery for mobile phones are boosting the expansion and development of the lithium-ion battery market in the North America region.

| Report Coverage | Details |

| Market Size by 2034 | USD 499.31 Billion |

| Market Size in 2025 | USD 115.89 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 17.69% |

| Largest Market | Asia PAcific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Capacity, Voltage, Component, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Burgeoning Automobile Sector

The burgeoning automobile sector is a major growth factor for the lithium-ion battery market. The growing demand for EVs and increasing sales are responsible for rapidly expanding the automobile sector. According to the International Energy Agency, approximately 14 million electric cars were sold globally in 2023. This increases the demand for lithium-ion batteries. These batteries are highly preferred in EVs due to their high power-to-weight ratio, high energy efficiency, good high-temperature performance, and long life. The increasing investments in automobile R&D to drive the latest innovations boost the market.

Metal Alternatives

The major challenge of the lithium-ion battery is the presence of alternatives to lithium. Several researchers are investigating the use of different metals to reduce the use of lithium due to scarcity, high prices, and safety concerns. Other metals, such as calcium and sodium, are being investigated as they are more efficient and less expensive energy storage systems.

Growing Demand for Environmental Sustainability

The future of the lithium-ion battery market is promising, driven by the growing demand for environmental sustainability. The use of internal combustion engines (ICE) consumes carbon-based fossil fuels, emitting significant pollutants such as carbon dioxide into the environment. This poses a significant threat to the environment. Several government organizations have released guidelines and launched initiatives to reduce the environmental burden of harmful pollutants. This increases the demand for lithium-ion batteries, replacing ICE. Additionally, lithium-ion batteries are highly recyclable. It is estimated that approximately 95% of a lithium-ion battery can be recycled into new batteries.

The lithium iron phosphate (LFP) segment dominated the lithium-ion battery market in 2024. The factors such as the surge in demand for lithium iron phosphate (LFP) batteries in devices such as which are portable in nature and growing need for durable and efficient batteries are driving the growth of the segment. In addition, the advantages provided by lithium iron phosphate (LFP) batteries such as long shelf life and safest solution is also boosting the segment growth.

The lithium nickel manganese cobalt (NMC) segment is fastest growing segment of the lithium-ion battery market in 2022. The lithium nickel manganese cobalt (NMC) is widely used in various equipment such as electric powering trains and electric bikes. The benefits of lithium nickel manganese cobalt (NMC) such as long life and reduced cost is paving new ways for the growth of the segment.

A push toward sustainability and renewable energy sources is growing, with governments providing subsidies and incentives to switch to electric and hybrid vehicles. As the climate crisis looms, the United States, China, India, and countries in the European Union are lowering taxes and building the required infrastructure to charge electric vehicles.

By Product

By Application

By Component

By Capacity

By Voltage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

May 2025

June 2025