October 2024

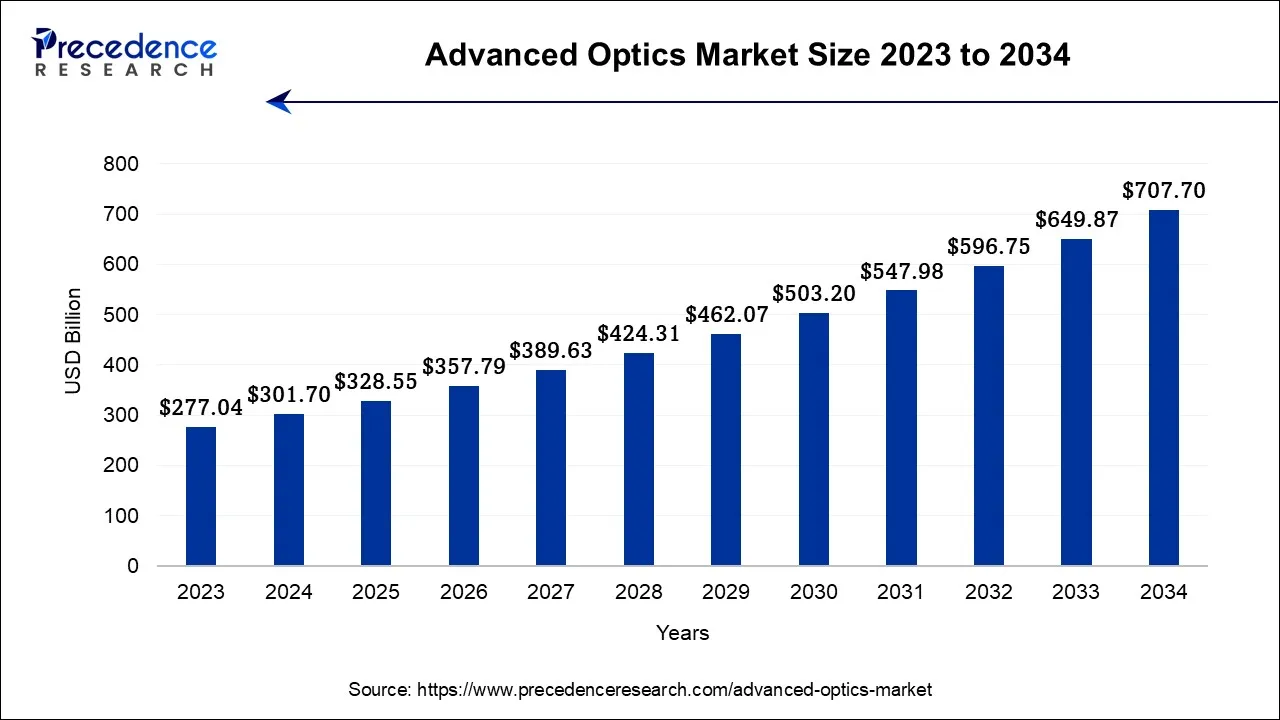

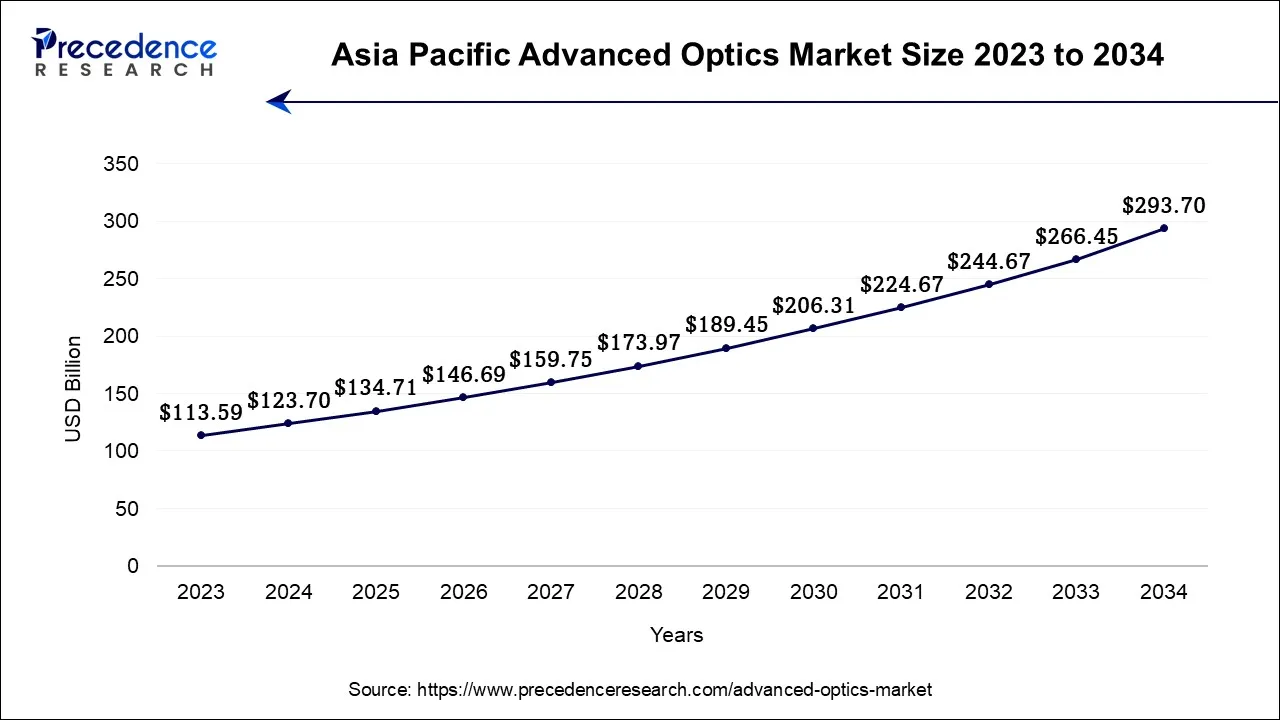

The global advanced optics market size is calculated at USD 301.70 billion in 2024, grew to USD 328.55 billion in 2025 and is predicted to hit around USD 707.70 billion by 2034, expanding at a CAGR of 8.90% between 2024 and 2034. The Asia Pacific advanced optics market size accounted for USD 113.59 billion in 2024 and is representing a notable CAGR of 9.03% during the forecast period.

The global advanced optics market size accounted for USD 301.70 billion in 2024 and is projected to reach around USD 707.70 billion by 2034, expanding at a CAGR of 8.90% from 2024 to 2034.

The Asia-Pacific advanced optics market size was estimated at USD 123.70 billion in 2024 and is projected to surpass around USD 293.70 billion by 2034, expanding at a CAGR of 9.03% between 2024 and 2034.

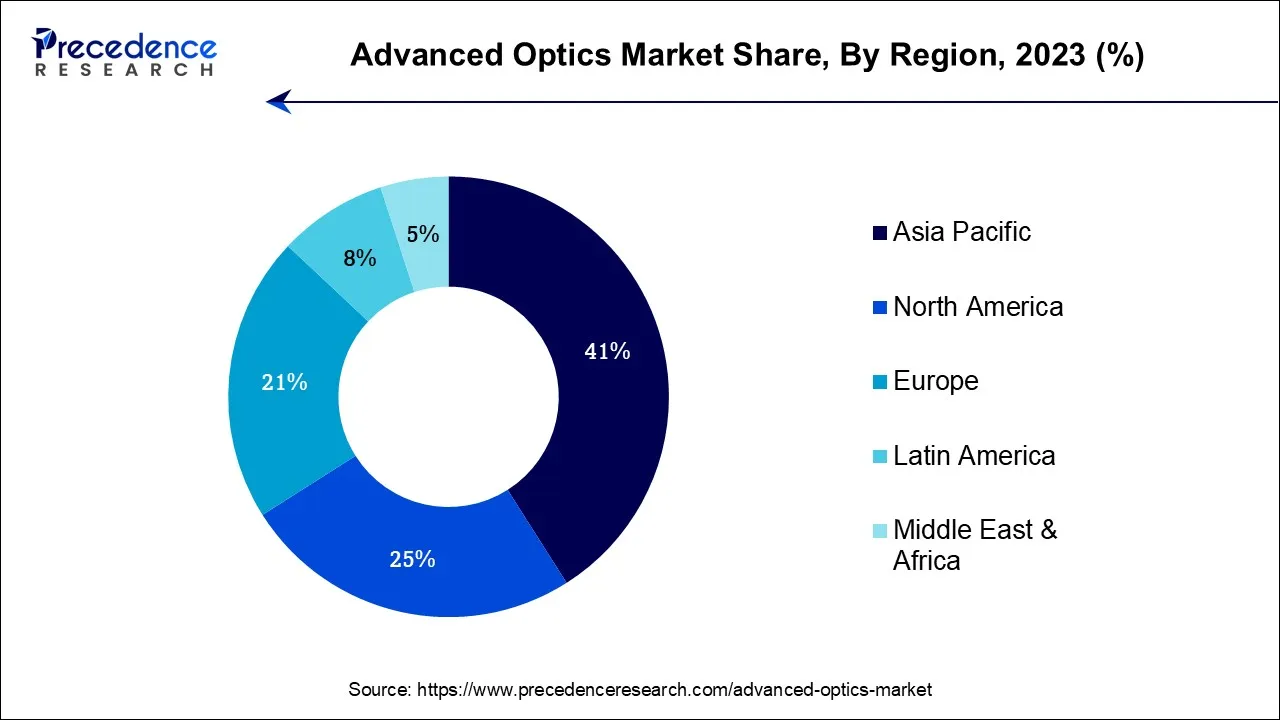

Asia-Pacific has held the largest revenue share in 2023 and is estimated to observe the fastest expansion. This is due to the various driving factors including surging adoption of advanced optics in industries such as healthcare and telecommunications, rapid technological advancements, and the existence of key manufacturing hubs of advanced optics in countries such as China, India, Japan, and South Korea. Furthermore, the expansion of 5G networks and the rising demand for optical communication technologies, such as fiber optics, may considerably drive demand for the advanced optics market across the Asia-Pacific region. Countries including China and India were heavily investing in the development of 5G infrastructure, boosting the demand for optical components.

The region is home to numerous companies and research institutions dedicated to advancing optical technologies. Investments in research and development drive innovation and contribute to market growth. The healthcare industry in North America places a significant emphasis on cutting-edge medical imaging and diagnostic technologies. Advanced optics play a pivotal role in devices such as MRI machines, CT scanners, and endoscopes, contributing to market expansion.

The European advanced optics market is expected to flourish at a high rate in the coming years, owing to Europe's commitment to research and development in optics and photonics is evident through participation in international research projects and collaborations. The European Commission has funded various photonics research initiatives.

The advanced optics market consists development, manufacturing, and sale of cutting-edge optical components, devices, and systems for various applications. It involves the use of precision engineering, specialized materials, and innovative technologies to control and manipulate light for several purposes, such as communication, imaging, sensing, and manufacturing processes. It plays a vital role in numerous industries and is crucial for allowing technological innovations and enhancing the performance of optical systems and devices.

The market provides superior lenses, mirrors, prisms, filters, gratings, and other optical elements intended to control and manipulate light with a high degree of precision. These are integrated systems or setups that use advanced optical components to achieve specific functions, such as telescopes, cameras, microscopes, and laser systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 707.7 Billion |

| Market Size in 2024 | USD 301.70 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.9% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, End-Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The requirement for precision and clarity in imaging has been more critical these days across various industries, such as healthcare, aerospace, automotive, consumer electronics, and others. For instance, in healthcare, advanced optics are integral to cutting-edge medical imaging devices like MRI and CT scanners, as well as endoscopes and microscopy systems. These technologies enable healthcare professionals to diagnose diseases and conditions with greater accuracy, ultimately improving patient care. Also, in aerospace, advanced optics are essential for surveillance, navigation, and remote sensing applications. High-resolution imaging from satellites and aircraft is vital for monitoring weather patterns, tracking environmental changes, and ensuring national security.

The automotive industry relies on advanced optics for applications like adaptive headlights, LiDAR sensors for autonomous vehicles, and heads-up displays. These technologies enhance driver safety and provide a more immersive driving experience.

Moreover, consumer electronics consumers may expect improved display and camera quality in their smartphones, tablets, and televisions by advancing optics technology. This drives the development of advanced optical components and systems, making them a key feature in the competitive consumer electronics market. Thus, the increasing demand for high-resolution imaging and vision systems underscores the indispensable role of advanced optics in delivering superior image quality, precision, and performance across a myriad of industries, fueling its sustained growth and innovation.

Designing, manufacturing, and integrating advanced optics systems can be highly complex, requiring specialized knowledge and expertise. Its design may need a deep understanding of materials science, optical physics, and precision engineering. The development process may require a multidisciplinary approach, including experts in fields such as optics, mechanical engineering, and electronics. This complexity extends to the manufacturing phase, where extreme precision and quality control are essential. The demand for specialized expertise may create an obstacle to entry for businesses and individuals to enter the advanced optics market. New companies in the market must invest significantly in research, development, and personnel training to meet the industry's high standards. Moreover, finding skilled professionals with the necessary expertise may be challenging, as there is a shortage of qualified optical engineers and technicians.

The intricacy of advanced optics also translates into longer development cycles and higher production costs. Thus, while the advanced optics market offers immense potential for innovation and growth, the complexity of design and the need for specialized expertise can limit the rate of adoption and expansion. Companies are using various initiatives such as partnership, collaboration, and investing in substantial resources in research and development to stay competitive and keep pace with rapidly evolving technologies.

For instance, in October 2022, Lockheed Martin collaborated with Ayar Labs to develop future sensory platforms. It supports Ayar Labs in advancing optical I/O microchips that use light to transfer data faster, at a lower latency, and a fraction of the power of existing electrical I/O solutions.

AI brings intelligence and automation to optical systems, making them smarter and more adaptable. For instance, AI-driven image analysis and machine learning algorithms may swiftly detect defects and anomalies in optical components, ensuring that products meet rigorous quality standards. This not only boosts production efficiency but also reduces costs associated with defective items. Moreover, AI aids in optical design optimization, enabling engineers to explore complex design spaces efficiently. AI algorithms can simulate and analyze vast datasets to identify design improvements that might be challenging to uncover using traditional methods. This streamlines the development of cutting-edge optical systems and components.

In addition, AI enhances image processing, reducing noise and enhancing image resolution. This proves invaluable in medical imaging, improving diagnostic accuracy. Also, AI-driven optical character recognition (OCR) systems facilitate text extraction from images, benefiting document scanning, autonomous vehicles, and robotics.

For instance, in May 2023, AICRAFT, an Australian artificial intelligence (AI) company signed two memorandums of understanding (MoUs) with Scanway to develop new solutions for space such as innovative smart imaging systems & HEX20 (Australia) and new constellations of smart satellites. In partnership, the company supports AICRAFT’s artificial intelligence (AI) and semiconductor technologies, and Scanway’s expertise in designing and manufacturing electro-optic systems for space and industrial applications.

Furthermore, AI-powered facial recognition and biometrics systems find applications in security, access control, and authentication. The increasing demand for these technologies provides various opportunities for advanced optics in the near future.

According to the technology, the quantum optics segment technology has held the highest revenue share in 2022. It is a specialized field that explores the quantum mechanical behavior of light and its interaction with matter. It delves into the fundamental quantum nature of photons and their interactions with atoms and molecules. Quantum optics is essential for technologies such as quantum cryptography, quantum computing, and quantum sensors. It leverages the principles of superposition, entanglement, and quantum states to develop advanced optical systems that exploit quantum effects for various applications.

The wave optics technology is anticipated to expand at a significant CAGR during the projected period because it is crucial for understanding complex optical phenomena, such as the behavior of light as it passes through small apertures, the interference patterns created by multiple light sources, and the characteristics of laser light. It plays a critical role in the design of advanced optical systems used in applications like microscopy, spectroscopy, and laser technology.

The lighting solution is anticipated to hold the largest market share in 2023. This is because it is used in lighting systems in various applications to improve energy efficiency, color rendering, and light distribution. This includes applications in architectural lighting, automotive lighting, and LED technology.

The optical communication is projected to grow at the fastest rate over the projected period. It involves the transmission of data through optical fibers. It is a key technology for high-speed and long-distance data transmission, including telecommunications networks and data centers.

The commercial segment had the highest market share of on the basis of the end-use industry. The commercial sector includes applications in retail, entertainment, and hospitality, where advanced optics are used in displays, projectors, lighting systems, and augmented reality (AR) technologies to enhance customer experiences.

The space end-use industry is anticipated to expand at the fastest rate over the projected period. Space exploration and satellite technologies heavily rely on advanced optics for telescopes, imaging systems, sensors, and scientific instruments used in Earth observation, planetary exploration, and space research.

By Technology

By Application

By End-Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

October 2023

December 2024