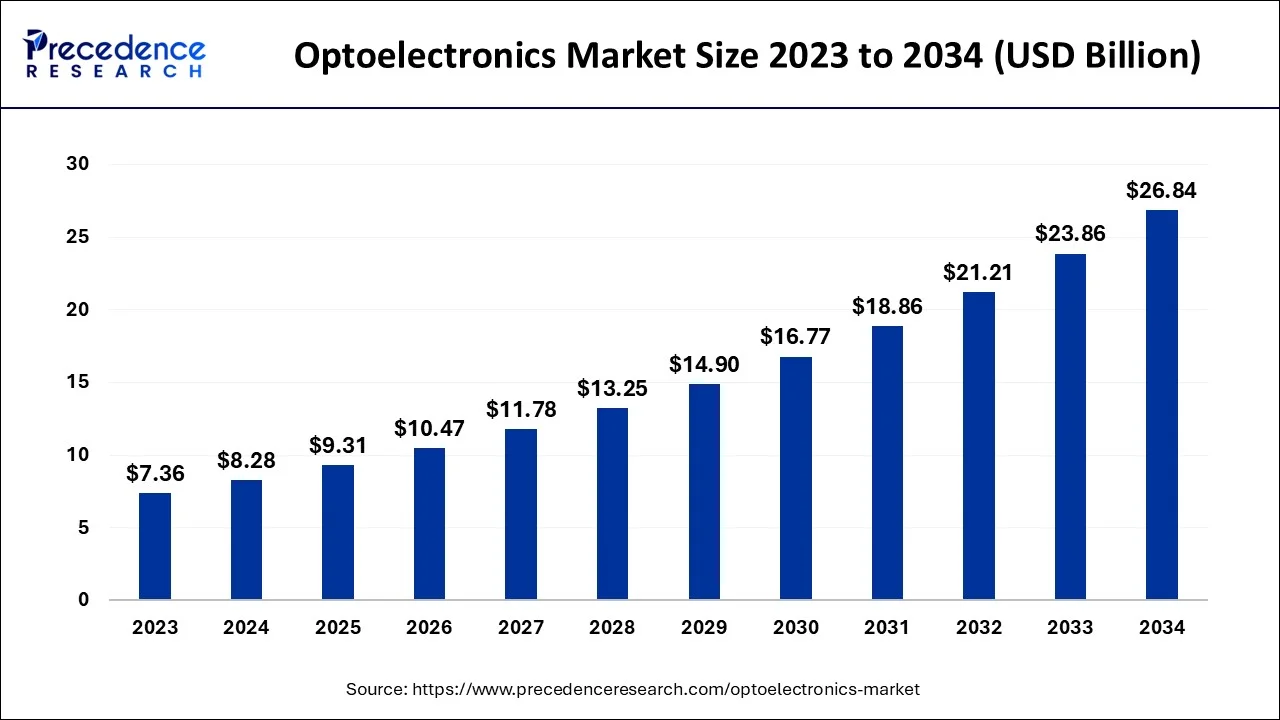

The global optoelectronics market size accounted for USD 8.28 billion in 2024, grew to USD 9.31 billion in 2025 and is projected to surpass around USD 26.84 billion by 2034, representing a healthy CAGR of 12.48% between 2024 and 2034.

The global optoelectronics market size is estimated at USD 8.28 billion in 2024 and is anticipated to reach around USD 26.84 billion by 2034, expanding at a CAGR of 12.48% between 2024 and 2034.

Optoelectronics is the term for electrical devices that source, detect, and regulate light. The study and use of electrical systems and devices that source, detect, and control light are topics covered in the field of optoelectronics, which is a subfield of physics. The research relates to creating, producing, and researching electrical hardware equipment, such as fiber optic technologies and X-ray machines. Electricity is transformed into photons in these devices for a variety of uses, including telecommunication and medical imaging, among others. To carry out various activities, optoelectronics light medium in electronic devices frequently consists of X-rays, gamma rays, and infrared. Because photonics technology includes the subsegment of optoelectronics, it is expected that demand would increase. The optical communication, optical storage, and optical imaging sectors all converge in optoelectronics. The optoelectronics market is being driven by the growing aerospace and defense sector, increasing consumer electronics industry, growing automotive sector and increasing product launches.

According to the International Trade Administration, U.S. Department of Commerce, the number of new passenger cars, SUVs, and commercial vehicles sold in the Australian market increased to 1,049,831 in 2021 from 916,968 in 2020. SUV sales made up 49.6% of the market, followed by passenger cars with 24.2%, light trucks with 22.4%, and heavy trucks with 6.4%. The right-hand drive must be offered for sale on new cars. In the Australian market, there are 380 car models and 60 vehicle brands. Over 3,600 dealer locations are available.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.28 Billion |

| Market Size by 2034 | USD 26.84 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.48% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Device, By Device Material, By Application, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing automotive industry

The main purpose of electronic components is to increase the performance and effectiveness of power train systems. These parts aid automobile power train systems in communicating, detecting signals, and managing their activities. The use of these components in the vehicles is to increase safety and improve vehicle performance. In the present scenario, modern vehicles are equipped with electronic components such as sensors and others. Thus, the growing automotive sector is expected to propel the market growth over the forecast period. For instance, according to Euromonitor, automotive unit sales are predicted to reach 78 million units in 2022, above pre-pandemic 2019 levels (+10% over 2021, which was itself up 10% over 2020). This year, OEMs profits increased overall as well, with many setting record highs.

Restraints:

High cost of optoelectronics product

Optoelectronics-based products are more expensive than normal products, which is frequently one of the obstacles preventing market expansion. Since LCD screens are less expensive than LED screens, customers can select alternate technologies in place of optoelectronic products. When compared to ordinary products, changing spare parts is more expensive. The cost thus acts as a limiting factor in the growth of the optoelectronics market. The optoelectronic market depends heavily on LCD screens, therefore the decline in sales will have a significant impact.

Increasing application in the medical field

Optoelectronic applications in endoscopic treatment and surgery are expected to make positive strides. Additionally, optoelectronics is used in the fields of pulse oximetry, blood diagnostics, and dental diagnosis in the healthcare industry. Due to the devices' incorporation for optical reasons, optoelectronics also finds use in the market for medical equipment. There are a ton of opportunities in the optoelectronics business as a result of the convergence of healthcare and technology. Thus, the increasing application of optoelectronics in the medical field is expected to drive the growth of the market over the forecast period.

Based on the device, the global optoelectronics market is segmented into LEDs, sensors, infrared components, optocouplers, photovoltaic cells, displays, and others. The sensors segment is expected to dominate the market over the forecast period. The growth in the segment is attributed to the increasing adoption of sensors including photodiodes, optical sensors, and image sensors in various industry verticals such as automotive, manufacturing, aviation, medical and healthcare, and marine.

In automotive applications sensors are used for braking and traction control, airbags-anti cushion restraints systems, and avoiding collision. For example, wheel-mounted Antilock Braking System (ABS) sensors continuously feed data to the system's control unit, measuring the wheel's speed and braking force. The ABS releases the braking pressure to prevent wheel sliding or locking when the driver applies the brakes suddenly using the braking pressure and speed data it has received from the sensors. One of the most important factors of a vehicle's safety is this. Thus, the increasing use of sensors in different industry verticals for critical use is expected to flourish the segment growth over the forecast period.

Based on the device material, the global optoelectronics market is divided into gallium phosphide, gallium arsenide, gallium nitride, silicon carbide, silicon germanium, and indium phosphide. The gallium nitride segment is expected to dominate the market during the forecast period. The growth in this segment is owing to the various advantages such as reduced energy cost, higher power density, higher switching frequency, and lower system cost. For instance, GaN devices' greater switching frequencies make it possible to employ smaller inductors and capacitors in power circuits.

The inductance and capacitance drop in direct proportion to the frequency; for every 10X rise in frequency, the capacitance and inductance are reduced by 10X. This can lead to a significant reduction in weight, volume, and expense. In motor drive applications, the higher frequency can also mean less acoustic noise. High frequency also allows for greater spatial freedom, larger transmit-to-receive air gaps, and wireless power transfer at higher powers. Thereby, driving the segment growth.

Based on the industry vertical, the global optoelectronics market is divided into consumer electronics, automotive, aerospace & defense, IT & telecommunication, food & beverage, healthcare, energy & utilities, residential, industrial, commercial and others. The consumer electronics industry is expected to hold the largest market share over the forecast period. The segment growth is attributed to the increasing demand for consumer electronics including smartphones, TV, refrigerators and laptop. For instance, in September 2022, India's export of electronics goods reached USD 2,009.07 million, a rise of 71.99% YoY. Mobile Phones, IT hardware (laptops and tablets), consumer electronics (TV and audio), industrial electronics, and car electronics are some of the industry's major exports product. India's electronics industry export is anticipated to reach USD 120 billion by 2026, according to the Ministry of Electronics & IT vision. Thus, the aforementioned facts support the growth of the segment, which in turn, propel the market growth over the forecast period.

The Asia Pacific is expected to capture the largest market share over the forecast period. The regional growth is attributed to the growing consumer electronics and automotive industry, particularly in China and India. As per China Information Technology Industry, the production volume of electronics in China rose from 10% in 2016 to 14.5% in 2017. This increase in the country's electronics industry is owing to the increasing customer demand for smart gadgets, virtual reality and drones. Smartphone production in the country alone grew from 237.2 million units in 2012 to 901.2 million units in 2017. In addition, according to the International Trade Administration, with domestic production anticipated to exceed 35 million vehicles by 2025, China is still the largest market for vehicles worldwide in terms of both annual sales and manufacturing output. According to the Information from the Ministry of Industry and information technology, approximately 26 million vehicles, including 21.48 million passenger cars, were sold in 2021, an increase of 7.1% from the previous year. Thus, the aforementioned facts support the market growth during the forecast period.

North America is expected to grow significantly during the forecast period. The growth in the region is attributed to the developed medical and medical device sector. Moreover, the increasing investment in the aerospace and defense sector is also driving the market growth during the study period. For instance, as per the Canadian government budget 2022, the government-funded USD 8 billion on defense over five years. Thus, the increased funding in the defense industry is expected to drive the growth of the market in the region.

Segments Covered in the Report:

By Device

By Device Material

By Application

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client