September 2024

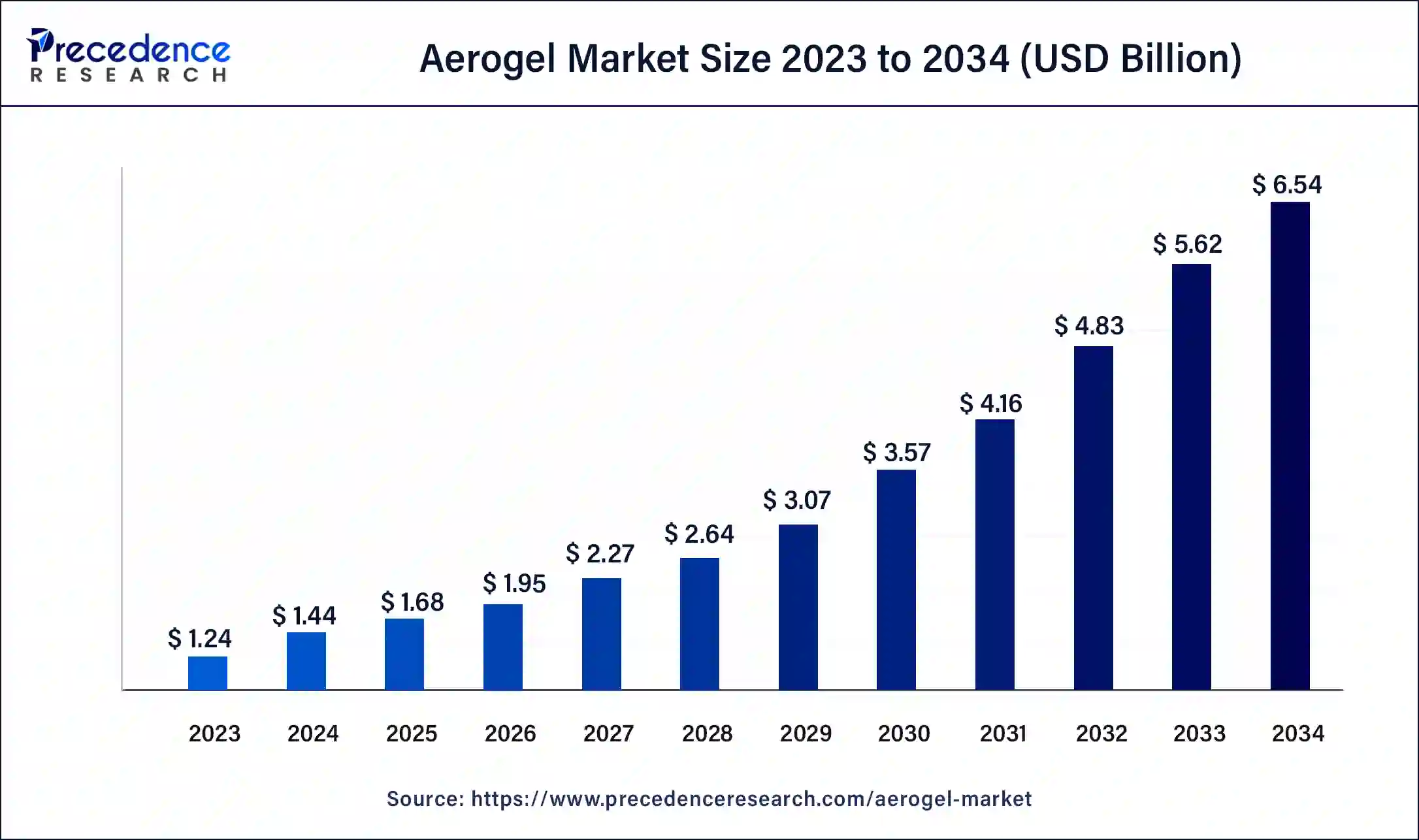

The global aerogel market size surpassed USD 1.24 billion in 2023 and is estimated to increase from USD 1.44 billion in 2024 to approximately USD 6.54 billion by 2034. It is projected to grow at a CAGR of 16.32% from 2024 to 2034.

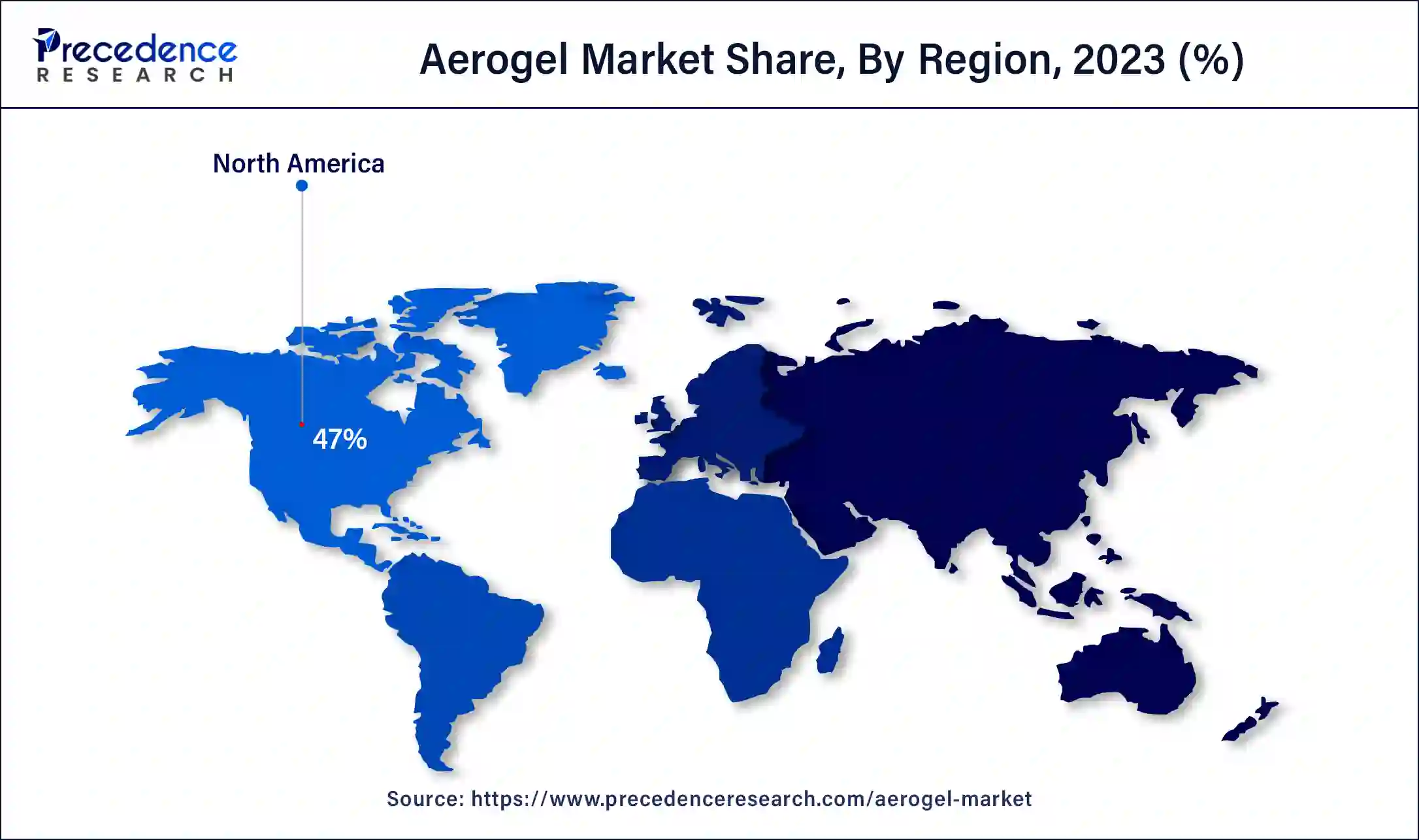

The global aerogel market size is projected to be worth around USD 6.54 billion by 2034 from USD 1.44 billion in 2024, at a CAGR of 16.32% from 2024 to 2034. The North America aerogel market size reached USD 1.24 billion in 2023. The increasing demand for aerogel in the various end-use industries is driving the growth of the market.

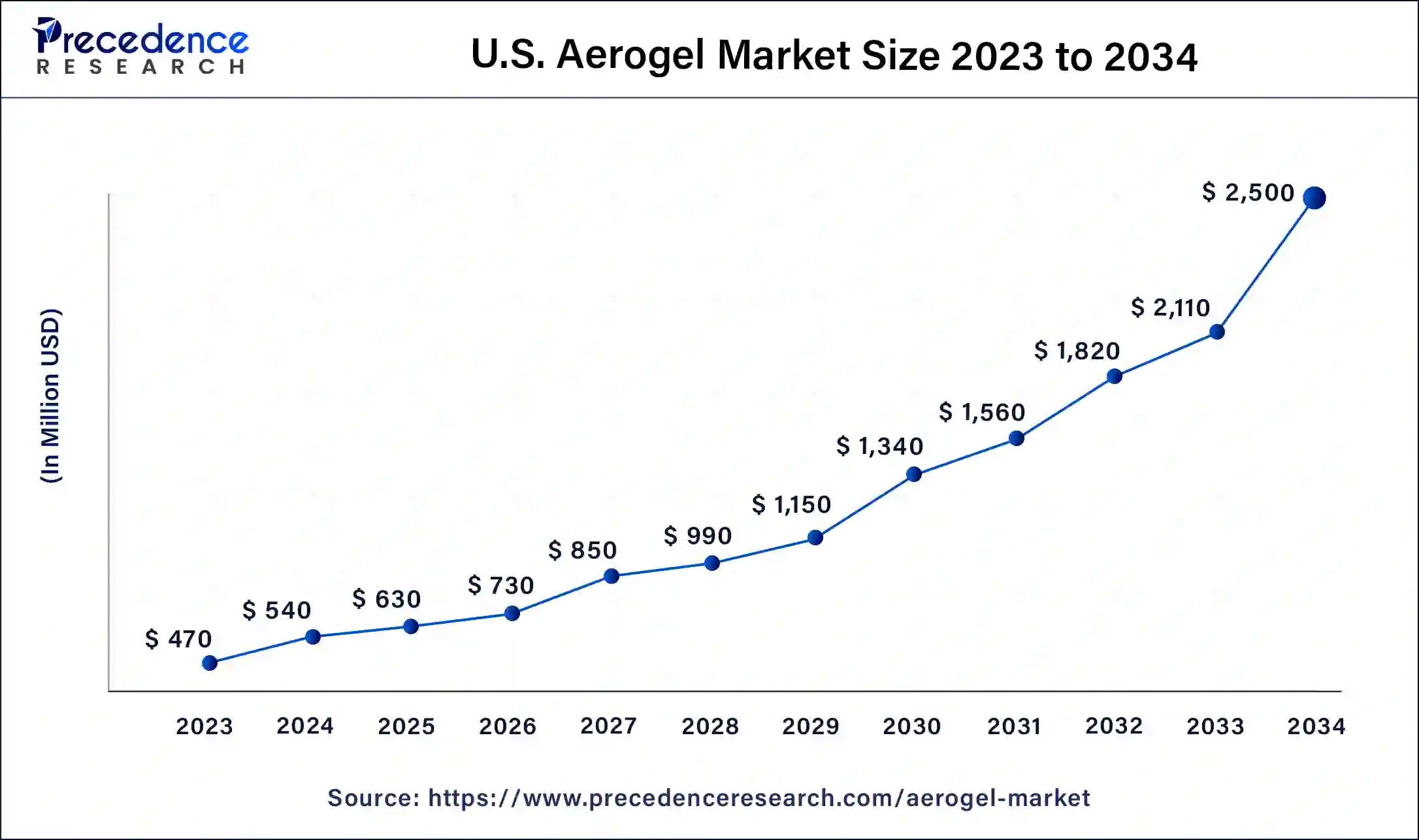

The U.S. aerogel market size was exhibited at USD 470 million in 2023 and is projected to be worth around USD 2,500 million by 2034, poised to grow at a CAGR of 16.40% from 2024 to 2034.

North America dominated the aerogel market with the largest market share in 2023. The growth of the market is attributed to rising industrial development and the increasing availability of end-use industries such as construction, automotive, energy, electronics, and others, which are driving the demand for aerogel. The rising investment by the public and private firms in industrial development and maintaining safety standards in the industries are driving the growth of the aerogel market in the region.

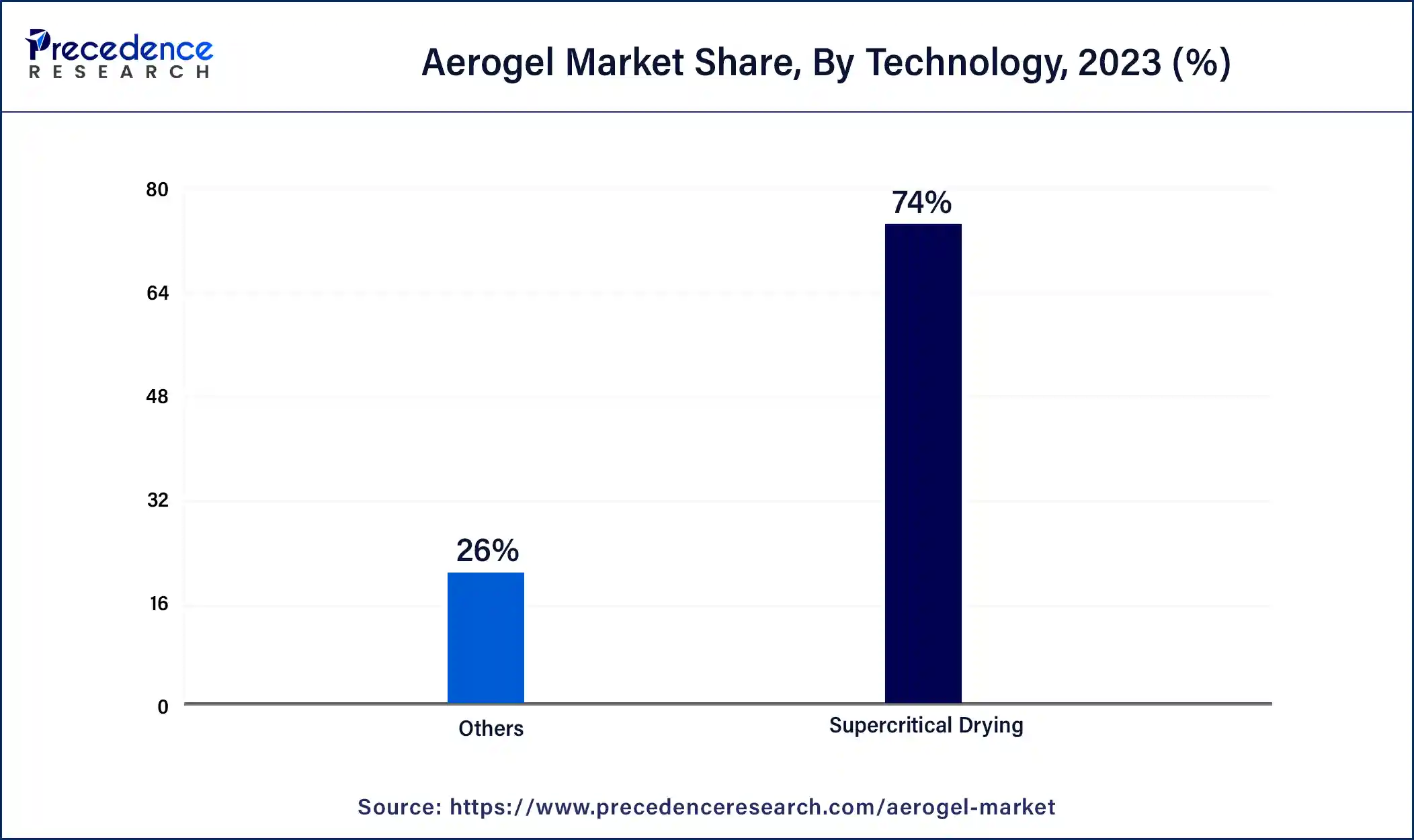

The aerogel is an extremely lightweight, porous, solid component made by replacing liquid in gel gas without impacting its original size, shape, or structure. Aerogel can be derived from a number of chemical compounds, such as silica and polymer-based aerogel. These aerogels are derived from the extraction of liquid components with the use of technologies like freeze-drying and supercritical drying.

Aerogel is a pressing soft material. Despite it being a rigid, dry, and solid material, it does not leave any mark on it. The aerogel material consists of 50% to 99.98% of the air by its volume and exhibits 90% to 99.8% of the porosity. Aerogel has great thermal insulation and conductivity, which makes it the ideal material for building, industrial construction, and clothing insulation, driving the growth of the aerogel market.

How Can AI Impact the Aerogel Market?

Artificial intelligence is transforming the landscape of the aerogel used in the industries. A number of leading technologies are adopting AI, robotics, and other advanced technologies in the designing of sustainable aerogel material in wearable technologies. The aerogel materials are lightweight and have higher thermal insulation than the other insulation materials, making it easy and efficient to use the aerogel in wearable technology.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.54 Billion |

| Market Size in 2023 | USD 1.24 Billion |

| Market Size in 2024 | USD 1.44 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Form, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increased use of aerogel in the automotive industry

The automotive industry is rapidly expanding, and continued research on the development of new technology, materials, and other advancements for expanding the efficiency and performance of the vehicles are contributing to the adoption of the new technologies and materials that are driving the implementation of aerogel in the automotive sector. The aerogel can be used in the designing and manufacturing of both conventional and electronic vehicles. Aerogel plays an important role in vehicles; it reduces the potential risk of fire, heat preservation, and heat insulation and abstracts the higher noise by the vehicle.

The aerogel works as the firewall or the heated wall between the engine and the passenger compartment, though it reduces the heat emitted by the engine to the passenger compartment. The aerogel has several beneficial properties, such as great insulation, thin thickness of heat insulation layers, higher performance, and lower thermal conductivity that improves the performance of the vehicle. It has waterproof properties that promote longer service life, and it is the most toxic-free material that creates no negative impacts on the environment.

High cost

The increased cost of aerogel and its raw materials in the manufacturing process is limiting the adoption of aerogel as the insulation material in the different applications that restrain the growth of the aerogel market.

Advancements in aerogel applications

Aerogel materials have several beneficial properties that make them an ideal choice for industrial applications. Industries like space research and the leading space research firm NASA have used aerogel as the thermal insulation material in designing space suits and trapping cosmic dust particles in Stardust Spacecraft.

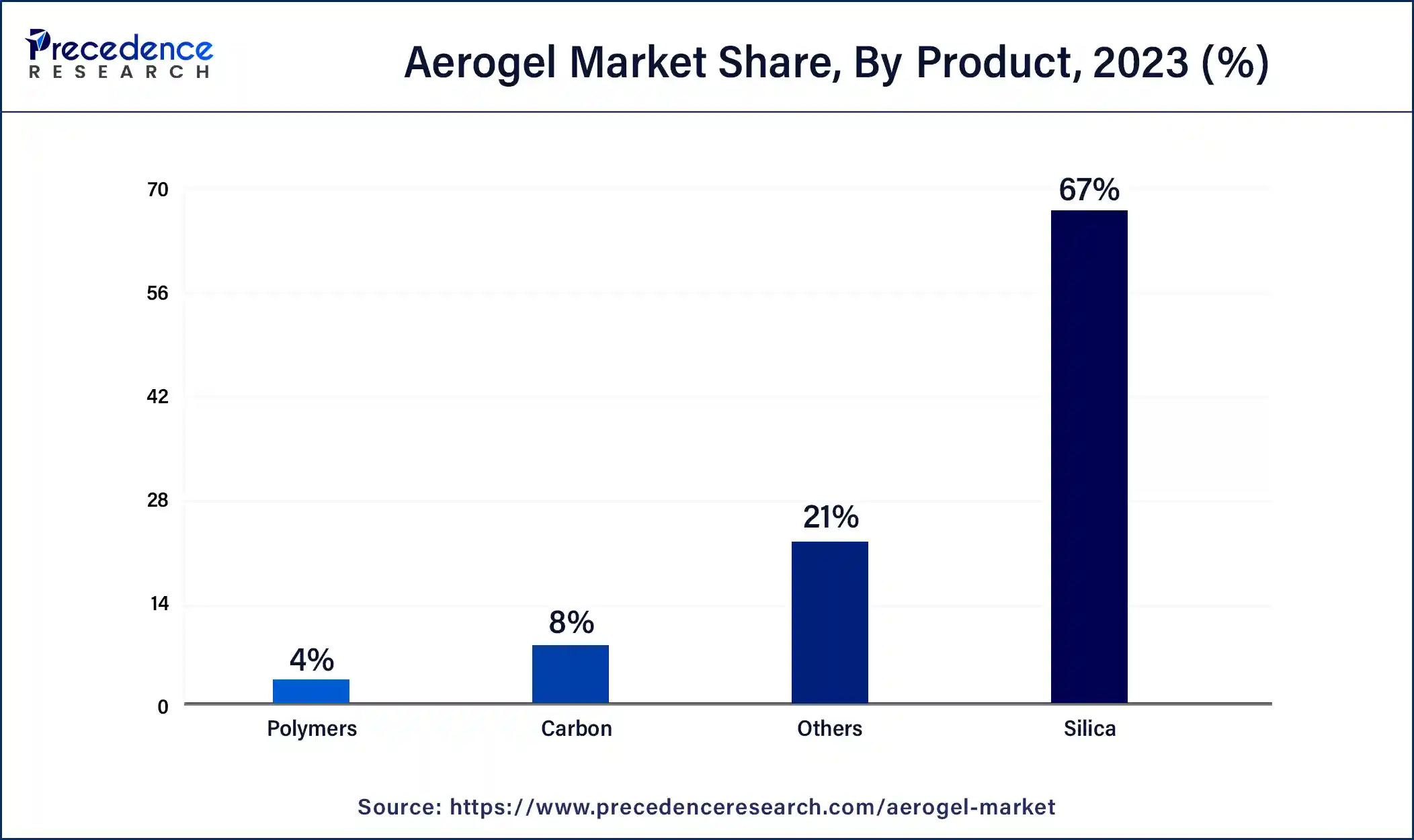

The silica segment dominated the aerogel market in 2023. The silica aerogel is the most common type of aerogel; it is made from the extraction of liquid from the silica gel. The silica gel is generally produced from the sol-gel process. The rising demand for silica gel is due to its efficient chemical properties, which can be used in a wide range of technological applications. These types of aerogels are nanostructured materials with higher porosity, minimized dielectric constant, density, and great heat insulation.

The silica gel is also used in space or cosmic applications; it is used by space organizations such as NASA to capture cosmic or space dust. The silica aerogel is lower in mass, which makes it ideal for trapping space dust.

The carbon segment is expected to grow significantly in the aerogel market during the forecast period. The rising use of carbon aerogel in various electrical applications such as supercapacitors, fuel cells, and desalination systems. This type of aerogel is the lightest material on earth, with the lowest density. The carbon aerogel is a porous material combined with carbon nanoparticles. The carbon aerogel has the highest electricity conductivity and higher surface area. Due to the higher electric conductivity, it is used in a wide range of electrical applications, which drives the demand for the segment.

The supercritical drying segment led the aerogel aerogel market in 2023. Supercritical drying is the technology that is used to replace the liquid material with the gas isolate. Supercritical drying is also called supercritical extraction, critical point drying, and supercritical lyophilization.

Supercritical drying leads to specific characteristics in the aerogel, like low density, higher porosity, and large surface area. It is the process or technology that extracts the solvent from the pores of aerogel, which is also known as the efficient technology in drying wet gels. There is an increasing demand for supercritical drying in laboratory drying units.

The blanket segment dominated the aerogel market in 2023. Blanket aerogel is equipped with great insulation properties, though it is increasingly used as an insulation material in buildings and clothing. The growing demand for blanket aerogel is due to its higher beneficial properties such as water repellency, high breathability, low powdering and low dusting, and light diffusion. Thus, the rising construction activities and the rising use of blanket aerogel in buildings and industries to maintain safety standards are driving the demand for the blanket aerogel segment.

The panel segment is projected to grow significantly in the aerogel market during the forecast period. The growth of the segment is attributed to the rising adoption of aerogel panels in several applications in the construction, defense, and other industrial sector due to their higher thermal conductivity, easy handling, and hydrophobicity. The aerogel panels are also used in various electric applications.

The oil & gas segment dominated the aerogel market in 2023. Aerogels are highly in demand in the oil and gas industries due to their efficient properties such as higher thermal insulation, conductivity, hydrophobicity, mechanical strength, and other properties that make aerogel an ideal material for wide applications in the oil and gas industry such as it used in the construction of the deep underwater pipes and oil and gas piping.

It reduces the requirement for steel and other materials in the pipeline, which reduces production costs, reduces corrosion in the pipeline, and expands the life of the pipe. Aerogel is efficiently used to address a number of challenges, including the thermal insulation of equipment and pipelines; it is widely used in gas separation and absorption of oil leakage.

According to recent study, “Oil and Gas Industry Annual Contracts Analytics by Region, Sector (Upstream, Midstream, and Downstream), Planned and Awarded Contracts, and Top Contractors,” the entire contract associated with the oil and gas industry is increased to $183.63 billion in 2022 from $178.86 billion in 2021. The contract volume saw a slight reduction from 6,972 in 2021 to 6,668 in 2022.

The building & construction segment is expected to have significant growth in the aerogel market during the anticipated period. The aerogel is largely adopted by the construction sector for the thermal insulation of building and industrial units. Aerogel is used in various forms, such as panels, boards, blankets, and renders, to maintain the strength, integrity, and authenticity of heritage buildings. A number of major construction sector players have adopted aerogel for thermal insulation in buildings to maintain safety standards.

Segments Covered in the Report

By Product

By Technology

By Form

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024