August 2024

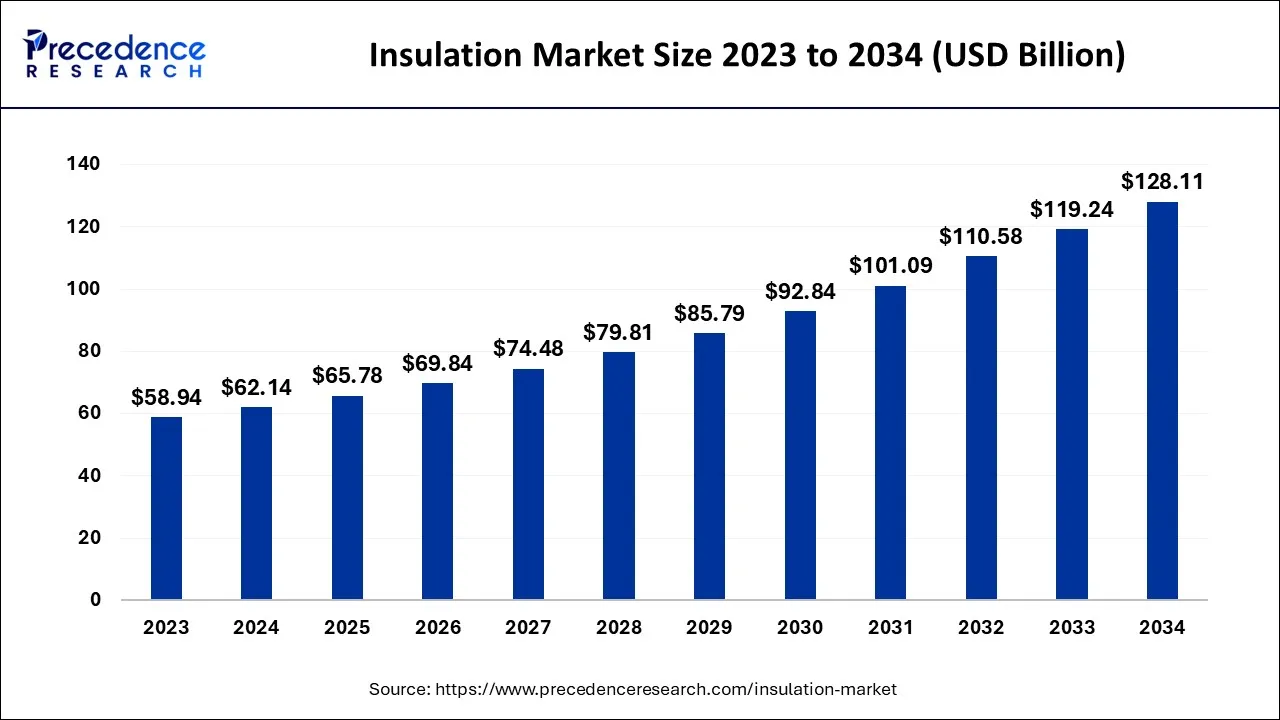

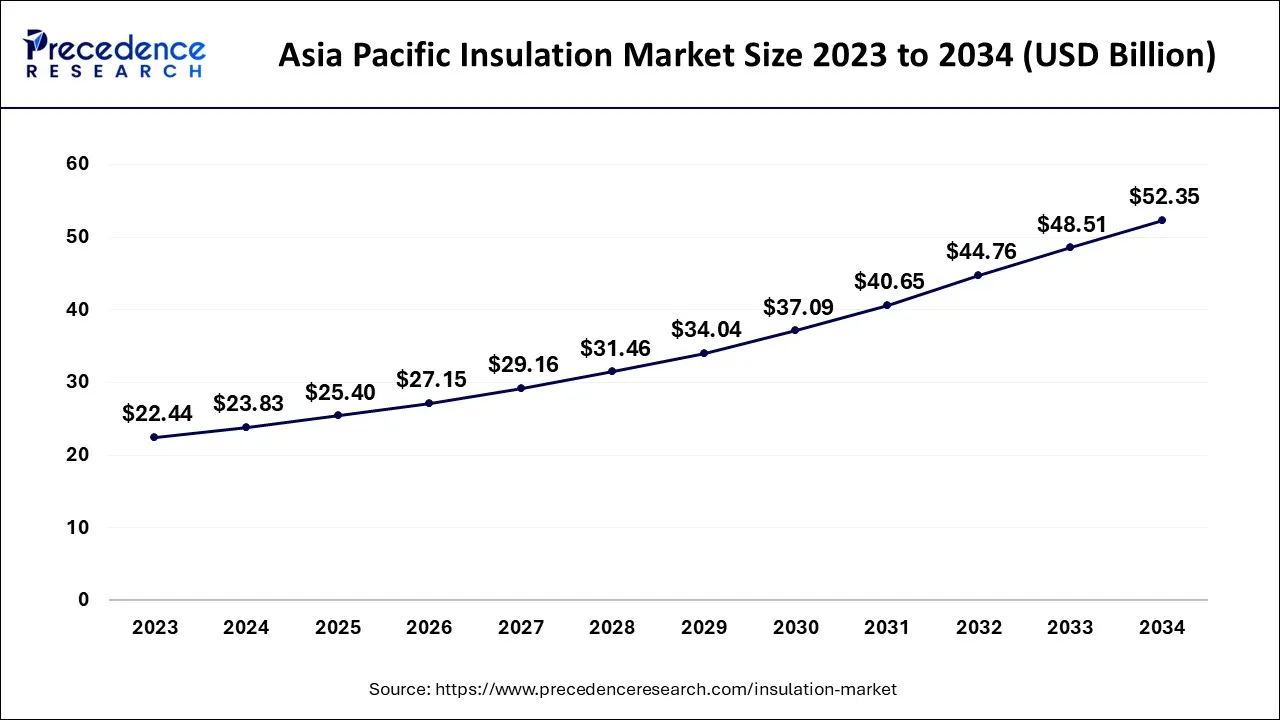

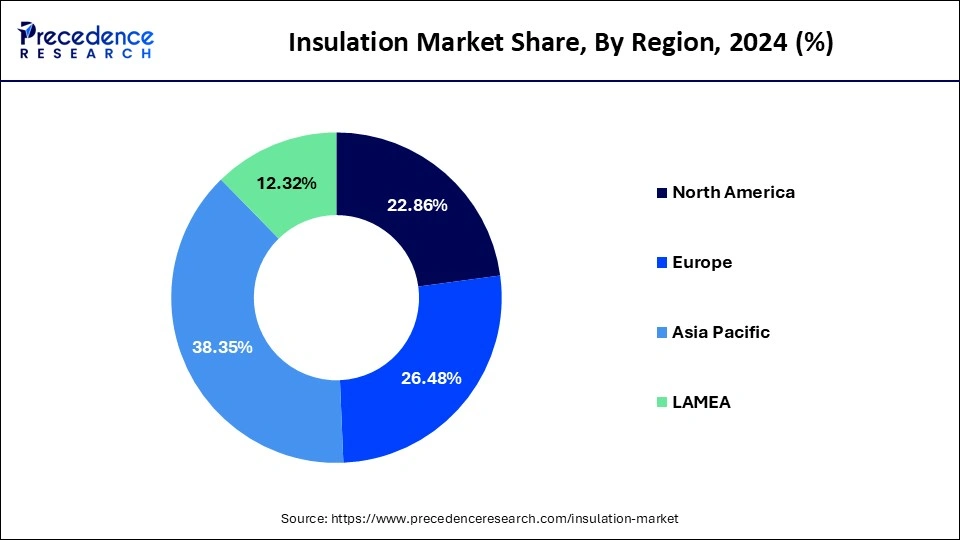

The global insulation market size accounted for USD 65.78 billion in 2025 and is forecasted to hit around USD 128.11 billion by 2034, representing a CAGR of 7.70% from 2025 to 2034. The Asia Pacific market size was estimated at USD 23.83 billion in 2024 and is expanding at a CAGR of 8.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global insulation market size accounted for USD 62.14 billion in 2024 and is predicted to increase from USD 65.78 billion in 2025 to approximately USD 128.11 billion by 2034, expanding at a CAGR of 7.70% from 2025 to 2034. The market is driven by favorable regulations in a majority of regions and increasing consumer awareness leading to energy conservation.

The Asia Pacific insulation market size was exhibited at USD 23.83 billion in 2024 and is projected to be worth around USD 52.35 billion by 2034, growing at a CAGR of 8.40% from 2025 to 2034.

Asia Pacific is dominated the insulation market in 2024. In countries like China and India due to increased oil production, there has been a significant use of insulation materials. There has been increased use of insulation to prevent energy wastage and an increasing demand for insulation in refurbishing and renovation applications.

North America is expected to grow fastest during the forecast period. The North American region also has a great demand for insulation materials. The market in the North American region is influenced by the demand for oil and gas, metal and mining, power, and manufacturing industries where the temperature of operation is high. Due to rapid industrialization and the presence of major manufacturers of insulation material European market is also expected to have a significant revenue share during the forecast period. There is a growth in the insulation materials market across various regions in the globe due to the maintenance and repair work in the infrastructure. The market in Africa in the Middle East region is also expected to grow as there are many petrochemical industries located in these regions.

The insulation market deals with various materials such as mineral wool or fiberglass. These materials are widely used for insulating air ducts in homes. When there is a need for insulation that combats high temperatures, insulation is used. These products come in an extensive range of thicknesses.

| Report Coverage | Details |

| Market Size in 2025 | USD 65.78 Billion |

| Market Size by 2034 | USD 128.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.70% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Insulation Type, Material Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing construction and residential industry

The increasing installation of environmentally friendly, recyclable, and efficient materials and increasing emphasis on reducing energy consumption are increasing the market growth. The rising demand for new homes and Increasing customer expenditure have a positive impact on the market demand. In addition, the expansion of the construction industry combined with a rise in energy-efficient innovation further drives the market growth.

Domestic players are expected to compete with international ones, due to the need for a stronger customer relationship in this industry. Manufacturers are supposed to develop robust distribution networks to increase their profits. Furthermore, by decreasing the heating and cooling loads in the building industry, the use of EPS, plastic foam, and glass wool can reduce the overall energy consumption further contributing to propelling the market growth.

High Cost and Environmental Concerns

Crude oil is the major raw material for the majority of insulating products. Political uncertainty in these regions has a significant impact on crude oil supply and pricing globally since Middle Eastern countries produce most of the world's crude oil. In addition, the high cost of crude oil is affecting the market demand and further restraining the growth of the insulation market.

Increasing demand for insulation services from developing nations

The high demand from emerging countries will drive the market’s growth. The market is growing rapidly in growing markets such as India, Mexico, South Korea, Indonesia, Turkey, Russia, and China. Considerations such as government regulations, low transportation costs, cheap labor, and the availability of land have made manufacturing plants and automobile manufacturers in these countries.

Due to the increasing demand for insulation in the construction and refrigerator sectors, the market is growing rapidly in India. In addition, EPS provides improved high-performance insulation, precision, durability, and moisture resistance. Thus, the growth of the construction industry in developing markets is further anticipated to enhance the growth of the insulation market.

The thermal insulation segment dominated the insulation market in 2024. The segment growth is attributed to factors such as the increasing demand for energy regulations, government initiatives, indoor air quality, and noise reduction. Thermal insulation materials minimize noise transmission through ceilings, floors, and walls and make them crucial components.

The expanded polystyrene (EPS) segment dominated the insulation market in 2024. Expanded polystyrene is a high-tensile and lightweight plastic foam insulation produced from rigid polystyrene pellets. The product is expected to continue its dominance during the forecast period.

The glass wool product segment is estimated to grow fastest during the forecast period. Glass wool has acoustic and thermal insulation properties such as high tensile strength and low weight and is made of sand. Removable blankets are byproducts of glass wool and make an amazing cover for flanges, valves, expansion joints, tanks, heat exchangers, pumps, turbines, and other irregular surfaces creating heat in industrial environments.

The aerogel segment is expected to grow at a notable rate during the forecast period. The product is mesoporous, open-celled, and solid foam of nanostructures connected in a network. Aerogel is the lightest solid material in comparison with other insulation materials.

The product tolerates various advantages such as quick application on large-bore piping and vessels, faster application on large-bore vessels and piping, and improved the lightest solid material in comparison with other insulation materials. The product tolerates various advantages such as quick application on large-bore piping and vessels, faster application on large-bore vessels and piping, and improved thermal conductivity in high-temperature service.

The building and construction sector segment accounted for the largest market share in 2024. Due to the increasing number of insulation-intensive buildings in urban areas, the construction sector is expected to grow. The4 construction or building sector was followed by the residential and transportation construction sector is expected to expand at a significant rate. Refineries and petrochemical industries are insulated for condensation prevention, effective operation of chemical reactions, maintaining a uniform temperature, heat gain/loss reduction, and energy conservation.

On the other hand, the transportation segment is observed to grow at the fastest rate in the insulation market during the forecast period. The transportation sector comprises aerospace, marine, and automotive in the market in 2024. Automakers are continuously looking to comfort vehicles and enhance safety, which is expected to drive the insulation market demand.

This surge is driven by increasing demand for energy-efficient vehicles, advancements in electric vehicle (EV) technology, and the rising focus on reducing carbon emissions in the transportation industry. Enhanced insulation materials are being sought after to improve fuel efficiency, thermal management, and noise reduction in vehicles, fueling this rapid growth.

By Insulation Type

By Material Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

December 2024

December 2024