January 2025

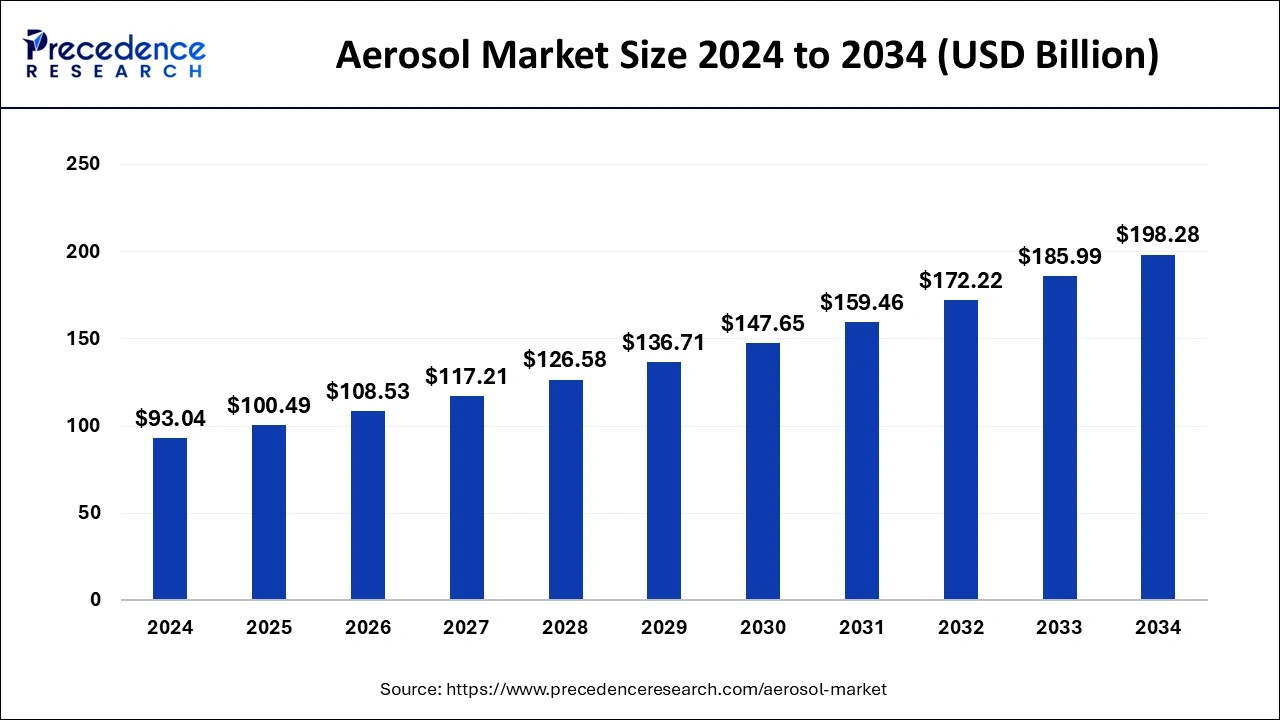

The global aerosol market size is calculated at USD 100.49 billion in 2025 and is forecasted to reach around USD 198.28 billion by 2034, accelerating at a CAGR of 7.86% from 2025 to 2034. The Europe aerosol market size surpassed USD 34.17 billion in 2025 and is expanding at a CAGR of 8.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aerosol market size was accounted for USD 93.04 billion in 2024, and is expected to reach around USD 198.28 billion by 2034, expanding at a CAGR of 7.86% from 2025 to 2034. The aerosol market is driven by the growing demand for personal and grooming products.

Aerosols are found to play a crucial role in increasing or decreasing the surface temperature and suppressing the precipitation. By leveraging AI techniques, such as deep learning or ensemble models, researchers can start sophisticated models that can learn from the data, determine complex patterns, and produce accurate predictions about aerosol concentrations.

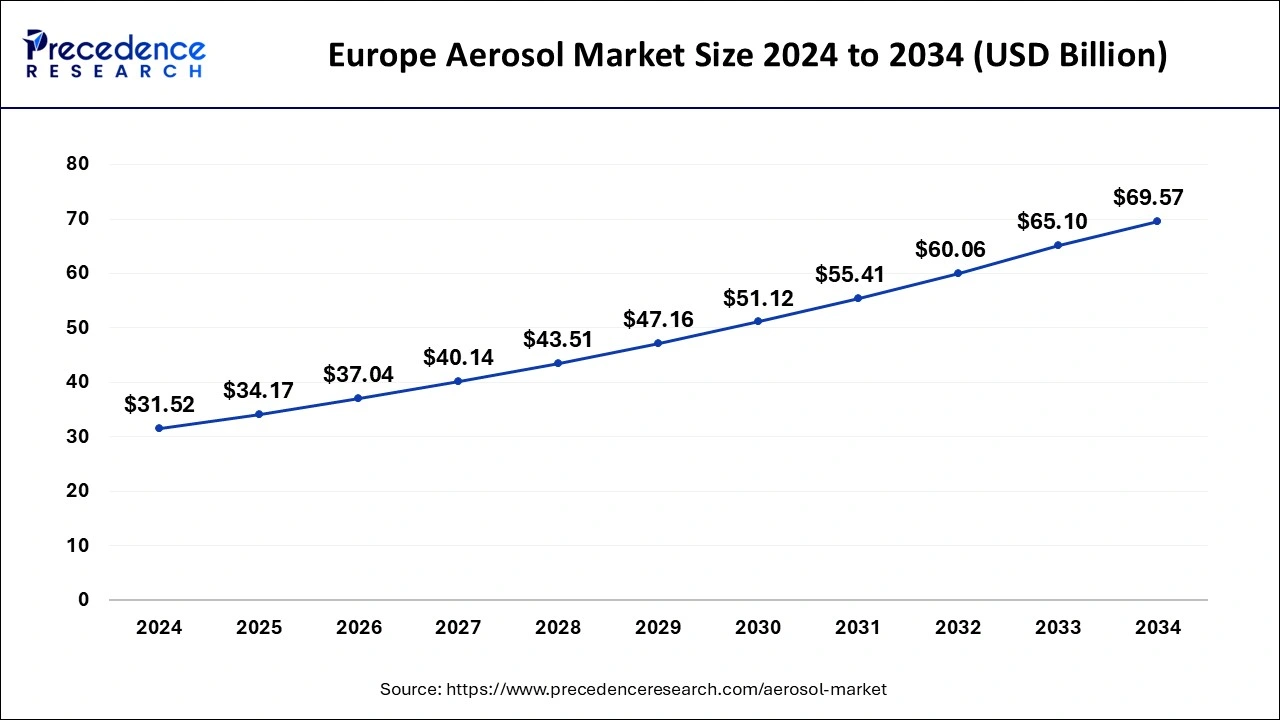

The Europe aerosol market size was estimated at USD 31.52 billion in 2024 and is predicted to be worth around USD 69.57 billion by 2033, at a CAGR of 8.24% from 2025 to 2034.

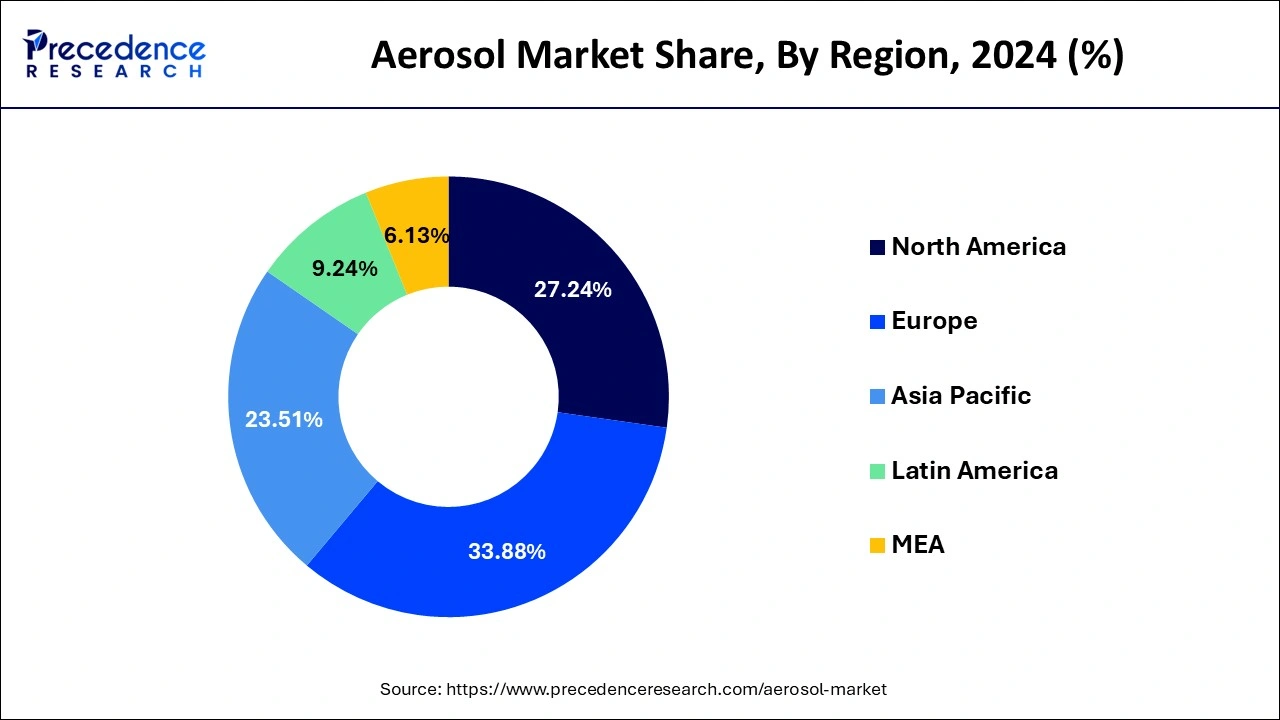

Increase in the sales of household goods is likely to make Asia-Pacific the aerosol market's fastest-growing region. Driven by an increase in the demand for deodorants and hair care products. Due to changing lifestyles, a focus on gender-specific products, and increased consumer expenditure, the market for personal care products has seen a strong increase in emerging nations. Demand for pharmaceutical products from consumers is on the rise, which is boosting revenue in this sector. Due to rising incomes and shifting customer preferences, the market for consumer household items in Asia is changing, which raises the need for products created from aerosol cans. Asthma, chronic obstructive pulmonary disease, and other obstructive airway diseases are only a few of the obstructive airway diseases that are becoming increasingly common, which has a substantial impact on the rapid use of compressed aerosol propellants in this domain.

The European market is anticipated to have consistent revenue growth. This is anticipated to be fueled by the region's rapidly expanding use of aerosol spray propellant in the cosmetics, skincare, and fragrance industries. Liquid aerosol compressed body spray and lotion are used by renowned cosmetics brands including Avene, Caudalie Paris, and others. Rise in living standards of the people and preference for using more cosmetics and skin care products are driving the market. Skin care industries are rising due to rise in number of skin problems.

A suspension of particles in the atmosphere called an aerosol. When pine trees release the oil alpha-pinene, which suspends as a haze, they may naturally form. Air pollution, haze, and smoke are examples of artificial aerosols. An aerosol is typically referred to as a spray that disperses a substance from a can. Aerosol sprays can be used to provide both pesticides and medications. The prediction for the aerosol market indicates growing demand for personal care products including body creams, deodorants, sunblock, and other cosmetics, which is beneficial for the aerosol sector. It is projected that the market will benefit from the presence of a strong manufacturing base of personal care firms including Estee Lauder, Johnson & Johnson, Procter & Gamble, and more.

The fast-rising population, rising disposable income, changing lifestyles, and expanding selection of personal care products are all contributing factors to the rising demand for personal care products, which is primarily seen in emerging nations. The market for aerosols has expanded as a result of rising usage and demand for household goods including sanitizers and disinfectants, room and car air fresheners, and more.

| Report Coverage | Details |

| Market Size in 2025 | USD 100.49 Billion |

| Market Size by 2034 | USD 198.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.86% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Propellent Type, By Propulsion, By Valve Type, By Material, By Type, By End Use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Compared to other propellant sources, the liquefied gas propellant has a higher revenue share. The consumer packaged goods industry uses liquefied gas propellants widely for a variety of products, including body deodorant, hair mousse spray, moisturizer, insect killer spray, room fresheners, and many others. The three readily flammable naturally occurring hydrocarbons such as propane, butane, and n-butane, are combined to form autogas, also known as liquefied gas propellants. It is frequently utilized in the packaging of consumer goods because it also produces odorless, toxin-free gas.

The category for compressed gas propellants accounts for a stable portion of income. Expensive compressed gas propellants are sensitive to low pressure. Healthcare, inhalers, anaesthetic solutions, and disinfectants are just a few industries that use compressed gas propellants. In the aerosol tin, the area above the fluid is occupied by compressed gas fuels. While initially maintaining a constant amount of gas, the disadvantage of compressed gas propellants is that they gradually lose the majority of their pressure, enabling the gas to escape from the aerosol container.

The mechanical actuator has the highest expected revenue growth rate among valve types over the forecasted period. Mechanical actuators for aerosol fluid product dispensers come in a pump type and are simple to operate. Different aerosol-pressurized metal, glass, and plastic containers use this kind of actuator. Mechanical actuators use a discharge cavity and a channel to connect their input and output. A number of axial fins, each of which may have a stop shoulder, are supported by a central post that is a component of the discharge chamber. For ease of usage, mechanical actuators offer visually pleasing designs.

Over the forecast period, the non-mechanical actuators segment is anticipated to experience consistent revenue growth. In comparison mechanical actuators with, non-mechanical actuators are more cost-effective and efficient. Aerosols for agriculture use non-mechanical actuators. Water and insecticide can be sprayed with an atomizing form through the nozzle of non-mechanical actuators. Numerous end users continue to adopt this conventional approach because it is more effective. Additionally, no pressure energy of any type is needed. The benefits of this type of valve are efficiency and low cost that propel the segment's sales growth.

On the basis of end use, the consumer packaged products segment is predicted to see the highest revenue growth rate based on end use. The swift adoption of aerosol compressed containers and packaging in beauty, health, and cosmetics products as well as domestic cleaning products is the primary factor driving the segment's revenue growth. Aerosol packaging's sealed solutions decrease the possibility of breakage, spills, and leakage. The aerosol's USP is its ability to provide consumers with convenience (USP). Additionally, aerosol compressed packing has a lot of cost-saving and environmentally friendly benefits, which are what are driving the segment's sales growth.

The pharmaceutical segment is also anticipated to experience consistent revenue growth. Pharmaceutical aerosols are stored in a container because they are tiny drug or medicine particles that are housed in a highly pressurized spray bottle and discharge a small mist when a button is depressed. For the treatment of obstructive airway illnesses such asthma, chronic obstructive pulmonary disease, and tuberculosis, aerosols are widely used in the pharmaceutical industry. For the treatment of asthma and airway illnesses, people employ nebulizers, dry powder inhalers, and metered dose inhalers (MDIs). Within an inhaler tube, pharmaceutical aerosols are squeezed under low pressure. Drugs are shielded from gastrointestinal tract breakdown by pharmaceutical aerosols.

By Propellent Type

By Propulsion

By Valve Type

By Material

By Type

By End Use

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025