February 2025

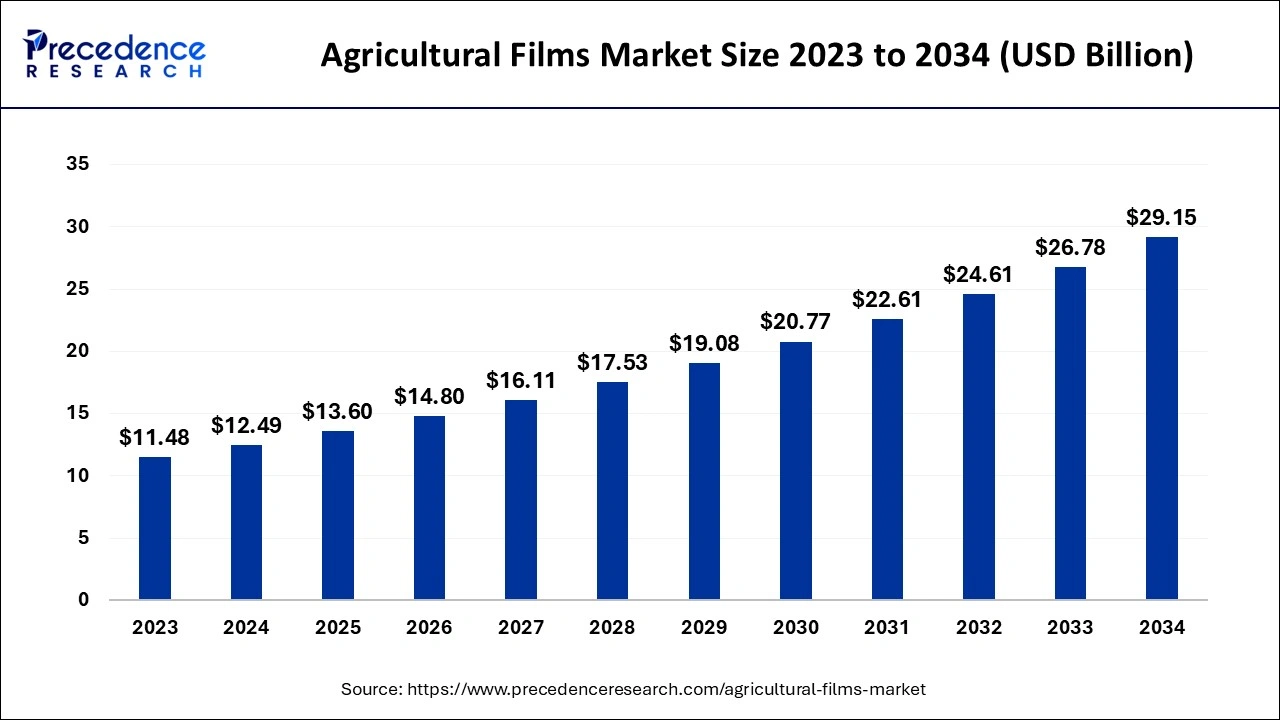

The global agricultural films market size accounted for USD 12.49 billion in 2024, grew to USD 13.60 billion in 2025 and is projected to surpass around USD 29.15 billion by 2034, registering a CAGR of 8.84% between 2024 and 2034. The Asia Pacific agricultural films market size is evaluated at USD 5.87 billion in 2024 and is expected to grow at a CAGR of 8.94% during the forecast year.

The global agricultural films market size is calculated at USD 12.49 billion in 2024 and is predicted to reach around USD 29.15 billion by 2034, growing at a CAGR of 8.84% from 2024 to 2034. The agricultural films market is driven by the growing usage of greenhouse agriculture.

Artificial intelligence (AI) systems investigate data from sensors, drones, and satellites to offer insights about weather patterns, soil conditions, and crop health. By using this information, farmers may maximize the efficiency of agricultural films by choosing when and how to employ them. AI technologies ensure that agricultural films are used responsibly by tracking their environmental impact. This includes monitoring the rates at which biodegradable films degrade and calculating the total carbon footprint of agricultural activities. It can assist in creating customized agricultural films that satisfy specific crop needs. For instance, AI-driven assessments of crop requirements can be used to build films with specific UV resistance or thermal characteristics.

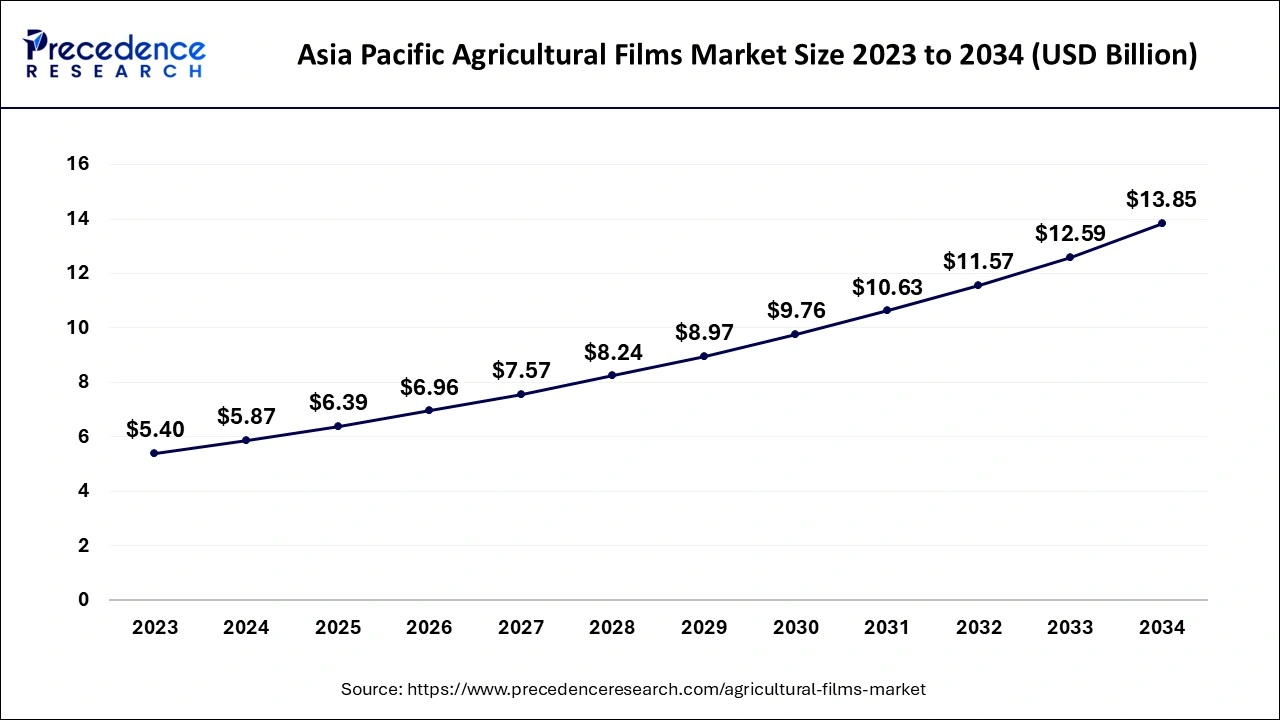

The Asia Pacific agricultural films market size is exhibited at USD 5.87 billion in 2024 and is expected to be worth around USD 13.85 billion by 2034, growing at a CAGR of 8.94% from 2024 to 2034.

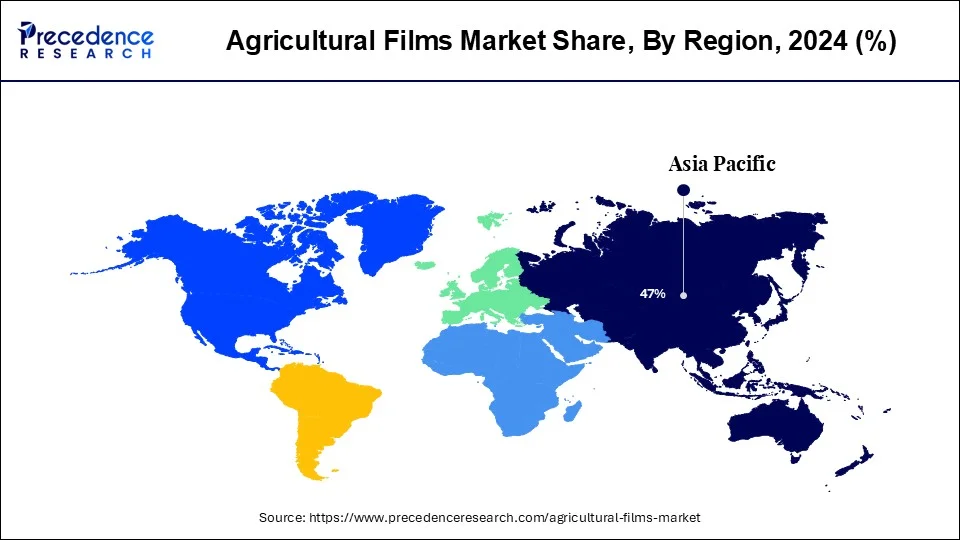

Asia Pacific dominated the agricultural films market in 2023. The population of Asia-Pacific is expanding quickly which demand for food. The adoption of agricultural films is driven by the need to boost agricultural output to meet this demand. Advanced materials like UV-resistant and biodegradable films are becoming more popular. These developments meet the growing need for environmentally friendly and sustainable farming methods. Market expansion is facilitated by initiatives to inform farmers about the advantages of employing agricultural films to increase crop output and quality.

North America is expected to grow at the fastest rate in the agricultural films market during the forecast period. Farmers in North America are known for implementing innovative farming techniques, including sustainable agriculture and precision farming. Among these methods is the use of the latest materials, such as agricultural films, to improve crop quality and output. Farmers are assisted by several government initiatives and subsidies in using contemporary technologies, such as agricultural films. This support boosts the demand for these products. Farmers can access tools and training from various organizations and institutes about the advantages of using agricultural films. Adoption is encouraged, and awareness is raised through this education.

Agricultural films, like greenhouse films and plastic mulch, regulate soil moisture retention, temperature, and weed control. Farming becomes more productive because of increased crop yields and quality. Agricultural films can improve resource management by maximizing water use and lowering the demand for chemical inputs. This is especially crucial in areas where water is scarce. These make transporting and storing agricultural products easier, ensuring that they reach customers in good condition as the demand for fresh produce rises globally.

| Report Coverage | Details |

| Market Size by 2034 | USD 29.15 Billion |

| Market Size in 2024 | USD 12.49 Billion |

| Market Size in 2025 | USD 13.60 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.84% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Raw Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing agricultural production

By 2050, there will be approximately 9.7 billion people on the planet, significantly raising the demand for food. To satisfy this demand, a considerable increase in agricultural output is required. Mulching with agricultural films helps control soil temperature, reduce weeds, and conserve soil moisture. This results in higher agricultural yields and higher-quality produce. By enhancing soil health and retaining nutrients in the soil, films can reduce the demand for artificial fertilizers and promote higher agricultural output.

Regulatory challenges

Stricter laws governing plastic and trash disposal are being implemented in several nations to reduce environmental contamination. Agricultural films, which are frequently composed of non-biodegradable polymers, may be prohibited or subject to limitations. For instance, the European Union's aims for reducing single-use plastics may impact plastic film usage in agriculture. Biodegradable films are becoming more and more popular as a way to lessen their adverse effects on the environment. However, these alternatives must fulfill strict performance requirements and undergo stringent certification and testing procedures, which may delay their uptake and raise R&D costs.

Innovations in materials and manufacturing processes

Biodegradable agricultural films are in high demand due to growing concerns about plastic waste. Conventional polyethylene films can be replaced with bioplastic developments like polylactic acid (PLA) and starch-based films. These films appeal to customers and regulatory agencies who care about the environment since they lessen their adverse effects on the environment and improve soil health after decomposition. Films with special qualities like enhanced strength, flexibility, and UV resistance can be produced by adding nanoparticles. Longer-lasting films that increase crop protection and yield and provide businesses with a competitive edge in the market can result from such advancements.

The LLDPE segment dominated the agricultural films market in 2023. Similar to other polymers, including low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE) has better tensile strength and flexibility. This makes it perfect for agricultural uses because it can tolerate a variety of environmental conditions, including wind and hail. Treating its films to offer superior UV protection can increase their longevity in outdoor applications. Because of its endurance, farmers won't need to change their films as often, which lowers overall expenses and reduces environmental waste.

The LDPE segment is observed to be the fastest growing in the agricultural films market during the forecast period. The need for food production is rising as the world's population grows. Farmers seek effective strategies to raise agricultural productivity and shield crops from environmental influences. Agricultural films made of low-density polyethylene (LDPE) aid in creating regulated conditions that support crop growth. Numerous LDPE films are coated to offer UV protection, which shields crops from damaging UV rays and helps stop the film from degrading. This characteristic allows LDPE films to last longer and be more durable.

The mulching segment dominated the agricultural films market in 2023. Mulching films are used for various crops, such as decorative plants, fruits, and vegetables. Their commercial reach and usage across several agricultural sectors have increased due to their adaptability. Numerous countries are putting legislation into place to encourage sustainable agriculture practices and offering incentives. This includes promoting mulching films and complementing programs to increase crop productivity and lessen their adverse environmental effects. Mulching films and other contemporary agricultural techniques are growing in developing nations. The agricultural film market's overall growth is greatly aided by this expansion into new markets.

The greenhouse segment is observed to be the fastest growing in the agricultural films market during the forecast period. Crops are shielded from unfavorable weather conditions, which includes high temperatures, hail, and torrential rains, by greenhouses-controlled settings. Due to climate change's effects on agriculture, more farmers are using greenhouse farming to guarantee crop life and output. Since greenhouse farming is viewed as a solution to sustainable agriculture and food security, several governments provide financial incentives and subsidies. Farmers are encouraged to invest in greenhouse infrastructure by this incentive.

By Raw Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2023

July 2024

July 2024