January 2025

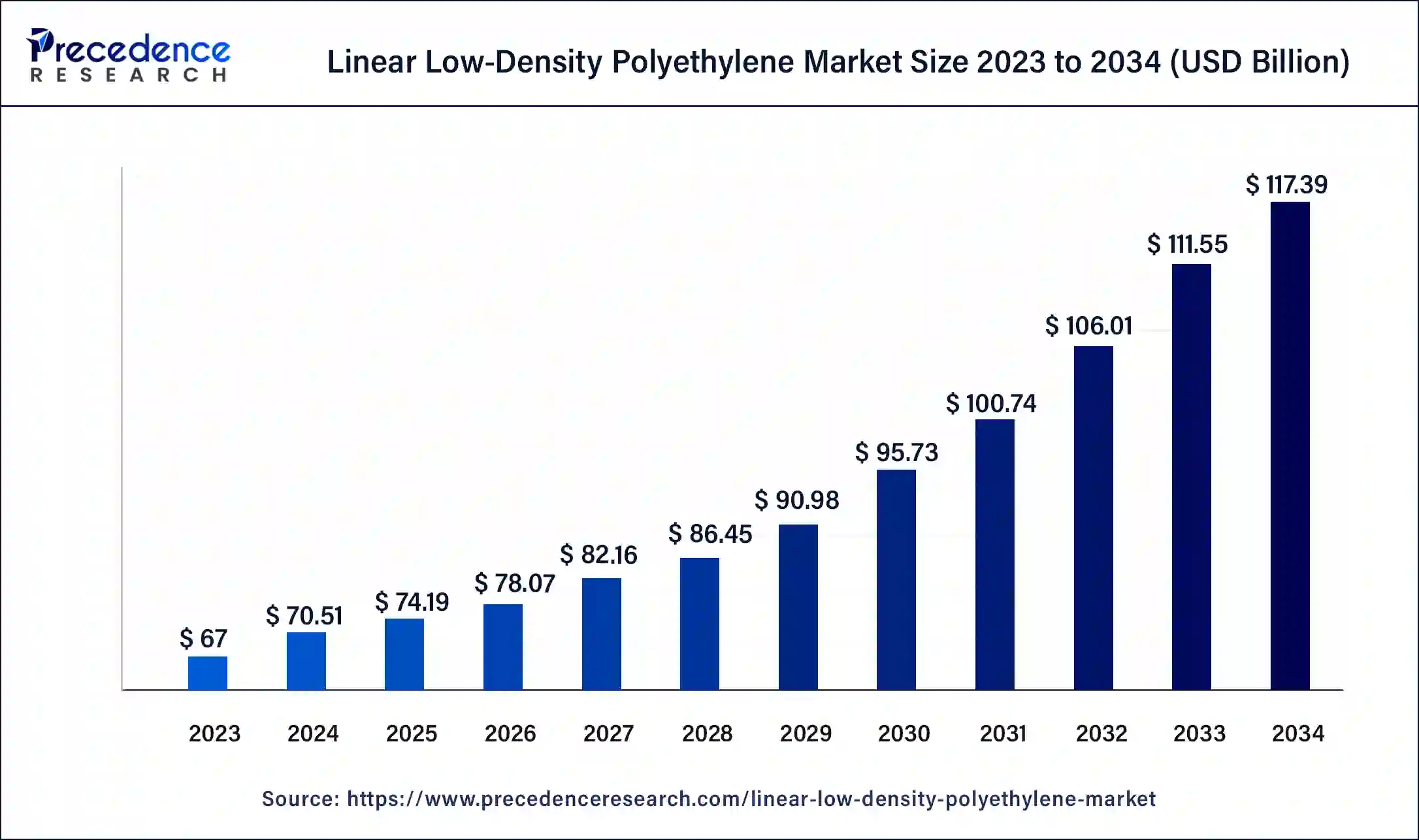

The global linear low-density polyethylene market size was USD 67 billion in 2023, calculated at USD 70.51 billion in 2024 and is expected to be worth around USD 117.39 billion by 2034. The market is slated to expand at 5.23% CAGR from 2024 to 2034.

The global linear low-density polyethylene market size is projected to be worth around USD 117.39 billion by 2034 from USD 70.51 billion in 2024, at a CAGR of 5.23% from 2024 to 2034. Compared to other polymers, linear low-density polyethylene (LLDPE) is very cheap, which makes it a desirable choice for companies and applications that are budget-conscious. The longevity and resilience of LLDPE against environmental stress cracking are advantageous for these applications.

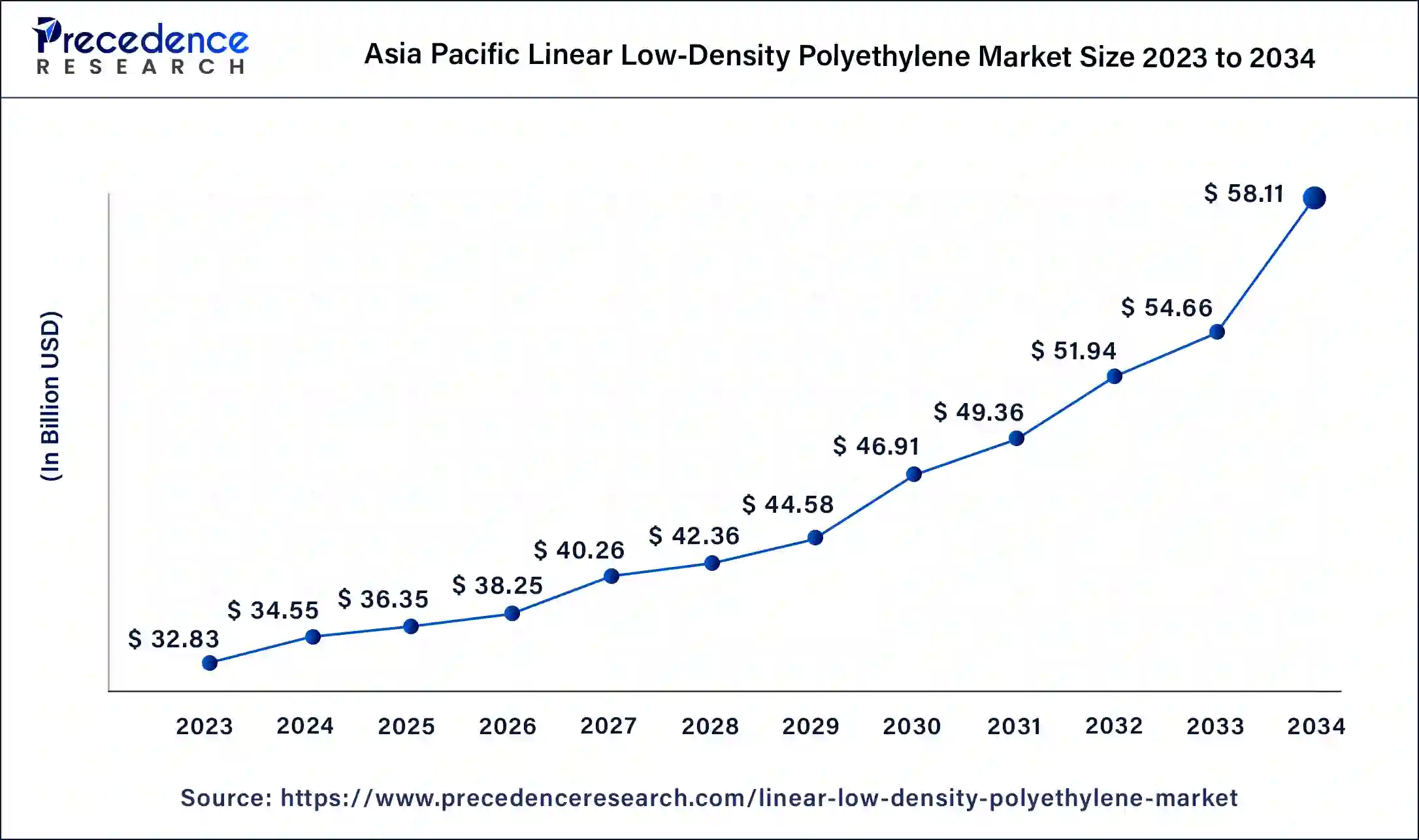

The Asia Pacific linear low-density polyethylene market size was exhibited at USD 32.83 billion in 2023 and is projected to be worth around USD 58.11 billion by 2034, poised to grow at a CAGR of 5.32% from 2024 to 2034.

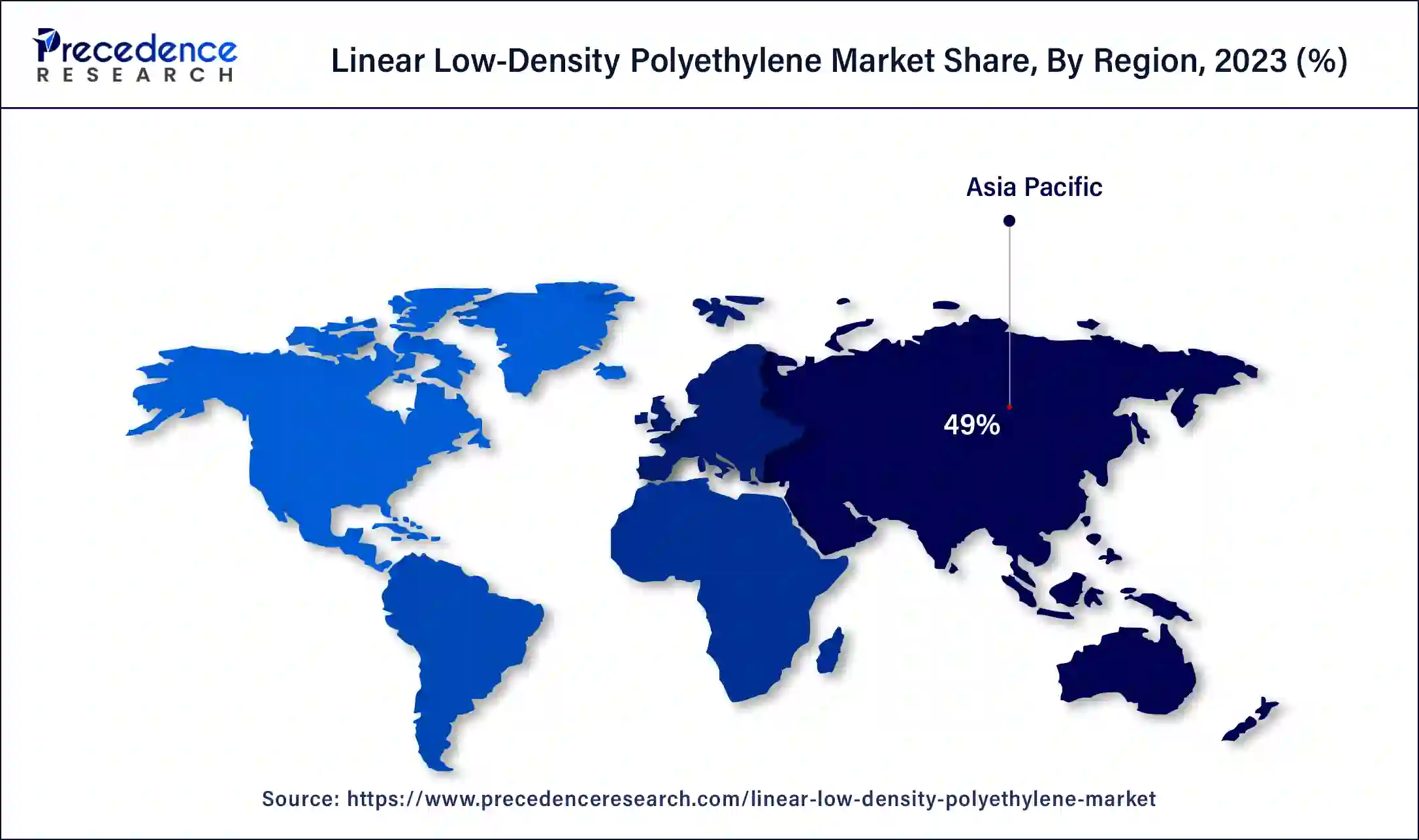

Asia Pacific held the largest share of the linear low-density polyethylene market. Because of its flexibility, resilience against deterioration, and capacity to withstand moisture, LLDPE is frequently used in packaging materials such as films, bags, and wraps. One major factor driving the expansion of the packaging sector in Asia Pacific is the rise in e-commerce and consumer product consumption. In the manufacturing of pipes, liners, and geomembranes, among other industrial uses, LLDPE is also employed. Demand is higher in nations like China and India due to their rapid industrialization and infrastructural development. The creation of new grades with improved qualities and advancements in LLDPE production techniques propel market expansion. These developments meet the changing requirements of many end-use sectors.

North America is expected to host the fastest-growing linear low-density polyethylene market during the forecast period. Because of its flexibility, resilience to abrasion, and ability to withstand punctures, LLDPE is frequently utilized in packaging applications. One such driver is the growing need for flexible packaging solutions in the food and beverage industry. LLDPE is used in automobile components and parts because of its strength and low weight.

A contributing factor to the rising demand is the expansion of the North American automobile industry. The market is expanding due to advancements in production technologies, such as the creation of new LLDPE grades with improved qualities. These developments enhance LLDPE's functionality and applicability. The utilization of recyclable materials and sustainability are becoming more and more important. Because LLDPE is recyclable, it fits perfectly with the circular economy and growing emphasis on environmental responsibility.

LLDPE is very flexible, durable, and chemical-resistant, making it ideal for a wide range of applications. The need for it is largely driven by sectors including packaging, agriculture, construction, automotive, and healthcare. The majority of linear low-density polyethylene market applications are still in packaging. Because of its strength and moisture barrier qualities, it is widely utilized in film applications for consumer goods packaging, industrial packaging (such as bags and stretch wrap), and food packaging. In agricultural films for mulching films, silage bags, and greenhouse covers, LLDPE is essential.

Because of its resilience to impact and chemicals, LLDPE is utilized in construction for geomembranes, pipes, and fittings. The market is growing as a result of its use in residential and infrastructural projects. Because of its impact resistance and ease of production, LLDPE is employed in automotive components like interior trim and underbody coatings. It is utilized in medical devices and packaging. Participants in the linear low-density polyethylene market face difficulties from fluctuating raw material prices, regulatory demands, and competition from other polymers (such as LDPE and HDPE).

The linear low-density polyethylene market is dominated by Asia Pacific due to rising demand for consumer goods, urbanization, and fast industrialization. With uses ranging from industrial to packaging, North America and Europe also make substantial contributions. The characteristics of LLDPE are constantly being improved by advancements in polymerization technology and manufacturing techniques, which makes it more appropriate for a wider range of applications and environmental circumstances.

The impact of artificial intelligence on the Linear Low-Density Polyethylene Market

Artificial intelligence has a significant impact on the production and quality control processes of polymers. AI-driven predictive analytics and machine learning is used to predict optimal manufacturing conditions improving the quality and consistency of linear low-density polyethylene as well as to reduce waste generation. Multivariate linear regression and multi-layer perceptron artificial neural network methods are also being deployed to predict energy consumption.

AI is also being used to automate quality control to ensure adherence to industry standards, and is crucial for testing the strength and puncture resistance of the polymers. Artificial intelligence is also being used to forecast market trends and predict fluctuations, allowing manufactures to optimize supply chains through balancing inventory levels, and identifying fuel-efficient delivery routes.

Researchers at the Damietta University and Benha University used Neural networks-based simulations to analyze data of pressure drop and shear stress across the short orifice die as a function of shear rate at different mean pressures for linear low-density polyethylene copolymer at 190°C, with one hidden layer.

| Report Coverage | Details |

| Market Size by 2034 | USD 117.39 Billion |

| Market Size in 2023 | USD 67 Billion |

| Market Size in 2024 | USD 70.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.23% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Process Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for packaging

The demand for the linear low-density polyethylene market is driven by the increase in the consumption of packaged goods and beverages because of its strength, flexibility, and resistance to impact and punctures in packaging materials. The e-commerce boom has increased demand for packing materials. LLDPE is often used in protective packaging to guarantee that goods arrive at customers undamaged.

Sustainable packaging options are becoming more and more important. Since LLDPE is recyclable, it meets the growing need for environmentally responsible packaging solutions. The demand for packaging made of LLDPE is increased when consumers in emerging markets spend more on packaged goods as a result of increased disposable income.

Recycling difficulties

Since LLDPE is frequently combined with other materials, efficient separation, and recycling are challenging. Food or other substance contaminants may make recycling more difficult. Separating LLDPE from other polymers is necessary. The inability of automated sorting systems to distinguish LLDPE from other similar plastics could result in inefficiencies and decreased recycling rates. The characteristics of regenerated LLDPE can vary. Shorter polymer chains can weaken the material's strength and make it less appropriate for high-end uses. Comparing the cost of recycling LLDPE against that of creating new plastic can reveal hidden costs. In the linear low-density polyethylene market, investments in infrastructure and recycling technologies may be discouraged by this economic mismatch.

Innovative product development

To enhance qualities like flexibility, tensile strength, and impact resistance, new LLDPE blends and formulations are being created. These advancements are tailored to certain uses, such as construction, automobile components, and packaging. The characteristics of LLDPE can be greatly improved by adding nanomaterials. For instance, the linear low-density polyethylene market films and coatings can enhance their strength, thermal stability, and barrier qualities by the use of nano-fillers.

Improved extrusion methods and injection molding are two examples of processing technology advancements that are lowering manufacturing costs and providing more exact control over the physical attributes of LLDPE. Creating smart packaging solutions with embedded sensors or indicators that can deliver real-time information about the product's status is one example of how LLDPE packaging is being innovated.

The gas phase segment held the largest share of the linear low-density polyethylene market in 2023. Gas phase polymerization is one way that LLDPE is made. This method involves polymerizing ethylene in a gas phase reactor together with comonomers (such as butene, hexene, or octene). When compared to alternative techniques like slurry or solution polymerization, the gas phase process is renowned for its great efficiency and comparatively low energy usage.

The procedure is more environmentally friendly because it produces fewer waste and byproducts. Due to its affordability and the growing need for high-performance LLDPE in the packaging and other industries, the gas phase segment is expected to increase. The efficiency and output of gas phase polymerization are still being improved by advances in catalyst technology and process optimization.

The solution phase segment is expected to grow at the fastest rate in the linear low-density polyethylene market during the forecast period. The manufacturing of linear low-density polyethylene via a solution polymerization process is the focus of the market's solution phase segment. This technique involves polymerizing ethylene in a solvent to create an LLDPE solution, which can then be processed into films, sheets, or other products. Solution-polymerized LLDPE is widely utilized in high-performance applications where improved toughness, flexibility, and clarity are required.

Superior films, coatings, and packaging materials are typical uses. When compared to alternative polymerization techniques, this procedure can yield LLDPE with a narrow molecular weight dispersion and better mechanical characteristics. It also makes it possible to manage the properties of the polymer more effectively.

The films segment held the largest share of the linear low-density polyethylene market in 2023. The market for linear low-density polyethylene is significantly influenced by the film segment because of the material's advantageous qualities and adaptability. Because of its flexibility, high tensile strength, and resilience to impact and puncture, LLDPE is frequently utilized in film applications. Food products are packaged using LLDPE films to maintain freshness and safety.

Retail products are also wrapped and protected with them. LLDPE film growth is being driven by the food and beverage industry's growing need for flexible packaging solutions. The use of LLDPE films is increasing due to the need for better agricultural techniques, such as better soil management and crop protection. The market is growing as a result of the rise of infrastructure projects and the requirement for strong geomembranes in environmental applications.

The other segment is expected to grow at the fastest rate in the linear low-density polyethylene market during the forecast period. Metal coatings are frequently made using LLDPE, mostly for packaging purposes. It offers a layer of protection that strengthens metal surfaces' resilience to rust. One important LLDPE processing technique that is used to make films, sheets, and other products is extrusion. To generate continuous shapes, the polymer is melted and then forced through a die.

Concentrated additives called masterbatches are used to provide LLDPE products with particular qualities like color, UV resistance, or improved mechanical capabilities. This market is driven by extrusion's adaptability in manufacturing a wide range of LLDPE products, from construction materials to packaging films. The food and beverage industry's demand for metal-coated packaging solutions is driving this segment's rise.

Tthe packaging segment held the largest share of the market in 2023. Because of the adaptability and desirable features of linear low-density polyethylene, the packaging segment is a prominent area of focus in the linear low-density polyethylene market. Used for goods such as food, drinks, and toiletries. LLDPE offers resilience to rips and tears, flexibility, and durability. Packaging that gives customers convenience and increases shelf life. Recycled LLDPE and biodegradable substitutes are increasingly being used to address environmental issues. Due to their superior manufacturing capabilities and high consumer demand for flexible packaging, both regions represent sizable markets for LLDPE packaging. This region's fast urbanization and industrialization are driving the LLDPE packaging market's expansion.

The other segment is expected to grow at the fastest rate in the linear low-density polyethylene market during the forecast period. Because of its flexibility and durability, LLDPE is utilized in the furniture sector to produce a variety of components, including tables, storage bins, and chair seats. It is appropriate for both indoor and outdoor furniture because it offers a balance between strength and impact resistance.

LLDPE is used in the medical industry to make packaging, medical equipment, and other items connected to healthcare. Intravenous (IV) bags, catheters, and other disposable medical equipment can be made of it due to its chemical resistance, low density, and simplicity of sterilization. The demand for LLDPE is being driven by the expanding healthcare industry as well as the growing requirement for medical packaging and disposables.

Segments Covered in the Report

By Process Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2025