August 2023

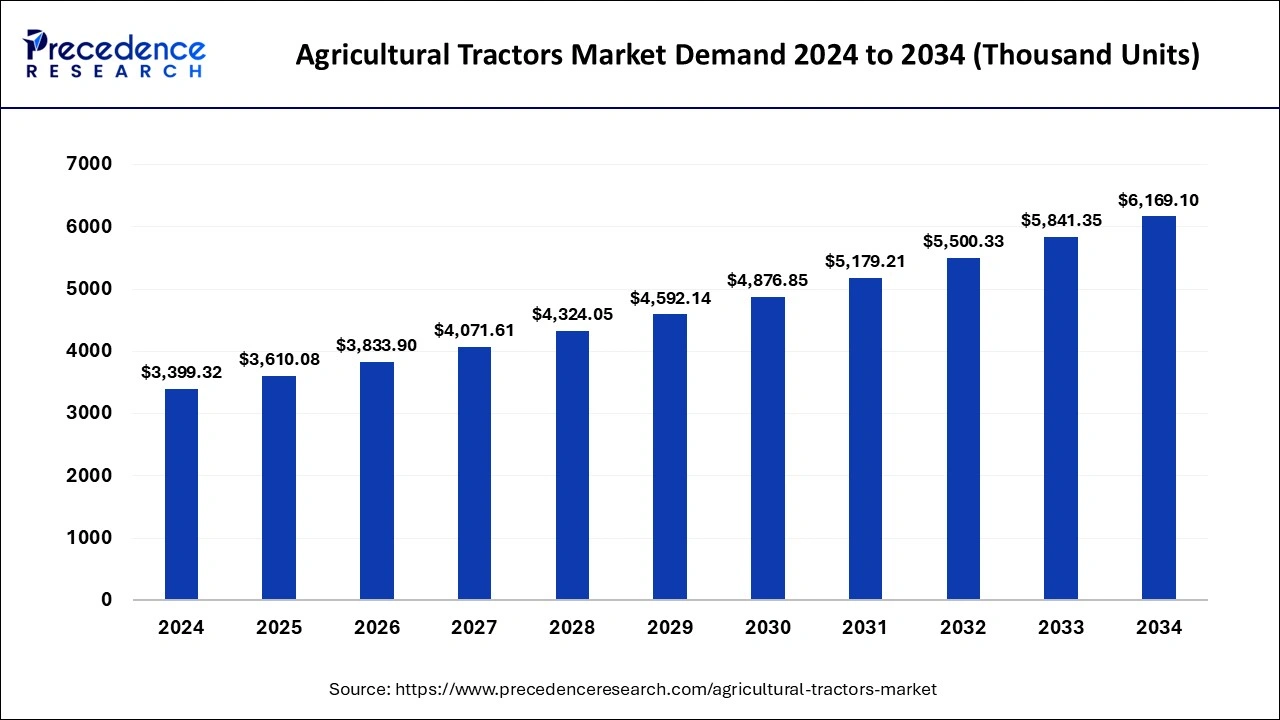

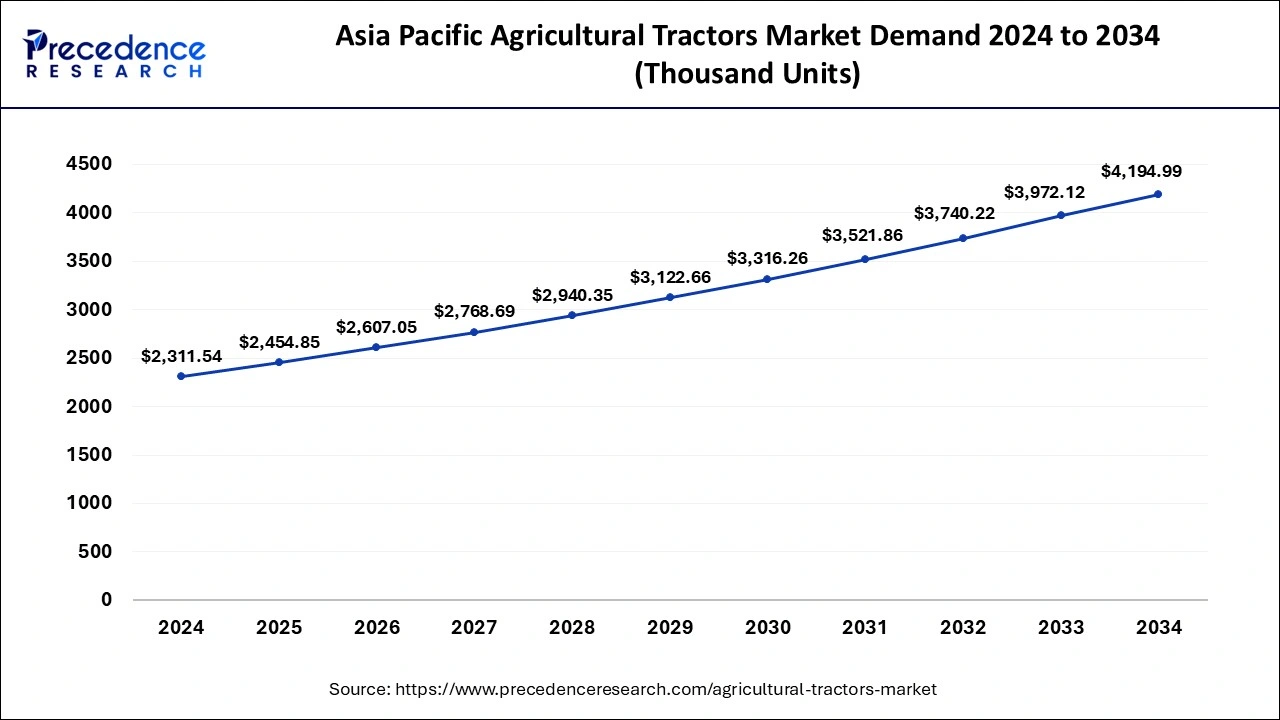

The global agricultural tractors market demand is calculated at 3,610.08 thousand units in 2025 and is forecasted to reach around 6,169.10 thousand units by 2034, accelerating at a CAGR of 6.14% from 2025 to 2034. The Asia Pacific agricultural tractors market demand surpassed 2,454.85 thousand units in 2025 and is expanding at a CAGR of 6.15% during the forecast period.

The global agricultural tractors market demand was estimated at 3,399.32 thousand units in 2024 and is predicted to increase from 3,610.08 thousand units in 2025 to approximately 6,169.10 thousand units by 2034, expanding at a CAGR of 6.14% from 2025 to 2034.

The Asia Pacific agricultural tractors market demand was estimated at 2,311.54 thousand units in 2024 and is predicted to be worth around 4,194.99 thousand units by 2034, at a CAGR of 6.15% from 2025 to 2034.

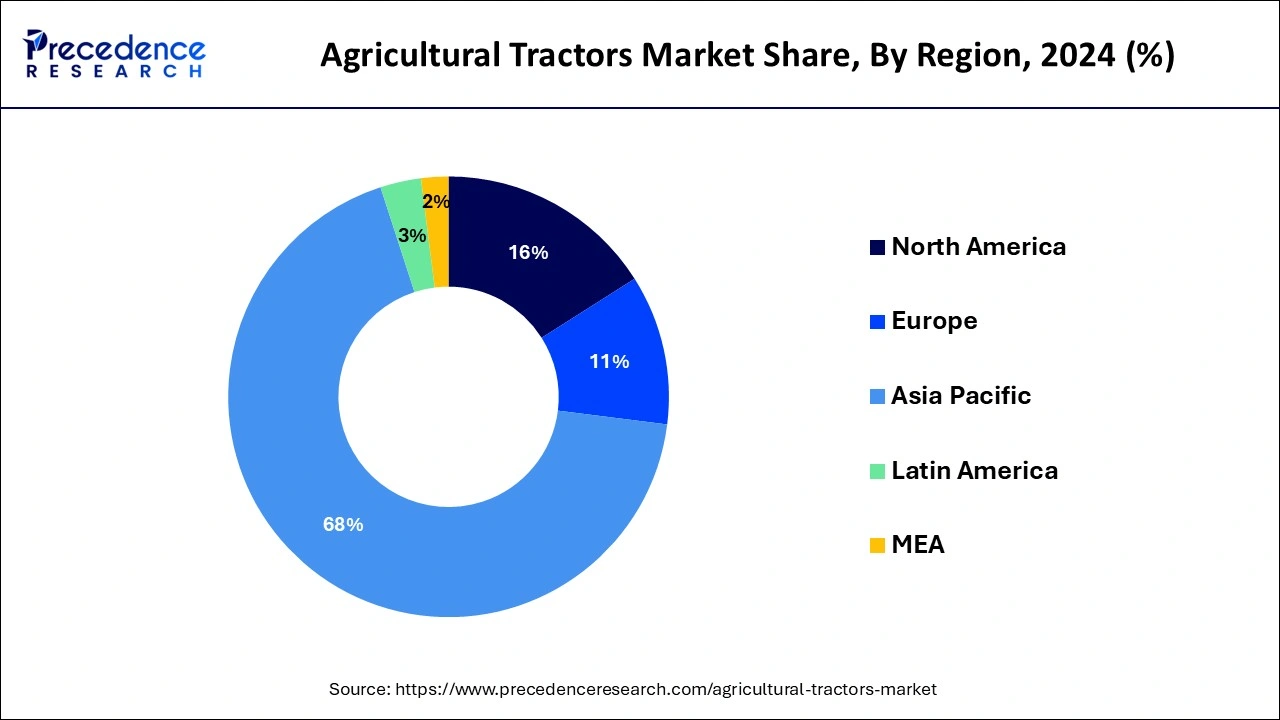

The Asia Pacific region generated the largest share, with over 68% in terms of volume. This results from growing tractor demand in nations such as India and China. Tractors are essential in India for boosting the nation's agricultural output. Agricultural tractors are sold between 600 thousand and 700 thousand units annually.

According to estimates, during climate change, Europe experienced major volume growth. Large farms in several European nations, including the U.K., the Netherlands, Hungary, Denmark, and Spain, are primarily to blame for this growth. 38% of all farms worldwide are located in Europe.

For various agricultural tasks like tilling, harrowing, ploughing, and planting, tractors are used as agricultural vehicles. Less than 20 HP to more than 60 HP are among the power ranges offered. It is also used in the orchard, row crop, and gardening applications. Furthermore, as the agriculture industry grows, more people in developing nations like India, Brazil, China, and others will require tractors for farming and other agricultural applications.

This, in turn, fuels the expansion of the tractor market worldwide. For example, the India Brand Equity Foundation estimates that 58% of India's population comprises farmers.

Governments in these countries also provide farmers with incentives and loans to encourage them to utilize agricultural machinery, which boosts crop cultivation. However, during the projected period, these factors are expected to work together to generate profitable growth opportunities for the agricultural tractor market worldwide.

Market segments for agricultural tractors include engine power, driveline type, application, and operation during the projected period. Factors including increasing usage of precision farming, support from the government for the expansion of agricultural activities, and improvements in tractor technology are expected to spur industry growth for agricultural tractors.

Moreover, during the projected period, low farmer awareness of effective agricultural tractors and high agricultural tractor prices are anticipated to restrain the market’s growth. Additionally, the industry for agricultural tractors is anticipated to benefit from the rising demand for fuel-efficient tractors and increased mechanization of agricultural processes.

Many governments, including those of India, the United States, China, and others, provide assistance for the growth of agricultural activities, including financial aid for purchasing machinery and seeds. The subsidies help to ensure adequate food production, lower the inflation rate for food commodities, protect farmer incomes, and enhance the agricultural industry. To increase agricultural production, developing countries like Brazil, India, and Africa provide a variety of subsidies, loan waiver programs, and other such amenities.

| Report Coverage | Details |

| Market Demand in 2025 | 3,610.08 Thousand Units |

| Market Demand by 2034 | 6,169.10 Thousand Units |

| Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Engine Power, By Driveline Type, By Application, and By Operations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A power-driven vehicle made explicitly for agricultural tasks like pushing or pulling farming equipment or trailers, scrapers, threshers, ploughs, planters, and pesticide sprayers is the agricultural tractor market. Due to their ability to supply power and mechanization for agricultural needs, tractors are now referred to as farm vehicles.

Government initiatives to fund farmers and provide them with lower interest rates on loans are also helping to boost the global market for agricultural tractors. Due to the increase in farm cash receipts, or profit and revenue from farming, tractors become more accessible, which is anticipated to increase the need for agricultural tractors. To help farmers, for instance, the Indian government and state governments have started several programs.

The industry is also expanding due to technological advancements that have changed how farming and agricultural processes are conducted. Self-driving agricultural tractors, for instance, are anticipated to increase industry efficiency and productivity. These are the key factors that are thus projected to fuel the expansion of the agricultural tractor market globally in the years to come.

The market for agricultural tractors may be constrained by several factors. Some of the key factors are as follows:

Overall, these elements may act as market restraints for agricultural tractors, preventing their expansion in certain areas or industries.

The market for agricultural tractors offers several chances for expansion and improvement. Some of the key opportunities are as follows:

Overall, these possibilities offer a positive outlook for the agricultural tractor market because manufacturers can take advantage of new patterns and shifting consumer preferences to expand their industries and serve farmers' needs.

The segment with less than 40 HP is expected to hold the largest share. This is explained by the fact that these tractors have more flexible uses. Farmers typically need access to large plots of land or a lot of extra cash. Since they are more effective, simple, and useful for small farms, they favour tractors with lower Horsepower.

Due to the growing demand from large farmers for larger tractors that can handle various tasks, the market for agricultural tractors with 40 HP engines is also anticipated to grow. The soaring demand for powerful tractors and aggressive marketing tactics is driving this area of the agriculture tractor market.

The market is divided into 2-Wheel Drive and 4-Wheel Drive according to the type of driver. The segment with the largest market share is expected to be 2-Wheel Drive. The possibility of a smaller turning radius with these tractors explains this. Ballast weights can be used to increase the traction of a 2-Wheel Drive and make it possible for the field to slip less.

Additionally, the segment's 6.1% annual growth rate between 2025 and 2034 will be the highest. The growth of interest in compact 2-wheeler tractors among amateur and professional farmers in developed and developing countries can be attributed to the segment's expansion. Moreover, farmers favor 2-wheeler tractors due to their ability to adapt, low initial cost, and superior mobility on small parcels of land.

A 4-wheeler tractor, on the other hand, has more power, which enhances its performance on marshes and unlevel ground. Furthermore, because of their high price, only large farmers with extensive farm fields can use 4-wheeler tractors.

Based on Application, the market is bifurcated into Harvesting, Seed Sowing, Irrigation, and Others. The Irrigation segment is anticipated to account for the highest market share. This can be attributed to the fact that tractors make the task significantly easier and help in saving water.

The market is divided into automatic tractor vehicles and manual tractor vehicles based on operations. The automatic tractor-vehicle segment is expected to hold the largest market share. This is explained by the fact that manual tractors are simple to operate, need less maintenance, and are generally less expensive.

Throughout the forecast, manual tractors are anticipated to grow significantly. The high availability of manual tractors drives the company's growth. Farmers have access to various manual tractors, which are less costly than autonomous tractors. The autonomous tractors segment is anticipated to expand moderately during the projected timeframe.

To diversify their product offerings, companies are making investments in the creation of electrically-propelled autonomous tractors. The advancement of electrically powered autonomous tractors is anticipated to be fueled by government initiatives to reduce automobile carbon emissions.

By Engine Power

By Driveline Type

By Application

By Operations

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2023

July 2024

July 2024

January 2025