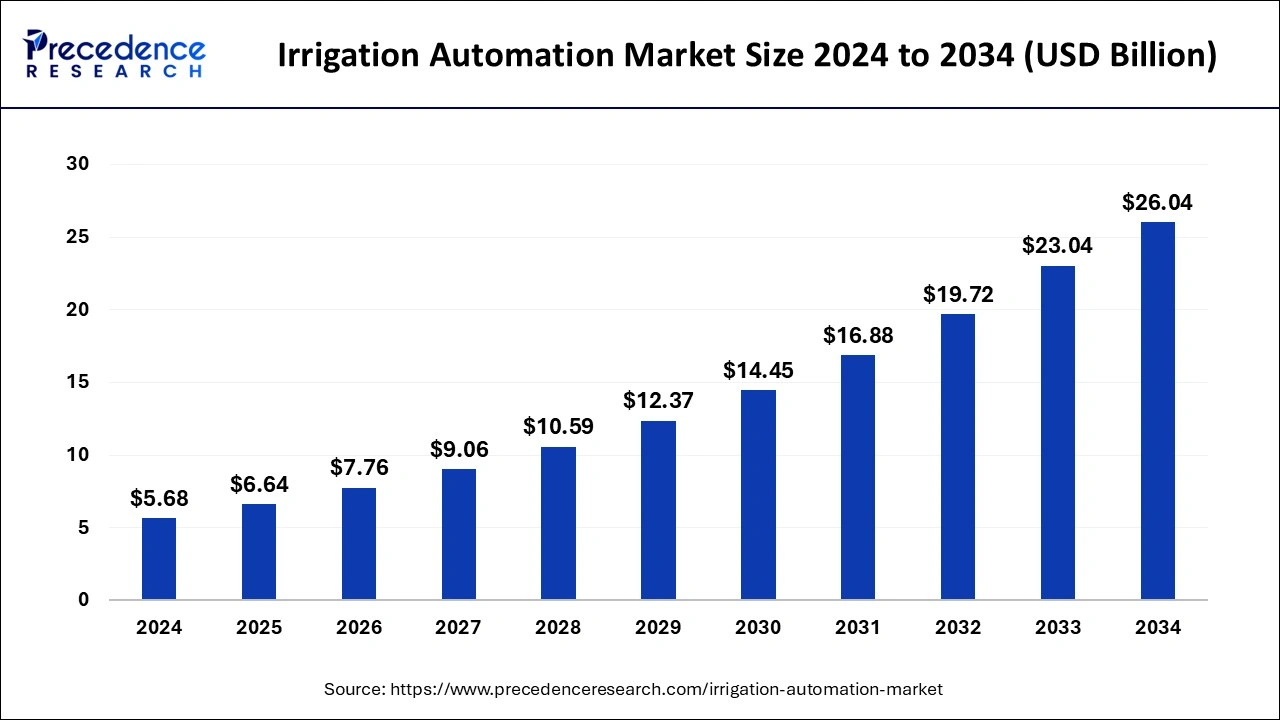

The global irrigation automation market size is calculated at USD 6.64 billion in 2025 and is forecasted to reach around USD 26.04 billion by 2034, accelerating at a CAGR of 16.45% from 2025 to 2034. The Asia Pacific irrigation automation market size surpassed USD 2.26 billion in 2025 and is expanding at a CAGR of 16.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global irrigation automation market size was valued at USD 5.68 billion in 2024 and is anticipated to reach around USD 26.04 billion by 2034, growing at a CAGR of 16.45% from 2025 to 2034. Increased adoption of precision agriculture is driving the global irrigation automation market. The demand for smart irrigation controllers has increased in agriculture, leading to the expansion of the irrigation automation market.

AI-driven innovations in agriculture have been transforming the shape of agricultural practice in recent years. AI is a significant tool in improving crop yield and maintaining water consumption requirements. As per the government's determination to adopt environmentally sustainable solutions, support for the utilization of AI-driven smart irrigation has been highlighted. The demand for AI-driven sensors in farming has dramatically increased to improve water resource management and landscape maintenance. The need to reduce water waste, enhance crop yield capacity, and maintain soil quality is the key reason behind the adoption of irrigation automation systems in agriculture. With the help of cutting-edge technology like AI, the agriculture sector is expected to improve quality and efficiency.

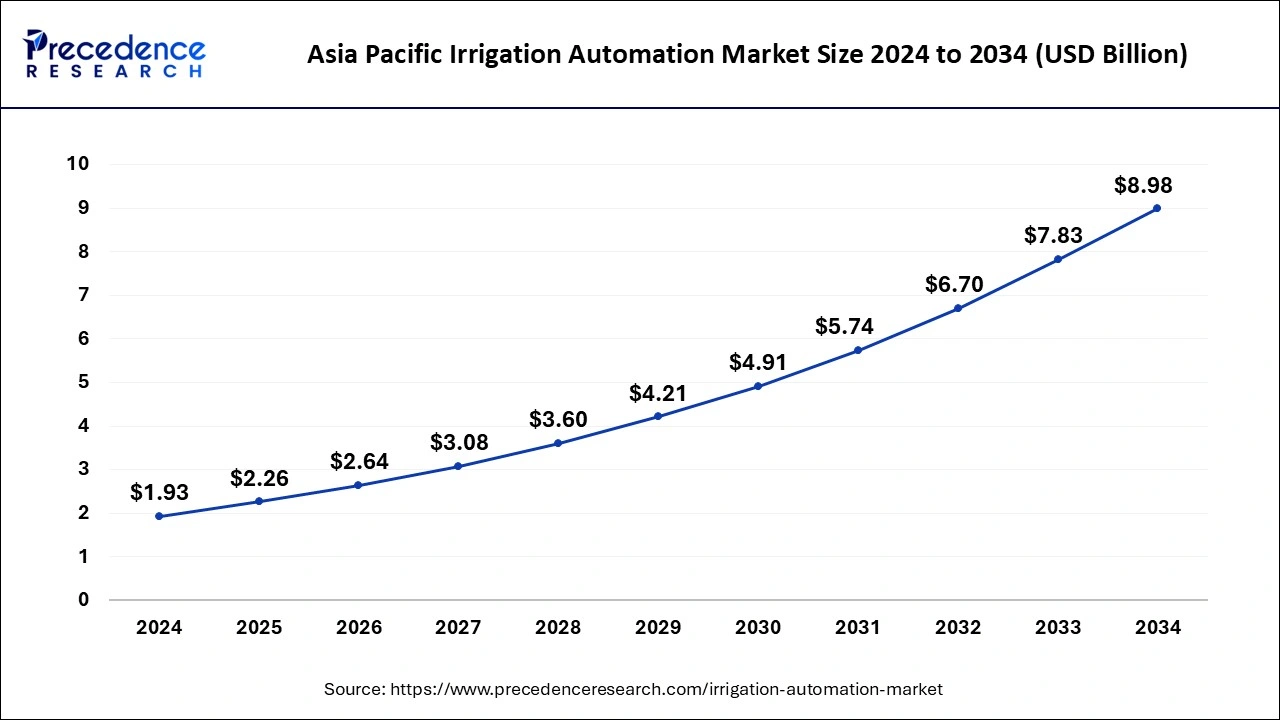

The Asia Pacific irrigation automation market size was estimated at USD 1.93 billion in 2024 and is predicted to be worth around USD 8.98 billion by 2034, at a CAGR of 16.62% from 2025 to 2034.

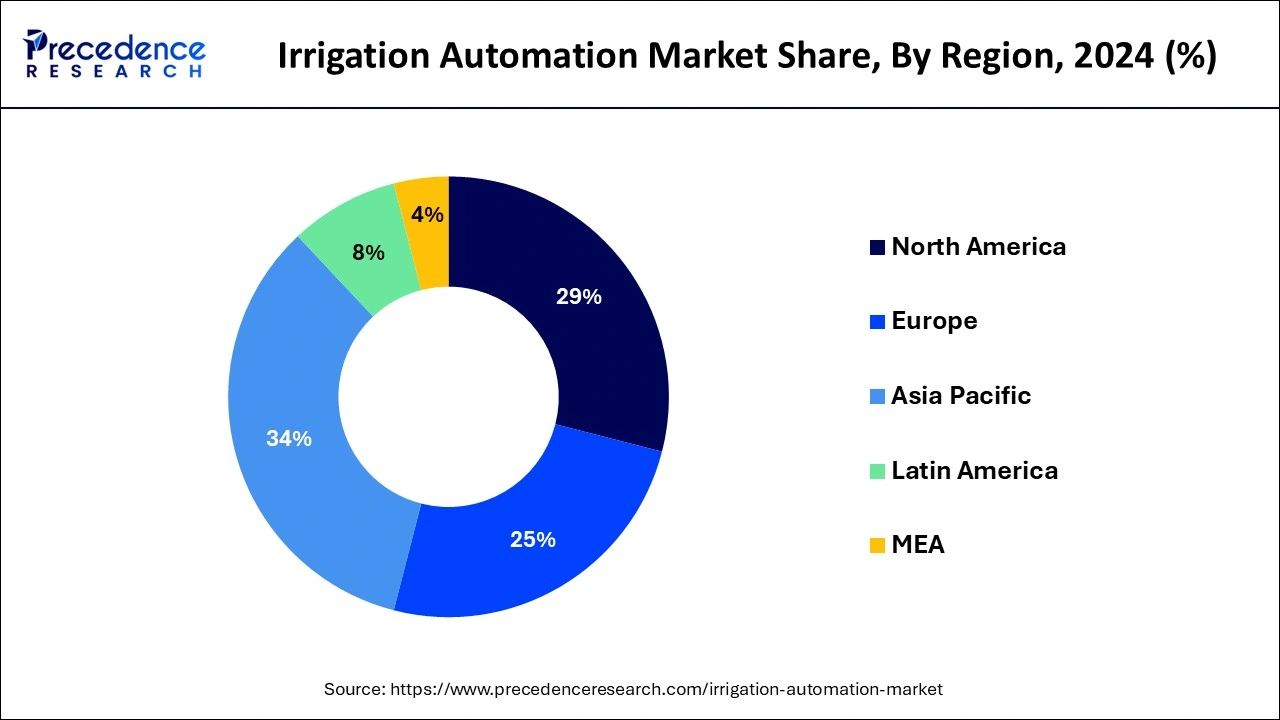

Asia Pacific dominated the irrigation automation market in 2024, mainly due to its extensive agricultural lands, shifting climate patterns, and efforts to reduce water waste, backed by government support. Moreover, high population density and declining water levels in countries like India and China are driving the adoption of sensor-based irrigation systems, which are expected to boost regional market growth in the future.

China's government initiative for water consumption and advancements in expanding agriculture are contributing significantly to the country's market growth. Additionally, increased adoption of micro-irrigation systems is fueling this expansion. On the other hand, India is driving irrigation automation markets due to increased government initiatives, policies, and support for the adoption of automation in the agriculture sector due to rising countries' populations and need for advancements. The large agricultural base of India has been essential for the adoption of irrigation automation; as a result, market growth is shaping the country.

North America is expected to show the fastest growth in the global irrigation automation market over the forecast period. Due to its strong agricultural sector and widespread use of advanced irrigation systems, North America leads in irrigation automation. The push for automation comes from the desire to save water, cut labor expenses, and enhance irrigation effectiveness. As water becomes scarcer and mechanization in farming increases, there's a growing demand for advanced irrigation methods in the region.

The United States is leading the regional market due to the availability of advanced technology and the presence of competitive landscapes in the country. However, Canada is projected to dominate the North American irrigation automation market due to rising urbanization and a growing need for efficient water management solutions in the country. Countries' key players are rising to partnerships to develop smart and advanced irrigation systems to provide support for farms, lawns, and gardens. The regulatory and government initiatives for the development of sustainable solutions are contributing to the market expansion. Additionally, growing consumer demand for environmentally sustainable products is driving the Canadian irrigation automation market.

Irrigation automation streamlines the process of watering plants by employing automatic systems, minimizing the need for manual intervention. It efficiently manages every aspect of irrigation, catering to various methods like drip, sprinkler, and surface systems. Reducing labor requirements effectively cuts down irrigation expenses. Moreover, irrigation automation aids in water conservation by eliminating wastage, which benefits both agricultural and non-agricultural sectors. The integration of hardware components such as controllers, sensors, and valves is crucial for its proper functioning. Also, government support for advanced irrigation systems and water conservation initiatives is expected to bolster the global irrigation automation market shortly.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.45% |

| Market Size in 2025 | USD 6.64 Billion |

| Market Size by 2034 | USD 26.04 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Automation Type, By Component, By Irrigation Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing instances of water scarcity and unpredictable rainfall patterns

A major force behind the global rise of irrigation automation is the escalating water scarcity and erratic rainfall patterns. Traditional farming methods struggle in these conditions, pushing the demand for more advanced irrigation solutions. By incorporating feedback-based methods, automated systems now manage resources more effectively than older approaches. Furthermore, there's a growing emphasis on conserving water and enhancing irrigation efficiency worldwide, which can further fuel the demand for advanced techniques provided by the irrigation automation market.

High installation cost

In the irrigation automation market, systems can be pricey, needing a substantial upfront investment. This expense isn't feasible for many farmers in developing nations, where financial resources are limited. Also, the high cost might impede market expansion in the foreseeable future. Additionally, a lack of awareness and education among farmers regarding the advantages and cost-effectiveness of advanced irrigation methods compared to traditional ones could also slow down market growth.

Government initiatives

Government initiatives promoting water conservation globally, along with increasing farmer awareness of automated irrigation techniques, are critical drivers of the projected growth in the global irrigation automation market. As labor and electricity costs rise, farmers are becoming more aware of the benefits of automated irrigation. They've noticed significant reductions in power consumption and the time and effort spent on watering fields. By automating tasks, farmers can make fewer trips to their farms, cutting down on labor expenses. Innovative irrigation technologies are revolutionizing agriculture and landscape management by conserving natural resources, cutting input costs, and increasing profits. These technologies monitor soil conditions, weather patterns, water levels, and watering schedules by incorporating tools like the Internet of Things (IoT), artificial intelligence, and machine learning.

The time-based automation type segment dominated the irrigation automation market in 2024. The growth of this segment can be credited to advantages like better control over irrigation, reduced fuel usage, and lower labor expenses. Time-based systems stand out for their ability to let users monitor crops, intervene, and exercise better control over irrigation stages at regular intervals. This feature is a crucial driver behind the segment's notable growth for the upcoming period.

The real-time-based automation type segment is anticipated to grow at the fastest rate over the forecast period. The growing preference for using tensiometers and sensors to monitor temperature, weather, and rainfall is driving the demand for real-time-based automated irrigation systems. These systems are considered more sustainable than other options on the market, leading to lower water consumption.

The controller segment dominated the irrigation automation market in 2024. The segment's growth is primarily fueled by rising demand for semi-automatic systems like volume-based and time-based systems worldwide. Additionally, controllers play a crucial role in delivering the necessary amount of water at the right time as per the desired schedule, further driving the segment's growth in the foreseeable future.

The sensors segment is expected to grow at the fastest rate in the irrigation automation market. The segment's growth is fueled by its many advantageous features, including real-time monitoring of soil moisture levels to assess irrigation requirements. Moreover, dripping systems, in conjunction with automated and advanced technology, can enhance productivity while reducing reliance on manual labor, and hence expectedly boosting market growth significantly.

The drip irrigation type segment dominated the irrigation automation market in 2024. Drip irrigation systems reduce water waste due to field run-off and evaporation. Furthermore, Factors like reduced water usage and lower costs of drip systems are driving the growth of this segment. Drip irrigation is considered the most effective irrigation method globally, except in certain Asia Pacific countries like Japan and China, where water-intensive crops like rice are cultivated.

Tthe sprinkler irrigation type segment is expected to grow at a significant rate during the forecast period. Sprinkler irrigation, widely used in agriculture, entails spraying water over crops with sprinklers. This method leads the global market due to its rising adoption in crops like wheat, corn, and soybean. Moreover, its simple installation and operation, compared to other methods, contribute to the segment's growth.

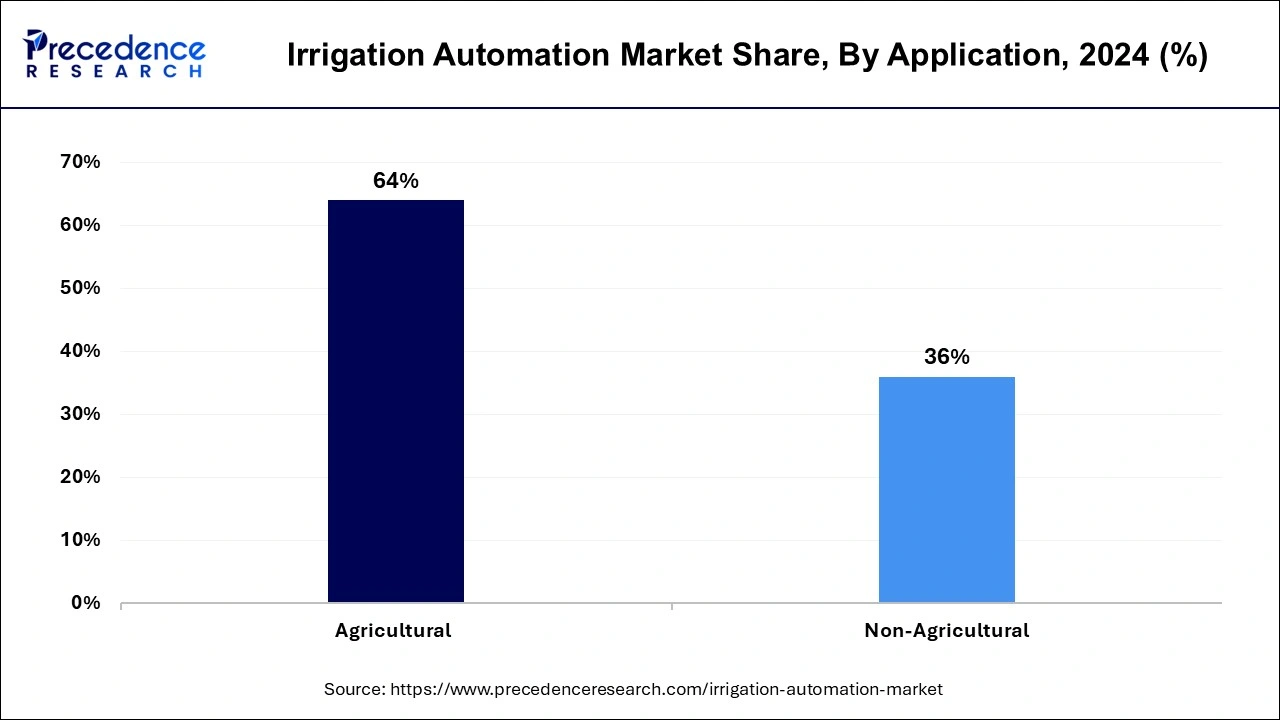

The agricultural application segment dominated the irrigation automation market in 2024. Agriculture is a significant occupation worldwide, particularly in many countries. Agricultural products are often standardized and cost less to produce, making them accessible to consumers, especially in emerging economies like India, China, and Indonesia.

The non-agricultural application segment is the fastest-growing segment over the first period. The growth is driven by the increasing number of golf courses, sports fields, gardens, residential areas, and turf and landscapes worldwide. Irrigation automation systems ensure timely watering with the right amount of water for these non-agricultural uses, reducing water bills. Additionally, automatic irrigation systems in golf courses enable owners to adjust irrigation based on time or volume and control it remotely.

By Automation Type

By Component

By Irrigation Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client