October 2024

The global AI in asset management market size is calculated at USD 5.75 billion in 2025 and is forecasted to reach around USD 38.94 billion by 2034, accelerating at a CAGR of 23.76% from 2025 to 2034. The North America AI in asset management market size surpassed USD 2.36 billion in 2024 and is expanding at a CAGR of 23.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global AI in asset management market size was estimated at USD 4.62 billion in 2024 and is predicted to increase from USD 5.75 billion in 2025 to approximately USD 38.94 billion by 2034, expanding at a CAGR of 23.76% from 2025 to 2034. The rising vast amount of data generation that needs to be processed precisely with stringent regulations by finance authorities is the major factor driving the global the AI in asset management market.

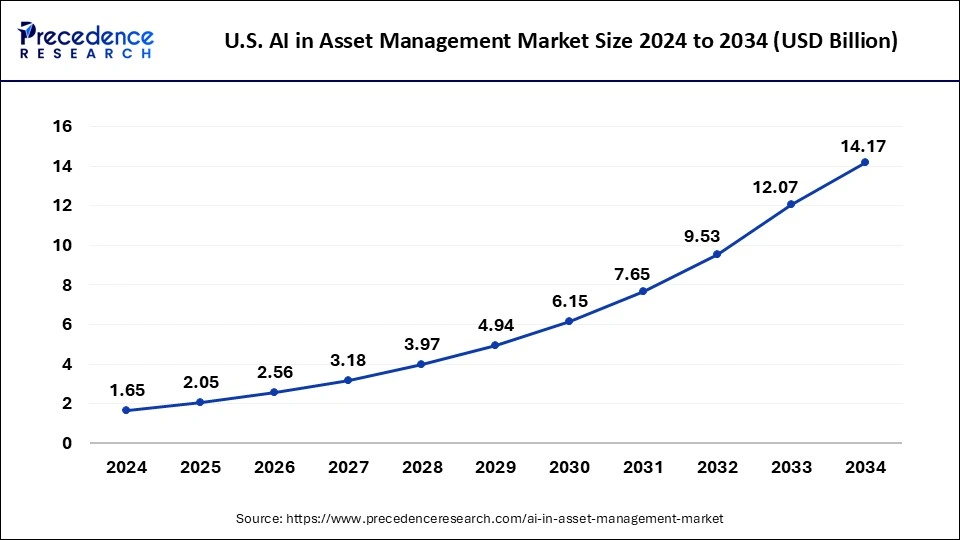

The U.S. AI in asset management market size was exhibited at USD 1.65 billion in 2024 and is projected to be worth around USD 14.17 billion by 2034, poised to grow at a CAGR of 23.99% from 2025 to 2034.

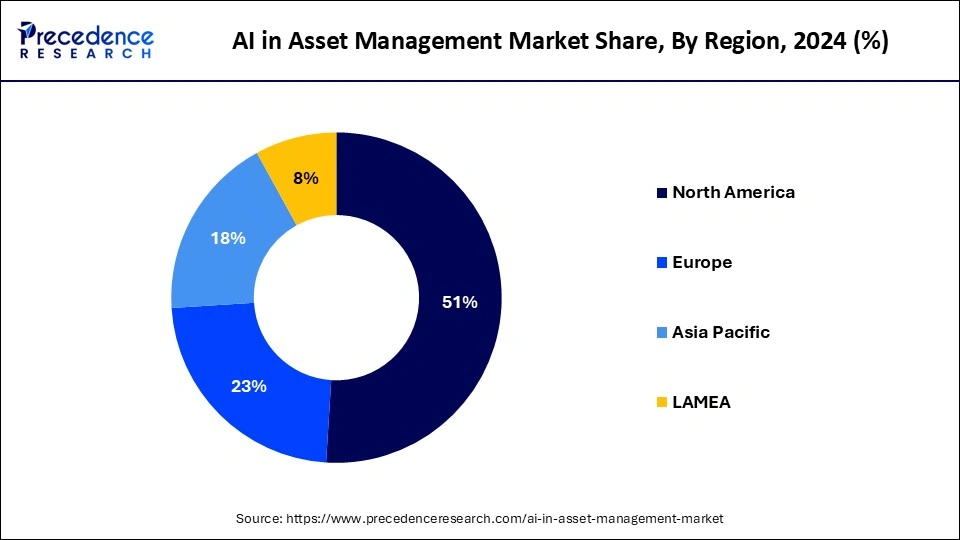

North America registered the largest revenue share of the AI in asset management market in 2024. North America dominates the AI asset management market due to its advanced technological infrastructure, significant investment in AI research, and presence of leading financial institutions.

The region's regulatory environment supports innovation, while its robust data analytics capabilities enhance decision-making and efficiency in asset management. Major AI firms and startups in the U.S. and Canada drive cutting-edge solutions, solidifying North America's leadership in this sector.

Asia Pacific is anticipated to showcase significant growth with the fastest CAGR in the AI in asset management market in the upcoming period. The region is rapidly emerging as a key player in the AI asset management market owing to the increasing adoption of AI technologies, significant investments in fintech, and a rising number of tech-savvy investors.

Countries like China, Japan, and India are at the forefront of leveraging AI for enhanced financial services. Regulatory support and a growing digital infrastructure further bolster this expansion. The region's diverse markets offer vast opportunities for AI-driven innovation, making Asia-Pacific a dynamic and fast-growing hub for AI in asset management.

The AI in asset management market is poised to witness a significant growth rate with increasing CAGR during the forecasted years. The growth of this market is owing to the stringent regulations, increasing vast amounts of data volumes across several sectors, including lower interest rates. by leveraging cutting-edge technologies such as machine learning, AI, and predictive analytics, many fintech companies offer exceptional services and solutions in the finance sector.

Integrating AI with asset management will provide benefits like satisfactory consumer experience, investment methods, and operational efficiency. AI can be applied to operational efficiency to improve quality checking, monitoring, and handling capability for huge datasets. Despite the innumerable benefits that AI still provides in asset management, the high cost, data quality, interpretability, and ethical use may create barriers to the adoption of the AI in asset management market. Since AI is in its early stage of development, it is essential to develop a synergy between human intervention and AI to drive the system it is applied to.

| Report Coverage | Details |

| Market Size by 2034 | USD 38.94 Billion |

| Market Size in 2025 | USD 5.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 23.76% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Deployment Mode, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of cloud-based AI services

The significant driver for the the AI in asset management market is the increasing adoption of cloud-based AI services owing to their potential to enhance overall efficiency, decrease cost, and ability to provide clarity and deeper insights emerging within data. Cloud platforms enable asset managers to leverage technically sound AI tools within a minimum upfront investment in existing infrastructure, as cloud platform offers highly scalable and on-demand computing resources. Therefore, AI tools are an essential and integrated part of the asset management market.

Real-time data analysis and services are crucial to facilitate data-driven decision-making in a fast-paced and evolving financial market. AI-powered algorithms can analyze huge amounts of data from the market, which helps identify patterns and trends. Such patterns are crucial to optimize the company’s portfolio to predict changes arising in the market, which in turn aid in mitigating the risk factors associated with the business.

Operational efficiency is also enhanced by the automation of repeated tasks such as regular reporting and communication with clients and meeting the regulations set by authorities for effortless business. Enhance security and integrity for data provided by cloud-based AI service providers. Hence, integrating cloud-based AI services in the asset management market represents a prominent shift towards data-driven strategies to achieve the highest results in the financial industry, which is the major factor driving the market globally.

Skepticism about AI algorithms

A major restraint that the AI in asset management market is witnessing is skepticism and disbelief about the algorithms set by AI. Many investors refuse to adopt AI-based algorithms to manage their finance-related work and documentation. Every evolving and upcoming technology creates a gap between investors and inventors due to the lack of data and doubt about its practicality or if the technology is not able to compel the regulations set by the authority. Investors' fear of not capitalizing on their products by using emerging technologies creates barriers in the market; the same principle goes with the use of the AI in asset management market, hindering its growth to some notable extent.

Furthermore, directing the vast amount of data poses a challenge in the finance sector. According to the rethink data report, nearly 68% of available data about businesses left unleveraged. Generative AI has foundational models that are specifically trained on structured and unstructured data, though data direction/orchestration is needed to gain insights from it. Additionally, deploying and designing the expected workflows is a stingy task, as it does not require a major shift in the way the organization works only, but it needs an extensive paradigm shift in the working culture of the organization that probably needs to first embed digital workers and AI advisors.

AI holds the potential to replace human decision-making

The major opportunity for the AI in asset management market is an exponential increase in complex data and managing risks faced by many financial institutes and managers. Here, AI models can help resolve complicated data and insights by searching for repeated keywords. Mathematical models and conventional rule-based algorithms undoubtedly work well with recognizing the risk associated with investments due to market volatility, although AI can efficiently process vast DATA and bring an innovative way to handle risks better than humans can. These AI models are trained with the huge datasets fed to them and work by using predictive analytics.

A human decision-making process heavily depends upon cognitive abilities, which are basically influenced by the biases they develop through life experiences, psychology, perceptions, emotions, and evolving social patterns. Here, AI can act as a savior to predict the huge loss before it comes into existence by analyzing the billions of patterns of past events without any biases within unseen and neglected data, which is not possible to comprehend by any human intelligence accurately so far and without influencing by human emotions. Thus, AI can see what humans cannot, which will bring a revolution in various fields, including the global asset management market.

The machine learning segment dominated the AI in asset management market in 2024 and is expected to grow at a rapid pace during the forecast period. Machine learning (ML) in asset management enhances decision-making by analyzing vast datasets for predictive insights and improving investment strategies. It optimizes portfolio management through real-time risk assessment and automated trading, increasing efficiency and reducing human error. ML algorithms identify market trends and anomalies, offering a competitive edge. They facilitate personalized investment advice by tailoring recommendations to individual client profiles. Overall, ML drives higher returns, operational efficiency, and superior risk management, transforming asset management into a more precise and responsive industry.

The NLP natural language processing segment will grow at the fastest rate in the AI in asset management market over the forecast period. NLP is helpful when analyzing data, which is full of articles and generally in the text format, and cannot be convertible into numbers to fit into a mathematical model of predictive analytics to gain insights from it. Here, NLP helps by pulling repetitive keywords and phrases from the data that indicate specific emotions or sentiments reported by the masses, which easily aid in sorting out the final implementations from which to gain benefit.

The portfolio optimization segment led the global AI in asset management market in 2024. The growth of this segment is related to the increasing adoption of AI-applied stock-picking methods adopted by finance institutes and asset managers. A number of papers published have demonstrated the potential of AI algorithms to create huge wealth in asset management. Different techniques have been adopted, such as random forest RF, support vector machines –SVM, and neural networks for the evaluation and analysis of vast amounts of quantitative data that can be helpful in picking a particular stock by highlighting key points.

The data analysis segment is predicted to witness prominent growth in the AI in asset management market over the forecasted period. Data analysis in AI revolutionizes asset management by uncovering insights from vast datasets, improving investment strategies and risk management. It enables real-time market trend identification. Personalized investment recommendations are generated based on individual client profiles. Enhanced predictive analytics support proactive decision-making, leading to higher returns and operational efficiency. Thus, data analysis in AI drives smarter, more informed asset management practices.

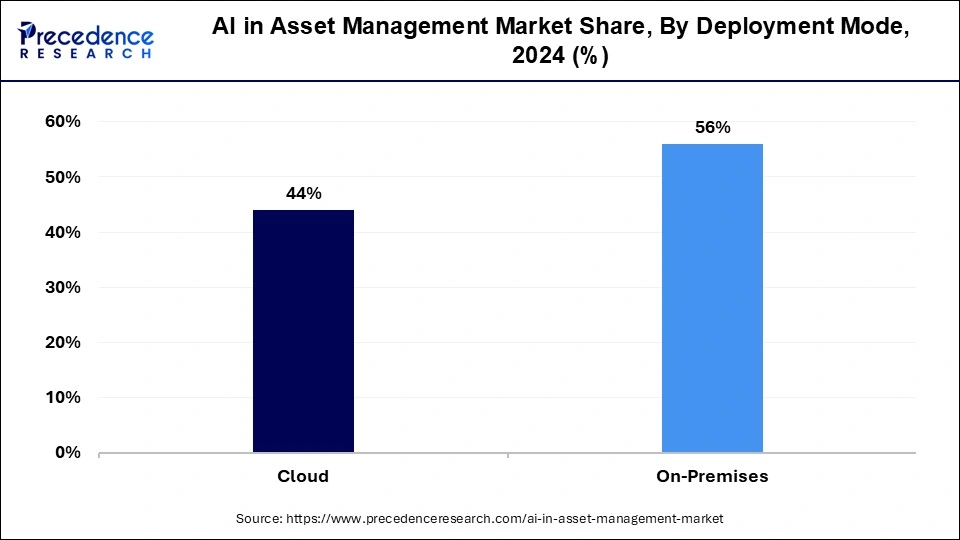

The on-premises segment held the largest share of the AI in asset management market in 2024. AI on-premise means deploying AI-based infrastructure and applications for an organization that involves maintaining and setting up essential Hardware, software, and networking components. The growth of this segment is due to the high-level control and customization provided by on-premises deployment, which is crucial for the stringent regulations for security purposes and holds utmost importance in the asset management market.

The cloud segment is anticipated to show the fastest growth in the AI in asset management market over the foreseeable period. Cloud segments driven by AI technology are utilized by several organizations to build, deploy, and manage AI-enabled applications. The growth of this segment is attributed to the benefits provided by cloud services, such as cost efficiency, scalability, flexibility, agility, high availability, and fault tolerance.

By Technology

By Deployment Mode

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

February 2025

January 2025