February 2025

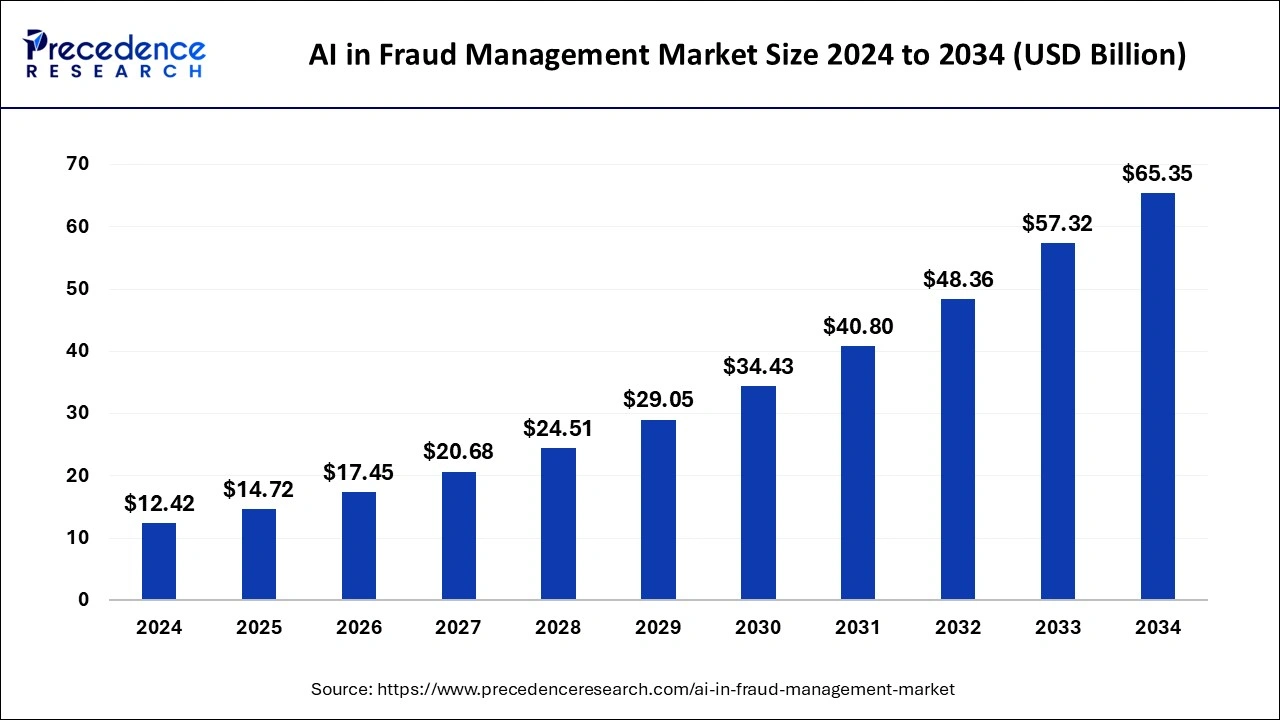

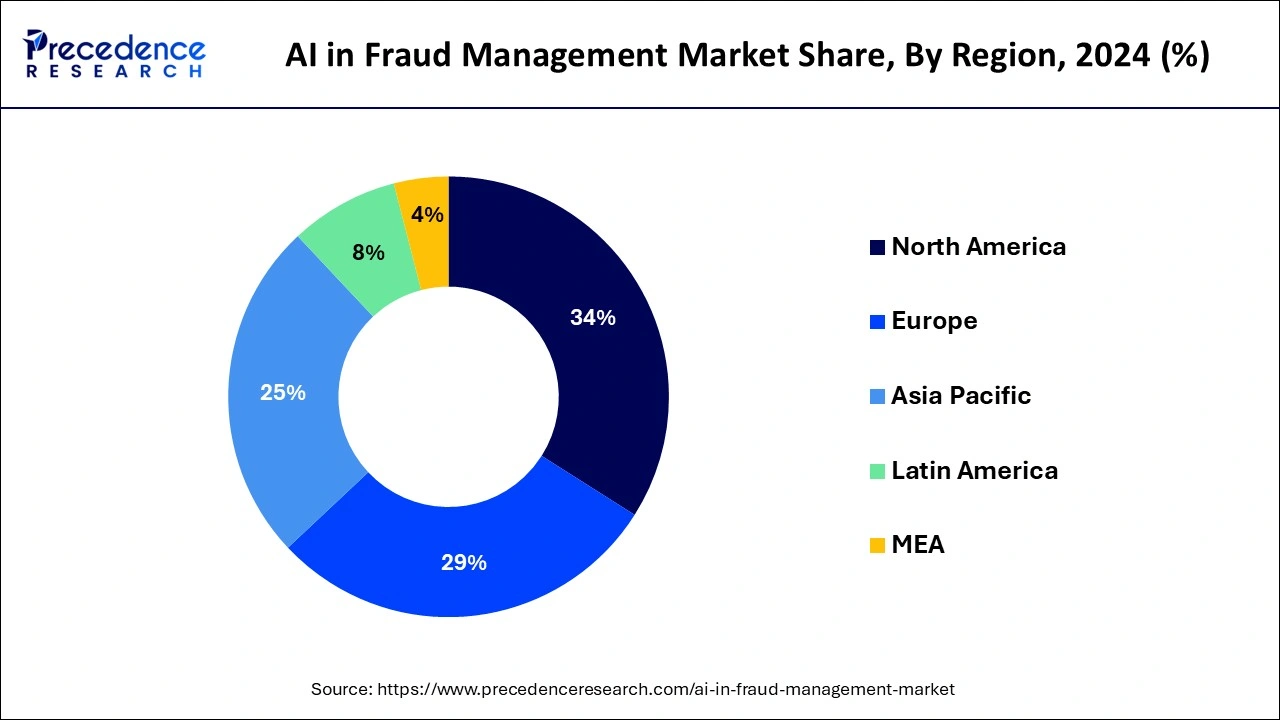

The global AI in fraud management market size is calculated at USD 14.72 billion in 2025 and is forecasted to reach around USD 65.35 billion by 2034, accelerating at a CAGR of 18.06% from 2025 to 2034. The North America AI in fraud management market size surpassed USD 4.22 billion in 2024 and is expanding at a CAGR of 18.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global AI in fraud management market size was calculated at USD 12.42 billion in 2024 and is expected to reach around USD 65.35 billion by 2034, expanding at a CAGR of 18.06% from 2025 to 2034. The rising demand for an efficient fraud management system that drives the growth of the AI in fraud management market.

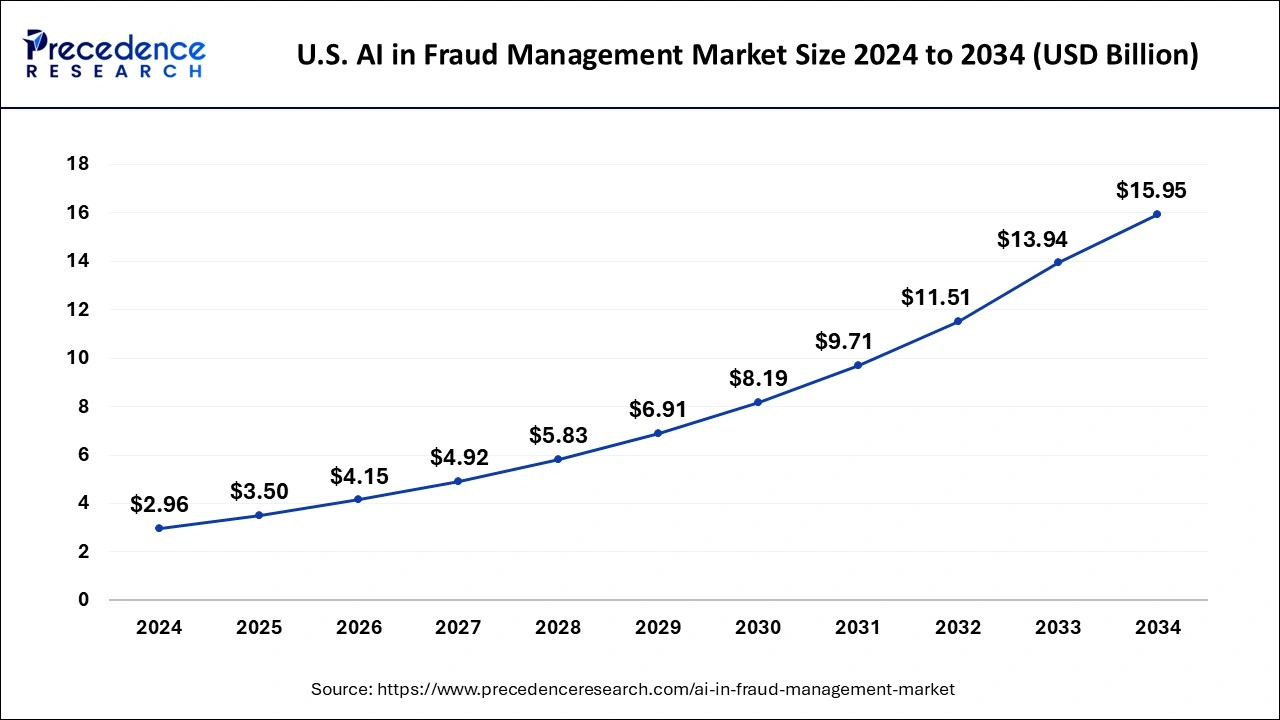

The U.S. AI in fraud management market size was exhibited at USD 2.96 billion in 2024 and is projected to be worth around USD 15.95 billion by 2034, poised to grow at a CAGR of 18.34% from 2025 to 2034.

North America led the global AI in fraud management market in 2023. The growth of the market is attributed to the rising digitization in the industries, the acceptance of online services, and online fraud cases that are driving the demand for an efficient fraud management system that boosts the growth of the market. The higher availability of AI service providers in fraud management in regional countries like the United States is driving further expansion of the market. The rising demand for artificial intelligence in fraud management from the various end-use industries such as healthcare, retail, manufacturing, e-commerce, and others is fueling the growth of the AI in fraud management market in the region.

Asia Pacific is expected to witness the fastest growth in the AI in fraud management market during the forecast period. The growth of the market in the region is increasing due to the rising fraudulent activities in banking and financial institutions, which are driving the demand for artificial intelligence (AI) in fraud management systems for detecting and analyzing anomalies in transactions. The rising integration of AI into various other applications is driving the growth of the market.

The increasing trends towards the online lifestyle and use of online applications and the rising cases of fraud cases, cyberattacks, and others are driving the demand for efficient and effective technology for fraud management. Artificial intelligence plays a vital role in fraud management. The integration of smart and modern technologies, such as AI and machine learning (ML) algorithms, can help detect and analyze anomalies that may indicate fraudulent activities.

AI-powered fraud management helps in analyzing and detecting the various types of fraud, such as identity theft, payment fraud, and phishing attacks. Thus, the rising adoption of online services and the increasing concern about cyberattacks are driving the growth of the AI in fraud management market.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.72 Billion |

| Market Size in 2034 | USD 65.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.06% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Application, Enterprises, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with the integration of AI in fraud management system

The rising adoption of the AI in the several end-use industries for the enhancement in operation and efficiency in productivity are contributing in the growth of the AI in fraud management market. The increasing cases of cyber threats, data theft, identity theft, and other cybercrimes in different industries are driving the demand for an effective solution that integrates AI into the fraud management system to detect and analyze fraudulent activities efficiently.

The integration of fraud management into artificial intelligence and machine learning is working on the principles of learning from data, such as data processing, data collection, training, detection, and feedback loop. Further, there are several types of fraud detected by artificial intelligence, including credit card fraud, identity theft, insurance fraud, account takeover, phishing attacks, payment fraud, and money laundering. Thus, all these benefits of the AI in fraud management market drives the expansion of the market into several industries.

Lack of awareness

The lack of awareness about the technologies and the insufficiency of professionally skilled forces to operate the technology is limiting the growth of the AI in fraud management market.

Advancement in technologies

The advancement in AI technologies, such as predictive analytics and automation, enhanced the efficiency of fraud management systems. Predictive analytics leverages large amounts of data to detect and analyze anomalies and patterns that are suspicious of fraudulent activities. Automation involves reducing information technologies and control systems to minimize human participation in operations. Automation offers efficient analysis and processing of large amounts of data. Thus, the integration of AI tools like predictive analytics and automation revolutionizes fraud management and drives the opportunity for the growth of the AI in fraud management market.

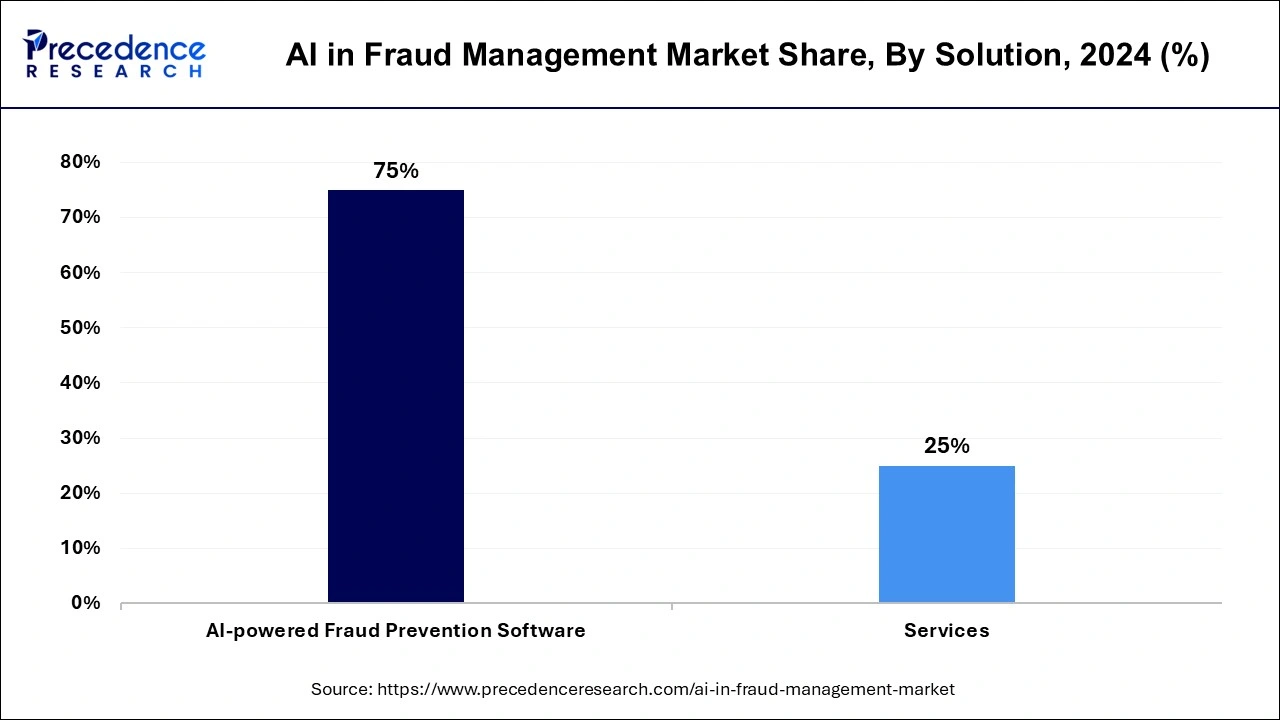

The AI-powered fraud prevention software segment dominated the AI in fraud management market in 2024. The increase in online service applications, the inclination towards digitization, and the rising fraudulent activities are driving the demand for AI-powered fraud prevention software. The AI-powered fraud prevention software works on the principle of machine learning, which aims to detect and analyze anomalies and behaviors that indicate fraud. The system analyzes the transaction data, patterns, and user behavior. There are several stages or mechanisms used in AI fraud prevention software, including data collection, model training, feature engineering, anomaly detection, continuous learning, and alerting and reporting.

AI fraud prevention software is divided into two major categories: on-premise and cloud-based. There are several benefits associated with AI fraud prevention software, such as providing real-time prevention and detection, enhancing accuracy and efficiency, and cost reduction. There are several end-use industries that are adopting AI-powered fraud prevention software to prevent data theft or any type of cyberattack that contributed to the expansion of the segment in the market.

The application segment is further divided into identity theft protection, payment fraud management, and anti-money laundering, in which the identity theft protection segment was estimated to account for the highest share of the market in 2024. The rise in digitization has resulted in a rising number of identity theft cases. Identity theft is impacting both customers and the financial institutions. It can cause legal issues, financial losses, and damage to institutions. The AI in fraud management market provides practical solution for the same.

The AI in fraud management market plays a crucial role in detecting and minimizing identity theft. The integration of technologies such as data analytics, machine learning, and real-time monitoring, as well as artificial intelligence, completely revolutionizes the process of prevention and identification of fraud. AI helps prevent and detect fraudulent activities using a large amount of data; it identifies patterns and problems that can suggest fraudulent activities. AI platforms help companies prevent identity theft.

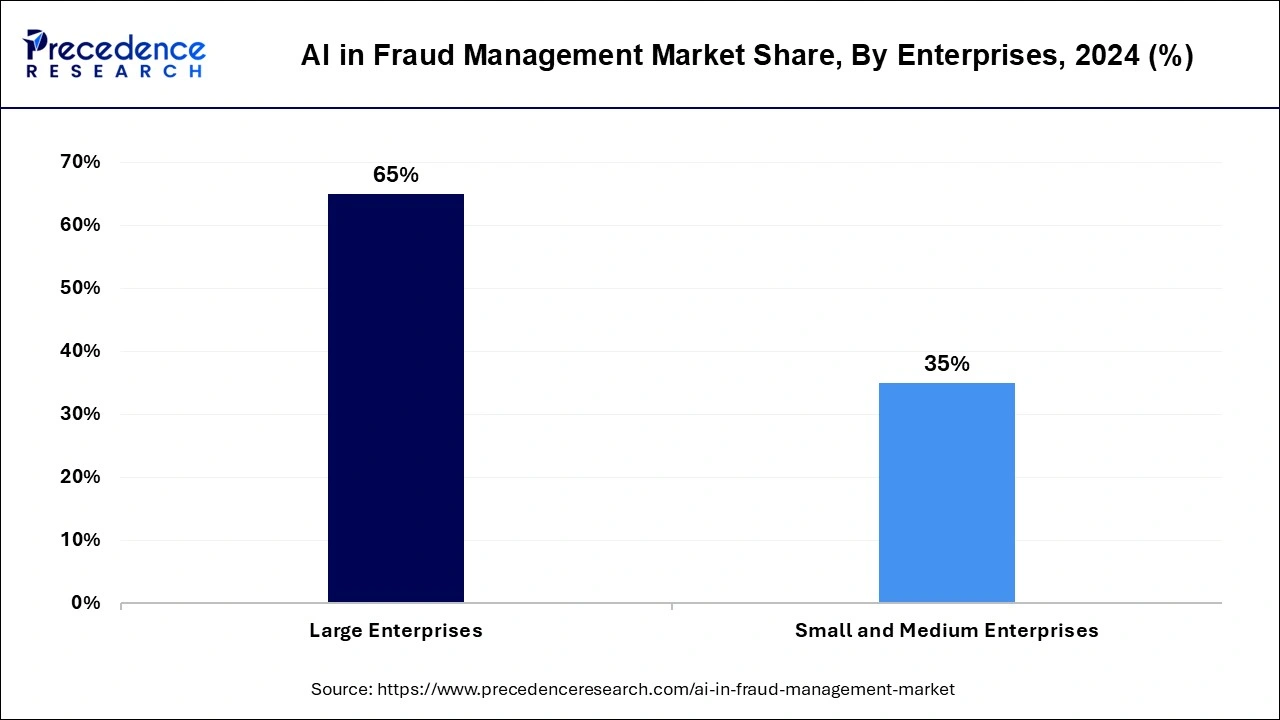

The large enterprises segment dominated the AI in fraud management market in 2024. The rising adoption of digitization and adaptation of technologies are driving the demand for the AI in fraud management.

The increasing adoption of artificial intelligence in fraud management in the end-use industries such as healthcare, automotive, manufacturing, and others is driving the expansion of the market. The higher availability of complexities in operation, the increasing number of fraud cases, and the investment in technologies boost the growth of the market.

The BFSI segment dominated the global AI in fraud management market in 2023. The increasing adoption of digitization and artificial intelligence in the banking and financial sector for enhancement in operations, customer experience, and efficiency in other services. The BFSI sector is highly experienced with security threats in terms of customer data, payment transactions, fraudulent transactions, and other issues that drive the demand for the technologically advanced fraud management system that drives the growth of the market.

By Solution

By Application

By Enterprises

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

February 2025