January 2025

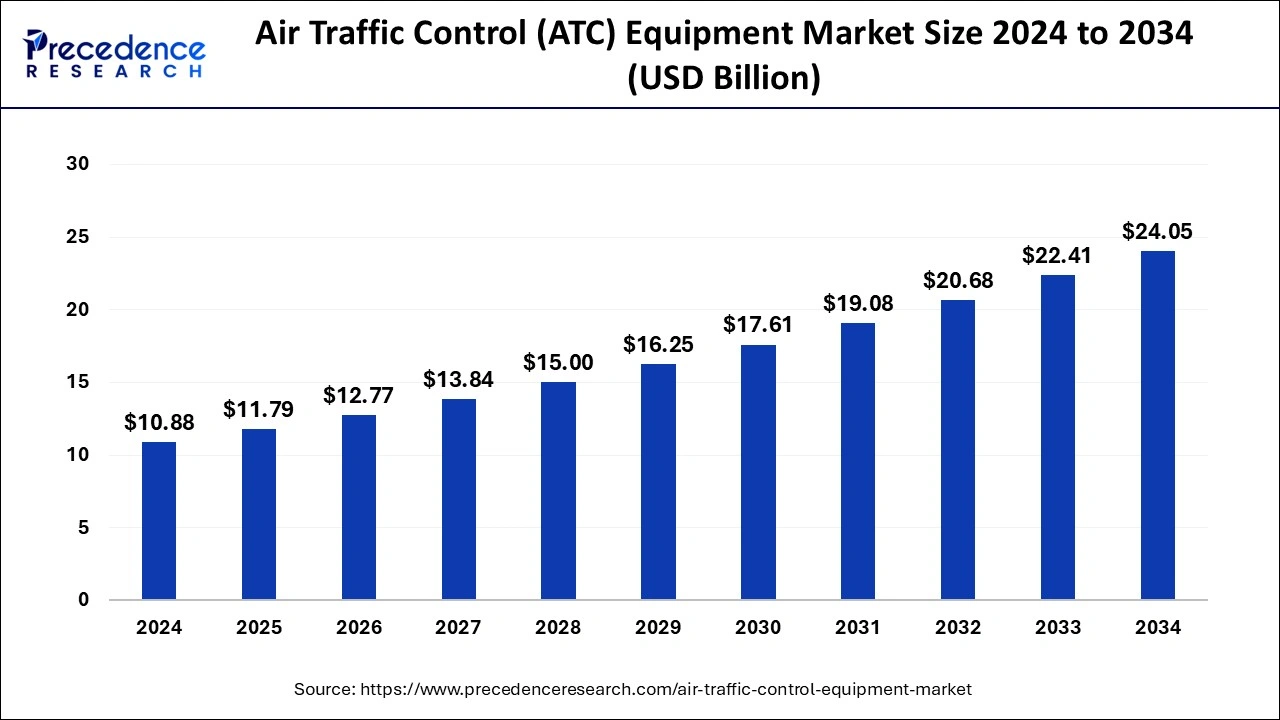

The global air traffic control (ATC) equipment market size is calculated at USD 11.79 billion in 2025 and is forecasted to reach around USD 24.05 billion by 2034, accelerating at a CAGR of ccc% from 2025 to 2034. The Asia Pacific air traffic control (ATC) equipment market size surpassed USD 4.24 billion in 2025 and is expanding at a CAGR of 8.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global air traffic control (ATC) equipment market size was estimated at USD 10.88 billion in 2024 and is predicted to increase from USD 11.79 billion in 2025 to approximately USD 24.05 billion by 2034, expanding at a CAGR of 8.26% from 2025 to 2034.

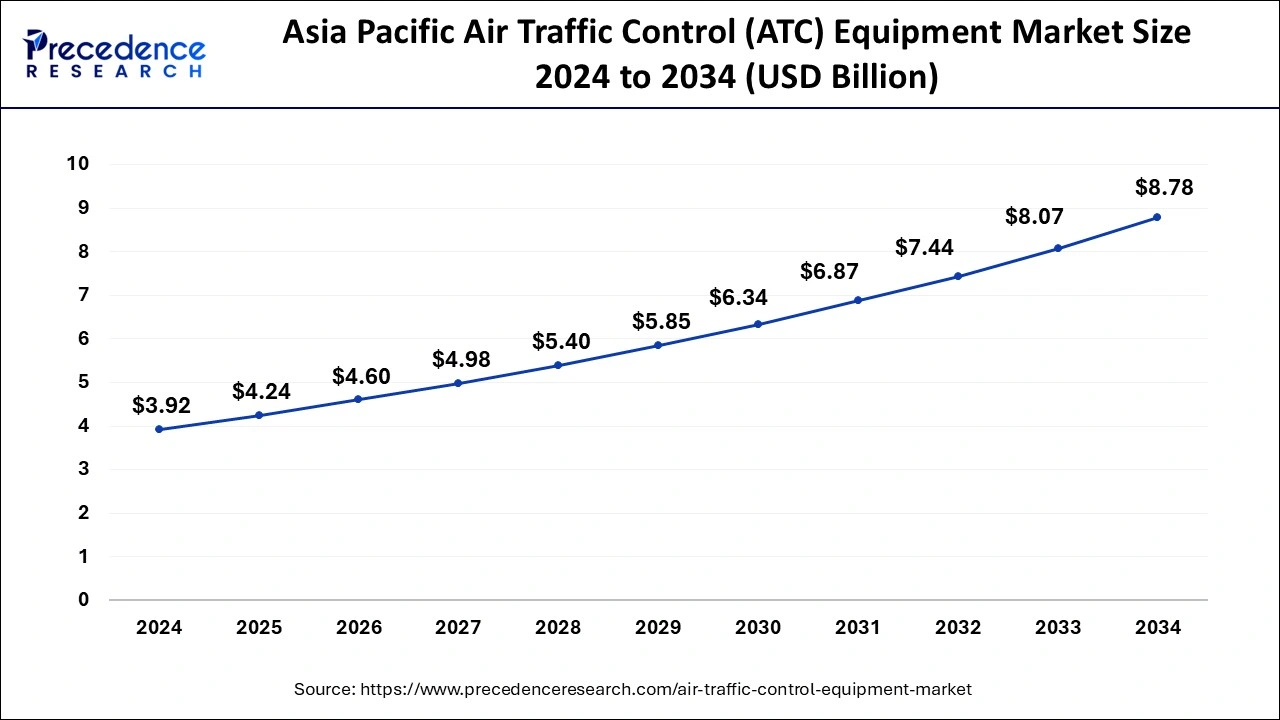

The Asia Pacific air traffic control (ATC) equipment market size was estimated at USD 3.92 billion in 2024 and is predicted to hit around USD 8.78 billion by 2034 at a CAGR of 8.40% from 2025 to 2034.

Asia Pacific emerged as a dominant force propelling the expansion of the Air Traffic Control (ATC) equipment market, driven by concerted efforts to modernize aviation infrastructure and meet growing demand. The introduction of the Common Regional Virtual Private Network (CRV) infrastructure, spearheaded by the International Civil Aviation Organization (ICAO), addresses communication limitations inherent in legacy civil aviation technologies. By transitioning to a centralized IP-based network infrastructure, the APAC region paves the way for future high-speed aviation applications, facilitating the exchange of crucial meteorological and surveillance data among Aviation Navigation Service Providers.

The Asia Pacific Regional Air Traffic Flow Management (ATFM) Concept of Operations (CONOPS), developed collaboratively by key stakeholders, including Civil Aviation Authorities and industry partners, underscores the region's commitment to innovation and operational efficiency. Singapore, a major air hub in the region, leads by example as an early adopter of Air Traffic Management (ATM) changes to accommodate rising capacity demands. Drawing lessons from Europe's Single European Sky ATM Research (SESAR) and the United States NextGEN programs, which paved the way for modernizing ATM systems, APAC invests in research and development to synchronize plans and federate resources.

With Asia Pacific hosting many of the world's largest and fastest-growing economies, it has experienced significant economic and aviation growth in recent years. Looking ahead, as the aviation sector rebounds from the global pandemic, the region is poised to exhibit the highest economic growth worldwide over the next two decades. This growth trajectory, propelled by the expanding middle class in several APAC countries, will drive continuous increases in airline passenger volumes, both domestically and internationally. As such, the Asia Pacific region presents lucrative opportunities for the Air Traffic Control (ATC)equipment market, fueled by a commitment to innovation, infrastructure modernization, and sustained economic growth.

The air traffic control (ATC)equipment market is a crucial segment within the aerospace and aviation sector, tasked with ensuring the safe and efficient movement of aircraft in increasingly congested skies. This market encompasses a wide array of technologies and systems aimed at preventing collisions, maintaining orderly traffic flow, and optimizing airspace utilization. Key components of this market include surface movement and surveillance radars, as well as advanced holographic radar systems, which enable air traffic controllers to monitor and manage traffic both in the air and on the ground.

As air transportation continues to experience significant growth projections over the next two decades, the importance of enhancing safety measures and minimizing operational costs becomes paramount. Stakeholders in the industry, including governmental entities and airspace users, are increasingly focused on investing in innovative air traffic management (ATM) solutions to address these challenges. This includes the adoption of cutting-edge air traffic control (ATC)systems, navigation tools, communication networks, and surveillance solutions to improve operational efficiency and mitigate risks.

The evolution of air traffic management is driven by advancements in technology and the need to optimize airspace utilization in the face of escalating flight volumes. Effective ATM not only minimizes the possibility of accidents and incidents but also reduces delays and enhances overall operational performance. Strategic partnerships with leading contractors and suppliers are essential for the development and deployment of state-of-the-art ATM solutions that cater to the evolving needs of the industry.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.26% |

| Market Size in 2025 | USD 11.79 Billion |

| Market Size by 2034 | USD 24.05 Billion |

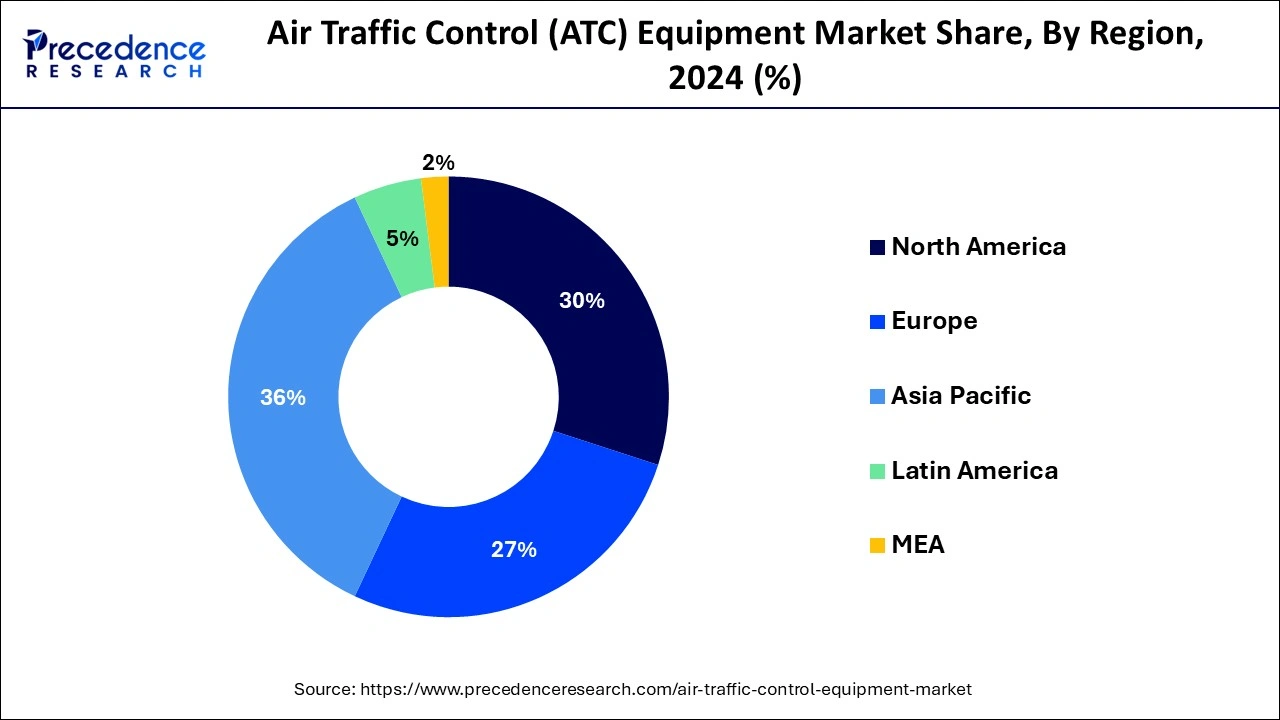

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emergence of FAA forecasts

The Federal Aviation Administration (FAA) anticipates a significant increase in air traffic over the next 10 to 20 years, necessitating a corresponding rise in demand for air traffic control (ATC)(ATC) services. FAA's plans for modernizing and expanding the National Airspace System are built upon the expectation of accommodating continued rapid growth.

Despite past discrepancies between FAA forecasts and actual demand, where projections exceeded real growth by as much as fifty percent, the agency's assumption of unconstrained future growth remains a key driver for the expansion of the Air Traffic Control (ATC)equipment market. This discrepancy underscores the imperative for ongoing investments in advanced ATC facilities and equipment to meet the anticipated surge in air traffic effectively.

Enhanced security and efficiency in airspace utilization

The evolving trend in air traffic management emphasizes the imperative for enhanced security and efficiency in airspace utilization, coupled with heightened control over air threats within it. This necessitates greater interoperability and integration between civilian and military air surveillance, control, and navigation systems.

Suppliers in the Defense and Security field, renowned for their proprietary technology-based solutions tailored for Armed and Security Forces globally, are playing a pivotal role. Their offerings in Surveillance and Air Defense systems are pivotal drivers in the expansion of the air traffic control (ATC) equipment market, facilitating the adoption of advanced solutions to meet the evolving demands of airspace management and security.

Cost pressures and certification requirements

The air traffic control (ATC) industry, characterized by high costs and concentration, faces significant political pressure to reduce operational expenses, particularly to maintain competitiveness among smaller airports. Despite the trend towards centralized remote towers for cost efficiency, the risks and associated costs of cyber and physical attacks are often underestimated, posing substantial challenges. Moreover, stringent FAA certification requirements add to the expense, limiting market growth by elevating barriers to entry and investment in air taffic control (ATC) equipment.

Digital tower technologies

The integration of automation and digital technologies in air traffic control (ATC) and management presents lucrative opportunities for the air traffic control (ATC) equipment market. High-definition (HD) cameras, automatic surveillance-broadcast technology, and remote sensing technologies are driving the development of unmanned or autonomous digital towers.

Technological advancements enable remote centralized air control centers to receive comprehensive views of airfields, enhancing controller awareness and improving operational efficiency, safety, and flexibility. Digital tower technologies also streamline operations, increase productivity through centralized control, and reduce maintenance requirements for systems and equipment. As such, the adoption of these innovative technologies creates a favorable landscape for growth and expansion within the market.

Advanced computing technology

The introduction of advanced high-speed computers and new software heralds a significant opportunity for the air traffic control (ATC) equipment market. These technological advancements empower the ATC system to enhance overall traffic flow management and devise tactical measures ensuring conflict-free, expeditious, and fuel-efficient flight paths for individual aircraft.

The phased replacement of computers, starting from en route ATC centers to terminal areas and culminating in a centralized flow control facility for national air traffic management, promises not only safety and capacity benefits but also a remarkable level of automation in ATC operations. This automation holds the potential to substantially reduce the workforce required to handle future traffic loads, paving the way for increased efficiency and cost-effectiveness in air traffic control (ATC) operations and thus driving growth opportunities within the market.

The communications equipment segment held the largest market share by product. Central to this segment is the communication backbone (CB), a sophisticated network comprising synchronous digital hierarchy rings and microwave links. This network seamlessly interconnects various vital systems, including communication, navigation, surveillance, and air traffic management, ensuring robust and efficient data transmission.

A pivotal component within the communications equipment segment is the voice communication switching system (VCSS), a state-of-the-art computerized voice communication system. VCSS facilitates direct and seamless communication between pilots and Air Traffic Control (ATC) officers, as well as among various Air Traffic Control (ATC) working positions in ATC Centers, ATC Towers, and Rescue Coordination Centers. VCSS ensures clear and reliable communication channels essential for safe air traffic management by leveraging preset aeronautical frequencies, direct communication lines, and telephone connections.

Effective communication is paramount in air traffic control (ATC) for ensuring the safe and efficient movement of air traffic. The communication process involves using standardized phrases, abbreviations, and procedures to enhance clarity and minimize the risk of miscommunication. Proper communication protocols ensure that all parties involved are well-informed of the current situation, enabling prompt and appropriate action to be taken when necessary.

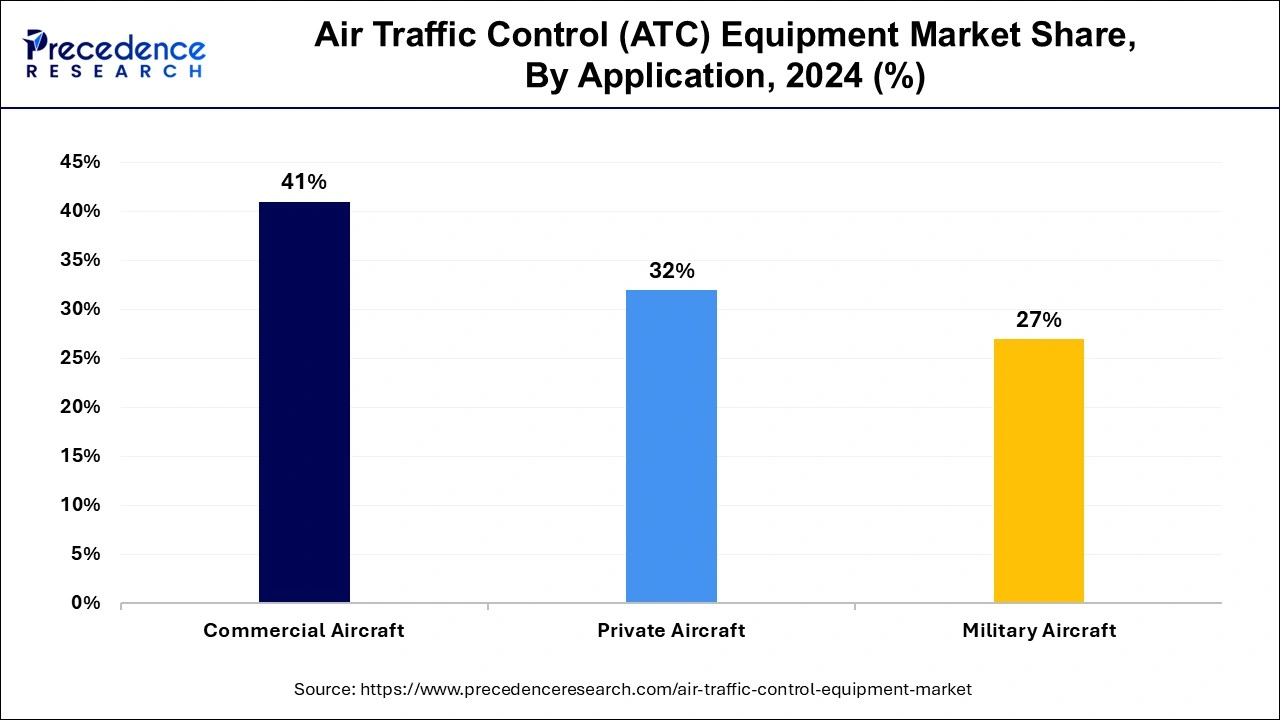

The commercial aircraft segment held the largest share of the air traffic control (ATC) equipment market in 2024. This dominance was fueled by the pivotal role of modern aircraft in global networking and connectivity. These aircraft, characterized by high-speed operations, rely on advanced material selection to ensure safety, reliability, and efficiency. High-speed aircraft typically utilize low-drag, low-lift airfoils, while slower aircraft carrying heavy loads opt for thicker airfoils with high drag and lift.

The modernization of commercial aircraft has significantly contributed to shrinking the world by enabling seamless global connectivity. This transformation is made possible through the utilization of advanced materials in aircraft manufacturing, ensuring optimal performance across a wide range of temperature and force conditions. These materials are selected to withstand extremes of temperature, from high-altitude lows to ground-level ambient temperatures, while also delivering high strength-to-weight and stiffness-to-weight ratios.

Besides commercial aircraft, the military aircraft segment is projected to show the fastest growth during the forecast period. The recent expansion of the industry can be attributed to increased demand for military aircraft and revelatory equipment in response to tense international relationships. This expansion is further supported by government policies and technological advancements. Moreover, the market further benefits from the growing defense sector, especially the naval forces. Another key aspect of the dynamics of this segment is the favorable regulatory support granted to the military. Federal and state policies make it possible for market players to engage in profitable business opportunities, enhancing the growth of the segment and overall market.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025