January 2025

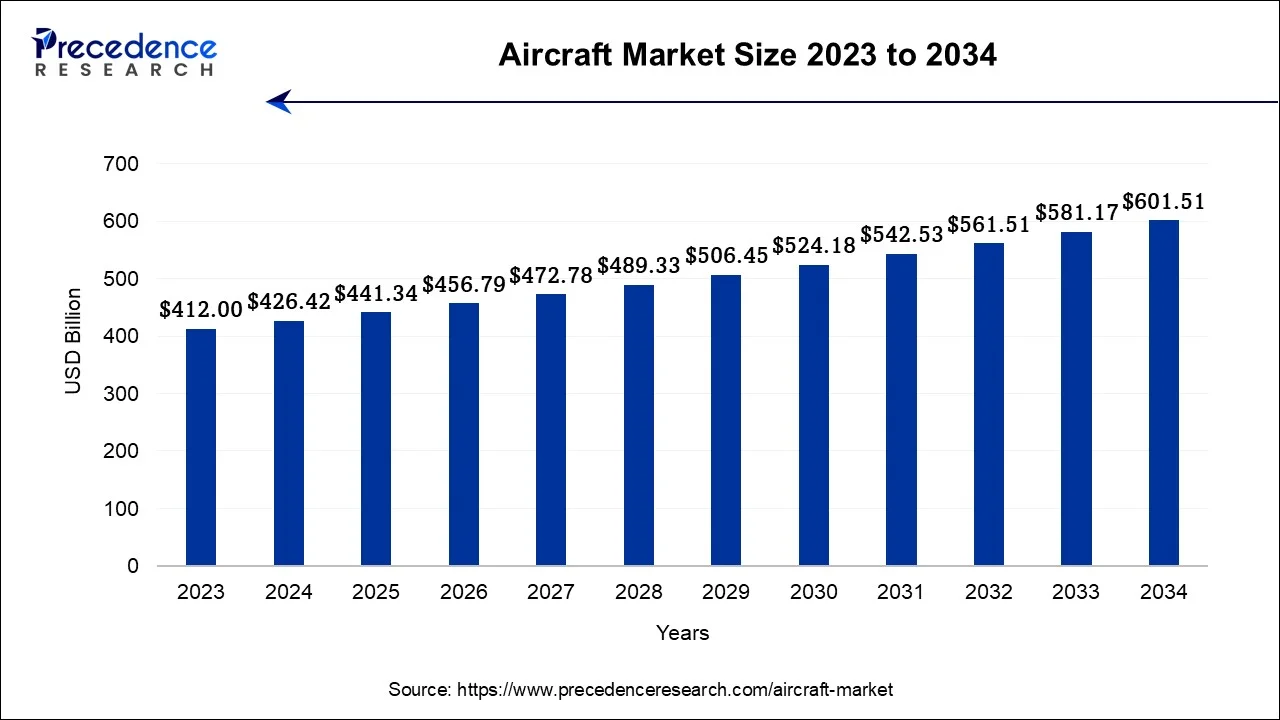

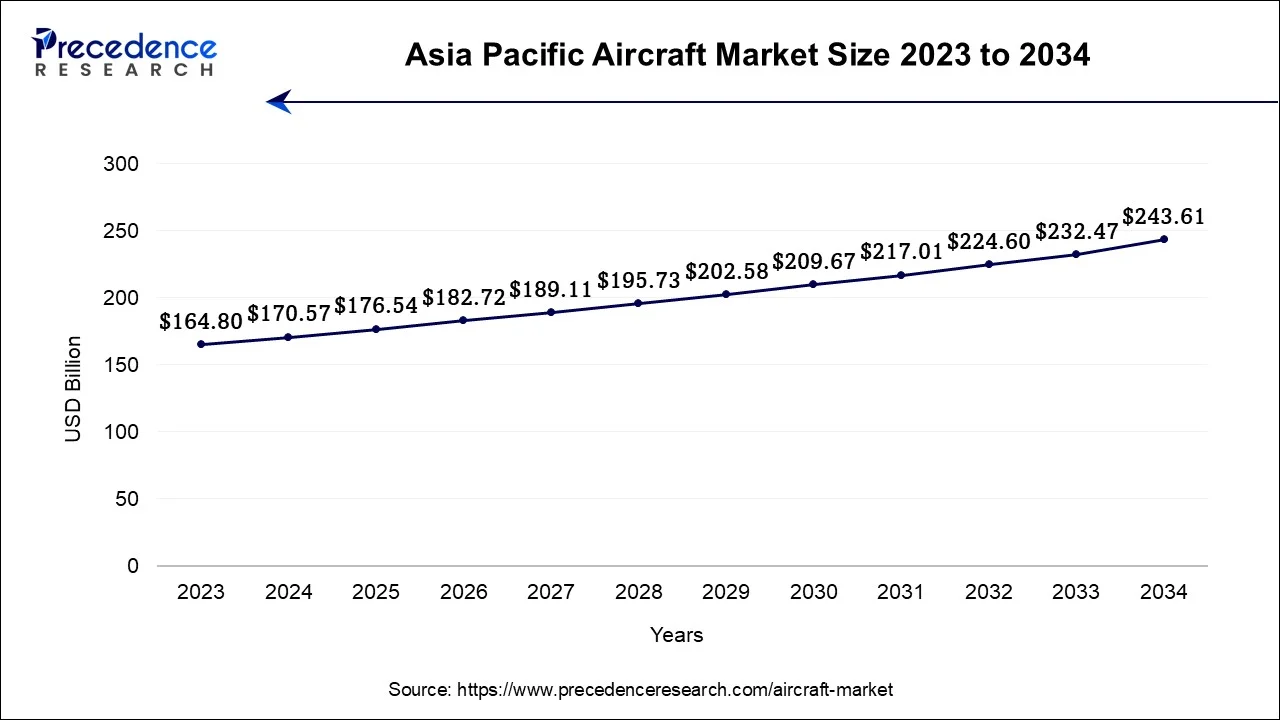

The global aircraft market size accounted for USD 426.42 billion in 2024, grew to USD 441.34 billion in 2025 and is projected to surpass around USD 601.51 billion by 2034, representing a healthy CAGR of 3.50% between 2024 and 2034. The Asia Pacific aircraft market size is worth around USD 170.57 billion in 2024 and is expected to grow at a fastest CAGR of 3.67% during the forecast period.

The global aircraft market size was estimated at USD 426.42 billion in 2024 and is projected to hit around USD 601.51 billion by 2034, growing at a CAGR of 3.50% during the forecast period 2024 to 2034.

The Asia Pacific aircraft market size was exhibited at USD 170.57 billion in 2024 and is estimated to reach around USD 243.61 billion by 2034, expanding at a CAGR of 3.62% from 2024 to 2034.

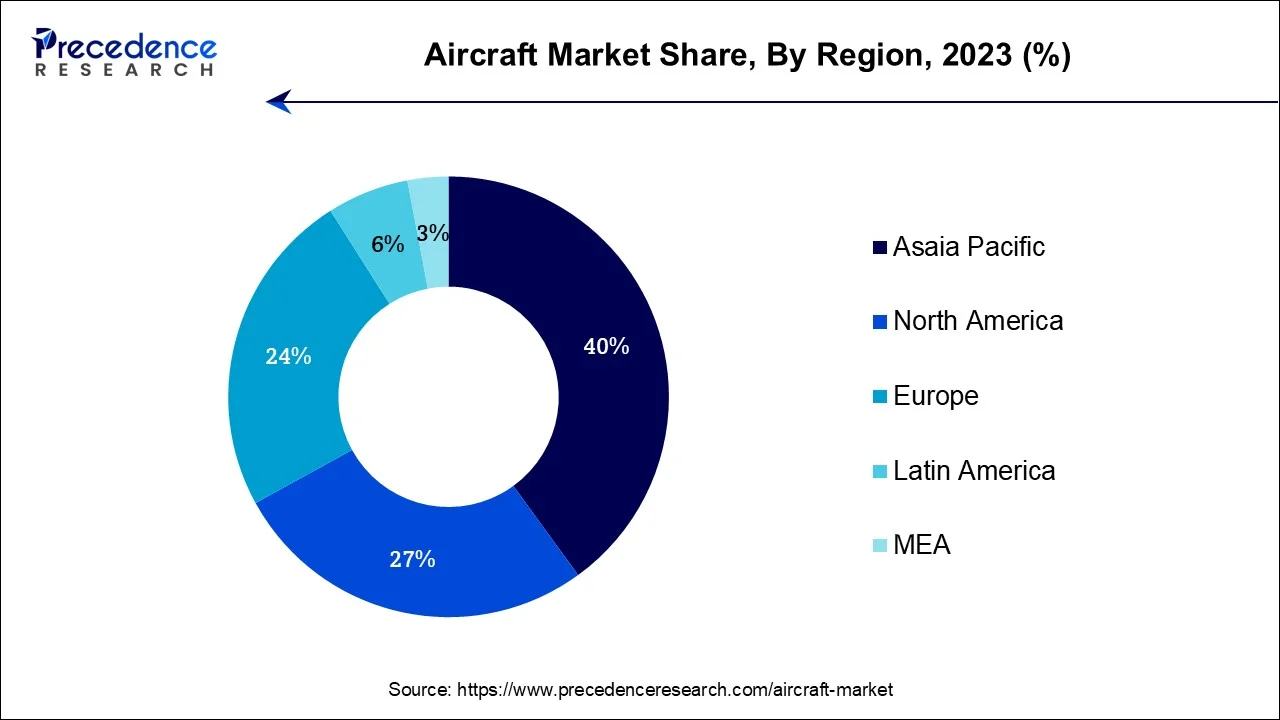

Asia Pacific dominated the aircraft market in 2023, the region is expected to sustain growth at a robust pace throughout the forecast period. The overall increasing rate of air travel among the population is promoting the market’s growth in Asia Pacific. Emerging economies like India, China, and Japan are expected to contribute to the acceleration of the aircraft market in upcoming years. Moreover, the market in Asia Pacific is expected to grow due to the rising disposable income in the population and rising demand for faster commute and transportation. In addition, governments are continuously seeking ways to get faster transportation methods for goods that contribute to the nations’ economies. Thus, all these elements promote the market’s growth in Asia Pacific.

North America is expected to witness significant growth in the market during the forecast period. The growth of the market in the region is expected to be accelerated due to the growing air defense of the nations such as the United States and Canada, the overall increased demand for aircraft and other associated services from the military and defense sector promotes the market’s expansion. In North America the United States holds the largest aviation market. The Unites States is home for the top ten major market players of the aircraft market. Technological innovations by the country’s top players create a significant potential for the market for the predicted period.

The global aircraft market refers to the industry involved in the manufacturing, buying and selling of aircraft. Airplanes, helicopters and drones along with other flying vehicles are included in the industry. The market encompasses sectors such as commercial aviation, military aviation and general aviation. The aircraft industry is one of the commercially expanding industries. The aircraft industry is categorized into commercial, defense, and general aviation. There are some of the main components which are in the aircraft such as wings, fuselage, power plant, tail or empennage, and landing gear or undercarriage.

Faster transportation and luxurious transportation have been offered by the aircraft industry. Rising demand for general aviation for internal defense and for emergency healthcare services promotes the market’s growth. driving the growth of the market. Moreover, key players in the market are focusing on the adoption of technological advancements, the element is expected to accelerate the market’s expansion in the upcoming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 601.51 Billion |

| Market Size in 2024 | USD 426.42 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.50% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The only form of freight that can cover great distances quickly is air as compared to other forms of transportation. This element makes the aircraft model the best option for clients who need to export a product urgently or whose freight requires exceptional standards of protection or acclimatization. Since it is the quickest means of transportation, it is excellent for long-distance cargo shipping. Convenient, dependable, and quick transportation services are provided by air travel. It is regarded as the most affordable method of shipping goods internationally. Moreover, as businesses and people seek a regular, practical, trustworthy, and quick service for transportation, the market for aircraft and other associated services is expected to be accelerated.

Cost of the fuel is one of the major restraining factors of the aircraft industry. The continuously fluctuating rates of fuel across the globe directly impact on the financial portfolio of the industry. The increase in the fuel of aircraft is directly impacting the financial portfolio of the aircraft industry. Such varying expenses can lead to decreased operations and reduced adoption of aircraft, especially in economically weaker countries. Thus, the factor is observed to restrain the market’s growth.

There are several different types of aircraft that have been electrified recently, either totally or partially. There are various forms of electrification, such as transforming totally to an electric form of aircraft or in a hybrid way. The idea of electrification makes use of electric power for all non-propulsive systems in order to increase the effectiveness of present operations or systems or decrease the workload placed on the engine through aircraft or operational modification. Examples include making the most of the available ground space, using crewed electric tugs or pilot-controlled, guidable tugs for low-speed taxis, and using on-vehicle wheel motors. The advantages of electrification are observed to increase the emphasis on electrification by manufacturers. This advancement is expected to offer the potential for the market to expand.

The commercial aircraft segment dominated the global aircraft market in 2022. The commercial aircraft segment is further divided into passenger aircraft and freighter. The increasing population and rising demand for faster commutes in the population is anticipated to drive the growth of the commercial segment. Rising production of commercial aircraft such as Boeing and Airbus due to the rising passenger demand is observed to be another growth factor for the segment.

The military aircraft segment is expected to grow at a significant rate during the forecast period. For the betterment of defense services, military and defense sectors of multiple countries are focused on adoption of advanced and stronger aircraft. The military aircraft segment is sub-divided into combat aircraft and non-combat aircraft. The growing demand for combat aircraft for the strong defense service and the technological advancement in the combat aircraft are driving the growth of the military aircraft segment.

The narrow-body aircraft segment led the market with dominating share in 2022. The dominance of the segment in the market is attributed to its size and substantial preference in the commercial aviation industry. The simple structure of manufacturing and production for narrow-body aircraft promotes the adoption of such aircraft. Narrow-body aircraft are slightly smaller, have lesser capacity of passenger and have one aisle in the aircraft. The rising rate of adoption for narrow body aircraft can be attributed to the rising demand for domestic transportation for short distances.

The wide-body aircraft segment is expected to grow significantly throughout the forecast period. The rising utilization of wide-body aircraft for international flights and long-distance travel promotes the segment’s growth. The wide-body aircraft has multiple aisle and a larger capacity for passengers.

Segments Covered in the Report

By Type

By Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025