October 2024

The global air transport MRO market size is calculated at USD 86.46 billion in 2024, grew to USD 90.96 billion in 2025, and is predicted to hit around USD 143.55 billion by 2034, poised to grow at a CAGR of 5.2% between 2024 and 2034. The Asia Pacific air transport MRO market size accounted for USD 29.40 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.4% during the forecast year.

The global air transport MRO market size is expected to be valued at USD 86.46 billion in 2024 and is anticipated to reach around USD 143.55 billion by 2034, expanding at a CAGR of 5.2% over the forecast period from 2024 to 2034.

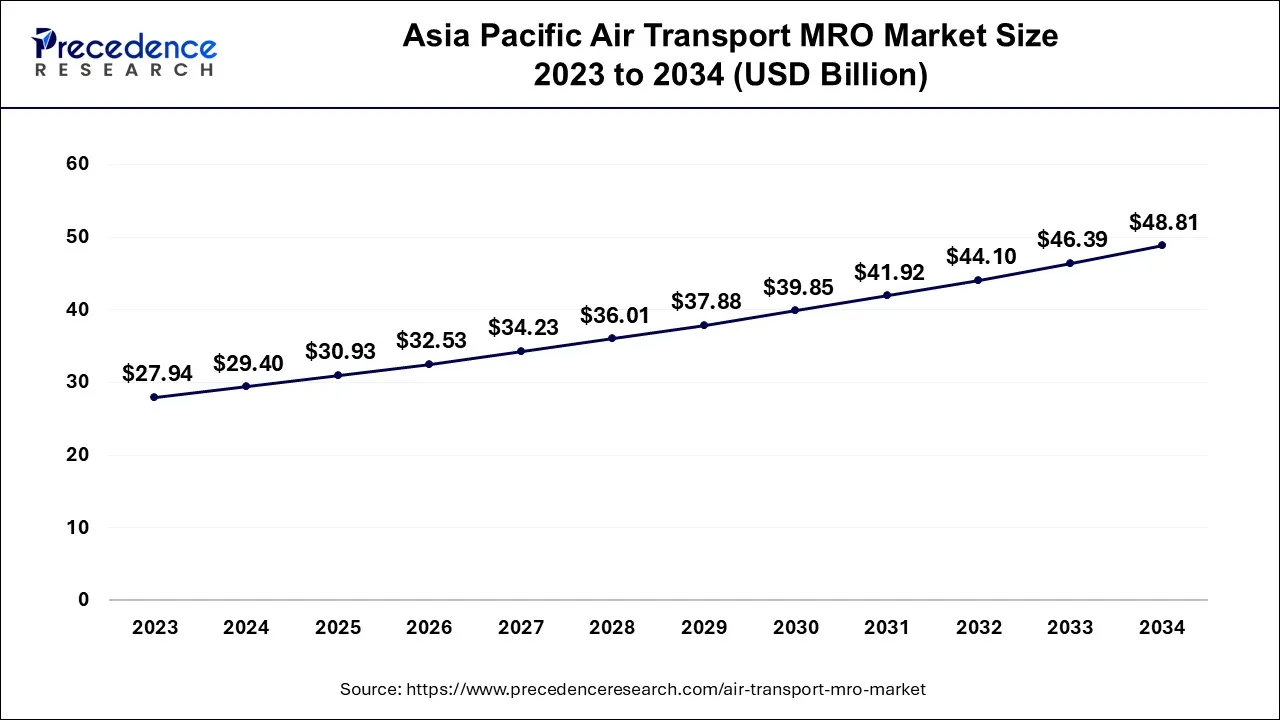

The Asia Pacific air transport MRO market size is accounted for USD 29.40 billion in 2024 and is projected to be worth around USD 48.81 billion by 2034, poised to grow at a CAGR of 5.4% from 2024 to 2034.

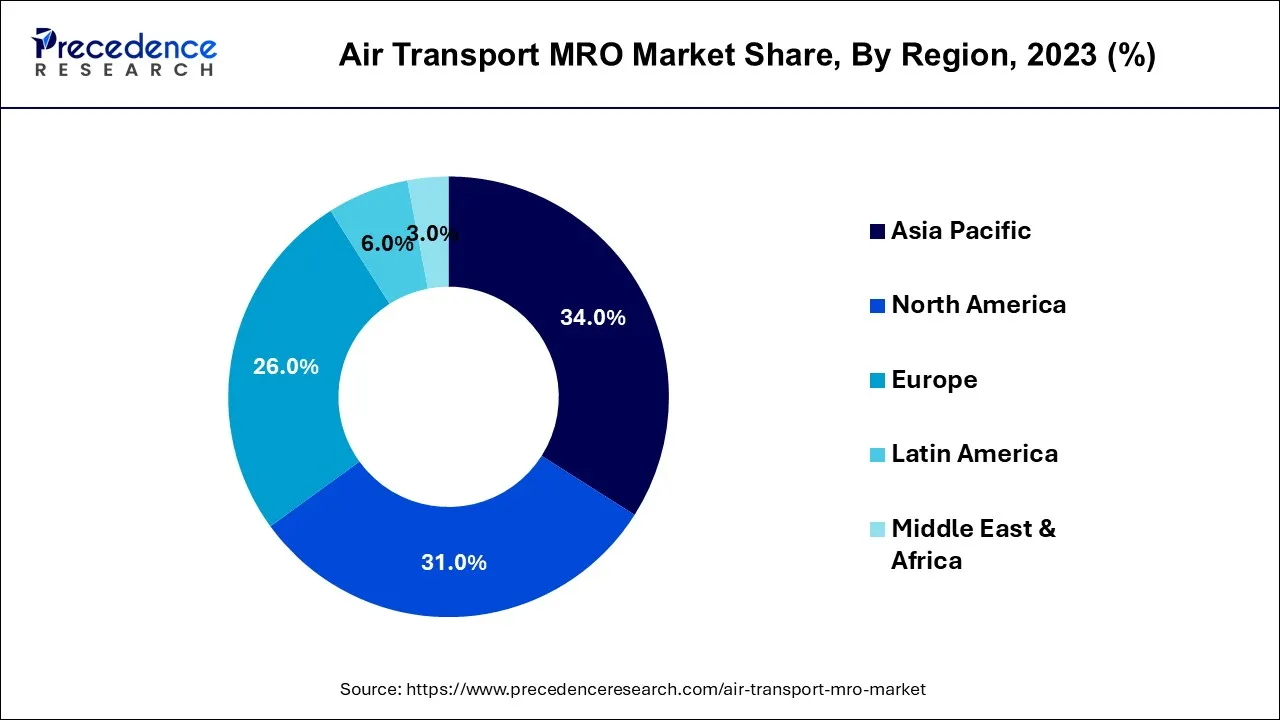

Asia Pacific has held the largest revenue share of 34% in 2023. Asia Pacific dominates the air transport MRO market due to the rapid expansion of the aviation industry, increasing air travel demand, and a growing fleet of aircraft. Countries like China and India have witnessed substantial economic growth, driving investments in aviation infrastructure and MRO services. Additionally, the region's strategic location as a global transportation hub further boosts its prominence in the air transport MRO market, attracting significant business from both domestic and international airlines seeking high-quality maintenance services for their expanding fleets.

North America is estimated to observe the fastest expansion. North America dominates the air transport MRO market due to a robust aviation industry, a large and diverse fleet of commercial aircraft, and significant technological advancements. The region hosts major MRO providers, OEMs, and a well-established infrastructure supporting aviation maintenance. Moreover, stringent safety regulations and a high level of awareness regarding the importance of regular maintenance contribute to a strong foothold. The presence of leading airlines, favorable government policies, and a focus on innovation position North America as a key hub for air transport MRO activities.

Air transport MRO, or maintenance, repair, and overhaul, is a critical sector within the aviation industry dedicated to ensuring the safety and operational efficiency of aircraft. It encompasses a wide range of activities, including routine inspections, scheduled maintenance, repairs, and the overhaul of aircraft components. MRO services are essential for prolonging the lifespan of aircraft, complying with safety regulations, and minimizing operational disruptions.

These services involve highly skilled technicians and engineers who perform intricate tasks such as engine overhauls, avionics upgrades, and structural repairs. The Air Transport MRO industry plays a pivotal role in aviation safety and the overall reliability of air travel. With advancements in technology and the increasing complexity of modern aircraft, MRO providers continually adapt to new challenges, incorporating innovative solutions and digital tools to enhance efficiency and maintain the highest standards of safety and reliability in the global aviation network.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.20% |

| Market Size in 2024 | USD 86.46 Billion |

| Market Size by 2034 | USD 143.55 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service Type, By Organization Type, and By Aircraft Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data-driven maintenance and digitalization of records

Data-driven maintenance and digitalization of records play pivotal roles in surging the demand for the air transport MRO market. The integration of data analytics and predictive maintenance techniques enhances operational efficiency by providing real-time insights into aircraft performance and component health. Airlines can proactively address potential issues, minimizing downtime and optimizing maintenance schedules.

Digitalization of records streamlines documentation processes, replacing traditional paper-based systems with electronic databases. This not only improves accessibility and accuracy but also facilitates quicker decision-making and compliance with regulatory standards. Airlines and MRO providers adopting these technologies experience cost savings, reduced paperwork, and enhanced overall productivity, driving a heightened demand for MRO services. As the industry embraces these advancements, the air transport MRO market is propelled forward, meeting the evolving needs of a technologically driven aviation landscape.

Price volatility

The air transport MRO market faces significant constraints due to a skilled labor shortage and the cyclical nature of the aviation industry. The shortage of highly skilled and specialized technicians and engineers hampers the MRO sector's ability to meet the increasing demand for maintenance services. This scarcity not only limits capacity but also intensifies competition for skilled labor, potentially driving up labor costs. Moreover, the cyclical nature of the aviation industry introduces uncertainties, as economic downturns and fluctuations in air travel demand directly impact airline budgets.

During periods of reduced economic activity, airlines may cut back on MRO spending, affecting the overall market growth. The interplay of these factors highlights the challenges MRO providers face in maintaining a skilled workforce and navigating the industry's susceptibility to economic cycles, underscoring the need for strategic planning and flexibility within the air transport MRO market.

Globalization of MRO services and military aviation MRO

The globalization of MRO services and the expansion of military aviation MRO present significant opportunities in the air transport MRO market. The trend towards outsourcing MRO services globally allows providers to access new markets, diversify their customer base, and collaborate with international partners. This globalization fosters knowledge exchange and enables MRO providers to offer specialized services tailored to the unique needs of different regions.

Simultaneously, the increasing defense budgets globally open avenues for MRO providers to tap into the military aviation MRO sector. Offering maintenance and support services for military aircraft provides diversification and stability for MRO businesses. The expertise gained in military aviation MRO can also contribute to innovation and improved capabilities, creating a dual benefit for MRO providers. Embracing these opportunities requires strategic planning and adaptability to meet the specific demands of different markets and capitalize on the growth potential in both globalized MRO services and military aviation maintenance.

In 2023, the engine overhaul segment had the highest market share of 41% based on the service type. Engine overhaul, a crucial segment in the air transport MRO market, involves comprehensive restoration and maintenance of aircraft engines. This service addresses wear and tear, enhancing engine performance and longevity. The trend in engine overhaul reflects a shift toward predictive maintenance using advanced analytics and data-driven insights.

Airlines increasingly prioritize proactive engine maintenance, reducing unscheduled downtime and optimizing operational efficiency. As technology evolves, the engine overhaul segment is witnessing a transition from traditional scheduled maintenance to more cost-effective and predictive approaches, ensuring a seamless and reliable air transport experience.

The component segment is anticipated to expand at a significant CAGR of 6.3% during the projected period. In the air transport MRO market, the component segment refers to the maintenance and repair of individual aircraft components such as avionics, landing gear, engines, and other essential parts.

Trends in this segment include a growing emphasis on predictive maintenance using data analytics, advancements in component technologies, and an increasing demand for eco-friendly upgrades. MRO providers specializing in components are adapting to these trends, offering innovative solutions to enhance reliability, reduce downtime, and meet the evolving needs of the modern aviation industry.

According to the organization type, the independent MRO segment has held 52% revenue share in 2023. The independent MRO segment in the air transport MRO market refers to standalone Maintenance, Repair, and Overhaul providers that operate independently of aircraft manufacturers or airlines. These organizations specialize in offering third-party MRO services, catering to a diverse range of aircraft from various manufacturers. A notable trend in this segment involves a growing preference among airlines for independent MRO providers due to competitive pricing, specialized expertise, and flexibility, driving the expansion of the independent MRO market as a crucial player in the aviation maintenance ecosystem.

The OEMs segment is anticipated to expand fastest over the projected period. Original Equipment Manufacturers (OEMs) in the air transport MRO market refer to companies responsible for manufacturing and supplying aircraft and their components. In recent trends, OEMs are expanding their presence in the MRO sector, offering integrated solutions and services throughout an aircraft's lifecycle. This shift towards comprehensive support services by OEMs reflects a strategic approach to customer engagement, providing airlines with one-stop solutions for maintenance, repair, and overhaul needs, thereby streamlining operations and fostering long-term partnerships.

In 2023, the narrow body segment had the highest market share of 55% based on the aircraft type. The narrow-body segment in the air transport MRO market refers to single-aisle commercial aircraft with a fuselage width typically accommodating one row of seats on each side. This category includes popular models like the Boeing 737 and Airbus A320.

In recent trends, the narrow-body segment has seen significant growth due to its operational efficiency, fuel economy, and adaptability to diverse routes. MRO providers catering to narrow-body aircraft benefit from increased demand for maintenance services, driven by the expanding fleets and versatility of these aircraft in the aviation industry.

The wide-body segment is anticipated to expand fastest over the projected period. In the air transport MRO market, the wide-body segment refers to large, twin-aisle aircraft designed for long-haul flights. These aircraft, including models like the Boeing 777 and Airbus A350, present unique maintenance challenges due to their size and complex systems. Current trends in wide-body air transport MRO involve a focus on advanced technologies such as predictive maintenance, data analytics, and digitalization. MRO providers are leveraging these tools to enhance operational efficiency, reduce downtime, and meet the evolving needs of airlines operating long-range, wide-body fleets in the global aviation landscape.

Segments Covered in the Report

By Service Type

By Organization Type

By Aircraft Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

May 2024