October 2024

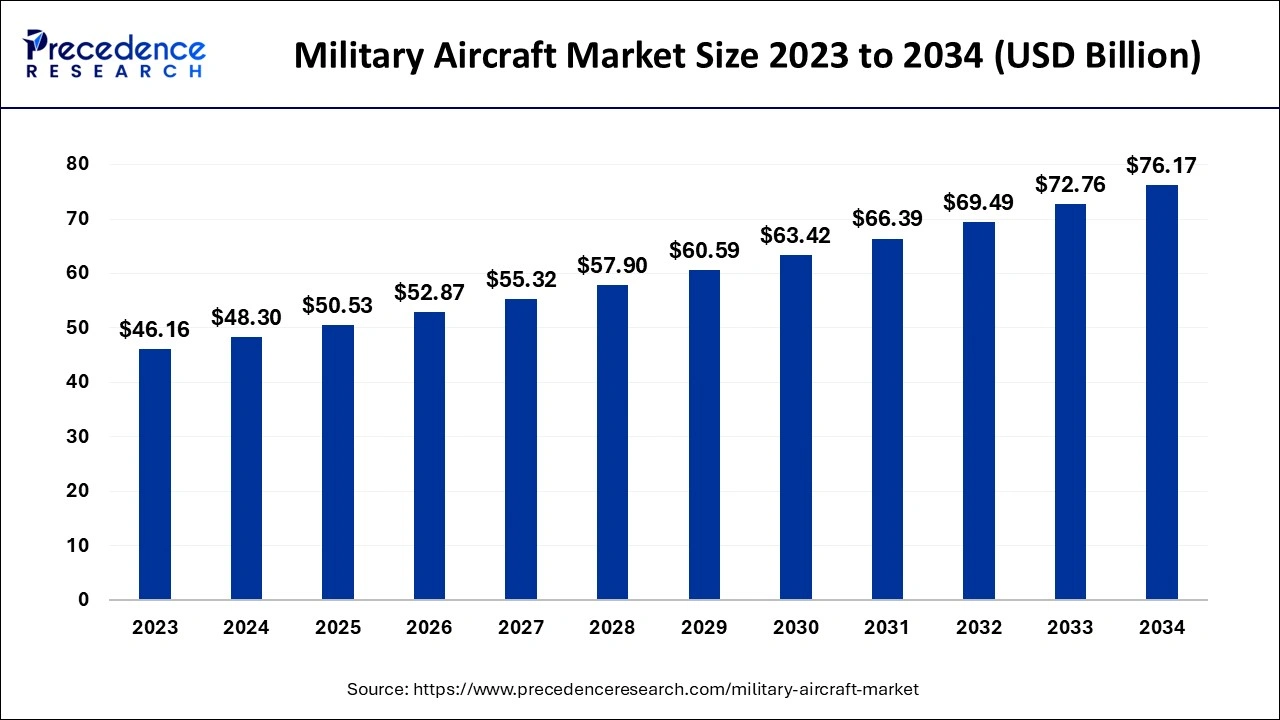

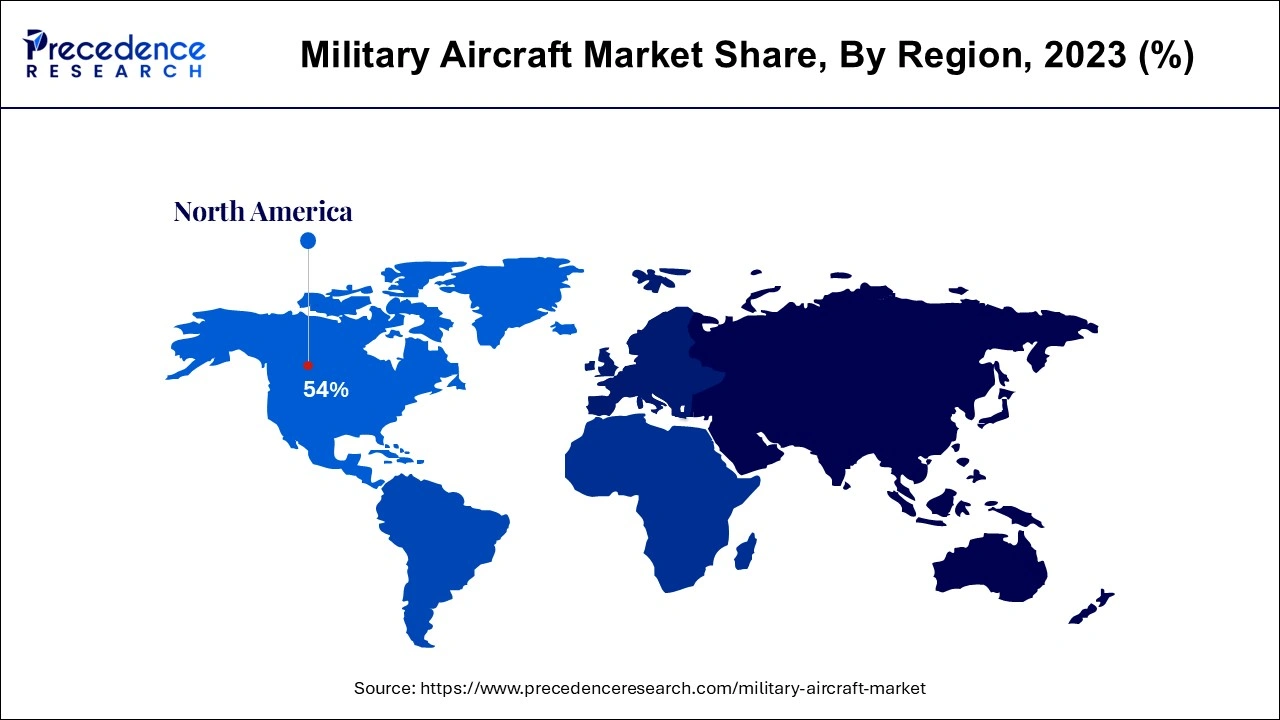

The global military aircraft market size accounted for USD 48.30 billion in 2024, grew to USD 50.53 billion in 2025 and is projected to surpass around USD 76.17 billion by 2034, representing a CAGR of 4.66% between 2024 and 2034. The North America military aircraft market size is calculated at USD 26.08 billion in 2024 and is expected to grow at a CAGR of 4.75% during the forecast year.

The global military aircraft market size is worth around USD 48.30 billion in 2024 and is predicted to hit around USD 76.17 billion by 2034, growing at a CAGR of 4.66% from 2024 to 2034. The military aircraft is essential to maintain an air superiority of the battlespace. Additionally, the transportation of goods and supplies to war zones or providing air support during battle is creating an impact on the military aircraft market.

Integration of artificial intelligence is transforming the military aircraft market with machines and technology that obtain the ability to predict and make decisions equivalent to humans. The AI system and technology are used in various industries including the United States Air Force. Currently, Air For has 44 active AI projects such as Advanced Battle Management System (ABMS) which helps with decision-making processes for combat operations. AI is proving itself to be undeniably beneficial in the Air Force and United States Military. AI has the potential to enhance the core mission which includes air superiority, intelligence, surveillance and reconnaissance, rapid global mobility, command and control, and global strike.

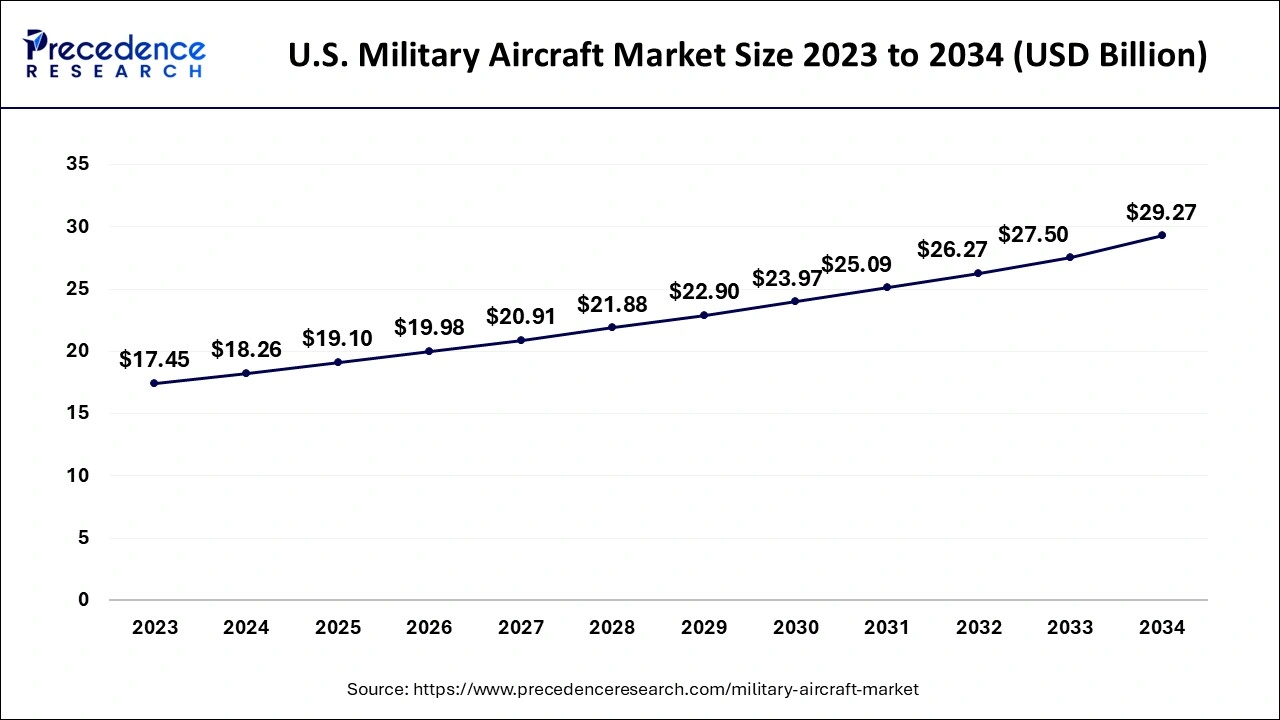

The U.S. military aircraft market size is evaluated at USD 18.26 billion in 2024 and is expected to exceed around USD 29.27 billion by 2034, growing at a CAGR of 4.81% from 2024 to 2034.

North America dominated the global military aircraft market in 2023 due to the largest air force in the world. The modernization of aircraft is extensively noticed in the transportation industry and military operations. The United States holds the largest number of military aircraft in the world is 5,213 active aircraft. The advancement in technology and the established air fleet globally are the primary factors in the growth of this region. Combine all the military departments in the United States- Navy, Army, and Marine Corps bringing to a total of 13,300 aircraft. This is the largest combined air fleet compared to Russia and China.

Europe is anticipated to grow at the fastest CAGR in the military aircraft market during the forecast period. The presence of key players in this region is driving the growth. Europe has great manufacturers of aircraft which include fighter jets, transport aircraft, and helicopters. Some well-known aircraft are controlled by Europe such as Eurofighter Typhoon, Rafale, JAS Gripen, and Airbus A400M. Europe comprises more than 11,000 military aircraft stations. The growth is experienced to improve efficiency, increase capacity, enhance aviation safety, diminish environmental impact, and reduce the cost of air navigation services.

Military aircraft are combat aircraft that help strengthen global security, protect citizens, and deliver aid in times of crisis. They have a broad range of categories which includes fighter, bomber, maritime, attackers, unmanned aircraft, electronic warfare, and multirole. Armed forces rely on military aircraft to accomplish their mission, constantly. All aircraft have a grey form to create a visual camouflage, painting the aircraft in grey color helps it blend into the sky and eventually the horizon. With the growing need for military aviation, it is expected to witness the next generation of military technology which includes uninhabited aerial systems. UAS is expected to take over all the roles of striking, air defense, aerial fuelling, air delivery, and many more.

| Report Coverage | Details |

| Market Size by 2034 | USD 76.17 Billion |

| Market Size in 2024 | USD 48.30 Billion |

| Market Size in 2025 | USD 50.53 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.66% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, System, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Adoption of modern military aircraft

It is essential to adapt to modern military aircraft with time and with growing technology and advancements. The modern aircraft are safer, smarter, and more accurate compared to the older models. The technologically advanced military aircraft market products are more efficient and quicker. Modern aircraft include computer-based systems that are incorporated with artificial intelligence and deep learning to provide better battlefield insights. The new aircraft ensures the pilot's safety as it consists of a combination of features such as a synthetic vision system on the head-up display and the weather scan radar which offers improved surrounding awareness. Additionally, the newer planes have less maintenance.

Cyber threat

The growing cyber threats in defense and aerospace products and systems are simultaneously increasing with digitalization and connectivity. Cybersecurity is an important component in the development of any aerospace manufacturing company. This issue has been given special attention for settlement. During the past few years, the companies have developed its cybersecurity capabilities and expertise, ensuring optimal protection for its products, operations, customers, and ecosystems.

The future of combat air system

The sovereignty of nations for defense and security is the advanced future of the military aircraft market. The next-generation weapon system (NGWS) is emphasizing its work towards unmanned remote carriers which will be connected to other systems in space, in the sea, ground, and in cyberspace through a data cloud known as the combat cloud. The connected platforms will perform as sensors, effectors, and C2 nodes which will offer decision-making and team working within an open, scalable, service-oriented infrastructure for the inclusion of future streamlining and technologies. Various nations and allied platforms are adopting NGWS in a collaborative strategy involving their individual capabilities.

The fixed-wing segment contributed the highest share of the military aircraft market in 2023. The dominance of this segment is observed due to its popularity in the aviation industry for transportation, military, and leisure purposes. This fixed-wing aircraft has a stationary wing that generates the lifting, the wing does not move. However, a fixed-wing provides a lot more control and stability. The application is noticed from commercial airline usage to private planes. Moreover, it offers greater aerodynamic efficiency and range than rotary-wing aircraft.

The rotary wing segment is projected to witness the fastest growth in the military aircraft market during the forecast period. The expansion of this segment is noticed due to its ability to fly vertically, take off and land in a narrow space, and hover in a fixed positive at any given height. The mechanics of rotary wings aircraft uses is the rotating airfoil. It is commonly used in helicopters, gyroplanes, and unmanned aerial vehicles. The lifting and propulsion in a rotorcraft are achieved through the rotating wings or rotor blades which are absent in fixed wings.

The engine segment contributed the highest share of the military aircraft market in 2023. The dominance of this segment is observed due to its high-efficiency performance. The engine helps the pilot to control and monitor the operation of the aircraft. Commercial aviation engines help to propel aircraft to high altitudes, at great speed, and ensure fuel efficacy and safe air travel. Commercial aviation incorporates engines with advanced jets, reliable turboprops, and engine technology that provides optimal performance and a great flying experience.

The avionic segment is anticipated to grow at the fastest CAGR in the military aircraft market from 2024 to 2034. The growth of this segment can be credited to the communication, navigation, display, and management of multiple systems it offers. Avionics combines electronic systems and equipment designed for aviation. At present, commercial airliners, helicopters, military fighter jets, unmanned aerial vehicles (UAV), business jets, and spacecraft all consist of avionics to provide services, carry out missions, make discoveries, track, and report performance measures, and operate with consideration of safety parameters.

The multirole transport segment captured the biggest share of the military aircraft market in 2023. The dominance of this segment is attributed to the significant advancement in design, technology, combat capabilities, and mission readiness. Multirole fighter aircraft is an ideal fit for a surveillance task and a low-level reconnaissance mission. Some great multirole combat fighters available are Saab JAS 39 Gripen, Boeing F/A -18 Super Hornet, Eurofighter Typhoon, Dassault Rafale, and Lockheed Martin F-35 Lightning II. Multirole aircraft are highly accepted due to their multiple-task performance and deployment of various systems.

The reconnaissance & surveillance segment is anticipated to grow at a notable CAGR in the military aircraft market during the forecast period. The application of intelligence, surveillance, and reconnaissance is most noticed in UAS or unmanned aerial vehicles (UAVs). ISR is important in military operations. It offers signals intelligence systems for specific missions such as maritime patrol aircraft or intelligence aircraft. The increasing multi-domain operation in the defense sector and growing threats from symmetric warfare are greatly driving the growth of this segment.

By Type

By Application

By System

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

October 2024