January 2025

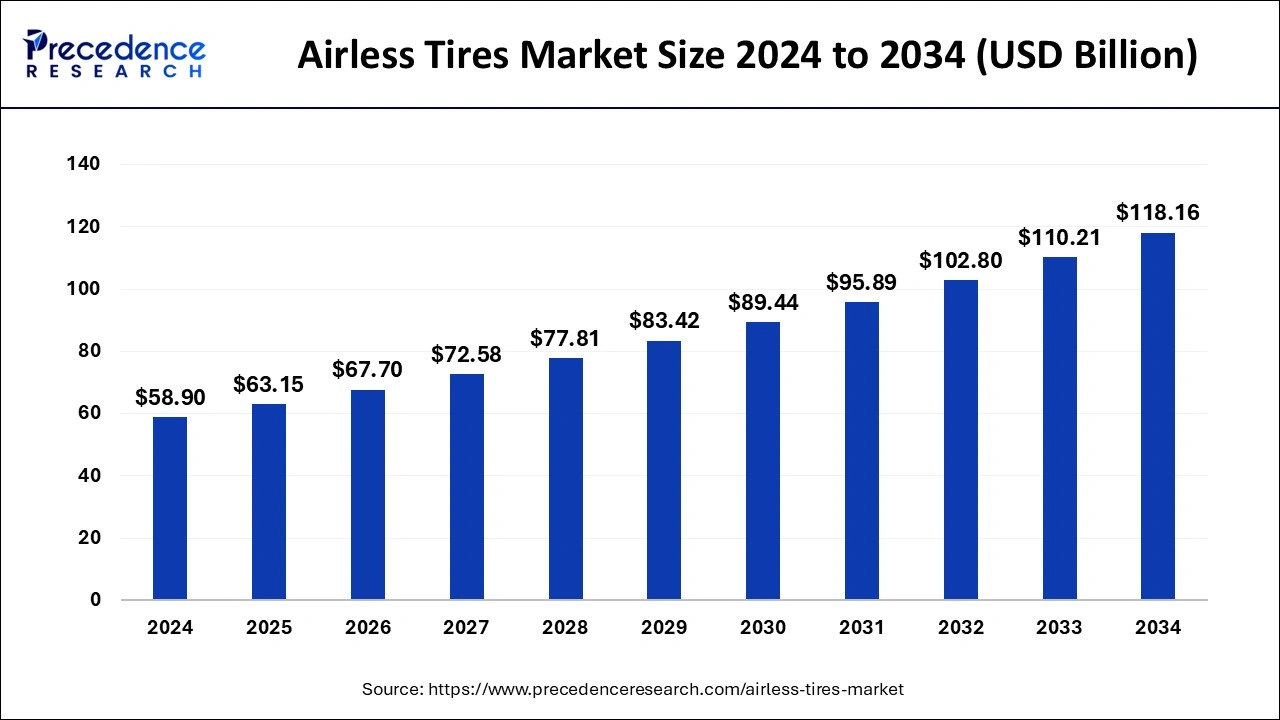

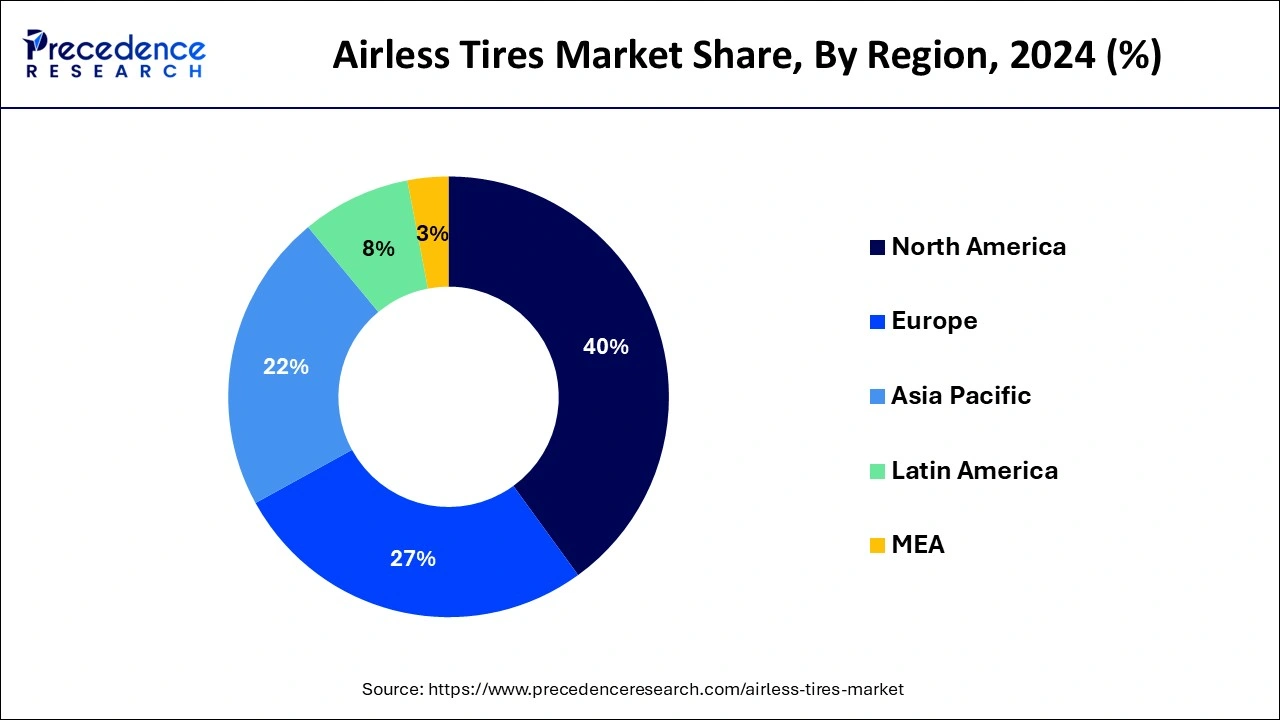

The global airless tires market size is calculated at USD 63.15 billion in 2025 and is forecasted to reach around USD 118.16 billion by 2034, accelerating at a CAGR of 7.21% from 2025 to 2034. The North America airless tires market size surpassed USD 23.56 billion in 2024 and is expanding at a CAGR of 7.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global airless tires market size was estimated at USD 58.90 billion in 2024 and is anticipated to reach around USD 118.16 billion by 2034, expanding at a CAGR of 7.21% from 2025 to 2034. Factors such as an increase in the number of heavy commercial vehicles, rising demand for airless tires in the aftermarket from passenger vehicles, and increasing demand for all-terrain and military vehicles are expected to drive the growth of the airless tires market during the forecast period.

With millions of vehicles around the world relying on tires for their optimum performance, the tire industry plays a crucial role in ensuring efficient and safe transport. In this digital era, the integration of artificial intelligence (AI) is shaping the future of the tire industry and will undoubtedly be indispensable. Tire quality control is of utmost importance. AI has the potential to enhance research and development processes, tire inspections, and real-life tire judgment. By harnessing the power of machine learning (ML) algorithms and big data analytics, Artificial intelligence allows tire manufacturers to achieve higher levels of efficiency, accuracy, and reliability in quality control. Tire quality control plays the most crucial role in the tire manufacturing process. The quality control assists in preventing defective tires from reaching consumers and also contributes to the overall durability and reliability of tires. With AI integration, the tire industry is constantly focusing on improving its quality control processes to deliver the highest-quality products that meet the ongoing demand of consumers. Therefore, leveraging artificial intelligence into tire quality control holds the promising potential to significantly transform the tire industry which leads to reliable, safer, and more sustainable tires.

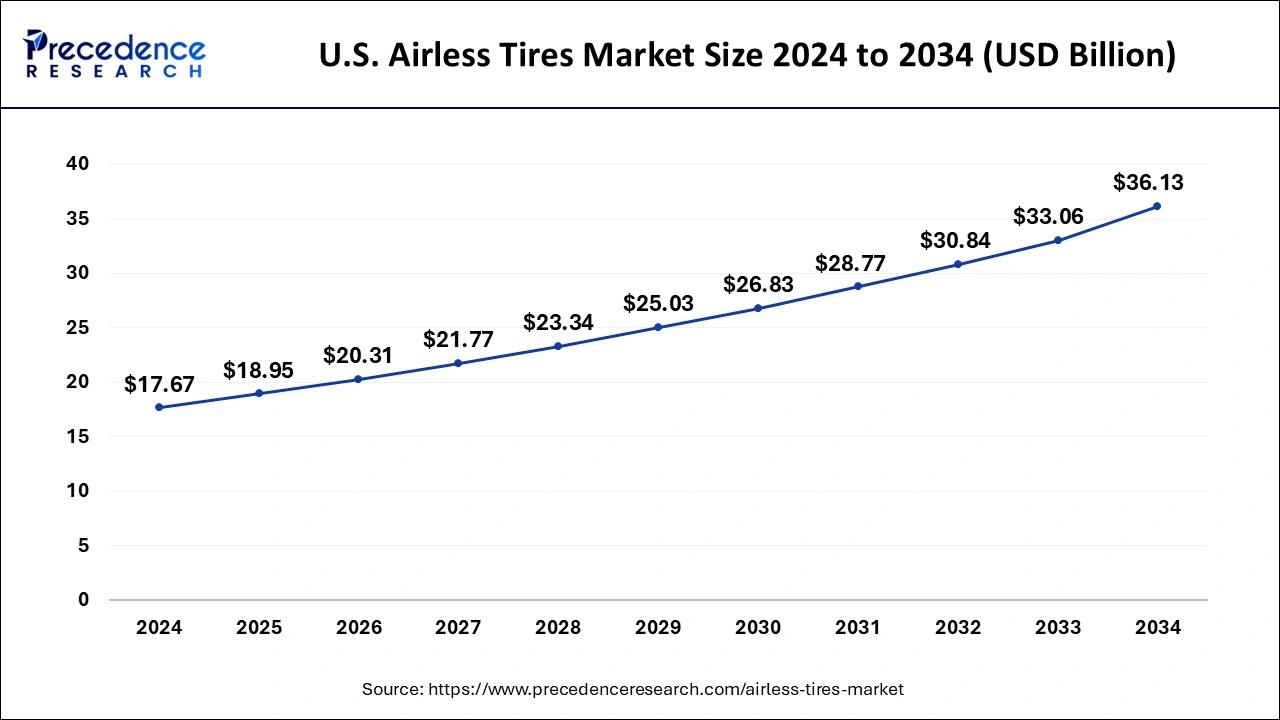

The U.S. airless tires market size was evaluated at USD 17.67 billion in 2024 and is predicted to be worth around USD 36.13 billion by 2034, rising at a CAGR of 7.41% from 2025 to 2034.

Based on the region, the dominated the global airless tires market with the largest market share of 40% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The increasing use of airless tires in military, terrain, and utility vehicles, as well as market players’ ongoing focus on delivering products for military and defense purposes, are expected to propel North America to the top of the market during the forecast period.

The Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. Asia-Pacific is expected to have considerable growth, which can be due to the presence of manufacturers, easy availability of raw materials, and increased vehicle ownership in the Asia-Pacific region.

| Report Coverage | Details |

| Market Size in 2025 | USD 63.15 Billion |

| Market Size by 2034 | USD 118.16 Billion |

| Growth Rate from 2025 to 2034 | 7.21% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Vehicle Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Increasing demand for airless tires

The rising demand for airless tires is expected to drive the growth of the airless tires market during the forecast period. As automakers are focusing on enhanced sustainability, the benefits of airless, puncture-less tread are becoming increasingly popular owing to its reduced waste and optimized fuel economy. Airless tires are usually made of plastic or rubber. These tires minimize accidents caused by flat tires and blowouts, as well as ensure passenger safety. These tires offer the additional advantage of puncture resistance and support extreme off-roading conditions. Furthermore, the airless tires market is likely to be driven by an increase in the number of heavy commercial vehicles, such as heavy construction equipment and heavy-duty trucks, as a result of globalization and urbanization. Additionally, the growing demand for all-terrain and mobility vehicles including UTVs, ATVs, and military vehicles, accelerates the growth of the airless tires market.

High Capital Investment

The high capital investment systems are projected to hamper the growth of global airless tires during the forecast period. The substantial capital investment required to establish new manufacturing facilities, as well as the volatility of raw material costs, may limit the airless tire market expansion. The solid tire performance in terms of suspension and friction, as well as heat dissipation difficulties, may hinder the airless tire market expansion. Such factors are likely to limit the expansion of the market during the forecast period.

Rising adoption of agricultural machinery

The rising adoption of agricultural machinery is projected to lucrative growth opportunities for the airless tire market. The increased demand for agricultural machinery has led to governments’ increased focus on the agricultural sector around the world, resulting in increased manufacturing of airless tires. The manufacturers are working on employing frequent technology developments to overcome the issues connected with these tires, such as noise and vibration. These factors are fueling the expansion of the market in the coming years.

The radial tires segment accounted largest revenue share in 2024. The radial tires are made up of a number of cords that go from the beads to the tread. This permits the cords to be set at almost right angles to the tread’s centerline and parallel to each other, as well as the belts to be laid precisely beneath the tread. The tire’s strength and shape are provided by this network.

The bias tires segment is estimated to be the most opportunistic segment during the forecast period. The nylon belts run at a 30-to-45-degree angle to the tread line on bias tires. The tire’s sidewall and tread are connected by overlapping rubber piles. The bias tires provide several advantages, including smoother rides on rough terrain surfaces and stronger sidewalls.

Based on the material, the rubber segment dominated the global airless tires market in 2024. The rubber is a low-cost, high-load-carrying material. To improve steering stability, rubber compounds used in airless tires, such as vulcanized rubber compounds utilized inside a tire must have a high rigidity.

The plastic is estimated to be the most opportunistic segment during the forecast period. The manufacturers favor plastic materials for airless tire production because they are recyclable. The market will rise as the use of recyclable plastic in the manufacture of two-wheeler tires with plastic spokes increases.

Based on the vehicle type, the two-wheeler segment accounted largest revenue share in 2024. The tires for airless two-wheelers are created from special foams that have been extruded into various shapes. Due to rising population, strong spending power, and favorable legislation, demand for passenger vehicles is increasing at a rapid pace.

The light commercial vehicle is estimated to be the most opportunistic segment during the forecast period. The minivans, buses, and pickup trucks are examples of light commercial vehicles. The need for light commercial vehicles is expanding as the processing, manufacturing, and logistics sectors grow, as well as the tourism and hospitality industries.

To boost their market position, the key market players in the airless tires market are merging and forming joint ventures. For example, the Bridgestone and Goodyear Tire and Rubber Company signed a contract in April 2018 to develop a tire distribution network in the U.S. The key market players are also expected to create strategic alliances in order to boost their distribution channels and product sales.

By Product

By Vehicle

By Material

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

July 2024