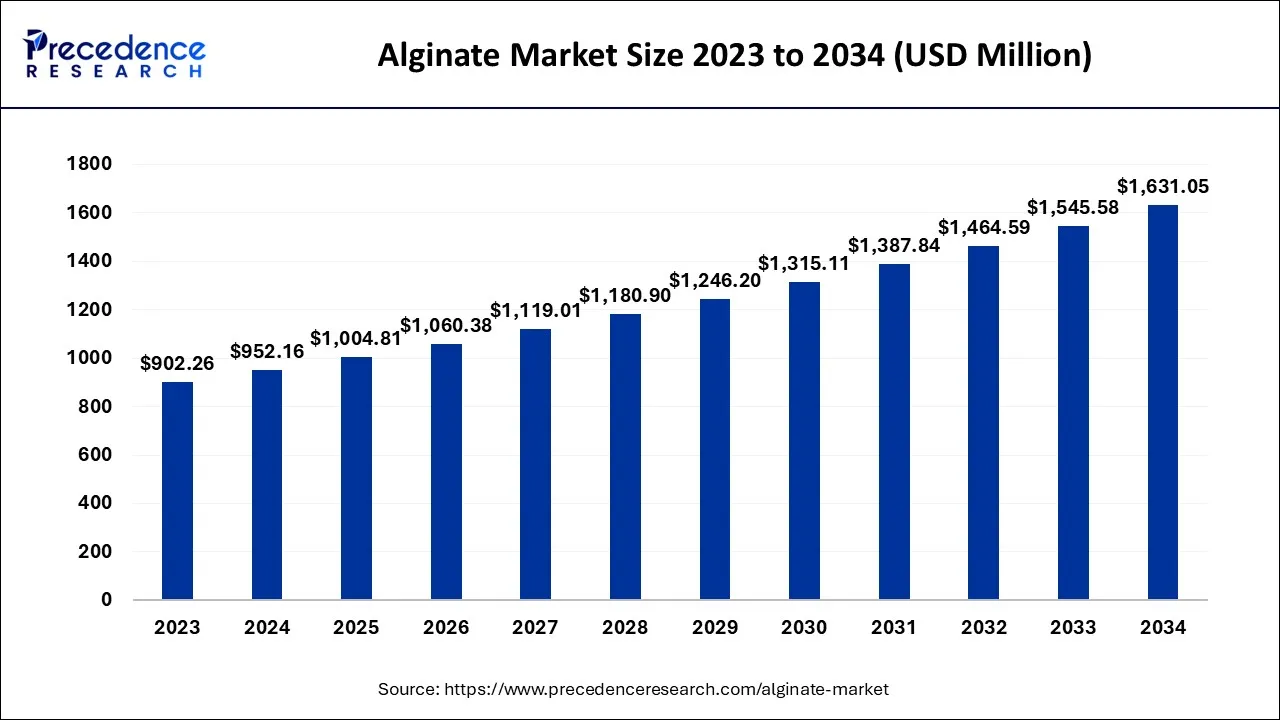

The global alginate market size accounted for USD 902.26 million in 2024, grew to USD 952.16 million in 2025, and is expected to be worth around USD 1,631.05 million by 2034, poised to grow at a CAGR of 5.53% between 2024 and 2034. The Asia Pacific alginate market size is predicted to increase from USD 361.82 million in 2024 and is estimated to grow at the fastest CAGR of 5.67% during the forecast year.

The global alginate market size is expected to be valued at USD 902.26 million in 2024 and is anticipated to reach around USD 1,631.05 million by 2034, expanding at a CAGR of 5.53% over the forecast period from 2024 to 2034. The rising demand for weight-loss medicines and health supplements across the globe is expected to boost the growth of the global alginate market.

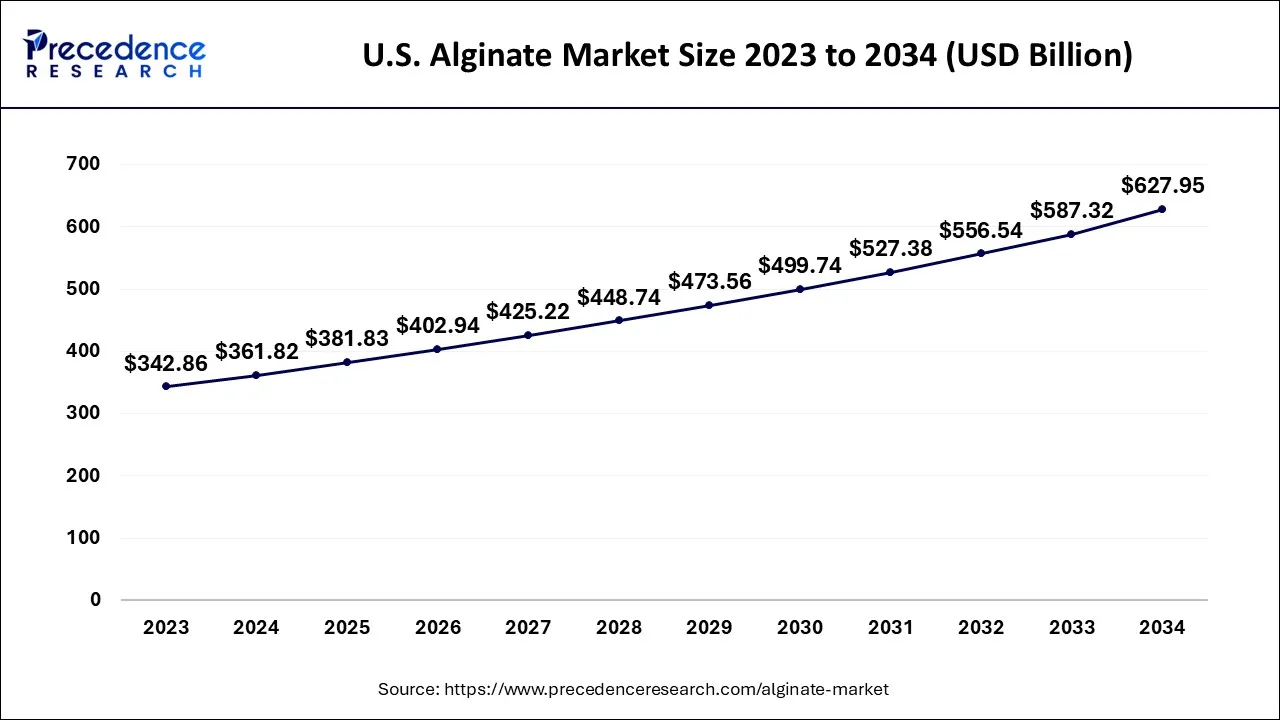

The Asia Pacific alginate market size is exhibited at USD 361.82 million in 2024 and is projected to be worth around USD 627.95 million by 2034, growing at a CAGR of 5.67% from 2024 to 2034.

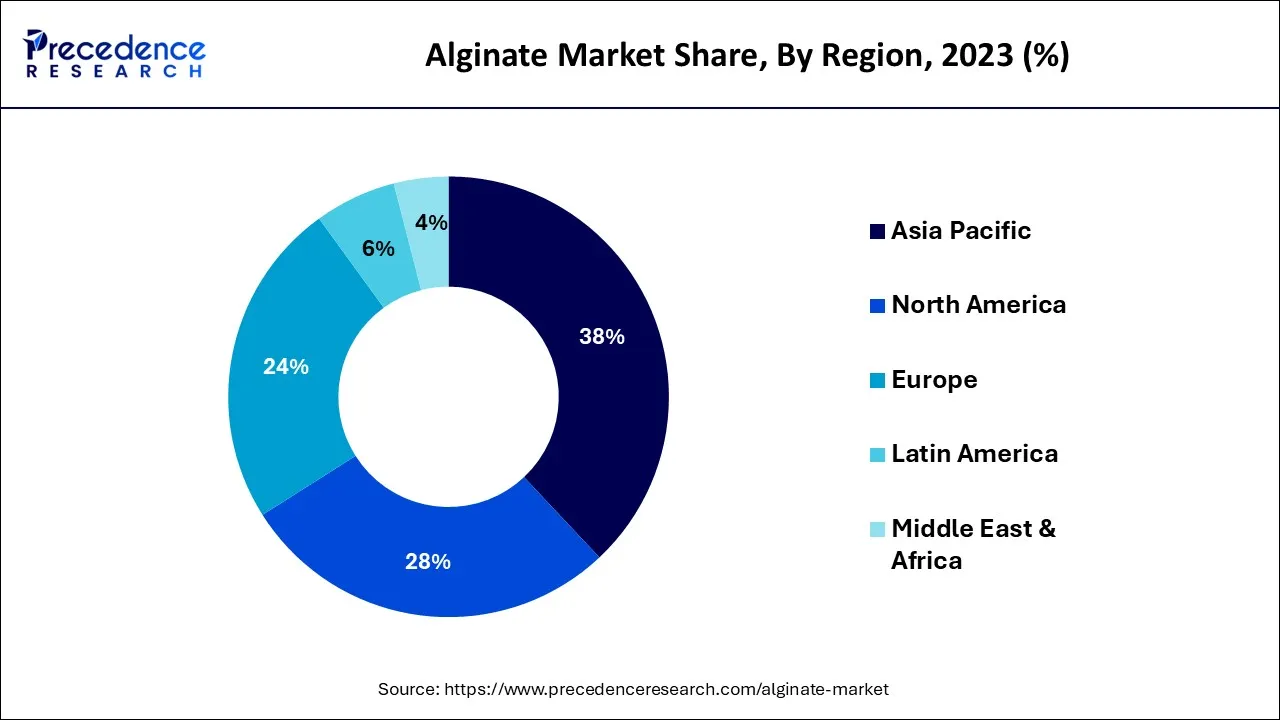

Geographically, Asia Pacific dominates the global alginate market with over 38% total market share. The rising demand for alginate from the pharmaceutical industry is the leading factor in boosting the growth of the alginate market in the region. The easy availability of raw materials in China and India makes these countries the most significant contributors to the development of the market. The continuously boosting food industry in India, China and other major countries will maintain the market share of the region in the global alginate market.

The rising spending on health supplements in North America is expected to boost the demand for alginates in the region. The growth of the alginate market in North America is attributed to the increasing demand for alginates from the food and beverage industry. The presence of major key players in the region is another factor to supplement the growth of the alginate market in North America.

Europe is likely to remain one of the largest marketplaces for alginate during the forecast period. The well-established pharmaceutical industry in Germany and the United Kingdom has been supporting the development of the alginate market in Europe. Moreover, the rising demand for quality cosmetic and personal care products in the region are observed as another factor in boosting the utilization of alginate.

The alginate market in Latin America, the Middle East and Africa is expected to grow at a noticeable CAGR of 5.20% during the forecast period. The rising application of alginate in the food and textile industries is predicted to propel the growth of the market. Saudi Arabia is observed as the largest producer of alginate in the Middle East. Moreover, the rising production of paper in Africa is considered to boost the demand for alginate.

Alginate is a natural polysaccharide found in certain species of brown algae. Alginate material is utilized as a hydrocolloid in various industries, including pharmacy and food. Alginates are also known as alginic acids and are composed of two types of uronic acid. Alginate is the most compatible and ideal component for various industries owing to its thickening, casting, and stabilizing properties.

Alginate is widely distributed in powder and granules form; these forms offer easy casting and thickening of alginate. Other than this, alginates are used in wound healing procedures and in curing various infections. Key players involved in the global alginate market focus on collecting certain species of brown algae that grow abundantly across the globe. Later, these algae are used in the production of alginate to meet global requirements.

The global alginate market is expected to witness noticeable growth during the forecast period due to rising awareness for biodegradable, recyclable and sustainable products. The rising requirements for alginate from the pharmaceutical, food and textile industries are observed as the most significant driver for the growth of the global alginate market.

The increasing demand from new end users, such as cosmetics and fine arts industries, will likely fuel the growth of the alginate market during the projected timeframe. The increasing demand for advanced wound care management from the healthcare sector across the globe will boost the growth of the alginate market. Growing consumption of plant-based products across the world is fueling the development of the alginate market.

Moreover, the rising demand for alginate for animal feed purposes is propelling the market’s growth. Factors such as new product development and the increasing number of key players in the market are observed to boost the market’s growth. However, the availability of raw materials will likely hamper the market’s growth. Moreover, the side effects of sodium alginate on human health hinder the market’s growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 902.26 Million |

| Market Size by 2034 | USD 1,631.05 Million |

| Growth Rate from 2024 to 2034 | CAGR of 5.53% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Function, By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Multiple benefits offered by sodium and calcium alginates for weight management

Obesity is one of the major causes that give hefty hospital bills for the population. The rising cases of obesity in children and adults due to emerging sedentary lifestyles contribute to the global demand for weight-loss or weight-management supplements and medications. Alginates effectively moderate the appetite by acting as an ideal weight-loss ingredient. Moreover, the intervention of alginate-based supplements in the diet offers hunger management during weight management attempts.

A recent report published by the American Journal of Clinical Nutrition states that a 12-week diet with an intervention of sodium alginate and calcium alginate combined supplements decreases body fat and boosts weight loss. Considering these benefits of alginates in weight management, the rising demand for alginates from the nutrition industry is observed as a driver for the market’s growth.

Unavailability of raw materials

The lack or unavailability of brown seaweed hampers the market’s growth. The significant raw material required for alginate is brow seaweed. Brown seaweed grows abundantly in world oceans, and seaweed has multiple other commercial uses apart from alginate. The rising utilization of brown seaweed has caused a severe shortage of raw materials for the development of alginate.

Moreover, the expensive cultivation of brown seaweed has hampered the availability of raw materials in the market. Along with this, poor environmental conditions and improper salinity affect the development of brown seaweed, which is another significant cause of the shortage of raw materials. The massive advantages of brown seaweed across various industries have highlighted the shortage in recent years.

Rising application of calcium alginates in advanced wound care management

The increasing prevalence of cancer, diabetes, and road accidents require advanced wound care management or wound healing treatment for a short or prolonged period. Calcium alginate dressing effectively absorbs the wound fluid by keeping the wound area dry. Alginates are highly preferred for wound dressing as they promote rapid re-epithelialization. In recent years, the improving healthcare sector across the globe has welcomed multiple advancements in wound healing treatment. The application of alginate dressing is one of the effective measures. The rising application of calcium alginates in wound healing treatment as a dressing material will offer lucrative opportunities for manufacturers and key players in the market.

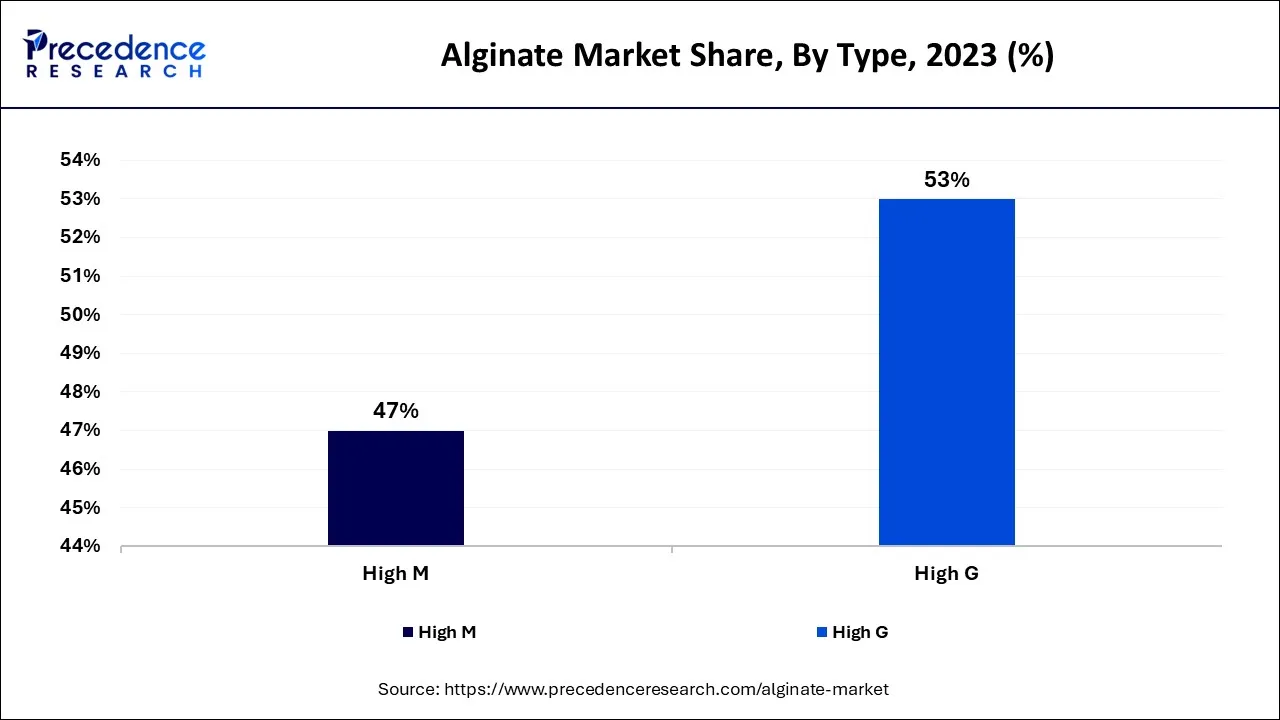

The high G segment accounted for over 53% of the total share in the global alginate market. The high G type of alginate is rich in guluronic acid; it has a variety of applications in the food and pharmaceutical industries. The high G segment has great potential to stimulate inflammation; this has resulted in increased demand from the medical sector for the high G segment.

The high M segment is predicted to grow at a CAGR of 4.7% during the forecast period. However, the high M segment has a wide range of applications in the cosmetics industry. Moreover, the rising demand for high M for the production of beer and ice creams is supplementing the segment's growth.

The thickener segment dominates the global market with the largest share. Alginates offer comprehensive properties which allow them to be used as thickeners in the food, cosmetics, textile, and pharmaceutical industries. The use of alginates during the formation of various food products, including ice creams and other frozen desserts, discourages the product’s ability to melt down and offers a smooth, desirable texture. The rising demand for quality skin care products propels the segment's growth in the global alginate market. Moreover, the increasing demand from the fine arts sector for setting up the ceramic structure to form casings will likely boost the growth of the thickener segment during the forecast period.

At the same time, the gelling agent segment is growing at a noticeable rate; the segment is expected to hold a significant share of the market during the forecast period. Gelling agents form heat-stable gels; this property of alginates allows them to be utilized in the production of bakery products. The application of alginates as a gelling agent is rising due to the increasing demand for re-structured and instant baking products across the globe. Moreover, the stabilizer segment shows steady growth in the global alginate market. Alginates are widely used as stabilizers during the production of beer, frozen juices and other beverages.

The sodium segment accounts for over 33% of the total share of the global alginate market; the segment is projected to maintain its growth during the forecast period. Sodium alginate is available in powder form and widely used as a thickening and gelling agent in various industries. The rising demand for sodium alginate is attributed to the increasing consumption of whipped cream, sauces and frozen bakery products.

The calcium segment is growing at a noticeable rate and is predicted to hold a significant share of the market during the forecast period. The rising importance of calcium alginates in the healthcare sector for wound care management is fueling the segment’s growth. Calcium alginates are utilized in wound dressing to maintain the dryness of the wound and soak the fluids from wounds.

Propylene glycol contains low pH levels; this property makes it an ideal fit for food products and skin care products. Propylene glycol alginates are used to maintain the acidity of products. The rising demand from the food and beverage industry, especially for the production of milk-based products, is propelling the segment’s growth.

The industrial application segment dominates the global alginate market with the highest share. Alginates are widely used in the textile industry as a raw material to maintain the structure of the fabric and prepare a thick set up of dyes. The textiles industry has accounted for the highest demand for alginates in recent years, and the segment is projected to maintain its growth during the forecast period.

The pharmaceutical segment is the fastest-growing segment in the global alginate market. Alginates are regarded as viscosity agents for the pharmaceutical industry; this property makes them an ideal raw material for drug development. Several alginates are utilized in the formation of Anti-acid drugs. Moreover, alginates can control the timing of drug-effective ingredients from a tablet. The pharmaceutical industry has adopted several alginates to develop eye drops, as eye drops containing alginates are prone to offer more effective results.

The food and beverage segment is predicted to account for a significant share during the forecast period. Alginates improve the physical properties of bread dough; this property makes alginates perfect for bakery products. Moreover, alginates are utilized as a modifier for preparing noodles, filling and dressing for food products. The rising demand for gluten-free food products is highlighting the utilization of alginates in the food and beverage industry.

By Type

By Function

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client