The global gelling agent market size is accounted at USD 5.37 billion in 2025 and is forecasted to hit around USD 8.28 billion by 2034, representing a CAGR of 4.92% from 2025 to 2034.

The global gelling agent market size was calculated at USD 5.12 billion in 2024 and is predicted to reach around USD 8.28 billion by 2034, expanding at a CAGR of 4.92% from 2025 to 2034. The increasing demand for clean and plant-based additives from different industries is driving the growth of the gelling agent market.

Artificial intelligence (AI) can have a positive impact on the market. AI has the ability to accelerate the formulation of new gelling agents. Using AI and Machine Learning technologies enhances the quality control process in manufacturing, leading to the production of high-quality gelling agents that meet stringent regulatory standards of food agencies. In addition, AI technologies automate manufacturing processes and reduce waste generation, which helps save resources, thereby reducing manufacturing and product costs.

The gelling agents are also known as additives or solidifiers. It has a gel-like texture and reacts with oil to form rubber-like solids. The gelling agent can be made naturally or artificially with simple sugar like glucose. It is an FDA-approved food additive that can be used in different types of food materials, such as thicker emulsifiers, stabilizers, and sometimes as a preservative. The gelling agent helps stabilize or improve the viscosity, structure, and color preservation in food products.

| Report Coverage | Details |

| Market Size by 2024 | USD 5.12 Billion |

| Market Size in 2025 | USD 5.37 Billion |

| Market Size in 2034 | USD 8.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Nature, Product, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with gelling agents

There is increasing awareness about the health benefits of the gelling agent market, such as improved gut health and enhanced digestion. There are several gelling agents that are used as an additive in food and cosmetics products. Gelling agents are used as a nutritional supplement in different plant-based products. Additionally, there are significant benefits of different gelling agents in skincare products, such as maintaining the pH level of the skin and others.

Insufficient antimicrobial properties

In the gelling agent, there is a lack of antimicrobial properties, which makes it necessary to use preservatives at the time of formulation in any type of product, and the availability of the alternatives collectively limits the growth of the gelling agent market.

Increasing demand from the cosmetics industry

The rapid evaluation of the cosmetic industry is owing to the continuous demand for new and innovative skincare and cosmetics products. The increasing adoption of the gelling agent into the wide range of cosmetic products as a thickener, natural polymer, and gums is driving the growth in the demand for the gelling agent. Xanthan gum, hydroxyethylcellulose, acacia gum, konjac, sclerotium gum, and hyaluronic acid are some types of gelling agents that are used in cosmetic products. The rise in the cosmetic industry is driving the potential opportunity for gelling agent market expansion.

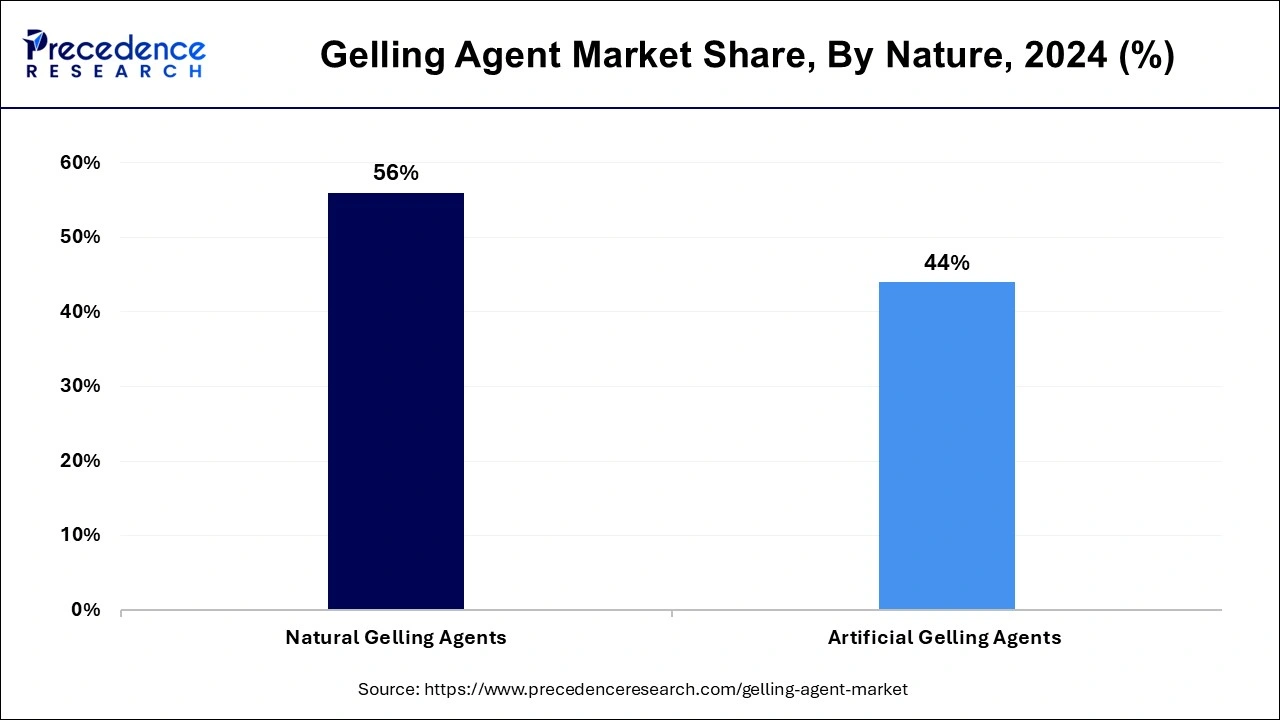

The natural gelling agents segment led the global gelling agent market in 2024. The rising demand for clean and sustainable sources of gelling agents is causing a higher demand for natural gelling agents. The increasing adoption of natural gelling agents from a wide range of industries, such as pharmaceuticals, food, chemicals, and others in different industrial applications, is accelerating the expansion of natural gelling agents.

The artificial gelling agents segment expects significant growth in the gelling agent market during the forecast period. The increasing demand for artificial gelling agents from the wide range of industries due to its long-lasting properties and superior quality. Many industries prefer artificial gelling agents due to their cost-effectiveness and quality.

The gellan gum segment dominated the gelling agent market in 2024. The Magellan gums are a type of food additive. It added different types of food material, typically for binding, texturizes, and processed food. It can be produced both naturally and artificially. It is naturally produced in the water lilies and can be artificially produced by sugar fermentation with some specific type of bacteria. Gellan gums are typically used in food and beverage products like juices and plant-based milk to dissolve the supplement nutrients evenly into the beverage rather than just lie down at the bottom of the container. It is used in desserts to give them a smooth and creamy texture.

The agar-agar segment will witness substantial growth in the gelling agent market during the predicted period. The agar-agar is also one of the types of gelling agents that is derived naturally from the red algae. It is a totally vegan type of food additive that can be consumed by people with a vegan diet. The agar-agar has no taste or smell, which makes it an ideal choice as the gelling additive in different types of food products. It is firmer than the gelatin and can also be set at room temperature. It is highly digestive and improves gut health. The rising acceptance of agar-agar from different brands of food and beverages is accelerating the demand for the gelling agent.

The stabilizers segment dominated the gelling agent market in 2024. The gelling agent can be used in the different industries including food, pharmaceuticals, cosmetics, chemicals, and others offering variety of functions to the different industrial applications. Gelling agents are used as stabilizers in the product. The gelling agent works as a stabilizer in the food product to dissolve or mix into the product evenly. Carrageenan, agar, and pectin are some types of stabilizers that are used in dairy products, syrups, and others.

The thickener segment expects notable growth in the gelling agent market during the forecast period. Thickener is the type of additive that is used in food products to improve their viscosity without causing any taste change. It is mostly used in soups, gravies, sauces, puddings, and gravies. Proteins like gelatin or polysaccharides like starches are some types of thickeners that are mostly used by different food brands.

North America dominated the gelling agent market in 2024. The growth of the market is attributed to the rising demand for the food and beverages industry and acceptance of the fast food and ready-to-eat food segment due to the changing lifestyle of people and low availability of the time, which causes the higher demand for the different types of gelling agent for making of a number of food items in which it can be used as a preservative, emulsifiers, thickeners, and stabilizers which creates the boosts in the market expansion. Additionally, there is a rising demand for gelling agents from industries such as cosmetics, chemicals, pharmaceuticals, and others.

Asia Pacific is expecting substantial growth in the market during the predicted period. The growth of the market is owing to the rising population and the increasing demand for the food industry, as well as the rising consumption of packaged food products by regional countries such as India, China, Japan, and South Korea is driving the expansion of the gelling agent for the manufacturing of the food products. The increasing awareness regarding gelling agents and additives in pharmaceuticals.

Food consumption is expected to reach USD 1.2 trillion by 2025-26 due to the changing consumption pattern and growing urbanization. India’s food processing industry is expected to reach USD 1,100 billion by FY35, USD 1,500 billion by FY40, USD 1,900 billion by FY45, and USD 2,150 billion by FY47 according to the Viksit Bharat@2047 report.

By Nature

By Product

By Function

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client