February 2025

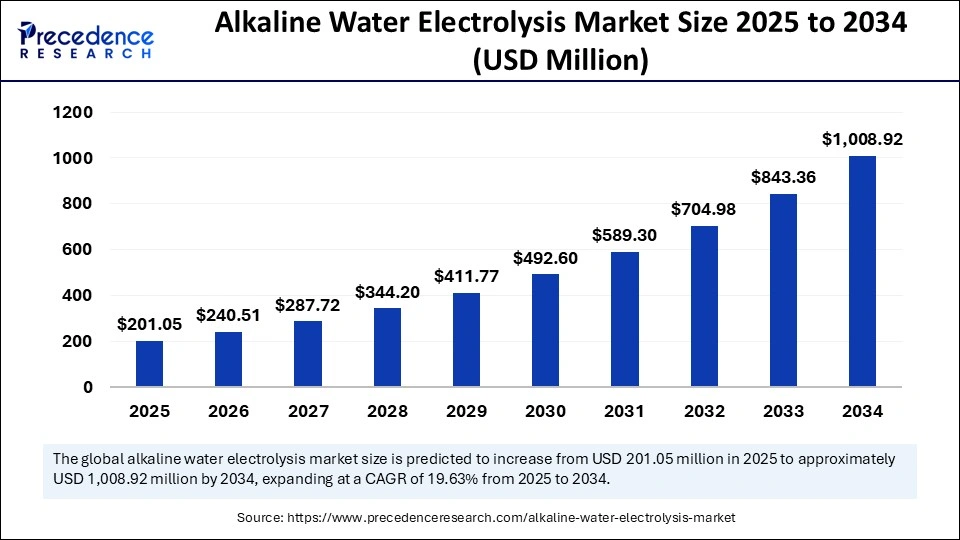

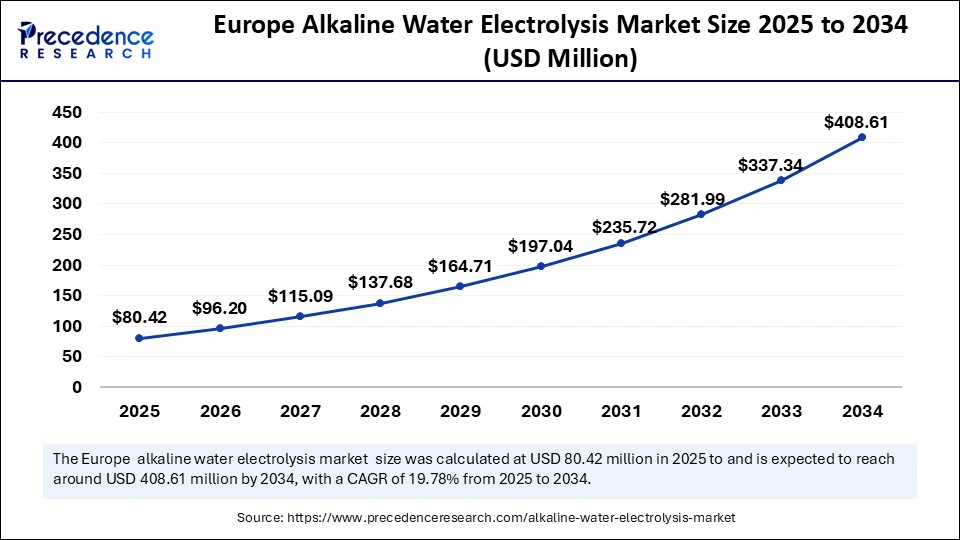

The global alkaline water electrolysis market size is calculated at USD 201.05 million in 2025 and is forecasted to reach around USD 1,008.92 million by 2034, accelerating at a CAGR of 19.63% from 2025 to 2034. The Europe market size surpassed USD 67.22 million in 2024 and is expanding at a CAGR of 19.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global alkaline water electrolysis market size accounted for USD 168.06 million in 2024 and is predicted to increase from USD 201.05 million in 2025 to approximately USD 1,008.92 million by 2034, expanding at a CAGR of 19.63% from 2025 to 2034. The demand for green hydrogen in various industries is driving the global market. The market is further witnessing a spectacular range with government support in advancements in hydrogen technologies and infrastructure developments.

Artificial intelligence (AI) is a significant tool for improving the efficiency and advancements of the alkaline water electrolysis market in several ways, including its predictive maintenance, process optimization, quality control, and energy management abilities. AI helps to detect potential issues in the system, helps to reduce downtime, and improves efficiency. Process optimization improves efficiency and reduces energy consumption. Additionally, AI can manage energy consumption in alkaline water electrolysis systems, helping to reduce cost and energy usage.

AI in research and development accelerates alkaline water electrolysis by analyzing a large database and practical outcomes, helping to advance research activities. Integration of AI algorithms, like artificial neural networks (ANNs), with computational fluid dynamics (CFD) models improves predictions of AWE cell performance. The real-time adjustments in changing operating conditions drive the need for an AI algorithm to ensure better and more effective working of the alkaline water electrolysis system.

The Europe alkaline water electrolysis market size was exhibited at USD 67.22 million in 2024 and is projected to be worth around USD 408.61 million by 2034, growing at a CAGR of 19.78% from 2025 to 2034.

How are Government Policies driving European Alkaline Water Electrolysis Plants?

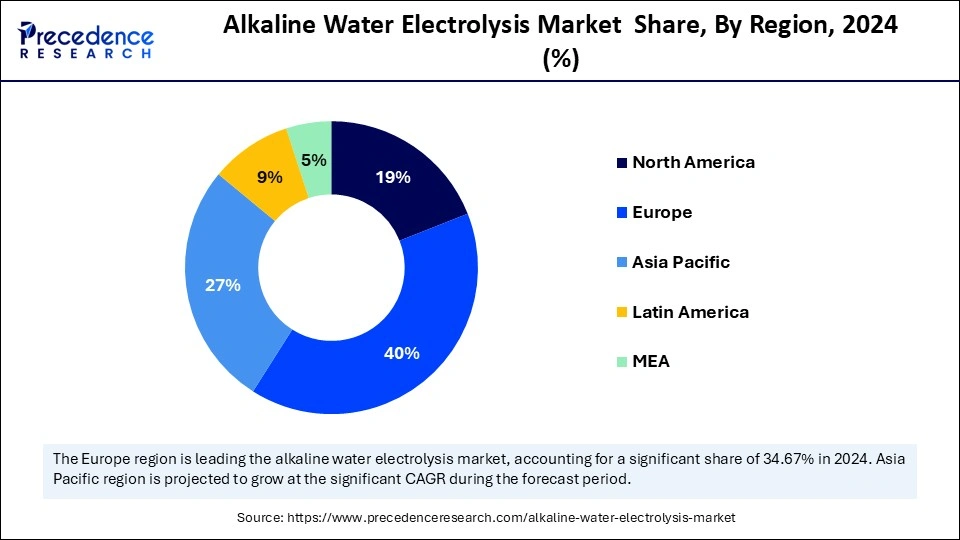

Europe dominated the alkaline water electrolysis market in 2024. It is the key area for renewable energy and clean energy demands. The government support for hydrogen production and infrastructure developments is the major factor contributing to increased emphasis on alkaline water electrolysis. The government is providing spectacular funding and support for hydrogen production and infrastructure advancements for production, storage, and distribution. Countries like Germany, France, and the Netherlands are heavily investing in large-scale hydrogen initiatives, increasing demand for alkaline water electrolysis.

Germany Alkaline Water Electrolysis Market Trends

Germany is leading the market in Europe due to high demand for hydrogen in various industries, including transportation, chemicals, and energy. Germany has a strong industrial base and hub for well-established research institutions and companies, actively developing and enhancing alkaline water electrolysis technologies. The shift toward renewable energy and government initiatives in promoting hydrogen technology developments is driving the market.

Investments in Technological Advancements Boost the North American Market

The North America alkaline water electrolysis market is anticipated to grow at the fastest CAGR during the forecast period due to substantial investments in green hydrogen projects and research. The increased demand for hydrogen in various industries like chemical, pharmaceutical, and automotive has driven a focus on large-scale renewable energy projects and advancing hydrogen infrastructure. The region is trending toward the production of green hydrogen by using renewable energy sources, driving demand for alkaline water electrolyzers. Additionally, factors like increased adoption of fuel cell electric vehicles and government policies encouraging investors in research and development.

The Green Hydrogen Industry Shift: To Drive the U.S. Market

The U.S. leads the regional market, driven by several factors, including countries' strong focus on renewable energy, the presence of key market vendors, government support, and demand for green hydrogen. Well-established and expanding industrial infrastructure is driving demand for green hydrogen, making the U.S. focus on the production of green hydrogen by using renewable energy sources. The U.S. government has launched initiatives to promote the development of a hydrogen strategy. The countries focus on hydrogen infrastructure developments, leading to collaborative approaches between research & development institutions and companies.

Rapid Industrialization Increased Adoption of Alkaline Water Electrolysis in Asia

Asia Pacific emerged as a significant player in the global alkaline water electrolysis market. Asia Pacific has witnessed rapid industrialization and energy demands. Countries like China, Japan, and India's industrialization has surged in energy consumption. Industrialization had increased the demand for clean hydrogen production. Sustainability goals and government investments in hydrogen production technologies and infrastructure developments fuel the need for clean hydrogen production by alkaline water electrolysis.

China’s Large-Scale Hydrogen Production Initiatives

China dominates the market in Asia due to various factors like industrial applications and government initiatives. China has well-established automotive, power generation, and pharmaceutical industries, driving heavy adoption of hydrogen. Counties that focus on clean energy and green hydrogen initiatives are driving the adoption of alkaline water electrolysis. Additionally, the rapid industrialization has shifted the government's focus to large-scale green hydrogen production and energy storage, and grid stability projects. China is exploring large-scale hydrogen production to support industrial applications.

The alkaline water electrolysis market has witnessed significant growth driven by various factors like increased demand for efficiency and cost-effectiveness in green hydrogen production. Global industry expansion in automotives, chemicals, pharmaceutical companies, power generation, and energy storage has increased the need for hydrogen. The trend of sustainability and clean energy is driving focus on the production of green hydrogen.

Global decarbonization and renewable energy integration goals are promoting the use of green hydrogen, driving the need for alkaline water electrolysis systems to improve efficiency, scalability, and cost-effectiveness. Additionally, the government worldwide is providing significant support in promoting hydrogen technologies and industrial developments, enabling technological advancements and initiatives for the research and development sector.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,008.92 Million |

| Market Size in 2025 | USD 201.05 Million |

| Market Size in 2024 | USD 168.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.63% |

| Dominated Region | Europe |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Decarbonization and renewable energy integration goal

The adoption of hydrogen is high in industrial applications, transportation, energy storage, and power generation, causing a high risk of carbon emissions. The global shift toward decarbonization and renewable energy storage is driving demand for green hydrogen production. Green hydrogen replaces fossil fuel and reduces carbon emissions. The need for clean energy sources further contributes to the demand for green hydrogen. The use of green hydrogen has increased for energy storage to stabilize the grid and ensure a reliable energy supply. The government initiatives and technological advancements fueling green hydrogen production are driving demand for alkaline water electrolysis.

High initial and production costs

The major restraint of the alkaline water electrolysis market is the high cost associated with the production of green hydrogen. The high initial investments in alkaline water electrolysis hinder its adoption in various companies. The production of green hydrogen with alkaline water electrolysis is expensive compared to conventional methods. The industries with thin profit margins hamper the adoption of the alkaline water electrolysis system. Additionally, the technology often faces competition from grey hydrogen production with a cost-effective nature. However, technological advancements and government initiatives can help reduce costs and improve efficiency.

Large-scale Hydrogen Production

The trends of decarbonization, renewable energy integration, and clean energy storage demand have increased the demand for green hydrogen. This demand has increased the need for large-scale production to reduce costs and increase efficiency. The large-scale production of green hydrogen is aimed at reducing greenhouse gas emissions. Increased industrial use of green hydrogen fuel requires large-scale production. The utilization of alkaline water electrolysis is increasing to meet large-scale hydrogen production demands. Moreover, technological advancements such as improving the efficiency, reducing the cost, enhancing the durability, and developing new and improved materials for electrolytes and separator membranes in alkaline water electrolysis systems are enabling the scaling up of large-scale hydrogen production.

The < 50 m³/h segment held the largest alkaline water electrolysis market share in 2024 and is projected to dominate in the forecast period due to increased demand for small-scale hydrogen. The < 50 m3/h is flexible and affordable compared to a large-scale system. The increased emphasis on green hydrogen production and decarbonization drives demand for < 50 m3/h alkaline water electrolysis. Additionally, technological advancements enabling efficiency, scalability, and cost reduction of the segment, driving industrial shift toward the < 50 m3/h alkaline water electrolytes.

The power plants segment dominated the alkaline water electrolysis market with the largest share in 2024 due to increased demand for green hydrogen and government initiatives in decarbonization and renewable energy sources. Power plants are being exclusively used for the production of green hydrogen to provide a clean fuel alternative. Technological advancements in electrolysis are improving efficiency and cost reduction, increasing adoption in the energy sector.

The industrial gases segment is expected to witness the fastest rate of growth during the predicted timeframe due to the increased need for hydrogen in various industries. The industrial gases are the key application for alkaline water electrolyzers. The demand for hydrogen has increased in chemical manufacturing, metallurgy, and oil refining. The rising industrial activities and the need for efficient carbon-free hydrogen production are fueling segment growth.

By Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

November 2024

October 2024