April 2025

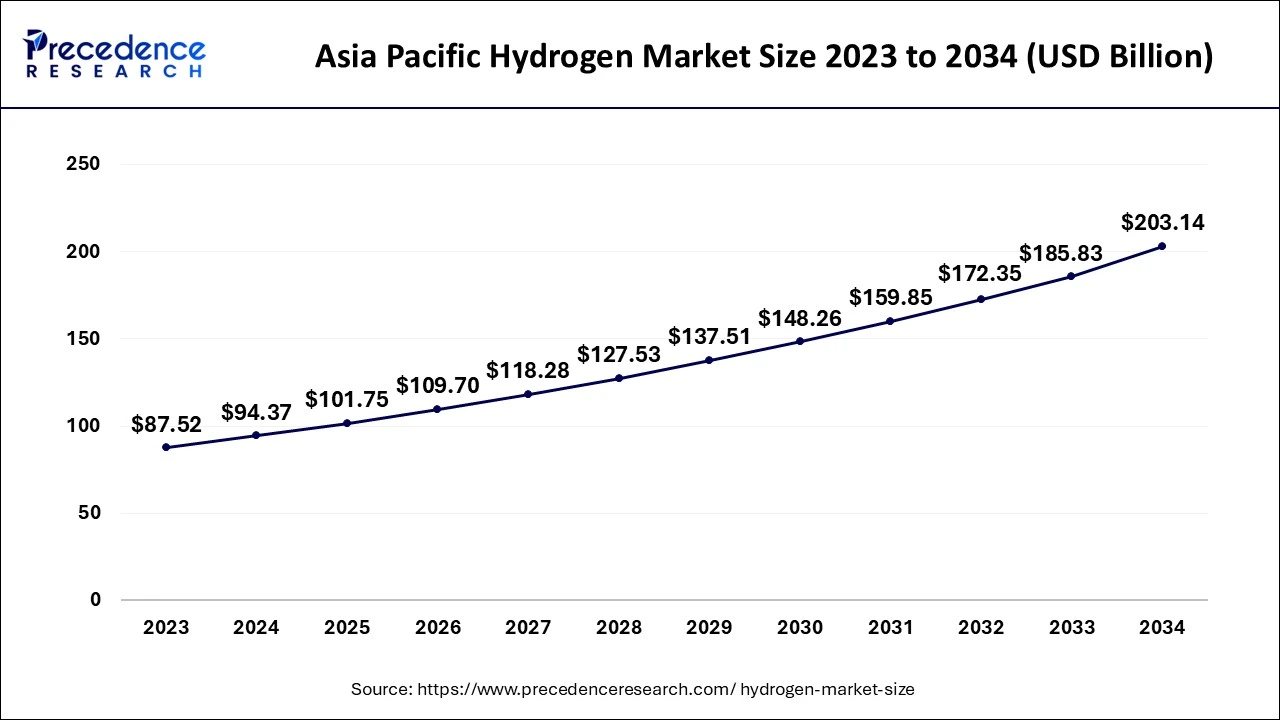

The global hydrogen market size is calculated at USD 282.63 billion in 2025 and is projected to reach around USD 556.56 billion by 2034. The market is expanding at a CAGR of 7.82% between 2025 and 2034. The Asia Pacific hydrogen market size is calculated at USD 101.75 billion in 2025 and is expected to grow at a CAGR of 7.97% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hydrogen market size accounted at USD 262.13 billion in 2024 and is projected to reach around USD 556.56 billion by 2034, growing at a CAGR of 7.82% from 2025 to 2034. The hydrogen market is driven by the growing demand for clean energy sources.

By optimizing operational conditions (such as temperature, pressure, and input energy), cutting expenses, and raising yields, artificial intelligence (AI) helps increase the efficiency of electrolyzers used in the manufacture of hydrogen. By detecting inefficiencies in the hydrogen supply chain, from production to consumption, AI-driven analysis can assist in lowering overall production and operating costs. To make the process cleaner and more sustainable, it helps integrate carbon capture technology with hydrogen production, primarily blue hydrogen (hydrogen produced from natural gas with carbon capture).

The Asia Pacific hydrogen market size was exhibited at USD 94.37 billion in 2024 and is projected to be worth around USD 203.14 billion by 2034, growing at a CAGR of 7.97% from 2025 to 2034.

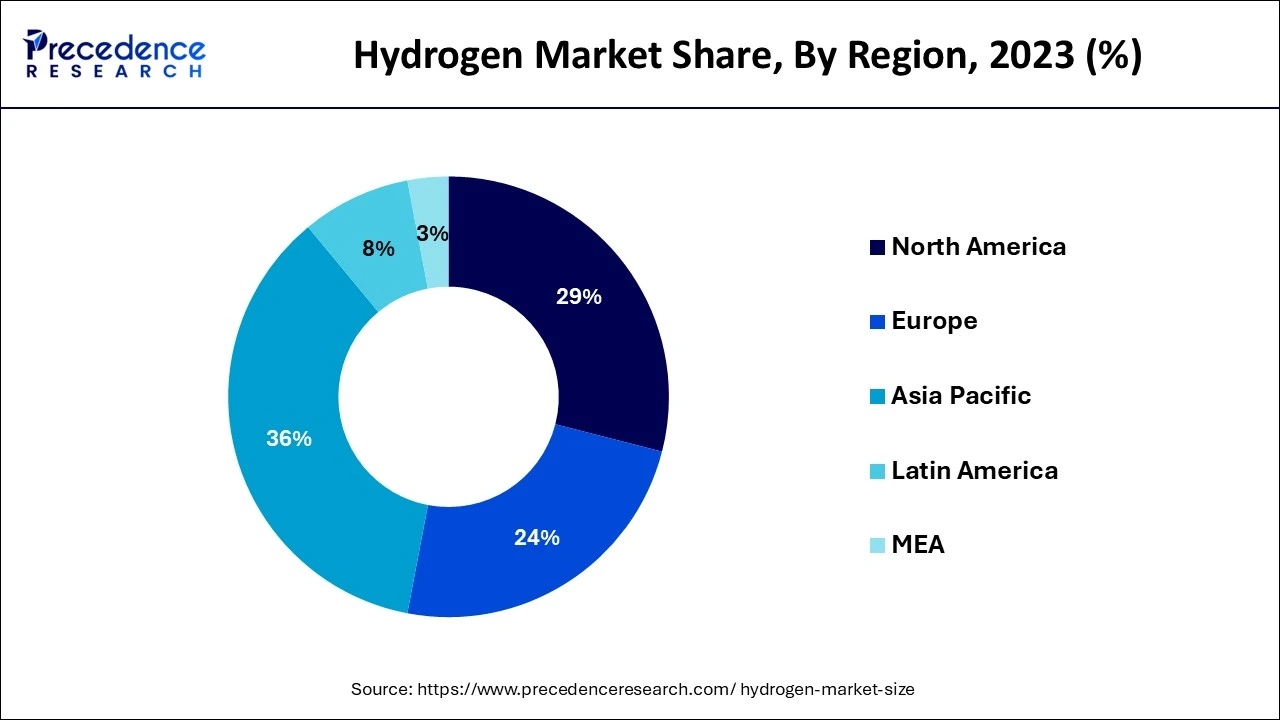

Asia Pacific dominated the global green hydrogen market with the largest share in 2024. Favourable policies and initiatives by governments in the region are promoting the adoption of clean energy solutions like green hydrogen. Abundance of renewable energy resources such as solar, hydro ad wind is contributing to cost-effective production of green hydrogen through electrolysis. Additionally, growing focus on reducing carbon emissions, advancements in electrolyzer technology, rising investments in renewable energy infrastructure for energy security as well as increased collaborations between local and international companies for deploying large-scale green hydrogen projects is bolstering the region’s market growth. Regional players, like Australia, Japan and South Korea are highly focused on adoption of green hydrogen.

Governments in North America have viewed hydrogen as a vital part of their clean energy plans due to their aggressive decarbonization goals and pledges to cut greenhouse gas (GHG) emissions. Hydrogen is a flexible way to cut emissions, especially in areas like power generation, heavy industry, and long-distance transportation that are challenging to electrify. Transportation, especially heavy-duty vehicles like trucks, buses, and trains, uses more hydrogen fuel cells. For example, California has taken the lead in establishing hydrogen refueling stations and policies that support hydrogen fuel cell vehicles. Demand is further increased by the aviation and maritime industries' exploration of hydrogen as a zero-emission fuel.

Green hydrogen, or hydrogen derived from renewable resources, is a clean fuel that only releases water in fuel cells. It plays a crucial role in assisting nations and businesses in achieving their decarbonization goals and cutting greenhouse gas emissions, which is essential for addressing climate change. Numerous resources, including nuclear power, renewable energy sources, and natural gas, can be used to create it domestically. This variety of production techniques improves countries' energy security, lessening reliance on imported fossil fuels.

Global investments in hydrogen projects are surging, with countries like Germany, Japan, and Australia committing billions to develop hydrogen infrastructure. For example, the European Union has announced plans to invest over €400 billion in hydrogen technologies by 2030.

Many governments are implementing hydrogen strategies. The U.S. Department of Energy launched the Hydrogen Shot initiative, targeting a significant reduction in the cost of clean hydrogen production. Countries like Japan are enhancing their hydrogen roadmaps, focusing on domestic production and international partnerships.

| Report Coverage | Details |

| Market Size by 2034 | USD 556.56 Billion |

| Market Size in 2024 | USD 262.13 Billion |

| Market Size in 2025 | USD 282.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sector, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Focus on Decarbonization from Industries

Many industries, especially those reliant on fossil fuels, face pressure to reduce their carbon footprint. Hydrogen, particularly green hydrogen produced from renewable energy sources, is viewed as a viable solution for decarbonizing various sectors, including transportation, manufacturing, and energy. The transportation sector is also a major contributor to greenhouse gas emissions. Hydrogen fuel cell vehicles (FCVs) offer a clean alternative, emitting only water vapor. Companies like Toyota and Hyundai have developed hydrogen FCVs, and infrastructure projects are underway to expand hydrogen refueling stations, facilitating broader adoption.

Lack of infrastructure

Green hydrogen production depends on electrolysis, necessitating large capital expenditures in production facilities. Because there are now so few electrolysis facilities, green hydrogen is more expensive than hydrogen from fossil sources. A vast network of hydrogen filling stations is necessary to use hydrogen in transportation, including fuel-cell vehicles (FCVs). The widespread use of hydrogen-powered cars is now hampered by the scarcity of these stations, particularly when contrasted with the extensive networks of charging stations for gasoline or electric vehicles.

Storage and transportation challenges

The volumetric energy density of hydrogen is lower than that of traditional fuels. This creates problems for compact storage since a lot of hydrogen is needed to store the same quantity of energy. Another approach is to transport compressed hydrogen in tubes or cylinders; however, this method is less effective for considerable amounts because the cylinders need to be heavy and take up space. There are additional difficulties in handling and delivering these high-pressure containers logistically.

Adoption hydrogen technologies

Technological improvements in electrolysis, such as alkaline electrolysis and proton exchange membrane (PEM), have made hydrogen more economically feasible by drastically lowering the cost of creating green hydrogen. With longer ranges and faster refueling than battery electric vehicles (BEVs), hydrogen is becoming a competitive fuel for heavy-duty vehicles (buses, lorries, trains) and maritime applications. Subsidies, grants, and tax breaks for research and development are just a few of the policies and incentives numerous governments are implementing to support hydrogen technologies.

The generation type segment led the hydrogen market in 2023. Under the same segment, the gray hydrogen sub-segment dominated the hydrogen market in 2023. The primary method for producing gray hydrogen is steam methane reforming, in which methane reacts with steam to produce carbon dioxide and hydrogen. This process is the most well-known and extensively utilized way to produce hydrogen, having been in use for decades. The substantial CO2 emissions linked to manufacturing gray hydrogen are one of its major disadvantages. Approximately 9–10 tons of CO2 are emitted into the atmosphere for every ton of hydrogen produced with SMR. However, for a large portion of the market's history, this problem had no bearing on regulations, which allowed gray hydrogen to thrive in an environment with low costs and little control.

On the other hand, the blue hydrogen sub-segment is observed to grow at the fastest rate in the upcoming period. The capability of blue hydrogen to reduce carbon emission as compared to natural gas promotes the segment’s expansion. As companies and manufacturers focus on eliminating hazardous materials by promoting the solutions for climate change, the segment will grow exponentially. Moreover, the demand for clean and on-demand energy across multiple industries create a significant driver for the segment to grow.

The chemical & refinery segment led the hydrogen market in 2024. Under the same, the petroleum refinery segment is observed to gain a traction as it held a notable share in 2024. Refineries generate significant amounts of hydrogen as a byproduct of various processes, such as hydrocracking and hydrotreating. This established production infrastructure makes refineries a major source of hydrogen. Refineries operate on a large scale, enabling them to produce hydrogen more economically compared to smaller facilities. This cost advantage reinforces their position in the hydrogen market.

The mobility segment is observed to grow at the fastest pace in the hydrogen market during the forecast period. Nearly 25% of all energy-related COâ‚‚ emissions come from the transportation industry, making it one of the most important contributors to carbon emissions. Hydrogen-driven vehicles, especially fuel cell electric vehicles (FCEVs), provide a cost-effective and sustainable substitute for traditional internal combustion engine (ICE) vehicles. Hydrogen is crucial to reaching the aggressive decarbonization targets many nations and regions have set. To encourage the expansion of hydrogen infrastructure and vehicles, governments have implemented several measures, including grants, tax breaks, and subsidies.

By Sector

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

May 2024

May 2025