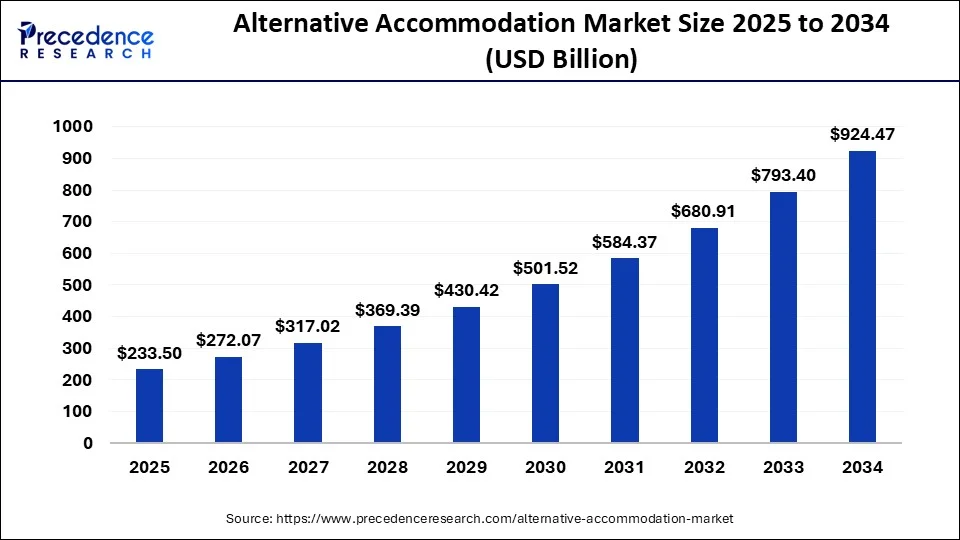

The global alternative accommodation market size was USD 171.98 billion in 2023, calculated at USD 200.40 billion in 2024 and is expected to be worth around USD 924.47 billion by 2034. The market is expected to expand at a double digit CAGR of 16.52% from 2024 to 2034.

The global alternative accommodation market size is predicted to surpass around USD 924.47 billion in 2034 from USD 200.4 billion in 2024, at a CAGR of 16.52% between 2024 and 2034. The global alternative accommodation market is mainly driven by the constantly evolving international tourism sector and comfortable vacation stays.

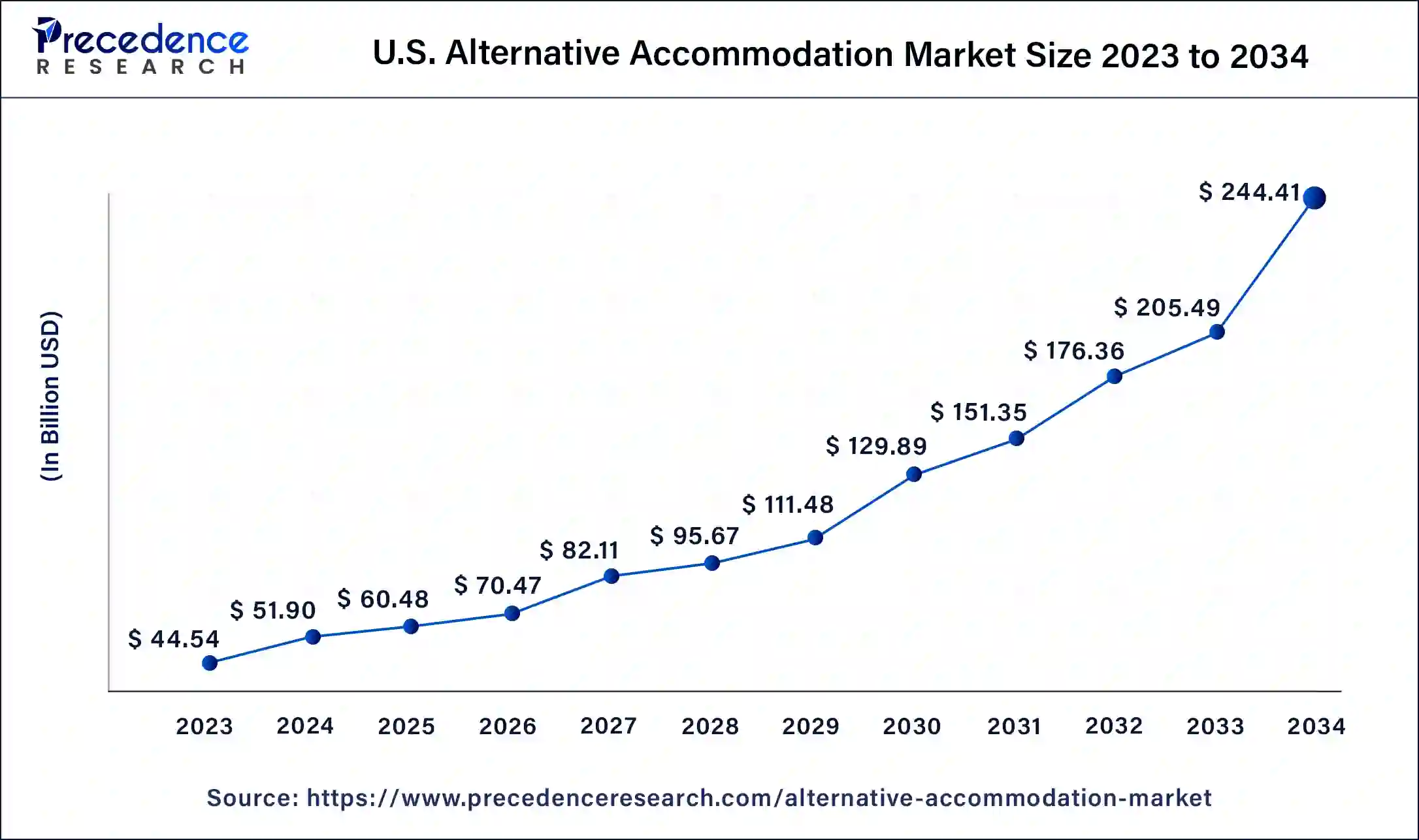

The U.S. alternative accommodation market size was exhibited at USD 44.54 billion in 2023 and is projected to be worth around USD 244.41 billion by 2034, poised to grow at a CAGR of 16.73% from 2024 to 2034.

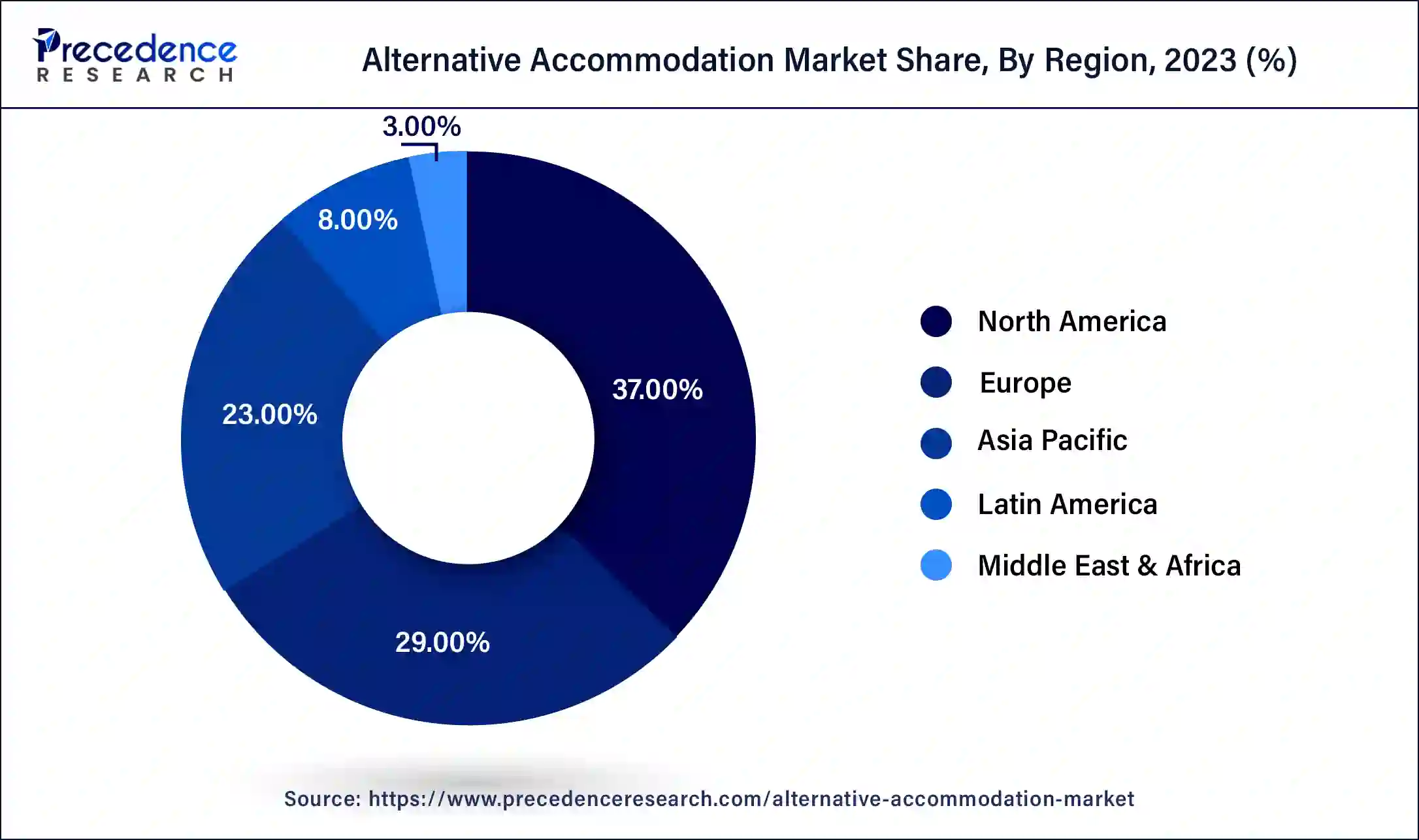

The alternative accommodation market was dominated by North America. Business travelers in this region are increasingly turning to alternative accommodations for extended stays or when traditional hotels are limited, which is creating new opportunities for companies in this sector. The region's higher spending on booking condominiums and homes, along with advanced technological infrastructure in countries like the U.S. and Canada, is expected to further accelerate market growth.

Asia Pacific will experience the fastest growth in the alternative accommodation market over the period studied. This expansion is primarily driven by increasing consumer spending on staycations and travel. Governments in countries such as India, China, Vietnam, and Australia are actively promoting tourism to boost overall regional growth by creating infrastructure and jobs. The demand for alternative accommodation is also rising due to tourists becoming more aware of these rental options.

The Asia Pacific alternative accommodation marketis projected to grow in the coming years. Increased government initiatives in countries like India, Indonesia, China, and Vietnam are aimed at expanding the tourism industry to generate income and create new jobs. Additionally, heightened awareness about the availability of holiday rentals is contributing to the strong growth of the region.

Alternative accommodation encompasses all types of lodging outside the formal or organized accommodation sector. This form of lodging differs from what is typically recognized as tourist accommodation, which presents a distinct alternative. It is also regarded as sustainable since it does not require a high concentration of resources or infrastructure and can be repurposed if tourism ceases to be a primary activity.

Accommodation types can be categorized into two groups: catered and non-catered. Catered accommodation includes food provisions for tourists, which may or may not be included in the overall price of the lodging. Catering services come in various forms, sizes, and quantities. Whereas not catering accommodations do not include food provisions.

| Report Coverage | Details |

| Market Size by 2034 | USD 924.47 Billion |

| Market Size in 2023 | USD 171.98 Billion |

| Market Size in 2024 | USD 200.40 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Accommodation Type, Booking Mode, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing consumer spending power

The rapid increase in consumer spending on tourism-related activities and the growing popularity of travel for various reasons, such as leisure, holidays, and business, are major factors driving the demand and growth of the global alternative accommodation market. Moreover, the continuous rise in internet usage worldwide and the convenience of booking hotels or alternative accommodations online significantly contribute to this growth. These factors help travelers easily find and understand their desired destinations, further fostering market expansion.

Safety security and lack of basic amenities

A major challenge for the alternative accommodation market is safety. The host has the potential to improve a traveler's stay but can also make it unpleasant. They might interfere or cause discomfort to the customer. The host’s right to cancel the stay and the lack of direct interaction between the booking platform (company) and the customer contributes to a sense of insecurity. Additionally, a downside of this budget-friendly option is the risk of non-disclosure. The absence of details about basic amenities, which may be considered obvious, can lead to significant discomfort for the customer.

Investment in alternative accommodation

Hotel companies are keen to diversify their portfolios by entering the alternative accommodation sector on a global scale. Since the COVID-19 pandemic, consumer preferences have shifted due to the flexibility to work or live from anywhere, with many seeking short-term rentals for extended stays. This shift in preferences is anticipated to accelerate growth and create lucrative opportunities for the alternative accommodation market players.

The home segment dominated the alternative accommodation market in 2023. The segment's growth is attributed to the rising popularity of homestays among both domestic and international travelers, thanks to the comfort, safety, and privacy they provide. Moreover, the affordability and pet-friendly environment of home-based vacation rentals attract travelers worldwide. Consumers are increasingly opting for home vacation rentals as they are less expensive than hotels while offering similar amenities. This trend is expected to contribute positively to the global market's growth.

The apartments/condominium segment is expected to experience the fastest growth in the alternative accommodation market during the forecast period. Staying in apartments or condominiums allows travelers to immerse themselves in the local culture and experience life as a resident rather than a tourist. This is expected to significantly drive market growth. Additionally, the increasing popularity of these accommodation types among millennials and business travelers is the main driving force due to the various luxury amenities such as sports clubs, swimming pools, and clubhouses.

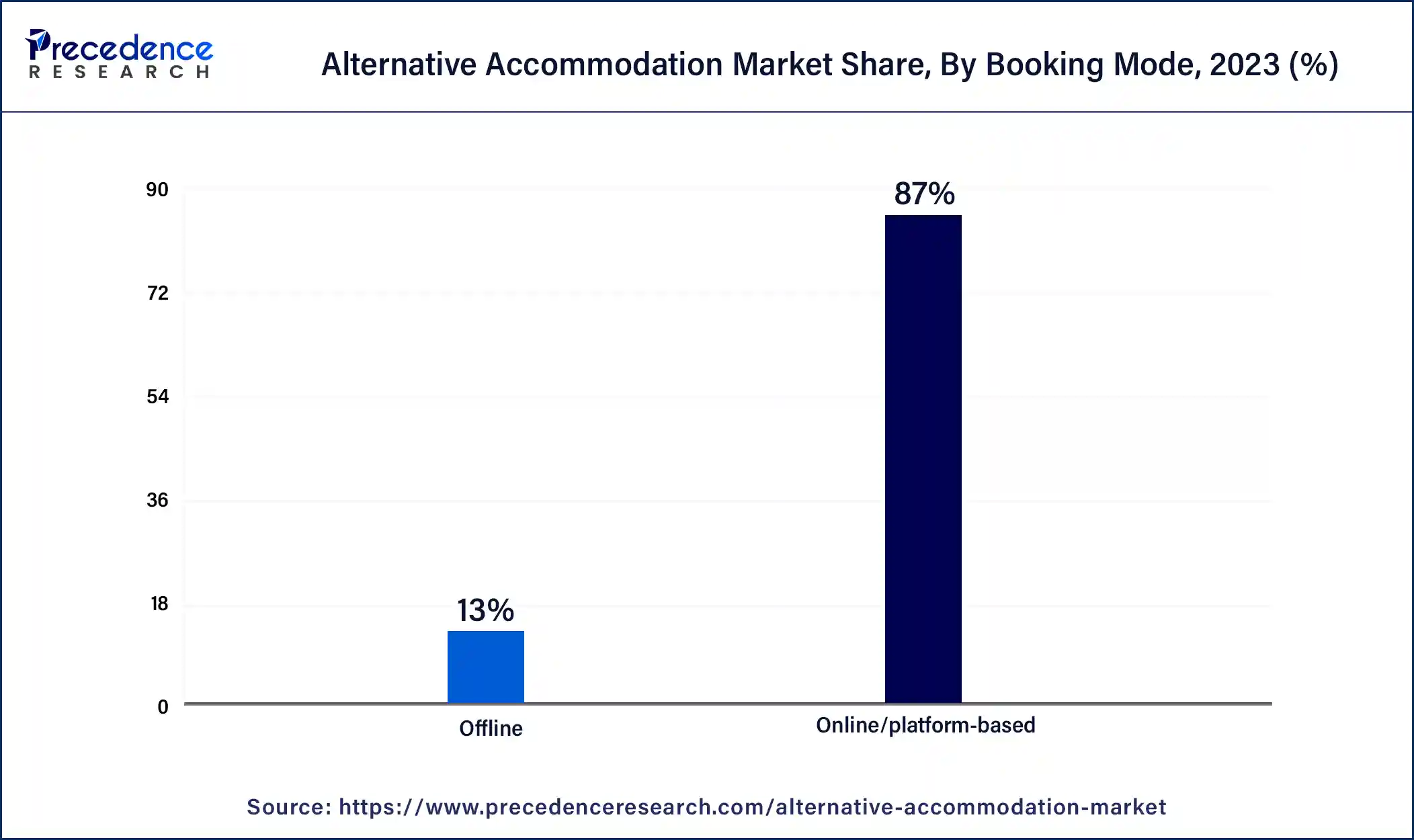

The online segment led the global alternative accommodation market in 2023. The primary factor driving the segment's growth is the increasing use of mobile phones. The rise in Internet usage has facilitated hotel bookings through online channels, which makes the process easy, simple, and convenient. Furthermore, online channels provide features such as straightforward payments, hassle-free bookings, secure payment options, and free cancellations, which attract more customers. Recently, consumers have increasingly favored online booking platforms for these features, further boosting the demand for online booking channels.

The offline segment is expected to grow at a faster rate in the alternative accommodation market over the projected period. The growth is largely attributed to Gen X and baby boomers, who constitute the primary consumer base. Globally, many consumers continue to prefer offline booking methods due to the ability to inspect and review the place before making a reservation.

Moreover, travelers seek flexibility and a high-quality customer experience when booking through offline channels, which contributes to this mode's growth. However, as internet and smartphone usage rise among consumers, preferences are expected to shift towards online booking. The emergence of online travel booking channels is anticipated to disrupt the industry in the coming years.

Segments Covered in the Report

By Accommodation Type

By Booking Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client