April 2025

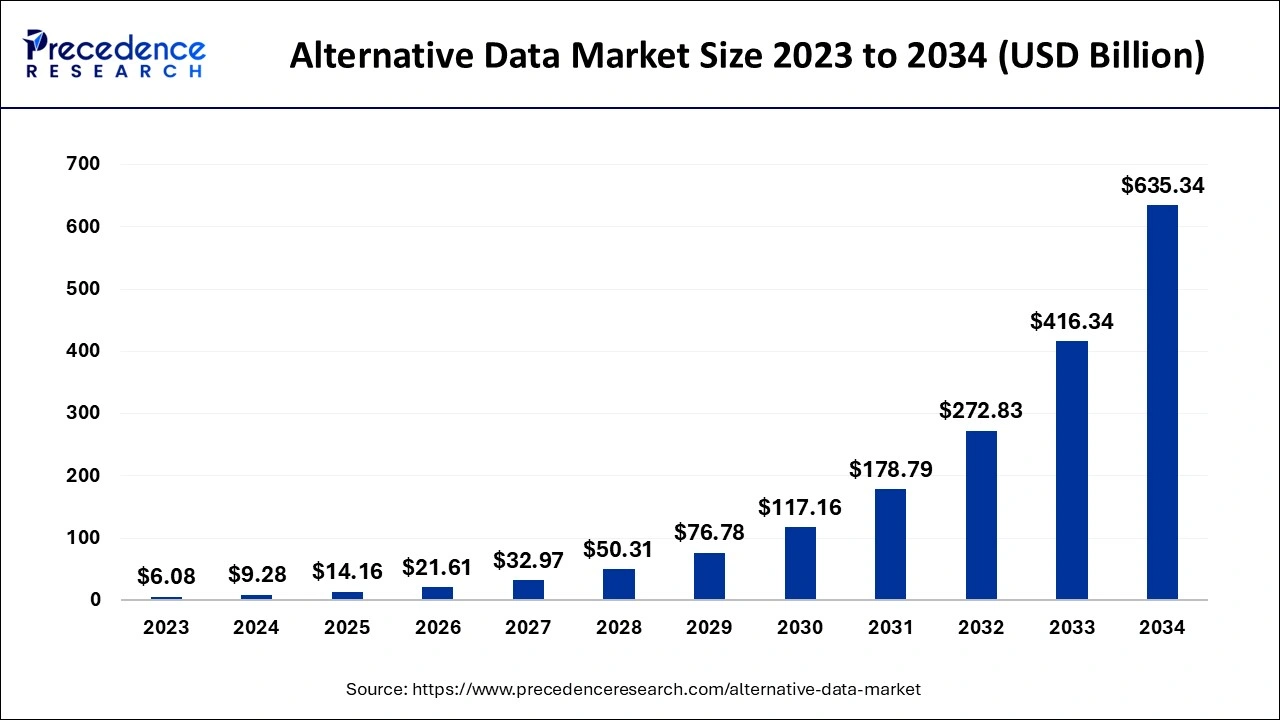

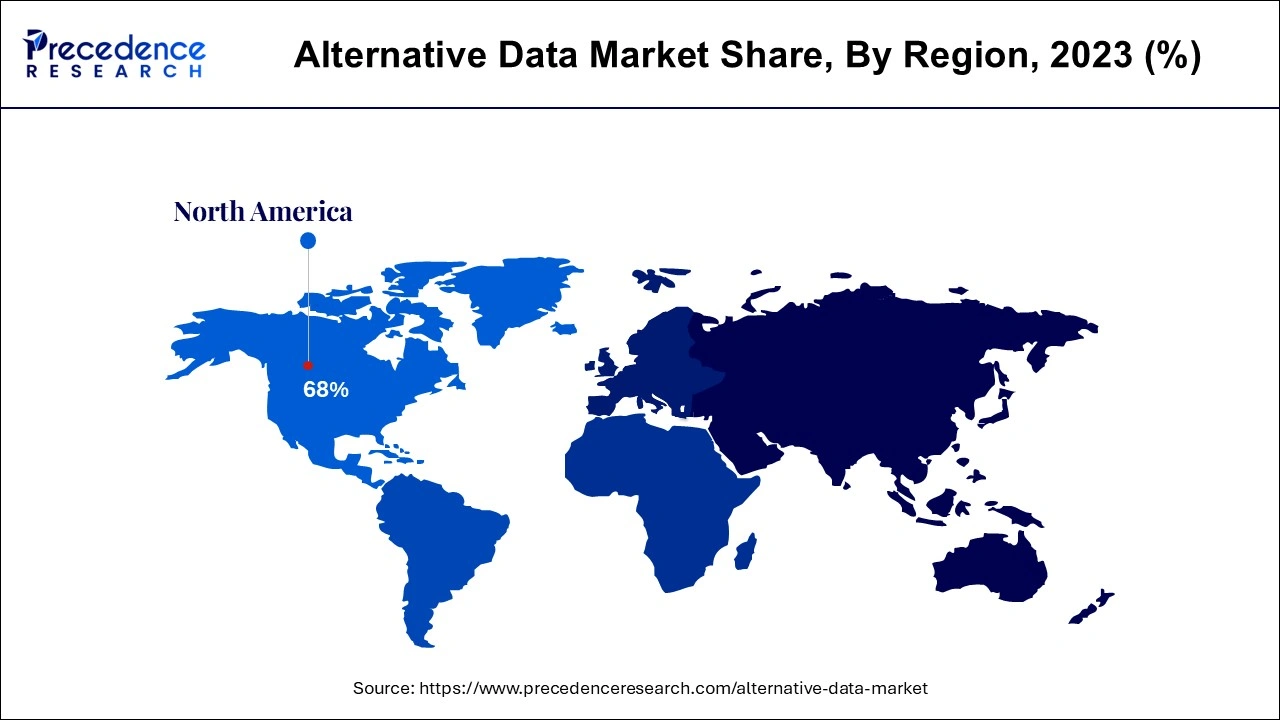

The global alternative data market size accounted for USD 9.28 billion in 2024, grew to USD 14.16 billion in 2025 and is predicted to surpass around USD 635.34 billion by 2034, representing a healthy CAGR of 52.60% between 2024 and 2034. The North America alternative data market size is calculated at USD 6.31 billion in 2024 and is expected to grow at a fastest CAGR of 52.72% during the forecast year.

The global alternative data market size is estimated at USD 9.28 billion in 2024 and is anticipated to reach around USD 635.34 billion by 2034, expanding at a CAGR of 52.60% from 2024 to 2034.

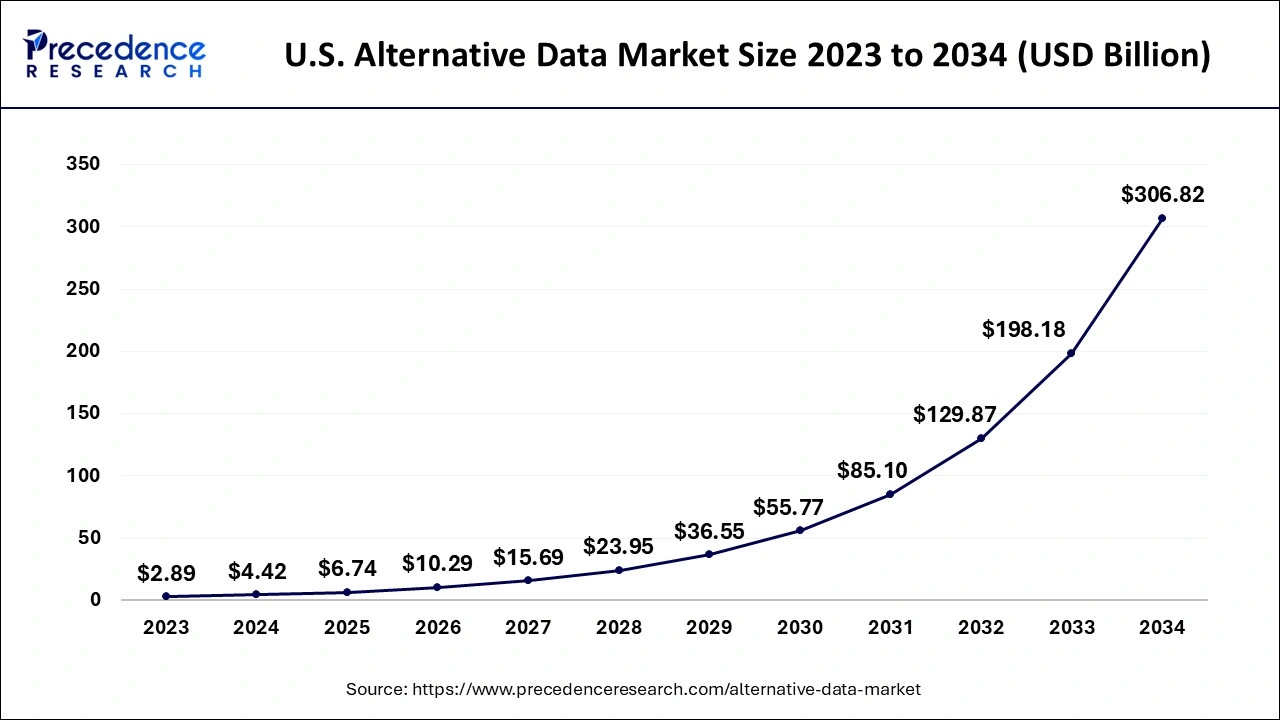

The U.S. alternative data market size is evaluated at USD 4.42 billion in 2024 and is predicted to be worth around USD 306.82 billion by 2034, rising at a CAGR of 52.82% from 2024 to 2034.

During the projected period, North America is expected to maintain its prominent position in the alternative data market. Advan, Eagle Alpha, M Science, and UBS Evidence Lab are just a few of the several market players that are credited with the region's sizable market share. The nation's early acceptance of alternative data from a number of industrial verticals also contributes to its substantial market dominance. Currently, more than 70% of American asset managers favor incorporating alternative data in their investment process. The rise of the regional market is also expected to be fueled by business alliances and purchases from Nasdaq and S&P Global Platts. These elements are elevating it above other regions.

Due to the sizeable alternative Assets under Management (AUM), the market for alternative data in Europe has a sizable revenue share and was anticipated to expand. These assets are mainly spread out among several classes, including real estate, private equity, hedge funds, and natural resources. Asset management firms are using alternative data more and more to develop successful alpha-generating methods.

Over the projected period, Asia Pacific is anticipated to rank among the regional markets with the quickest growth. This is because alternative data use cases in the BFSI, retail, automotive, and telecommunications industries are growing. The growth of the regional market is anticipated to be boosted by the usage of alternative data for investments and risk assessment, particularly from businesses in rising markets like China and India.

Information acquired from non-conventional sources is known as alternative data. Analysis of alternative data can yield insights that go beyond what can be learned from an industry's standard data sources. Investors employ non-traditional data sets known as "alternative data" to inform their investment strategy. Credit card transaction data, IoT sensor data, satellite images, mobile device data, product reviews, site traffic, weather data, app usage, and ESG (environmental, social, and corporate governance) data are a few examples of alternative data sets.

Some alternative data suppliers also keep tabs on congressional trade, government contracts, and business jet travel. The need for alternative data is anticipated to increase as hedge funds place more emphasis on generating alpha. Hedge funds, private equity funds, mutual funds, unit trusts, life insurance companies, pension funds, and other BFSI institutions' asset managers have a strong preference for using alternative data to provide predictive insights. Additionally, it is anticipated that the usage of alternative data for risk management procedures will propel market expansion.

Alternative data is undiscovered information that isn't found in conventional sources like SEC filings, financial statements, news announcements, and management presentations. It is compiled from a variety of sources, including social media, financial transactions, web traffic, public records, mobile devices, sensors, e-commerce websites, satellites, and more. When specialized analytics are applied to this assembled set, previously undiscovered insights are produced that are then used by investors to assess investment opportunities. The buy-side organizations, including private equity funds, hedge funds, mutual funds, pension funds, unit trusts, and life insurance companies, are actively using this new information to develop investment models to outperform the market because it is a key differentiator that contributes to alpha, market outperformance.

Alternative data, which was initially adopted by algorithmic or quantitative traders looking for signals, has extended throughout the institutional investment community and into the corporate sector. The COVID-19 problem marks a new stage for alternative data as well as an unprecedented challenge for corporations and governments.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.28 Billion |

| Market Size by 2034 | USD 635.34 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 52.60% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Data Type, Industry, End User and Geography |

The credit and debit card transactions segment is the market leader and is anticipated to contribute the most to the alternative data market in terms of data type. This substantial share can be attributed to the fact that there are various sources of credit card transaction data available and that investors have a high demand for this kind of data. This sector is also expected to develop at the fastest rate throughout the projected year because to the improved capabilities of the data providers, which include identifying client expenditure based on gender, age, seller, area, and other characteristics. The businesses are combining transaction data with various sorts of data to uncover hidden consumer spending trends, enabling investors to fund successful businesses.

During the projected period, it is anticipated that the social and sentiment data and mobile application usage categories would have significant increase. The increase is linked to the retail industry's growing need for smartphone usage. It is used by retail organizations to examine customer behavior in e-commerce applications. Additionally, merchants are leveraging sentiment data from social media websites more and more to identify consumer interests across diverse groups and geographies. The geolocation from satellite photos is also becoming more and more popular to assess the customer store visits on specific days and times, consequently structuring the operational plans for managing the businesses. Even though these sources are less accurate than transaction data, businesses are figuring out how to connect the connections and gain insights.

The Banking, Financial Services, and Insurance (BFSI) sector dominates the market for alternative data by industry. The expansion can be linked to the rise in demand for intelligent data from different BFSI enterprises. These animals aggressively employ the sources' occult predicting abilities to raise their alpha. During the forecast period, the retail industry segment is expected to display a sizable CAGR. Energy, real estate, construction, transportation, and logistics are some of the industries with the fastest growth.

By Data Type

By Industry

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025