October 2023

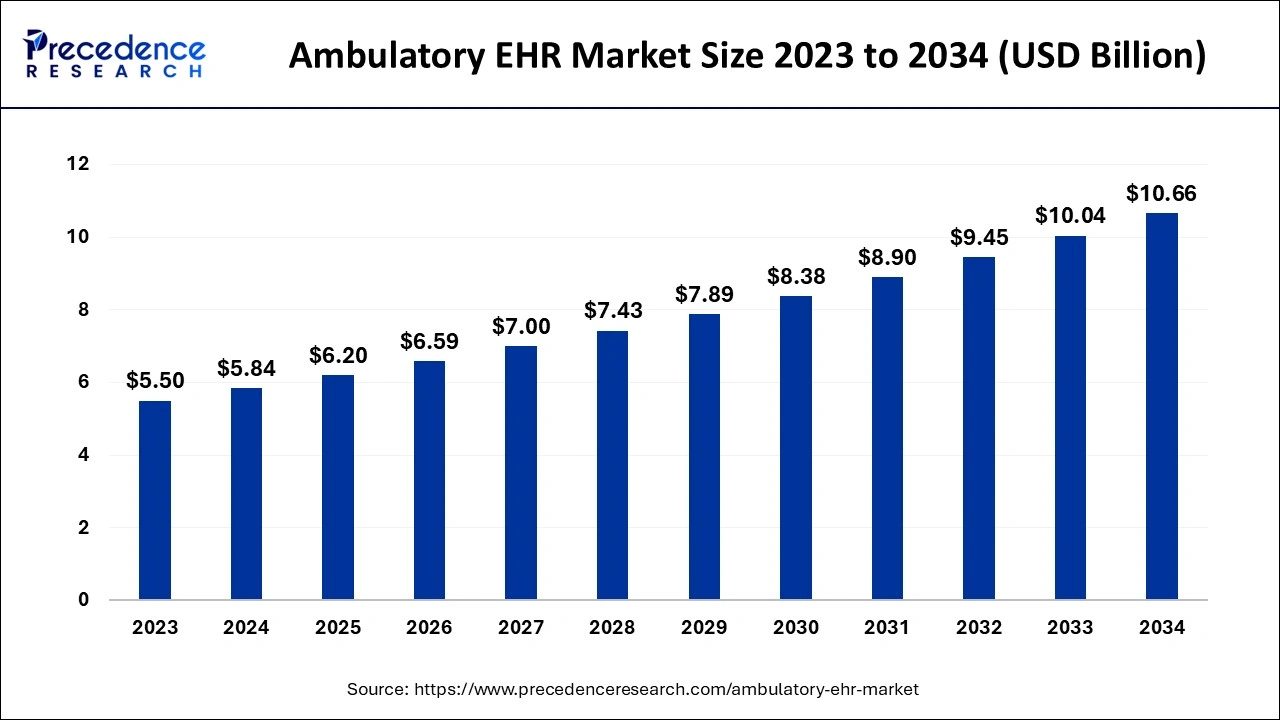

The global ambulatory EHR market size accounted for USD 5.84 billion in 2024, grew to USD 6.20 billion in 2025 and is predicted to surpass around USD 10.66 billion by 2034, representing a healthy CAGR of 6.20% between 2024 and 2034. The North America ambulatory EHR market size is calculated at USD 2.57 billion in 2024 and is expected to grow at a fastest CAGR of 6.30% during the forecast year.

The global ambulatory EHR market size is estimated at USD 5.84 billion in 2024 and is anticipated to reach around USD 10.66 billion by 2034, expanding at a CAGR of 6.20% from 2024 to 2034.

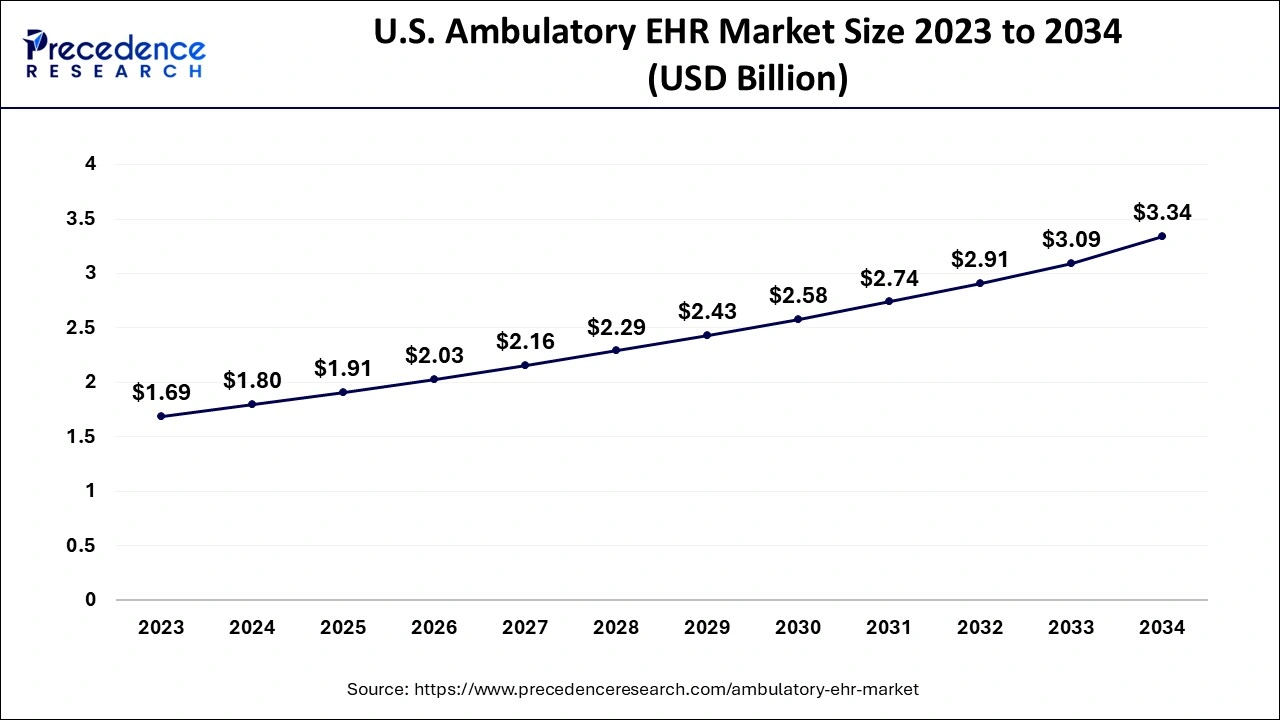

The U.S. ambulatory EHR market size is evaluated at USD 1.80 billion in 2024 and is predicted to be worth around USD 3.34 billion by 2034, rising at a CAGR of 6.39% from 2024 to 2034.

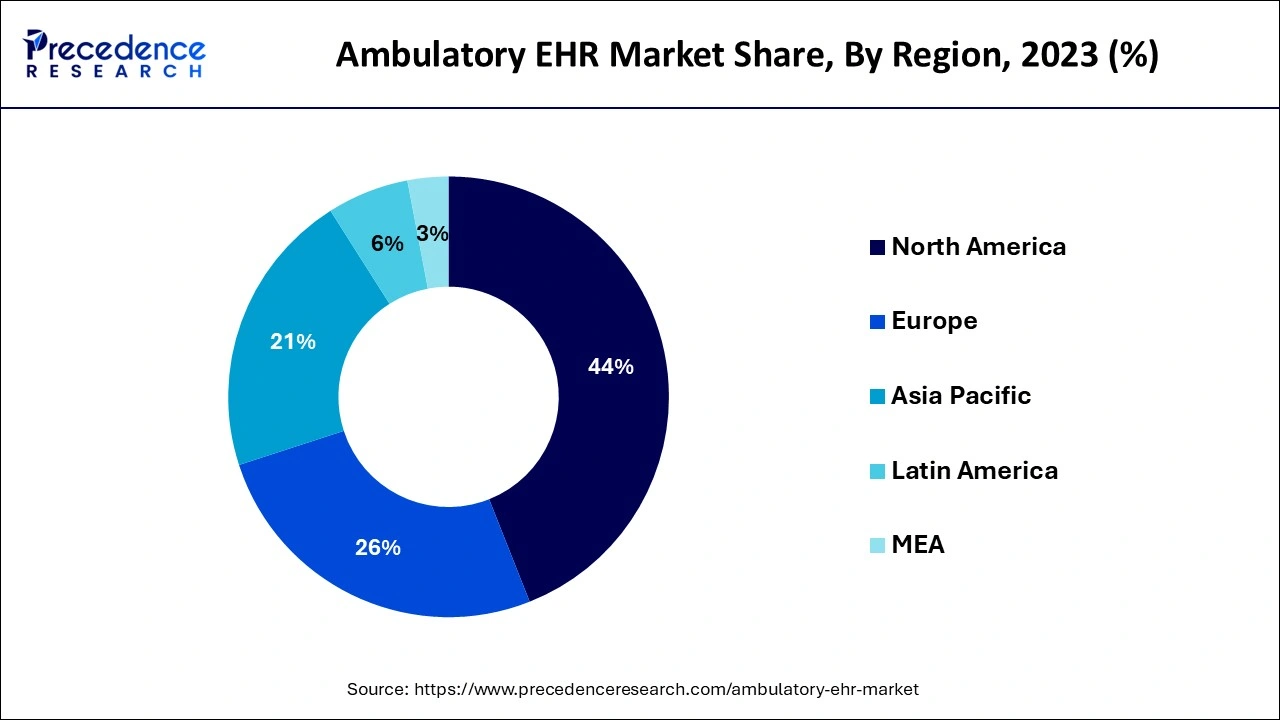

The international demand for portable EHR was controlled by North America. Developing government assistance to encourage the use of EHR systems and patients' rising preference for outpatient treatment above hospitalization are the main factors driving the expansion of such a market throughout North America, which accounts for the highest share. The United States had the greatest share of the outpatient EHR industry, and it is expected to keep that position throughout the forecast timeframe.

Europe had the second-highest share. The quick adoption of EHR solutions, the expansion of socialized medicine promotion initiatives, and the country's burgeoning aging people are all factors in Northern America's supremacy.

Asia-Pacific is anticipated to have the quickest growth rate because of the significant investment made in EHR systems from ministries, non-profits, and the financial industry. The population's advancing age and the increased prevalence of chronic illnesses are the driving forces behind development in many nations like China and India. Additionally, there are more medical doctors and outpatient treatment services available in the region thanks to a stronger hospital network as well as a training course.

As an alternative to the intricate labyrinth of hospital departmental services, portable electronic medical records (EHR) are created to assist outpatient treatment institutions and straightforward practices. Freestanding Electronic Health Records (EHRs) offer more benefits in long-term care because they continuously monitor the physician's record. Freestanding EHRs incorporate all patient health-related data, including details on illnesses, accidents, as well as other medical issues. This comprehensive picture of data aids doctors in the future diagnosis of diseases and consumer preventative medicine. To connect several specialist clinics for better data gathering, eClinicalWorks and FIGmd, Inc. engaged in a strategic alliance in April 2020.

Significant drivers of the growth of the global outpatient electronic medical record market include increasing demand for physician treatment centers, improved patient information registration for proper diagnosis, an increasingly large birth-rate percentage, and the requirement for earlier detection to lower the prevalence of chronic diseases. Moreover, the requirement for thorough patient data to enhance patient safety, the rise in the demand for smart software products within every growing number of patients, and workflow effectiveness are anticipated to accelerate the adoption of outpatient electronic health records over the projected timeframe. The demand for hospital outpatient electronic health records is being hindered by the high costs of software design and deployment, regular reports of data breaches, ineffective information management systems, the complexity of switching from a traditional to an effective system, and a lack of amiable medical staff.

A software application called an outpatient electronic medical record (EHR) is made to be used in outpatient treatment environments and smaller organizations. A patient's comprehensive medical information is accessible to medical practitioners and is kept in an online format. All information on surgeries or treatments that don't necessitate hospitalization is generally contained in these papers. The monitoring of a patient's health history and ongoing care is made simpler for healthcare professionals by transportable EHR systems. As a consequence of the collection and analysis of pertinent data about every patient by doctors using this software, extensive databases of the patient's health records are created. This extensive database aids doctors in developing a more thorough grasp of the health of their patients, thereby simplifying subsequent diagnoses.

The growing demand for outpatient treatment over in-patient care among patients increased government assistance for the use of EHR solutions and rising operational costs within the health industry are the main factors propelling the worldwide outpatient EHR market. A few other aspects that provide substantial potential prospects for market players include the incorporation of machine learning and deep learning technologies, as well as the shifting technology backdrop in emerging economies. However, it is anticipated that limitations in IT infrastructures in low-income nations, information security issues, high installation expenses, and hefty investments in infrastructure will to some degree restrain the growth of this industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.84 Billion |

| Market Size by 2034 | USD 10.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.20% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

EHR solutions are being more widely adopted in mature economies

Initiatives by the government to improve patient health information portals

There are more outpatient facilities and there are more patients

Establishing a safe communication channel

The cloud system's innovation has opened up new business opportunities

Simple, usable implementations of complex systems are possible

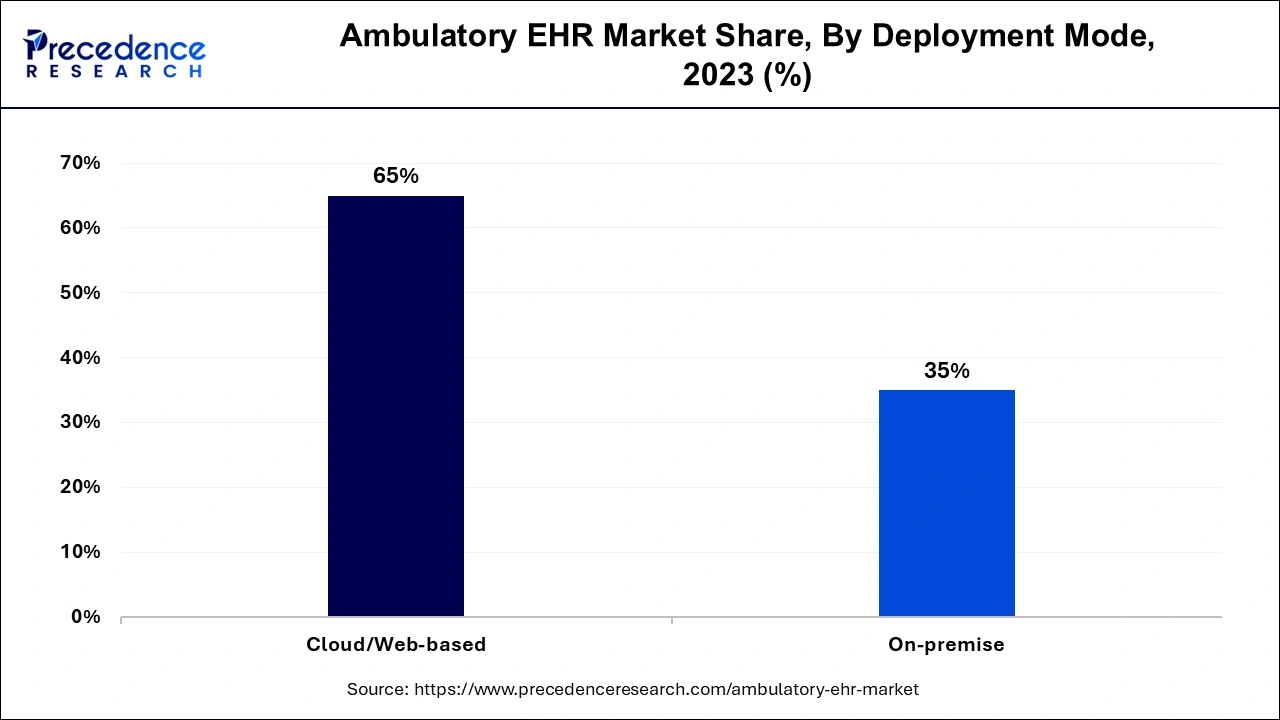

The largest portion of the worldwide outpatient EHR industry was catered for by the cloud/web-based installation method category. The main reasons influencing the expansion of this market are the benefits that the public cloud offers, including flexibility, data security, mobility, and reduced system prices compared to on-premise implementation. Implementing an EHR in the cloud gives doctors access to patient records in real-time, which enhances wellness.

Cloud-based EHR systems are also renowned for their adaptability, enhanced collaboration possibilities, and increased patient security. Furthermore, cloud computing is more secure because it complies with HIPAA regulations. Additionally, a cloud-based EHR program enables more secure patient data than in-house electronic health records and is far less expensive to deploy and operate than an internal EHR system.

Additionally, the launches of many leading competitors place a strong emphasis on such technology-based items. For instance, Somo General Hospital announced in Oct 2021 the adoption of a cloud-based EHR from healthcare IT vendor eClinical Works to enhance clinical decision-making. The abovementioned factors are driving segment expansion, which in turn fuels the outpatient EHR industry's overall expansion over the projection year.

The biggest proportion of the worldwide ambulatory EHR industry was held by the all-in-one segment. The significant market position of such a category is mostly due to elements like user-friendliness, accessibility to all features, and integrated software and hardware integration.

The largest portion of the worldwide ambulatory EHR market was occupied by large practices. The ability of larger practitioners to handle potential productivity, administration, and handling problems brought on by the adoption of new EHR technologies, as well as their financial capability to select from a variety of options, is what is driving this market's expansion.

The industry for ambulatory EHRs worldwide was dominated by the managed services sector. The program's sophisticated capabilities for medical record-keeping, appointment scheduling, and billing chores are what is fueling this market's expansion.

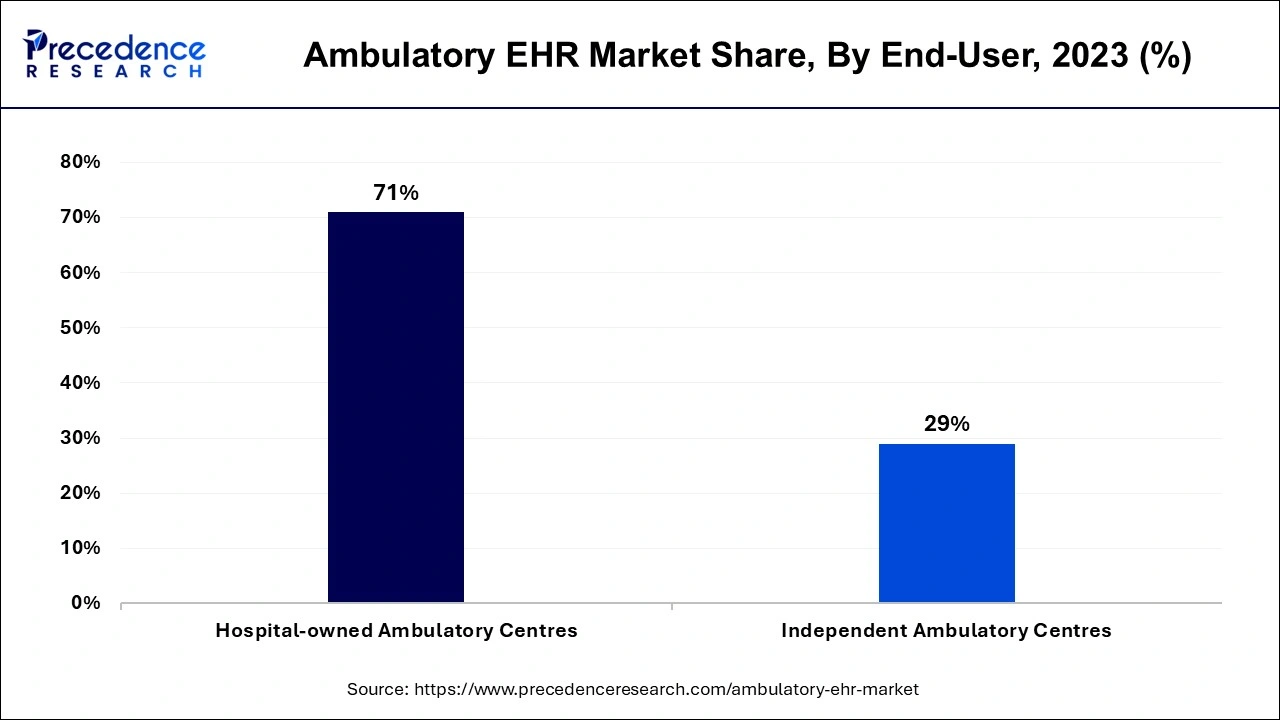

The sector of hospital-owned outpatient facilities held the biggest market share of mobile EHR globally. Hospital-owned outpatient centers' increased requirement to manage unorganized health information and their acceptance of EHR systems at a higher rate than freestanding outpatient institutes are also factors in the company's size.

By Deployment Mode

By Type

By Practice Size

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

September 2024

March 2025

February 2025