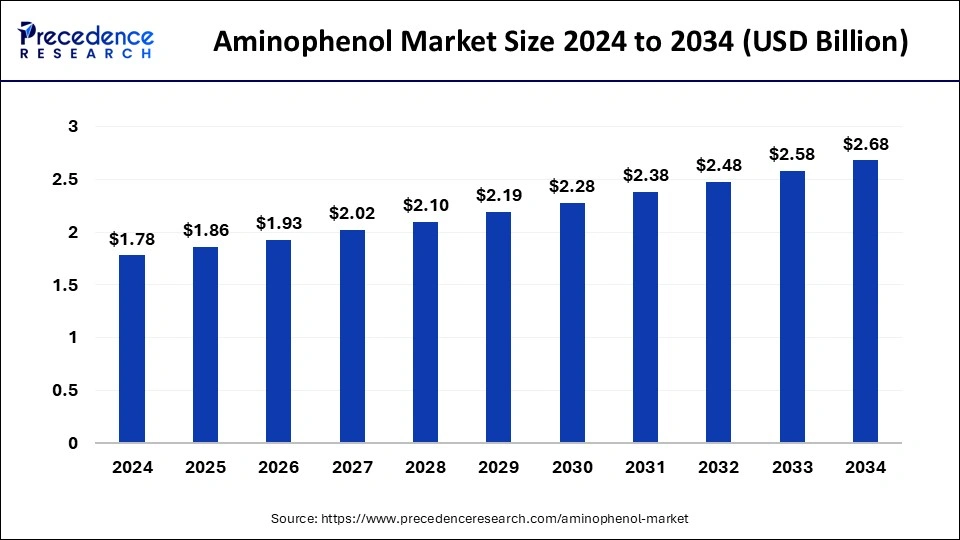

The global aminophenol market size is calculated at USD 1.86 billion in 2025 and is forecasted to reach around USD 2.68 billion by 2034, accelerating at a CAGR of 4.18% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aminophenol market size was estimated at USD 1.78 billion in 2024 and is predicted to increase from USD 1.86 billion in 2025 to approximately USD 2.68 billion by 2034, expanding at a CAGR of 4.18% from 2025 to 2034. Because aminophenol compounds may provide vivid and durable colors, they are frequently utilized in hair dyes.

A class of chemical compounds known as aminophenol are phenol derivatives that have an amino group joined to the aromatic ring. Ortho-aminophenol (OAP), meta-aminophenol (MAP), and para-aminophenol (PAP) are the three isomers of aminophenol. These substances are necessary intermediates in many chemical reactions, such as those that produce agrochemicals, medicines, and colors.

Due to its widespread usage in the production of the popular analgesic and antipyretic medication, paracetamol (acetaminophen), aminophenol, and especially PAP, are in high demand. Aminophenol compounds play a key role in the production of pigments and dyes, particularly in the textile and hair color industries. The need for aminophenol as an intermediate in the synthesis of pesticides and herbicides is driven by the expansion of the agricultural industry.

Growth in the aminophenol market may be hampered by strict environmental and safety laws pertaining to the manufacture and disposal of chemical intermediates. The dynamics of the market as a whole may be impacted by price fluctuations for the raw materials required to produce aminophenol. With so many chemical and pharmaceutical manufacturing facilities, particularly in China and India, this area has a substantial market share.

The expanding textile sector also helps the market expand. The aminophenol market is anticipated to expand gradually due to the ongoing demand from the dye and pharmaceutical sectors. Growth in the market can be supported in addition to advancements in production technology and diversification into new application areas.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.68 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.18% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing pharmaceutical industry

The need for essential intermediates like aminophenol is rising as pharmaceutical production facilities spread throughout the world, especially in developing nations. The necessity to fulfill the expanding healthcare needs of greater populations is driving this expansion. Technological developments in chemical synthesis and production have improved the productivity and affordability of aminophenol manufacture. Pharmaceutical businesses will find better-quality intermediates and higher yields from improved procedures more appealing.

Innovation in the aminophenol market is driven by ongoing R&D efforts to find novel medicinal applications for aminophenol. New market niches may become available due to improved medication formulations and therapeutic applications. Countries like China, India, and Brazil are experiencing rapid economic growth, which raises the cost of healthcare and increases pharmaceutical output. These areas are starting to emerge as major competitors in the worldwide aminophenol industry.

Health and safety risks

Aminophenol has the potential to trigger allergic reactions, especially in people who already have sensitivity issues. This can include symptoms similar to asthma following exposure and allergic contact dermatitis. Methemoglobinemia, a condition in which hemoglobin is changed into methemoglobin and loses some of its oxygen-carrying capacity, can be brought on by aminophenol. Aminophenols are flammable and can cause fires; this is particularly true when they are powdered, as the dust can produce explosive environments.

Fatigue, lightheadedness, cyanosis, and in extreme situations, possibly even death may ensue from this. Because they are chemically reactive and prone to oxidation, handling, and storage of aminophenol can be dangerous. Minimizing these dangers requires proper storage conditions, which include avoiding high temperatures and light exposure. Essential safety precautions include using non-sparking instruments, controlling dust, and providing enough ventilation.

Agricultural sector

Since aminophenol is mostly recognized as a chemical substance used in the manufacturing of colors, medications, and several other industrial applications, its connection to the agriculture industry may not be immediately obvious. Aminophenol and agriculture could, however, come into contact because of its use in the manufacturing of pesticides. In contemporary agriculture, aminophenol derivatives—such as herbicides and insecticides based on aminophenol—can be useful in managing crop-damaging weeds, pests, and illnesses. Farmers can include these compounds in products to safeguard their crops and boost harvests. Researchers may investigate how these substances might be used for disease resistance, crop protection, or other agricultural improvements.

The M-aminophenol segment dominated the aminophenol market in 2024. An essential step in the creation of the dyes used in cosmetics and hair colorants is m-aminophenol. It is a favored option in the personal care sector because of its capacity to produce stable and brilliant hues. The agricultural industry benefits from the usage of M-Aminophenol in the formulation of pesticides and herbicides, which protect crops and increase yield. It serves as an intermediary in the production of many medicinal substances.

Because of its chemical makeup, it can be used to create medications with particular medicinal effects. The market for M-Aminophenol is anticipated to expand gradually due to its numerous uses in different sectors. Future developments in production technologies and an emphasis on sustainable practices will probably influence the market's structure.

The P-aminophenol segment is expected to grow rapidly in the aminophenol market in the upcoming years. The main usage of P-aminophenol is as an intermediary in the production of the popular analgesic and antipyretic paracetamol (acetaminophen). The need for p-aminophenol is directly related to the paracetamol manufacturing process. The market for pharmaceuticals is affected by changes in the sector, especially when it comes to the need for drugs that reduce fever and relieve pain. In the aminophenol market, P-aminophenol is an essential component that is extensively used in the dye, pharmaceutical, and photographic industries. The need for paracetamol, improvements in production technology, and local industrial activity all affect market developments. In order to achieve sustainable growth, the market must address issues, including raw material shortages and environmental concerns.

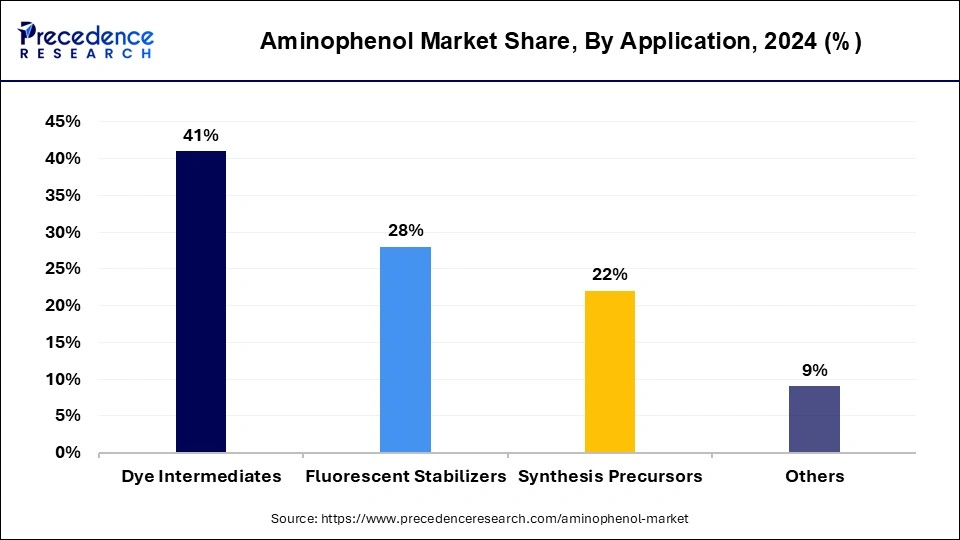

The dye intermediates segment held the largest share of the aminophenol market in 2024. Compounds with both amine and phenol functional groups are known as aminophenol. Their versatility in undergoing several chemical reactions to generate intricate dye molecules has led to their widespread use as intermediates in the manufacture of different pigments and dyes. The demand from the textile, hair care, pharmaceutical, and other industries drives the aminophenol market, which is essential to the larger chemical industry. This is especially true for dye intermediates. At the same time, raw material costs and environmental restrictions are obstacles for the business. Developments in technology and sustainability also present opportunities. It is imperative for stakeholders attempting to navigate this intricate industry to comprehend these aspects.

The fluorescent stabilizers segment is expected to grow at a notable rate in the aminophenol market during the forecast period. Fluorescent stabilizers are essential parts of several sectors, including the market for aminophenol. Fluorescent stabilizers can be beneficial when added to aminophenol, which is a chemical compound made from phenol and utilized in the production of medications, dyes, and hair coloring solutions. These stabilizers work to shield aminophenol-based products from light and heat-induced degradation, preserving their chemical integrity and functionality. By absorbing harmful UV light and releasing it as inert heat, fluorescent stabilizers prevent aminophenol compounds from photodegrading. Because they improve the stability, durability, and performance of goods based on aminophenol, fluorescent stabilizers are essential to the market.

The pharmaceuticals segment led the global aminophenol market in 2024. Because aminophenol is used in the production of numerous medications and pharmaceutical goods, the market for them is important, especially when it comes to the pharmaceutical industry. Aminophenols are useful intermediates in the production of pharmaceuticals because they are organic molecules with both phenol and amino groups in their structure. The aging population and rising healthcare costs are driving growth in the global pharmaceutical business, which in turn is driving demand for aminophenol. In the pharmaceutical sector, aminophenol is essential because it helps make life-saving drugs like paracetamol. The demand for healthcare services, the developing pharmaceutical industry, and the ongoing search for sustainable and new manufacturing techniques are the main factors driving the market.

The chemicals segment is expected to grow at a significant rate in the aminophenol market during the forecast period. Often used as a developer for photographs, in the production of colors, and in the manufacturing of medications (such as paracetamol). Ongoing research and development projects with the goal of creating new uses and more effective manufacturing techniques. Increasing emphasis on environmentally friendly chemicals and sustainable production techniques. Possibility of industry consolidation as larger firms buy out smaller ones to expand their capacities and reach. The need for aminophenol, especially p-aminophenol, which is used in the manufacturing of paracetamol, is greatly fueled by the growth of the pharmaceutical industry. The need for all forms of aminophenol has increased with the rise of the dye industry, especially in emerging nations.

Asia Pacific led the aminophenol market in 2024. The need for aminophenol in medicines, dyes, and other industrial applications is only one of the many drivers driving the market for this important chemical product in the area. Organic substances known as aminophenol are phenol derivatives with an amino group joined to the benzene ring. The three isomers of these compounds, ortho-aminophenol, meta-aminophenol, and para-aminophenol, each have different uses.

One of the main drivers is the growing need for paracetamol in the pharmaceutical sector. PAP is anticipated to be in high demand due to rising healthcare demands, particularly in nations like China and India. The aminophenol market is being driven by ongoing research and development into the chemical production and applications of aminophenol. Enhancing product quality and production efficiency is the companies' main priority.

North America is expected to grow at the fastest rate in the aminophenol market during the forecast period. The demand from the pharmaceutical and cosmetic sectors is expected to fuel the considerable growth of the market in North America in the next years. A vital precursor in the production of paracetamol (acetaminophen), a commonly used fever reducer and pain reliever, is aminophenol, specifically p-aminophenol.

Aminophenol demand is rising due to the growing need for medications, especially in an older population. Although development estimates are good, there are worries about how aminophenol should be handled and disposed of. If not sufficiently addressed, improper management can result in health and environmental issues, which may restrict the aminophenol market expansion.

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client