January 2025

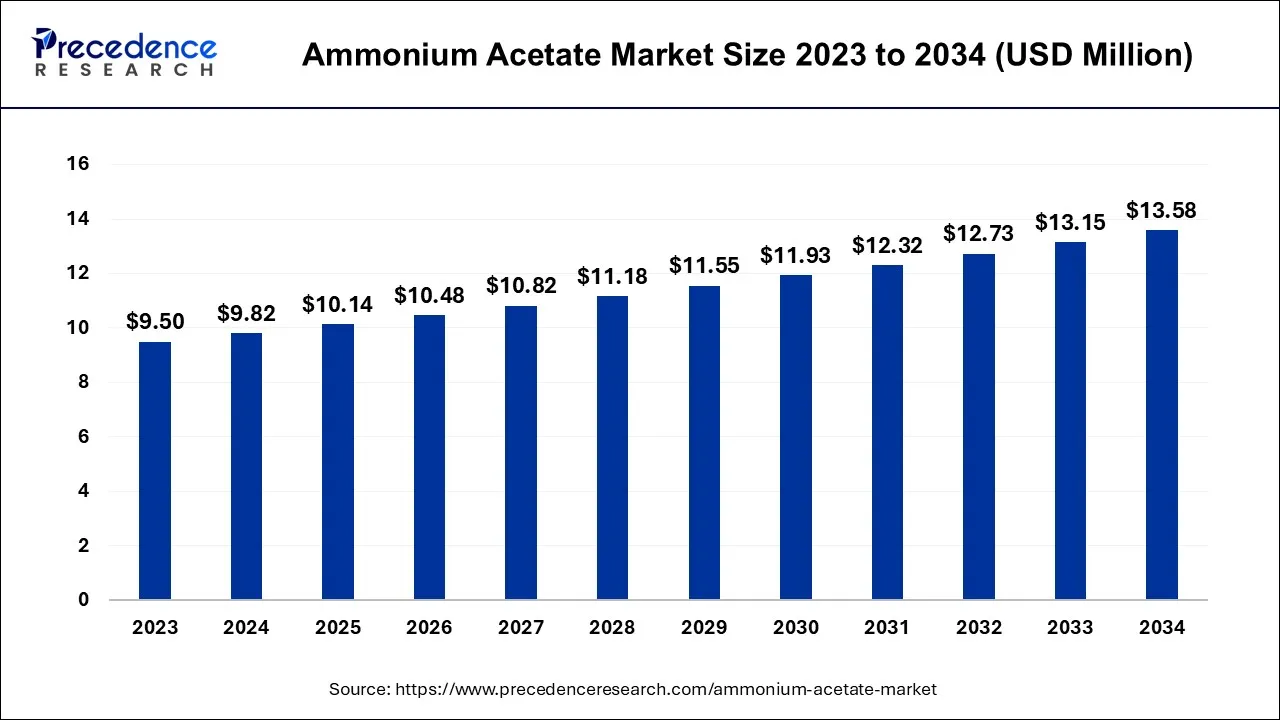

The global ammonium acetate market size is calculated at USD 9.82 million in 2024, grew to USD 10.14 million in 2025, and is predicted to hit around USD 13.58 million by 2034, expanding at a CAGR of 3.3% between 2024 and 2034. The North America ammonium acetate market size accounted for USD 3.73 million in 2024 and is anticipated to grow at the fastest CAGR of 3.43% during the forecast year.

The global ammonium acetate market size is expected to be valued at USD 9.82 million in 2024 and is anticipated to reach around USD 13.58 million by 2034, expanding at a CAGR of 3.3% over the forecast period from 2024 to 2034.

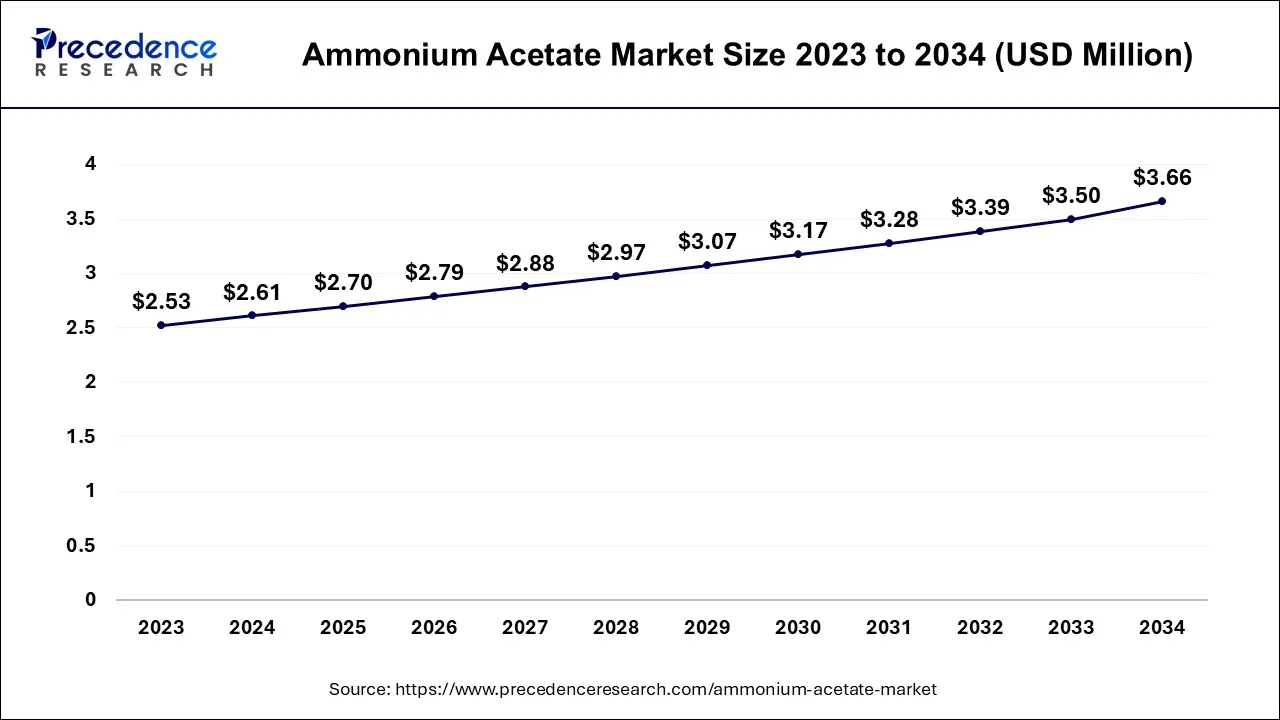

The U.S. ammonium acetate market size is accounted for USD 2.61 million in 2024 and is projected to be worth around USD 3.66 million by 2034, poised to grow at a CAGR of 3.44% from 2024 to 2034.

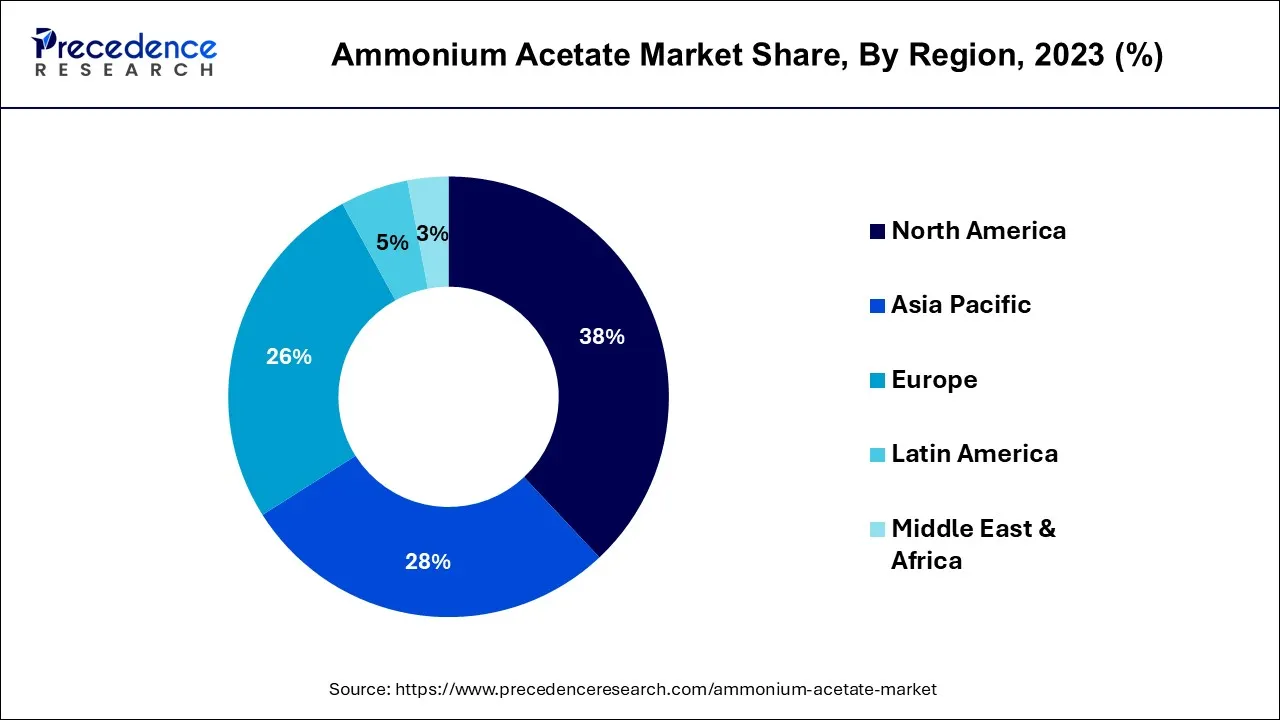

North America has held the largest revenue share 38% in 2023. North America's dominance in the ammonium acetate market can be attributed to several distinctive factors. The region boasts a well-entrenched pharmaceutical and biotechnology sector that heavily relies on ammonium acetate for precision-driven analytical chemistry and cutting-edge research. The region's uncompromising commitment to stringent environmental regulations and its inclination toward environmentally sustainable chemical solutions, like ammonium acetate, further solidify its foothold.

Moreover, the thriving agricultural industry in North America propels the demand for ammonium acetate-based fertilizers. The region's economic prowess, unwavering dedication to research and development endeavors, and a prevailing emphasis on sustainability collectively underpin North America's preeminent position in the ammonium acetate market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific’s growth in the ammonium acetate market is primarily due to its robust agricultural sector and burgeoning industrial activities. The region's extensive agricultural practices rely on ammonium acetate-based fertilizers, driving consistent demand. Moreover, Asia-Pacific's rapidly expanding pharmaceutical and chemical industries employ ammonium acetate extensively in research and production, further boosting consumption.

The region's cost-effective manufacturing capabilities, coupled with its growing population and urbanization, make it a key market for ammonium acetate. Additionally, the presence of several ammonium acetate manufacturers in the region strengthens its market share, as it cater to both domestic and international markets, consolidating its leadership position.

The ammonium acetate market is a chemical industry segment involving the production, sale, and utilization of ammonium acetate, a white crystalline salt with diverse applications. It serves as a source of acetate ions and is used in laboratory settings, agriculture as a nitrogen source, and in chemical processes like dyeing and electroplating. The market's dynamics are influenced by factors like demand in research and industrial applications, agricultural practices, and the overall chemical industry trends. Prices and availability fluctuate based on supply and demand, with manufacturers, distributors, and end-users driving the market's growth and stability.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.82 Million |

| Market Size by 2034 | USD 13.58 Million |

| Growth Rate from 2024 to 2034 | CAGR of 3.3% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Grade, By Application, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Scientific research and analytical applications

Scientific exploration and analytical applications function as the preeminent ignition for the surge in the ammonium acetate market, an escalation intrinsically linked to its inescapable role in amplifying and progressing the techniques that underlie a myriad of scientific fields. In the intricate realm of mass spectrometry and analytical chemistry, ammonium acetate occupies a pivotal niche, orchestrating the preparation and ionization of samples, thus facilitating the precise scrutiny of intricate molecular structures. Its seamless alignment with liquid chromatography-mass spectrometry (LC-MS) methodologies remains a distinctive hallmark, enabling the meticulous quantification of a wide spectrum of compounds, including pharmaceuticals, biomolecules, and environmental contaminants.

The insatiable pursuit of scientific ingenuity and the ever-expanding yearning for impeccable research results drive an unwavering demand for ammonium acetate. As researchers persistently push the frontiers of knowledge in sectors such as pharmaceuticals, biotechnology, and environmental sciences, the ammonium acetate market not only thrives but transgresses the confines of scientific inquiry, ushering in unprecedented applications and spreading its influence across an array of research domains.

Environmental concerns

Environmental concerns are emerging as a significant restraint on the growth of the ammonium acetate market. While ammonium acetate is considered relatively eco-friendly in specific applications, it may not align with increasingly stringent environmental regulations and sustainability objectives in various regions. One primary concern is its potential contribution to soil and water contamination when used in agriculture. The runoff of excess ammonium acetate can result in increased nitrogen levels in water bodies, causing ecological imbalances and posing risks to aquatic ecosystems.

Additionally, the disposal of ammonium acetate and its byproducts requires careful consideration to prevent harm to the environment. Handling and storage procedures must comply with safety and environmental regulations, increasing operational costs for manufacturers.

Furthermore, the carbon footprint associated with ammonium acetate production can be a concern, especially if manufacturing processes rely on energy-intensive methods. As environmental regulations continue to evolve and become more stringent, the ammonium acetate market may face obstacles in ensuring compliance and maintaining environmentally responsible practices, potentially limiting its market access and growth opportunities.

Biotechnology and pharmaceuticals

Biotechnology and pharmaceuticals are catalysts for the growth of the ammonium acetate market, providing lucrative opportunities. The pivotal role of ammonium acetate in mass spectrometry and analytical chemistry is paramount for drug discovery, analytical research, and pharmaceutical development. It serves as an essential reagent in sample preparation, facilitating the accurate analysis of complex biomolecules and pharmaceutical compounds.

As these industries continue to expand and innovate, the demand for high-purity ammonium acetate remains robust. The development of cutting-edge drugs and biotechnological advancements relies on precise and reliable analytical methods, where ammonium acetate plays a crucial part. Opportunities arise from the continuous quest for innovative pharmaceuticals, the need for efficient quality control, and the drive for accurate biomarker identification. This demand encourages market growth and creates avenues for ammonium acetate manufacturers to supply high-quality reagents, supporting the ever-evolving biotechnology and pharmaceutical sectors.

According to the grade, the medical grade segment has held a 36% revenue share in 2023. The medical grade segment holds a significant share in the ammonium acetate market due to its critical role in pharmaceutical and medical research. Ammonium acetate's high purity and consistency are vital in analytical chemistry, particularly in mass spectrometry, making it indispensable for drug development and biomarker analysis.

The global focus on healthcare and the increased demand for pharmaceuticals, especially during the COVID-19 pandemic, have amplified the need for reliable and high-quality reagents. As a result, the medical grade segment has become a major driver of the ammonium acetate market, meeting the stringent requirements of the pharmaceutical and healthcare sectors.

The food grade segment is anticipated to expand at a significant CAGR of 3.5% during the projected period. The preeminence of the food-grade segment within the ammonium acetate market can be attributed to its pivotal position in a myriad of food and beverage applications. As a verified, safe, and compliant food additive, it enjoys a distinct advantage. This grade of ammonium acetate has secured regulatory approvals for its deployment in the realm of food processing, rendering it a preferred choice.

Its primary function involves acting as an acidity regulator and pH modulator, significantly enhancing the preservation and sensory characteristics of food products. Furthermore, its environmentally friendly and non-toxic attributes seamlessly resonate with the surging consumer demand for sustainable and secure food ingredients, further solidifying its dominance in this specific market domain.

Based on the application, the fertilizers generator segment is anticipated to hold the largest market share of 25% in 2023. The prominence of the fertilizers segment in the ammonium acetate market is attributed to the indispensable role ammonium acetate plays in revolutionizing modern agricultural practices. It serves as a pivotal nitrogen source in fertilizers, fostering not only enhanced crop yields but also the adoption of sustainable and eco-conscious agricultural methods.

In an era of global population expansion and heightened demands for food security, ammonium acetate's reputation for environmental friendliness aligns harmoniously with the imperative for sustainable farming. Thus, it stands as a substantial force in the fertilizer industry, and its eco-friendly attributes substantiate its significant share within the ammonium acetate market.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The other segment holds significant growth in the ammonium acetate market due to the compound's versatility. This catch-all category encompasses a wide range of applications beyond the more defined sectors, including niche uses in research, chemical processes, and specialized industries. Ammonium acetate's flexibility and compatibility with various processes make it a valuable component in applications not covered by more specific segments, allowing it to cater to diverse and evolving market demands. This adaptability and broad utility in addressing unique needs contribute to the segment's substantial growth in the ammonium acetate market.

In 2023, the medical & pharmaceutical segment had the highest market share of 32% on the basis of the end-use industry. The dominance of the medical and pharmaceutical segment in the ammonium acetate market can be attributed to its indispensable contribution to drug development and analytical chemistry. Ammonium acetate plays a pivotal role in enabling the precise analysis of intricate biomolecules through mass spectrometry and analytical research in the pharmaceutical sector. Given the ongoing evolution and breakthroughs within the pharmaceutical and biotechnology industries, ammonium acetate's high-purity variant remains in unwavering demand.

Its reputation for delivering reliable and precise results in analytical methods underscores its irreplaceable significance in pharmaceutical research, quality control, and biomarker identification, thereby solidifying its prominent standing within this specific end-use sector.

The other segment is anticipated to expand at the fastest rate over the projected period. The others segment holds a substantial share in the ammonium acetate market due to the compound's versatility and wide range of applications that do not fit neatly into specific industry categories. Ammonium acetate finds use in various niche sectors, including food and beverage, construction, and cosmetics, where it serves unique purposes such as pH regulation, chemical processing, and as a buffering agent. This adaptability across diverse industries contributes to the "others" segment's significant market share, demonstrating ammonium acetate's ability to cater to a broad spectrum of specialized needs beyond the primary end-use categories.

Segments Covered in the Report

By Grade

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

January 2025