July 2025

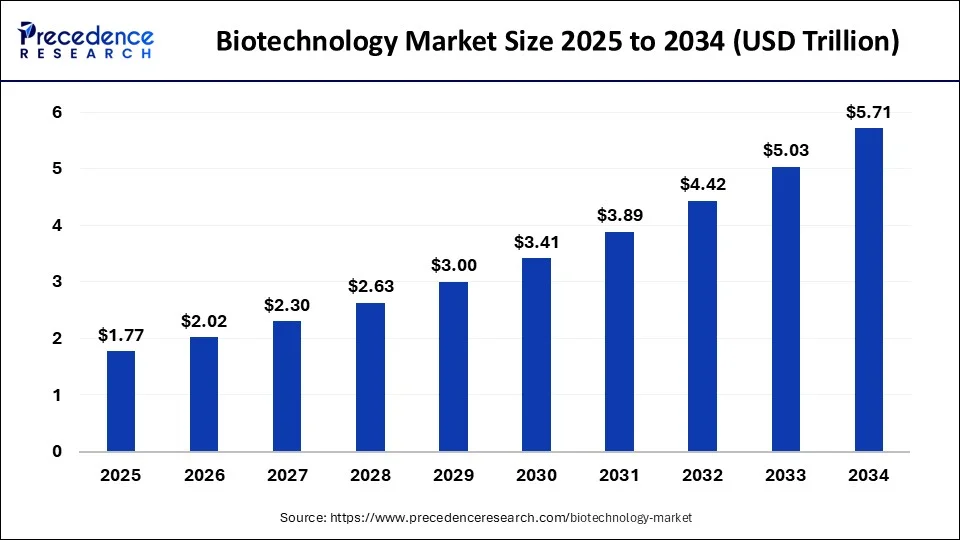

The global biotechnology market size was estimated at USD 1.55 trillion in 2024 and is predicted to increase from USD 1.77 trillion in 2025 to approximately USD 5.71 trillion by 2034, expanding at a CAGR of 13.90% from 2025 to 2034.

Various government initiatives for the biotechnology market

Union Minister Dr. Jitendra Singh, Minister of State (Independent Charge) for Science and Technology, participated in an exclusive interview with Doordarshan News, where he expressed strong belief that the year 2025 will see India taking a pivotal role in the Global Biotechnology revolution and that India's first Biotechnology policy - BIO-E3 introduced by the Modi Government 3.0 has paved the path for this.

Congress allocated a total of $7.5 million to support the Agricultural Biotechnology Education and Outreach Initiative, which requests that the U.S. Food and Drug Administration (FDA) deliver education and outreach to the public regarding agricultural biotechnology and food and animal feed products sourced from biotechnology. The FDA collaborated on this initiative alongside the U.S. Department of Agriculture (USDA) and the U.S. Environmental Protection Agency (EPA).

The European Commission released a communication initiating the EU Biotech and Biomanufacturing Initiative to boost competitiveness and modernize industry. These initiatives aim to promote innovation, enable investment, and establish the EU as a prominent center for biotechnology and biomanufacturing. The initiative outlines eight primary actions, notably: Initiating a study to aid in simplifying and enhancing the EU regulatory framework for biotech (possibly resulting in an EU Biotech Act), Creating an EU Biotech Hub to assist in understanding the regulatory landscape and scaling up, implementing various mechanisms to boost funding and investment in EU biotech and biomanufacturing, Evaluating the EU Bioeconomy Strategy. These actions hold considerable consequences for stakeholders in the EU life sciences ecosystem, particularly regarding the ongoing Pharma Package discussions and the forthcoming EU elections and institutional transitions.

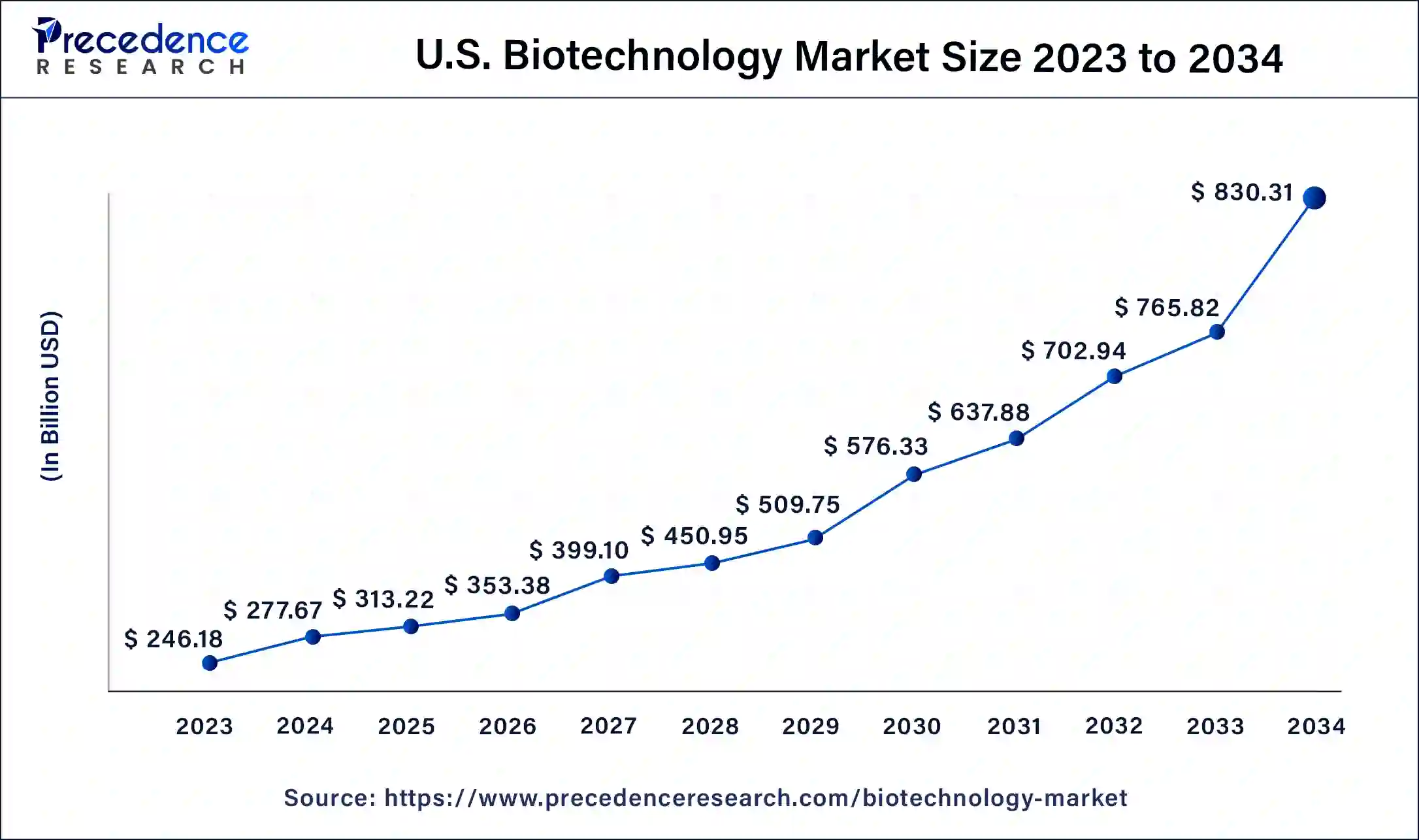

The U.S. biotechnology market size was estimated at USD 277.67 billion in 2024 and is predicted to be worth around USD 1,028.07 billion by 2034, at a CAGR of 14% from 2025 to 2034.

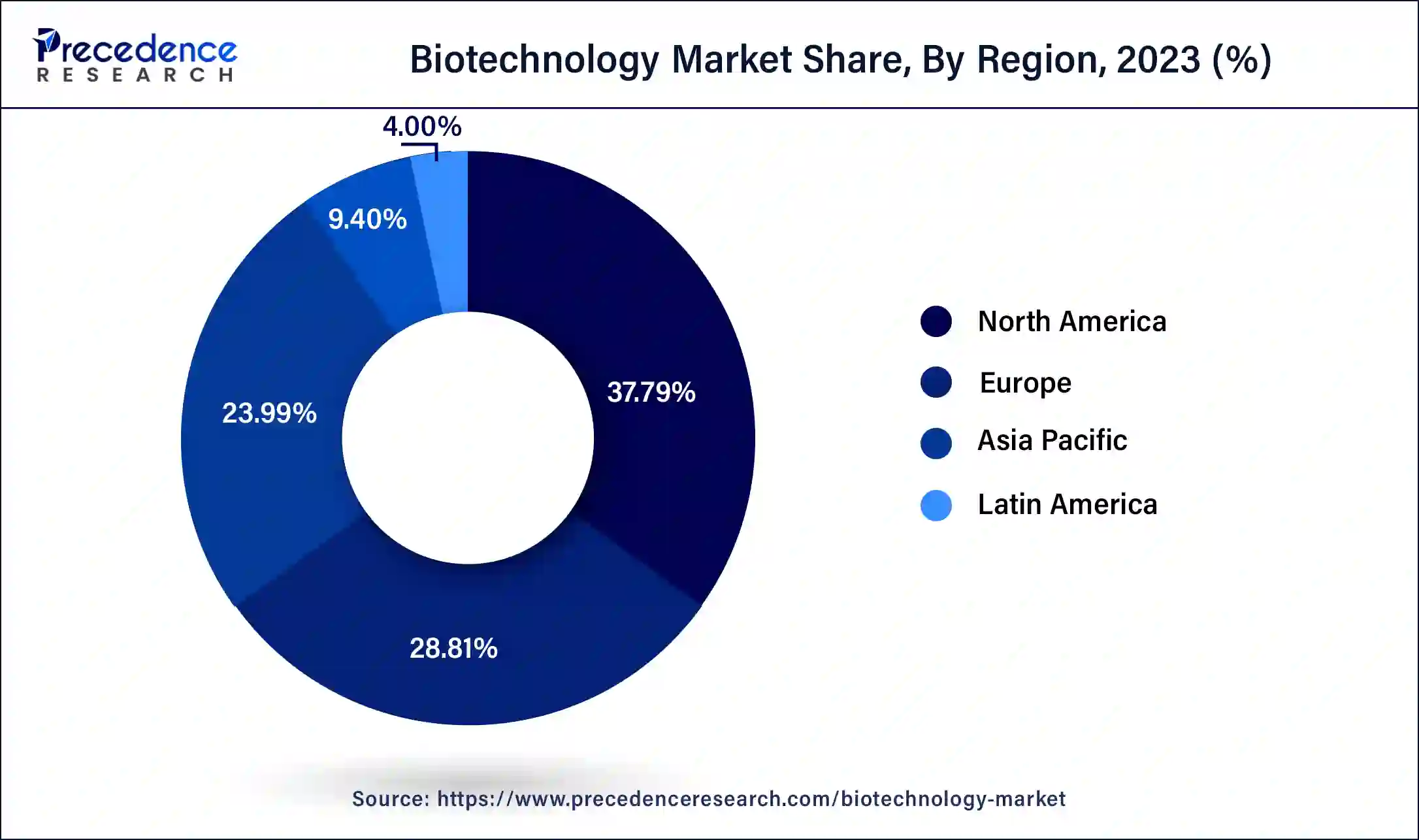

Based on the region, the North American region dominated the global biotechnology market with revenue share in 2024. Several factors, including the existence of important competitors, strong R&D initiatives, and high healthcare expenses, have contributed to the North America region market growth. Furthermore, a growing number of businesses operating in the region are gaining drug approvals, which is fueling market expansion.

The Asia-Pacific is estimated to hit a growth rate of over 14.8% during the forecast period. The improvement of healthcare infrastructure, clinical trial services, and supportive government regulations are all contributing to the Asia-Pacific biotechnology market growth. Moreover, the international market players are partnering actively with local companies in order to accelerate the biotechnology market’s growth.

U.S. Biotechnology Market Trends

The U.S. biotechnology sector is swiftly expanding owing to the persistent demand from multiple industries, such as healthcare, food and beverages, agriculture, pharmaceuticals, fermentation, natural resources and environment, biofuels, and others. A variety of valuable products have been created due to the diverse applications of biotechnology. Biotechnology involves utilizing biological principles to develop innovative products, processes, and organisms aimed at improving society and human health. Advancements in contemporary biotechnology are allowing us to combat rare and debilitating illnesses, reduce our environmental footprint, nourish the impoverished, consume less energy and cleaner resources, and enhance the safety, effectiveness, and cleanliness of industrial manufacturing methods. The biotechnology sector in the U.S. is advancing rapidly and has vast potential to tackle significant global challenges and improve living standards worldwide.

China Biotechnology Market Trends

The biotechnology market in China is undergoing substantial expansion and is emerging as a key contributor to worldwide innovation. This expansion is driven by robust government backing, heightened R&D funding, and a rise in new drug approvals and licensing agreements. Cities such as Hangzhou and Suzhou are emerging as important biotech centers, promoting innovation and drawing investment. Initiated in 2016, the Healthy China 2030 program establishes bold goals, with the intention of raising the nation's health service sector to a worth of $2 billion (16 trillion yuan) by 2030. It closely aligns with previous initiatives such as the Made in China 2025 strategy, which considered biopharmaceuticals as one of ten essential sectors for national growth. China's investment in biopharma research and development (R&D) has increased at an extraordinary pace. In 2023, China's overall biopharma research and development spending hit $15 billion, a significant rise from only $35 million in 2015.

Europe

Europe biotechnology market is growing at notable CAGR. The European Union (EU) establishes a regulatory framework for biotechnology advancements, guaranteeing safety, effectiveness, and quality benchmarks for agricultural biotechnology items, biopharmaceuticals, and genetically modified organisms. The integration of biotechnology with digital technologies like artificial intelligence, machine learning, and big data analysis offers prospects for innovation and market expansion. European biotech firms can utilize digital biotechnology tools to improve drug discovery and development workflows, streamline healthcare services, and reveal new understandings of disease mechanisms, boosting efficiency and market competitiveness.

Biotechnology is a branch of science that develops or creates products by utilizing biological systems, living creatures, or elements out of them. Biotechnology now encompasses a wide range of fields such as biochemistry, genetics, and molecular biology. Every year, new technologies and products are developed in fields such as medical, agriculture, and industrial biotechnology.

Due to the rise of the biotechnology sector in developing nations such as China, Japan, and India, the market is being driven by favorable government initiatives. The government activities are aimed at streamlining the medication regulatory pathway, standardizing clinical studies, enhancing reimbursement policies, and expediting the product approval process, all of which will provide the industry with lucrative growth potential.

Furthermore, agricultural input firms are concentrating their efforts on upgrading existing technologies, such as the development of new stacked features in crops and new germplasm through breeding innovations and gene sequencing. The key market players are concentrating their efforts on bringing agricultural innovations to market in order to boost production through long-term solutions.

The rising incidences of target diseases and genetic disorders, as well as continuous technological advancements in Polymerase Chain Reaction (PCR) technologies, the development of miniaturized portable instruments, and the incorporation of robotics, as well as increased investments, funds, and grants for research activities, are driving the growth of the biotechnology market during the forecast period.

The use of genomic analytic techniques such as microbial identification and detection of genetic changes in the diagnosis of major infectious diseases like HIV, malaria, and TB and genetic abnormalities has developed rapidly over the last decade. The expansion in the global prevalence of target diseases, together with the demonstrated usefulness of Polymerase Chain Reaction (PCR) analysis in the diagnosis and estimation of disease-causing bacteria, will drive up the use of clinical diagnostic tests and will ultimately boost the growth of biotechnology market.

The rising frequency of infectious and chronic diseases as well as increased research and development investments to develop breakthrough genomic techniques such as cell based assay and polymerase chain reaction (PCR), are likely to drive significant development in emerging countries. In developing regions, the biotechnology market growth will be aided by the rise in healthcare spending, the expansion of healthcare infrastructure, and lower procedural costs of disease diagnosis techniques.

The expansion of healthcare infrastructure in emerging countries is accompanied by rapid growth of healthcare facilities and modernization. This aspect is contributing to diagnostic laboratories’ increasing demand for clinical diagnostic procedures, which is leading in higher sales and revenue growth of biotechnologies in the market.

Biotechnology is becoming more important since large amounts of data generated by techniques such as nucleic acid and protein acid sequencing require data interpretation and management for medical and future research objectives. Consequently, the biotechnology market is likely to be driven by increased demand over the forecast period.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.90% |

| Market Size in 2024 | USD 1.55 Trillion |

| Market Size in 2025 | USD 1.77 Trillion |

| Market Size by 2034 | USD 5.71 Trillion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Precision Medicine

With progress in genomics, proteomics, and bioinformatics, there exists a considerable opportunity to create precision medicine customized to personal genetic profiles. Tailored therapies can improve treatment effectiveness, minimize side effects, and result in better patient outcomes. Businesses focusing on genetic testing, biomarker identification, and personalized treatment strategies can take advantage of this increasing need. The demand for eco-friendly farming methods offers a significant chance for biotech companies. Creating genetically altered crops that are more resistant to climate change, pests, and illnesses can greatly improve food security.

Stricter Regulatory Compliances

For biotech firms working globally, managing varied regulatory landscapes in different areas poses a major difficulty. Even with efforts for global standardization, significant discrepancies remain in approval criteria, timelines, and compliance benchmarks among key markets like the European Union, United States, China, and Japan. These differences can greatly influence product development plans, necessitating that companies create clinical trials that meet the needs of various regulatory bodies at once.

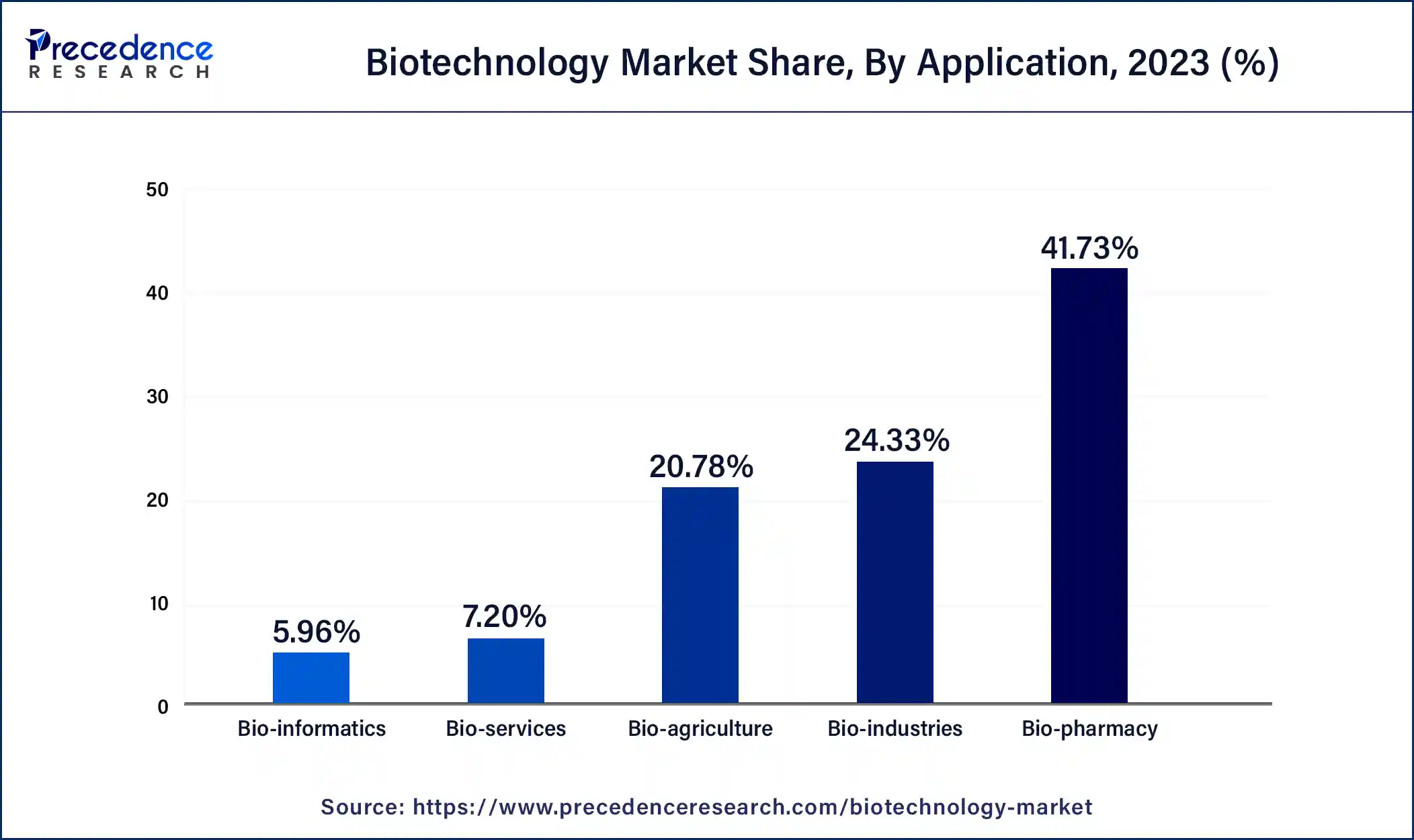

The bio-pharmacy segment dominated the biotechnology market in 2024 and is expected to grow at the fastest rate during the forecast period. This is mainly due to the increasing demand for biopharmaceuticals, driven by the increased prevalence of chronic diseases, such as cancer and autoimmune diseases. Ongoing innovation in biopharmaceuticals to discover novel drugs to treat a range of diseases further supports segmental growth. Moreover, rising regulatory approvals for novel biopharmaceuticals contributes to segmental expansion.

Bio-agriculture is the second-largest segment, expanding at a rapid pace in the upcoming period. The growth of the segment is attributed to the increasing focus on enhancing food products. This prompts the need for agricultural biotechnology to improve crop yields. Bio-agriculture offers sustainable solutions by reducing the need for chemical-based pesticides, enhancing crop protection and potential side effects. Moreover, stringent regulations regarding food safety contribute to segmental growth.

Global Biotechnology Market Revenue, By Application, 2022-2024 (USD Billion)

| Application | 2022 | 2023 | 2024 |

| Bio-pharmacy | 507.57 | 575.26 | 652.56 |

| Bio-industries | 298.88 | 335.41 | 376.75 |

| Bio-services | 91.91 | 99.30 | 107.38 |

| Bio-agriculture | 253.40 | 286.43 | 324.06 |

| Bio-informatics | 72.55 | 82.23 | 93.04 |

The tissue engineering and regeneration segment held the largest share of 19.17% in 2024. Tissue engineering and regeneration technologies are finding applications across a broad spectrum of healthcare domains, including orthopedics, cardiology, dermatology, and neurology. The versatility of these approaches in addressing diverse medical needs further strengthens their dominance in the biotechnology market. Regulatory agencies worldwide are increasingly recognizing the potential of tissue engineering and regeneration technologies and providing support for their development and commercialization. Clinical validation through successful trials and regulatory approvals has bolstered confidence in these approaches, paving the way for their widespread adoption and market dominance.

The chromatography segment is observed to grow at the fastest CAGR of 15.1% during the forecast period. Chromatography techniques offer unparalleled analytical precision, allowing biotechnologists to separate and analyze complex mixtures of biomolecules with high resolution and accuracy. This precision is crucial for various applications in biotechnology, including drug discovery, proteomics, genomics, and quality control. Chromatography techniques, particularly affinity chromatography, ion exchange chromatography, and size exclusion chromatography, are essential for protein purification in biotechnology research and production. These techniques enable the isolation and purification of target proteins from complex biological matrices, facilitating downstream applications in biopharmaceuticals, diagnostics, and research.

Global Biotechnology Market Revenue, By Technology, 2022-2024 (USD Billion)

| Technology | 2022 | 2023 | 2024 |

| Fermentation | 103.04 | 116.39 | 131.58 |

| Tissue Engineering and Regeneration | 236.90 | 265.50 | 297.81 |

| PCR Technology | 63.08 | 70.78 | 79.49 |

| Nanobiotechnology | 120.60 | 136.14 | 153.82 |

| Chromatography | 43.28 | 49.24 | 56.07 |

| Spectroscopy | 30.41 | 33.61 | 37.18 |

| Cell-Based Assay | 157.35 | 178.64 | 203.01 |

| DNA Sequencing | 203.70 | 229.01 | 257.70 |

| Others | 265.94 | 299.31 | 337.14 |

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

January 2025

January 2025

August 2024