July 2024

Amplifier Market (By Type: Voltage Amplifier, Current Amplifier, Power Amplifier; By Phase: Inverting Amplifier, Non-inverting Amplifier; By Coupling Method: Resistive-Capacitive Coupling Amplifier, Inductive-Capacitive Coupling Amplifier, Transformed Coupling Amplifier, Direct Coupling Amplifier; By Product Type; By Industry Vertical) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

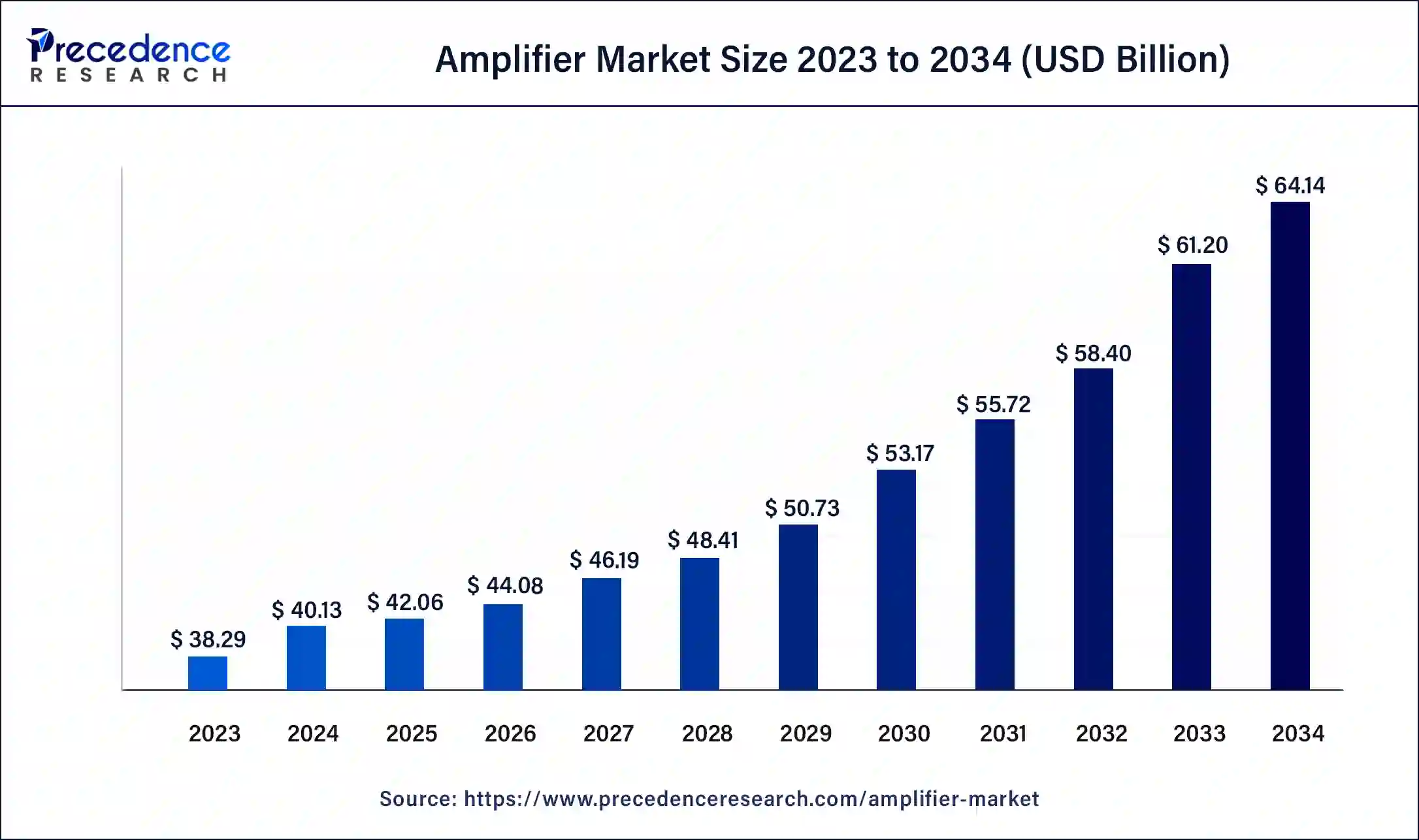

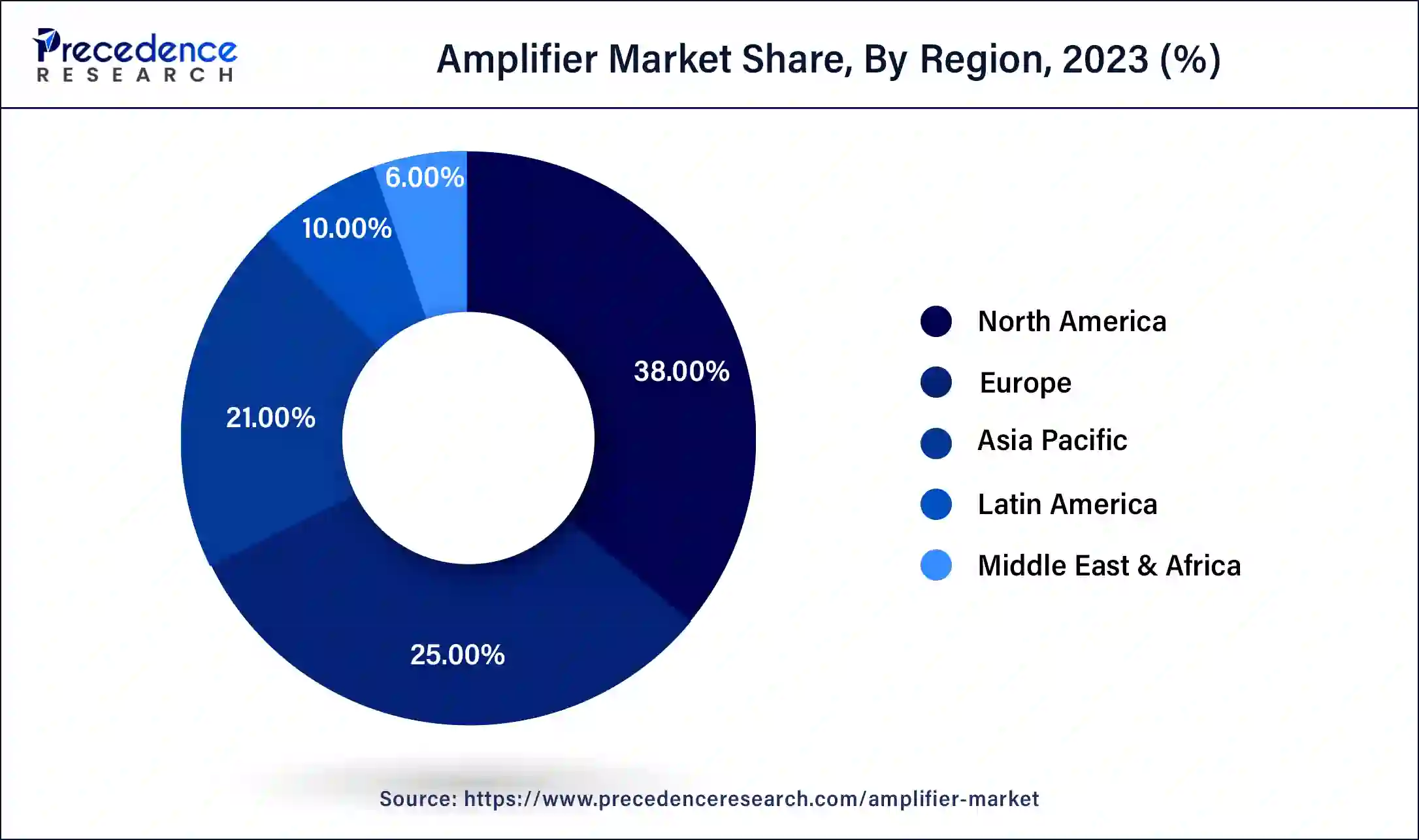

The global amplifier market size was USD 38.29 billion in 2023, accounted for USD 40.13 billion in 2024, and is expected to reach around USD 64.14 billion by 2034, expanding at a CAGR of 4.8% from 2024 to 2034. The North America amplifier market size reached USD 14.55 billion in 2023.

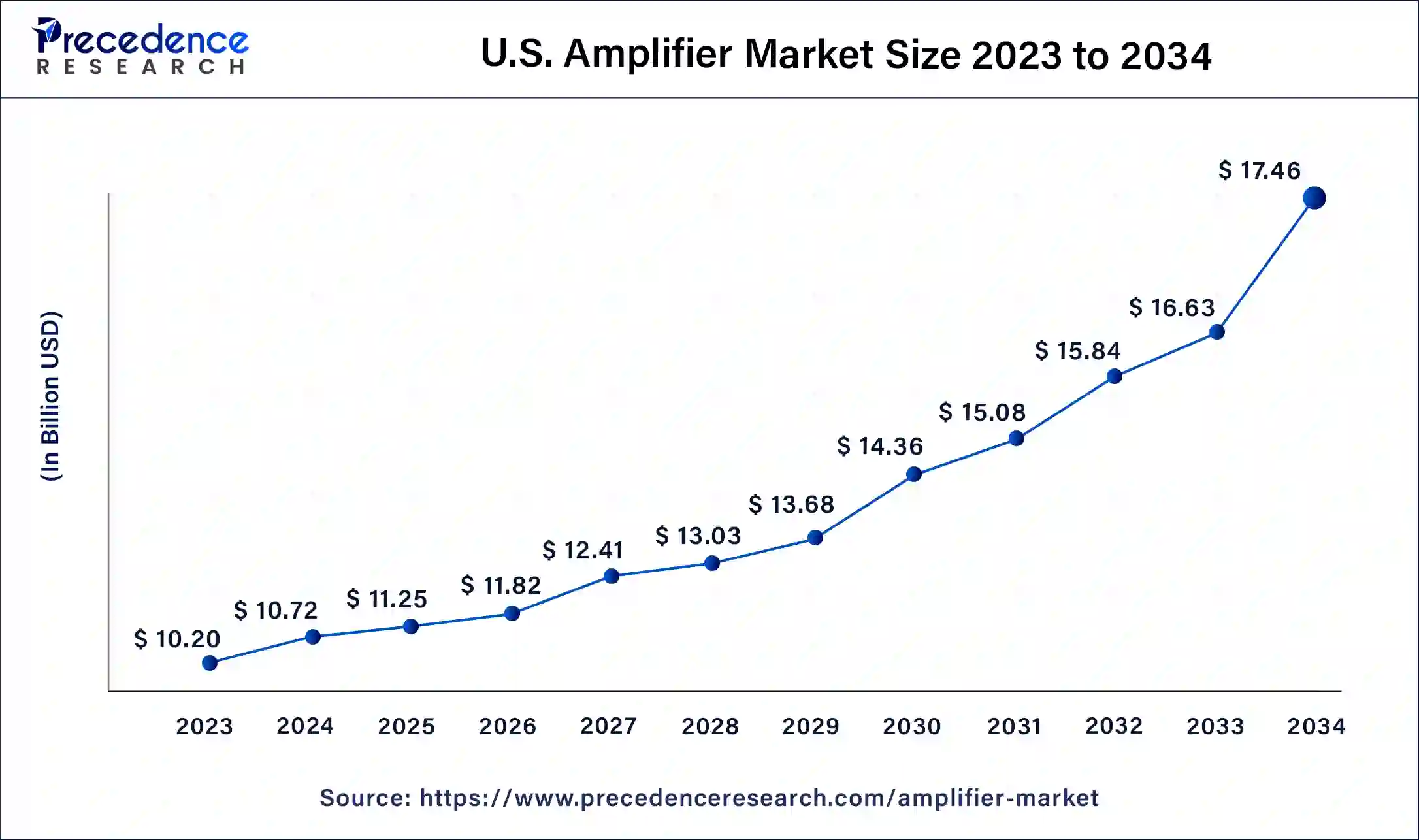

The U.S. amplifier market size was estimated at USD 10.20 billion in 2023 and is predicted to be worth around USD 17.46 billion by 2034, at a CAGR of 5% from 2024 to 2034.

North America has held the largest revenue share of 38% in 2023. The North American amplifier market is witnessing a surge in demand, driven by the increasing adoption of advanced audio solutions in sectors like home entertainment, automotive, and professional audio. The region's focus on technological innovation and the presence of key players contribute to a dynamic market landscape. Emerging trends include a growing preference for high-performance amplifiers with smart integrations for home automation and immersive audio experiences.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific amplifier market is experiencing robust growth, propelled by rising disposable incomes, urbanization, and a burgeoning entertainment industry. Countries like China and India are key contributors, with a growing consumer base seeking enhanced audio experiences. The market trend in the region encompasses a transition towards compact, energy-efficient amplifiers, aligning with the demand for portable audio solutions and the integration of amplification technology in a variety of electronic devices.

The amplifier market is characterized by the production and distribution of devices that enhance the amplitude of electrical signals, catering to a diverse range of applications. The market growth is propelled by increasing demand for audio and video amplification in consumer electronics, automotive, and communication sectors. Technological advancements, the rising popularity of wireless audio systems, and the integration of amplifiers in smart devices contribute to market expansion.

The global amplifier market demonstrates steady growth, driven by innovations, an expanding consumer electronics market, and the constant evolution of audio and communication technologies. Moreover, the emergence of advanced amplifier technologies like Class D amplifiers, coupled with the growing trend of home entertainment systems, further fuels market progression, creating new avenues for growth.

| Report Coverage | Details |

| Market Size in 2023 | USD 38.29 Billion |

| Market Size in 2024 | USD 40.13 Billion |

| Market Size by 2034 | USD 64.14 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Phase, By Coupling Method, By Product Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for home entertainment systems and growing automotive industry

The increasing demand for home entertainment systems has become a pivotal factor in driving the amplifier market. As consumers seek enhanced audio experiences for their home setups, amplifiers play a crucial role in delivering high-quality sound. With the rising trend of home theaters, soundbars, and immersive audio solutions, amplifiers have witnessed a significant uptick in demand. Homeowners are investing in amplifiers that can complement advanced audio systems, providing clear and powerful sound for movies, music, and gaming. This trend is particularly pronounced as people spend more time at home, emphasizing the importance of a premium audio experience.

Simultaneously, the growing automotive industry is contributing substantially to the increased demand for amplifiers. As automotive manufacturers focus on enhancing in-car entertainment and audio systems, amplifiers play a vital role in delivering superior sound quality within vehicles. Premium and luxury vehicles, in particular, are incorporating advanced audio technologies, creating a market niche for high-performance amplifiers. The intersection of automotive innovation and audio excellence is propelling the amplifier market forward, as consumers increasingly prioritize a sophisticated and immersive audio experience while on the road.

Cost constraints and competitive market dynamics

The amplifier market faces challenges related to cost constraints, especially in price-sensitive consumer segments. The production of high-quality amplifiers often involves sophisticated technologies and premium components, leading to elevated manufacturing costs. Consumers, particularly in economically sensitive regions, may be reluctant to invest in expensive audio systems, impacting the overall market demand. Additionally, intense competition among manufacturers to offer cost-effective solutions further exerts pressure on profit margins, limiting the ability to invest in research and development for advanced amplifier technologies.

The market is highly competitive, with numerous players vying for market share. This competition often leads to price wars and a focus on cost reduction strategies to gain a competitive edge. As companies strive to offer affordable amplifiers without compromising quality, they face challenges in achieving profitability. Intense rivalry can limit the pricing flexibility for manufacturers, and the emphasis on cost-cutting measures may hinder investments in innovation, impacting the introduction of new and advanced amplifier technologies. This competitive environment creates a challenging landscape for sustained growth and can impede the overall market demand for amplifiers.

Customization in amplifier design and class D amplifiers

Customization plays a pivotal role in surging the demand for amplifiers in the market. Consumers today seek audio solutions that align with their unique preferences, whether it's for home entertainment, professional audio setups, or automotive audio systems. The ability to customize amplifier designs allows manufacturers to cater to diverse needs, offering features like specific power outputs, connectivity options, and aesthetic choices. Customization not only enhances the user experience but also addresses specific requirements, making the amplifiers more versatile across various applications. Manufacturers that prioritize and excel in customization are likely to attract a broader consumer base, driving demand and fostering brand loyalty in the competitive amplifier market.

The rise of Class D amplifiers significantly contributes to the growing demand in the market. Class D amplifiers are known for their high efficiency and compact size, making them ideal for applications where space and power consumption are critical factors. With advancements in semiconductor technology, Class D amplifiers deliver robust performance with reduced heat dissipation. As energy-efficient solutions, they align with the increasing emphasis on eco-friendly and sustainable products. The adoption of Class D amplifiers, especially in audio systems for vehicles and portable devices, reflects a market preference for cutting-edge technology that meets performance expectations while addressing the need for energy efficiency.

According to the type, the voltage amplifier segment has held a 43% revenue share in 2023. Voltage amplifiers increase the amplitude of an input signal while preserving its waveform. In the amplifier market, voltage amplifiers are integral to various applications, such as audio systems and signal-processing equipment. Trends indicate a shift towards low-noise and high-gain voltage amplifiers, catering to the demand for enhanced signal fidelity, critical in applications like high-quality audio reproduction and precise instrumentation.

The power amplifier segment is anticipated to expand at a significant CAGR of 7.1% during the projected period. Power amplifiers boost the amplitude of signals to drive speakers or other output devices. In the amplifier market, trends involve the integration of Class D power amplifiers known for their efficiency. The industry also sees a surge in demand for power-efficient amplifiers tailored for energy-conscious applications like mobile devices and portable audio systems.

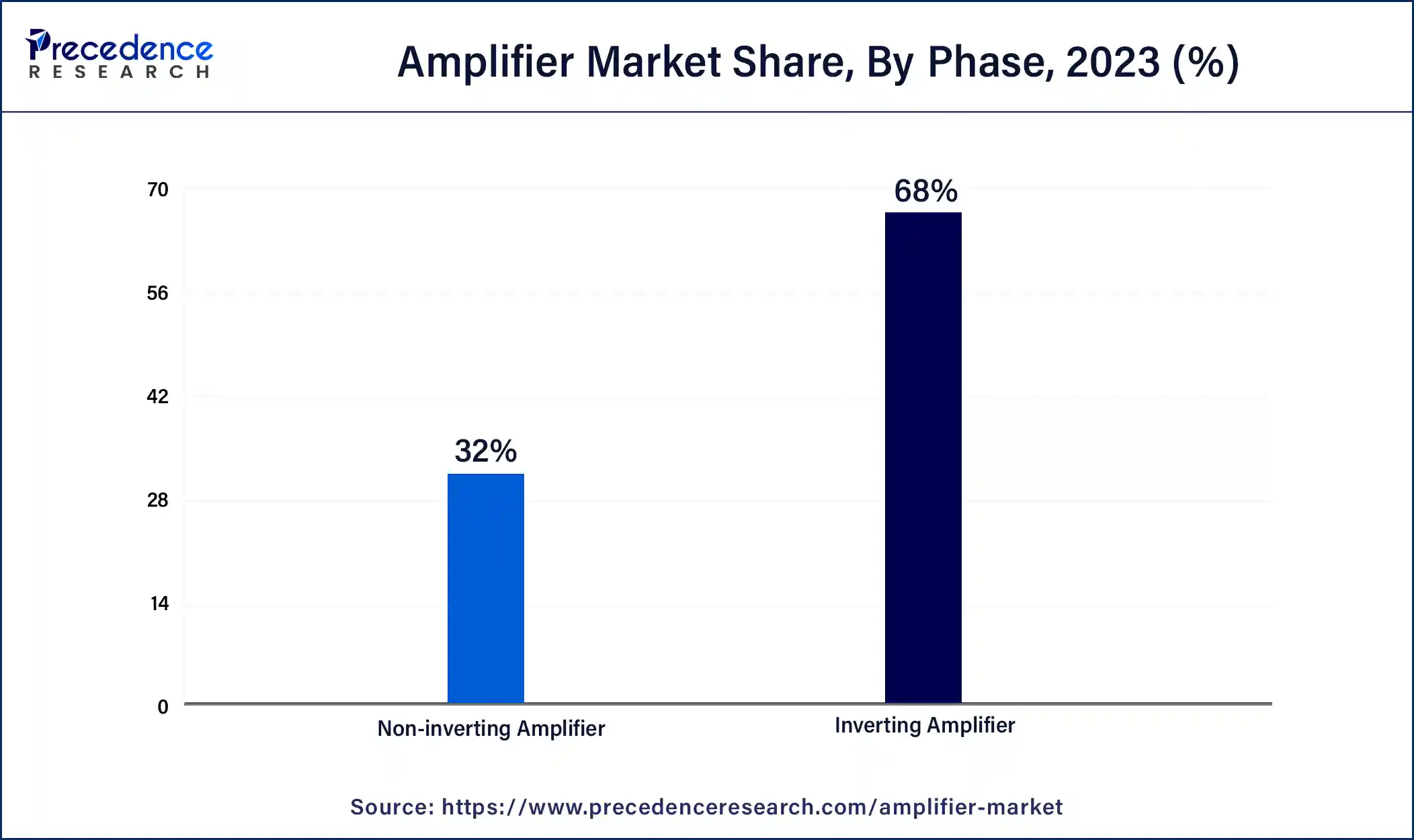

Based on the phase, the inverting amplifier segment held the largest share of 68% in 2023. Inverting amplifiers are a key component in audio signal processing, providing an inverted output relative to the input. A trend in the amplifier market involves enhancing the precision and noise reduction of inverting amplifiers. Manufacturers focus on improving the signal-to-noise ratio and minimizing distortions, ensuring that inverting amplifiers maintain high fidelity in audio reproduction, a crucial factor in the pursuit of superior sound quality.

On the other hand, the non-inverting amplifier segment is projected to grow at the fastest rate over the projected period. Non-inverting amplifiers amplify the input signal without inverting its phase, preserving the original signal's integrity. A trend in the market is the integration of advanced semiconductor technologies to enhance the performance of non-inverting amplifiers.

This includes optimizing bandwidth, reducing distortion, and improving the overall efficiency of these amplifiers. The trend reflects the industry's commitment to providing amplification solutions that meet the evolving demands of high-quality audio reproduction in various applications.

In 2023, the resistive-capacitive coupling amplifier segment had the highest market share of 39% based on the coupling method. A resistive-capacitive coupling amplifier employs a combination of resistors and capacitors to transfer AC signals between amplifier stages. This coupling method allows for the transmission of signals while blocking DC components, ensuring proper biasing. In the amplifier market, the trend towards resistive-capacitive coupling lies in its ability to maintain signal integrity, reduce distortion, and enhance the overall performance of audio amplifiers.

The Inductive-capacitive coupling amplifier segment is anticipated to expand at the fastest rate over the projected period. Inductive-capacitive coupling in amplifiers involves the use of inductors and capacitors to pass AC signals while blocking DC components. This coupling method is valued for its ability to maintain signal fidelity and facilitate impedance matching. In the amplifier market, the trend towards inductive-capacitive coupling amplifiers is driven by their effectiveness in audio applications, contributing to clearer and more accurate signal reproduction. As audio systems demand higher performance, these coupling methods play a crucial role in meeting the evolving requirements of the amplifier market.

Based on the product type, audio frequency amplifier segment held the largest market share of 41% in 2023. Audio frequency amplifiers are designed to amplify signals in the audio frequency range, typically from a few hertz to several kilohertz. The trend in this segment involves the integration of advanced features like low distortion, high signal-to-noise ratio, and compact designs, catering to the demand for premium audio experiences in various applications.

On the other hand, the intermediate frequency amplifier segment is projected to grow at the fastest rate over the projected period. Intermediate Frequency (IF) Amplifiers are vital components in communication systems, amplifying signals at intermediate frequencies. In the amplifier market, trends in IF amplifiers revolve around achieving higher bandwidth, improved selectivity, and enhanced linearity. Advancements in semiconductor technology contribute to the development of IF amplifiers with better performance parameters, meeting the requirements of modern communication systems and radio-frequency applications.

Based on the industry vertical, the consumer electronics segment is anticipated to hold the largest market share of 45% in 2023. In the consumer electronics sector, amplifiers are crucial components in audio systems, smartphones, smart speakers, and home theater setups. The trend in this vertical revolves around miniaturization, high power efficiency, and wireless connectivity. Manufacturers focus on creating compact yet powerful amplifiers with features like Bluetooth connectivity, catering to the demand for seamless and high-quality audio experiences in modern electronic devices.

On the other hand, the automotive segment is projected to grow at the fastest rate over the projected period. The automotive industry demands amplifiers for in-car entertainment and advanced driver assistance systems (ADAS). The trend here is toward integrated solutions that support connectivity options, surround sound, and efficient power management. As vehicles become more technologically advanced, amplifiers are evolving to enhance the in-cabin audio experience and support emerging applications like electric vehicle sound design, where amplifiers play a crucial role in creating a harmonious driving experience.

Segments Covered in the Report

By Type

By Phase

By Coupling Method

By Product Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024