August 2024

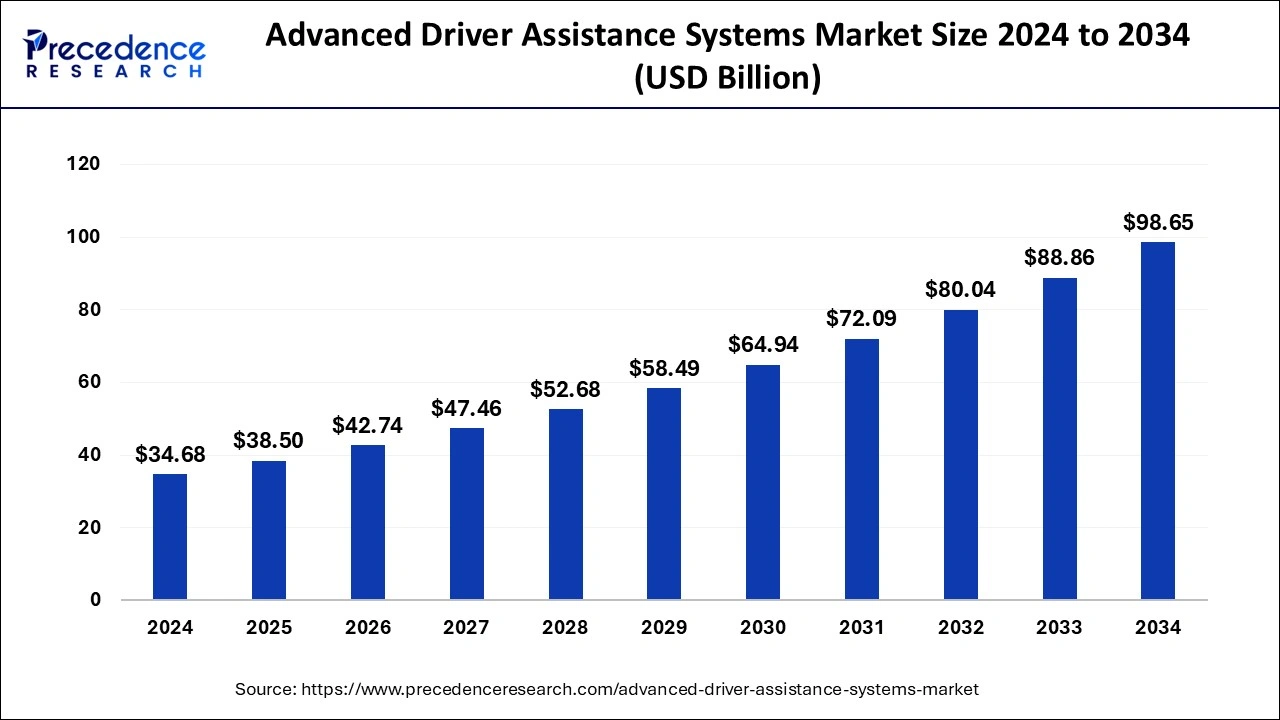

The global advanced driver assistance systems (ADAS) market size is calculated at USD 38.50 billion in 2025 and is forecasted to reach around USD 98.65 billion by 2034, accelerating at a CAGR of 11.02% from 2025 to 2034. The North America market size surpassed USD 11.14 billion in 2024 and is expanding at a CAGR of 11.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global advanced driver assistance systems market size was calculated at USD 34.68 billion in 2024 and is predicted to reach around USD 98.65 billion by 2034, expanding at a CAGR of 11.02% from 2025 to 2034. The advanced driver assistance systems market is driven by the growing demand for materialistic lifestyles.

Artificial intelligence and machine learning have transformed the advanced driver assistance system using spot-of-the-art deep learning methods. By effectively incorporating machine learning development techniques into the training deep learning models, ADAS systems can determine the sensor data in real-time and make informed decisions to improve driver safety and assist in driving tasks, making it future-ready for autonomous driving. They can also evidence distances, trajectories of surrounding objects, and velocities, allowing ADAS systems to predict potential collisions and offer timely warnings or take preventive actions.

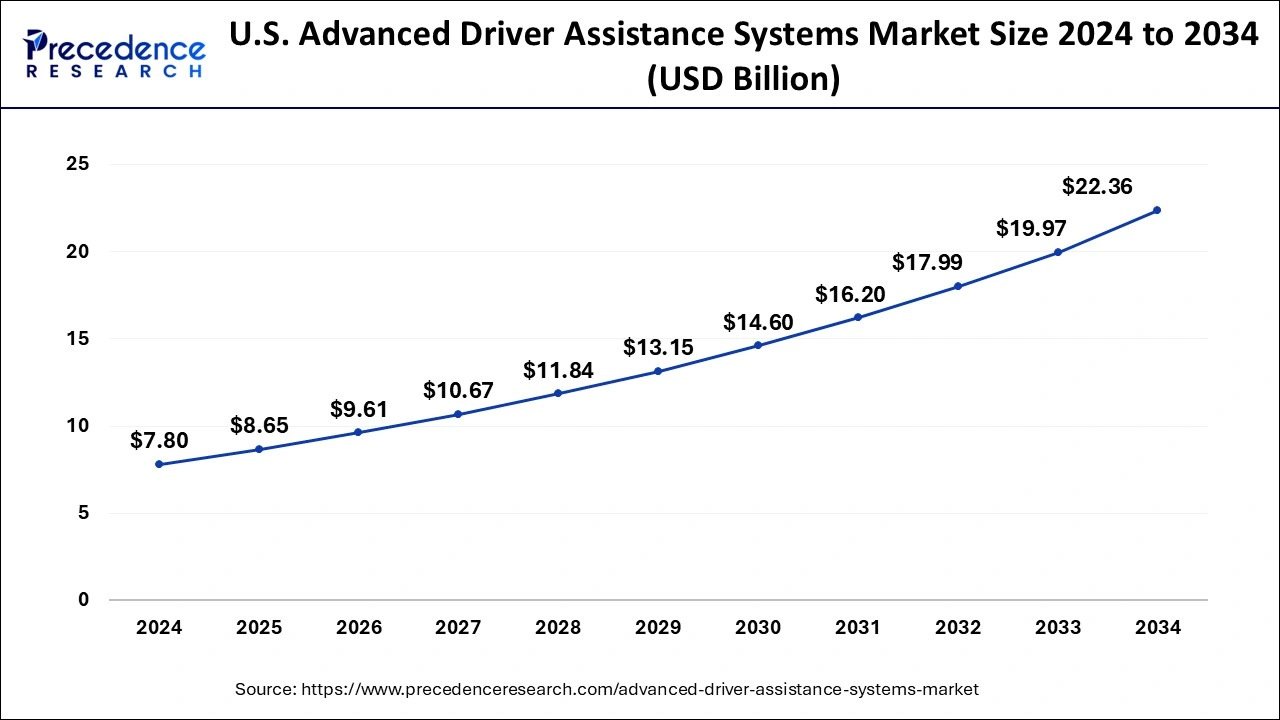

The U.S. advanced driver assistance systems market size was exhibited at USD 7.80 billion in 2024 and is projected to be worth around USD 22.36 billion by 2034, growing at a CAGR of 11.10% from 2025 to 2034.

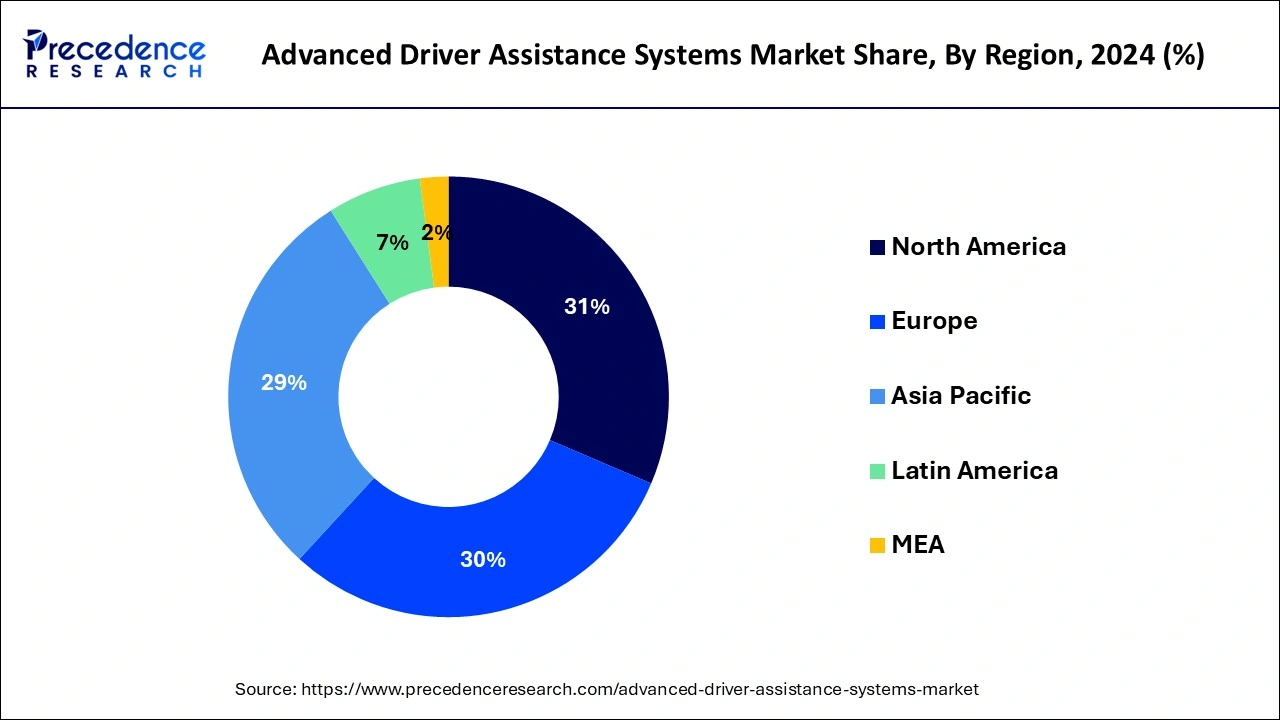

Europe and North America emerged as a dominant region for global ADAS market in past few years and held for over 70% of the global revenue share in 2020. High tech adoption rate and presence of major ADAS market participant is estimated to drive the market for ADAS in near future. As ADAS features are more in demand with customers and cars more than 60 million U.S. vehicle are fitted with ADAS technologies. Some shops have also started to see customers’ demands for aftermarket systems to be integrated in their vehicles.

Asia Pacific is expected to emerge as fastest growing market for ADAS in years to come and is predicted to grow at a CAGR of 14.8%. South Korea, China and Japan are estimated become as major revenue contributor for ADAS in Asia Pacific advanced driver-assistance systems (ADAS) market in years to come. A number of major ADAS solution providers such as Robert Bosch, Continental and Denso have regional production facilities.

Markets in the Asia Pacific region are anticipated to acquire the remarkable share over the next decade due to the high sales and manufacturing of vehicles in this region, a considerable growth in the adoption of electric vehicles in countries like Japan, and China, speedy technological developments in manufacturing units in emerging economies like India, China, among others. As per recent stats published by Canalys, there were nearly 1.3 million electric vehicles sold in China during the year 2020. In addition, to this, the sales in the country registered to grow by 50% in 2021 compared to past year. Similarly, India registered a strong growth in electric vehicles with 130,000 units sale in the financial year 2019 that represents a year-on-year growth of 132.1%.

The Asia Pacific is growing fastesr due to high production of automobiles, and increased usage of advanced electronic in South Korea, China, and japan. Governments in these countries have taken different initiatives to attract major original equipment manufacturers in national markets. Various American and European manufacturers have shifted their manufacturing plants in emerging economies. Apart from the decline in vehicle sales due to COVID-19 pandemic, current safety mandates would augment the penetration of ADAS featuring in upcoming automobiles. For example, China mandated tire-pressure monitoring system (TPMS) from 2019. Japan is a major market for advanced electrical and electronic components in this region.

The advanced driver assistance system (ADAS) enfolds an extensive range of active and passive systems formulated to assist the driver by offering comfort, safety, and efficacy at the time of driving and enhances the driver, passenger, and pedestrian safety and security. It has numerous vital elements like cameras, sensors, software, and radar which help the system perform correctly. The trend of driverless vehicles or automated vehicles is burgeoning enormously across the globe. Prominent players in the market are spending tremendously on research and advancements sue to the increasing need for safety measures in automobiles, more comfort, and highly efficient driving experience.

The growth of advanced driver assistance systems (ADAS) market is mainly attributed to increasing consumers’ preferences for safety and comfort features and growing demand from premium and luxury cars. Furthermore, government initiative towards passenger safety and decreasing system and component costs is estimated to fuel the demand for ADAS market. However, ongoing COVID-19 pandemic is expected to impact the spending of government on infrastructure activities and adversely affect the ADAS market. Even so, ongoing technology advancement in sensor tech is expected to open up new avenue for ADAS market in near future.

Rising awareness about vehicle safety ratings and reducing component costs due to wide application of cameras and radars are major growth factors for the ADAS market. Prominent original equipment manufacturers are clinching ADAS solutions to achieve higher safety ratings to gain traction among consumers. Thus, the growing penetration of advanced driver assistance systems properties is surging the demand for components such as LiDAR, ultrasonic sensors, cameras, and radar sensors during the forecast timeframe. However, lack of required infrastructure in emerging economies, and environmental constraints and security threats are impeding the market growth.

In addition, increasing demand for advanced driver assistant systems in compact passenger cars, and stringent safety rules are augmenting the revenue growth path of this market. However, the prospect of offering premium features in vehicles adds extra expenses to customers in the form of hardware, telecom service charges, and applications. High cost associated with app installation, and complex structures of systems, resulting in the reduced shelf life of vehicles are restraining the growth of this market to an extent. Several countries worldwide have mandated the driver safety assistance to increase road safety, and lower road accidents. For instance, European Union (EU) passed a bill that compelled the implementation of adaptive cruise control systems in all heavy commercial vehicles by 2020. Moreover, vehicle manufacturers need to earn safety ratings from various associations such as New Car Assessment Program (NCAP), International Centre for Automotive Technology (ICAT), and Insurance Institute of Highway Safety (IIHS), to gain the sales license of automobiles in the market. Hence, all these safety rules and regulations made by governments are projected to expand the market growth.

| Report Coverage | Details |

| Market Size by 2025 | USD 38.50 Billion |

| Market Size in 2034 | USD 98.65 Billion |

| Growth Rate | CAGR of 11.02% from 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Vehicle Type, Sensor Type, Electric Vehicle, Level of Autonomy, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for advanced driver assistance systems (ADAS) in compact passenger cars

As consumer needs shift towards enhanced safety, convenience, and a seamless driving experience, compact passenger cars, increasingly approved due to their fuel efficiency and affordability, are incorporating advanced technologies.

Regulatory challenges

ADAS systems are bound to undergo rigorous safety tests and certifications before being deployed in vehicles. The lengthy and costly testing process and the demand to prove that systems are reliable and safe can slow the pace of development and deployment.

Technological development

Improving sensor technology, including radar, LiDAR, and cameras, creates opportunities for more accurate and reliable ADAS systems. These sensors help vehicles to monitor their surroundings in real-time, which is vital for object detection, blind-spot monitoring, and 360-degree vision.

Driver Monitoring System (DMS) and Night Vision System (NVS) system are expected be to key system type segments in years to come. The growth of these segments is manly driven by government initiative to reduce road accidents. Moreover, rising luxury and premium car market is estimated to support the growth of driver monitoring system (DMS) and night vision system (NVS) system in forecast period.

Based on sensor type, the advanced driver assistance systems market is classified into image sensors, ultrasonic sensors, LiDAR, radar sensors, infrared (IR) sensors and laser sensors.

Radar sensor segment is predicted to account for the largest share due to its usage in various systems such as adaptive cruise control systems, etc., bolstering number of accidents, and increasing safety awareness, which results in robust demand for radar sensors primarily in countries like China, US, and major countries in Europe.

Increasing research and development activities by market players on ADAS sensors is expected to support the sensor type segment coming years. Radar sensor segment is estimated to have largest revenue share in analysis period owing to increasing number of accident mainly in Asia Pacific region.

The passenger car segment held the largest market share in 2024. This segment is predicted to retain its dominance in ADAS market throughout the analysis period. Rising awareness of road safety amongst consumer/passenger and promoting legislation are the major driving factors for the growth of passenger car segment. Growing urbanization, expanding industrialization, high growth of demography, and the extensive demand for passenger cars are the factors anticipated to attribute the market growth.

In addition, various countries in different region have placed in place laws mandating the introduction of various types of ADAS into the passenger car market. Furthermore, AEB and LDW mandates in various countries such as South Korea and France are expected to propel the demand for passenger car segment in analysis period.

Battery Electric Vehicles (BEV) emerged as the leading segment in electric vehicle types accounting for nearly 70% of market share in the global ADAS market. The prime factor attributed to the rapid growth of the segment is high and faster penetration of autonomous driving technologies in BEVs today. For instance, in April 2022, Toyota Motor enhanced advanced drive as well as advanced park capabilities with better detection, improved sensors, and higher level of safety sense in their all new 2023 bZ4X BEV.

On the contrary, Plug-in Hybrid Electric Vehicles (PHEV) register the fastest growth over the forecast time frame owing to their high adoption rate across the globe. In addition, automotive manufacturers also expand their electric vehicle features into autonomous driving technologies i.e. ADAS. For example, in February 2022, Kia Motor revealed that its Sportage PHEV, one of the fastest electric vehicle models of the company is equipped with advanced driver assistance systems (ADAS) feature that detects blind spots while driving and also provides 3D view of the surrounding.

Key Companies & Market Share Insights

The global ADAS market is highly competitive and still is modernly concentrated. The market participant operating in ADAS market are striving to gain higher market share by adopting different business strategies, such as partnerships, agreement and acquisitions & mergers of various player across the value chain. Furthermore, continuous launching of new product to cater the demand from customers, manufactures paying attention to product quality and effective service offering.

By System Type

By Sensor Type

By Vehicle Type

By Level of Autonomy

By Electric Vehicle

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

November 2024

January 2025