October 2024

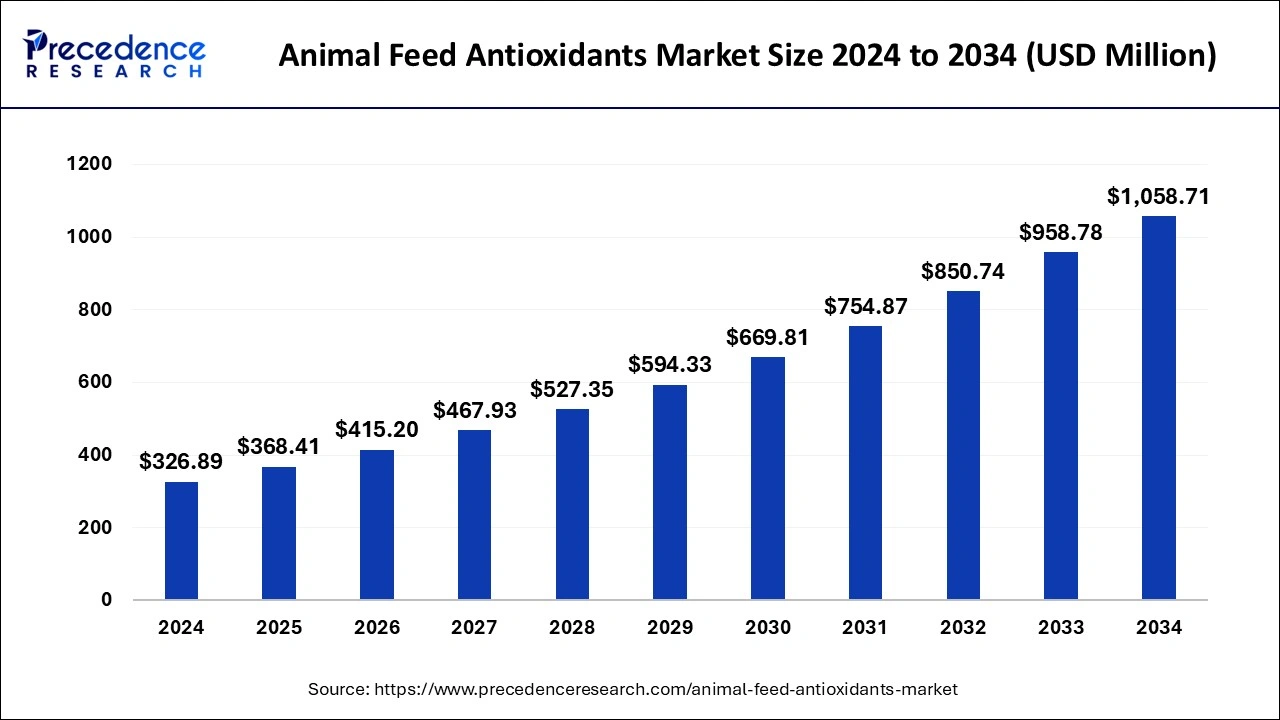

The global animal feed antioxidants market size is calculated at USD 368.41 million in 2025 and is forecasted to reach around USD 1,058.71 million by 2034, accelerating at a CAGR of 12.47% from 2025 to 2034. The Asia Pacific animal feed antioxidants market size surpassed USD 159.92 million in 2025 and is expanding at a CAGR of 12.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global animal feed antioxidants market size was accounted for USD 326.89 million in 2024, and is expected to reach around USD 1,058.71 million by 2034, expanding at a CAGR of 12.47% from 2025 to 2034. Increasing consumer awareness about the benefits of protein-rich products is a key factor driving market growth. Moreover, growing concern about animal health and feed safety are expected to boost the market growth in the coming years.

AI helps manufacturers create accurate feed formulations with the right amounts of antioxidants and nutrition. Integrating AI technologies in the production processes enhances the overall production efficiency and nutritional levels in final products. Furthermore, AI and ML algorithms analyze vast amounts of data related to animal health, enabling manufacturers to develop personalized feeds.

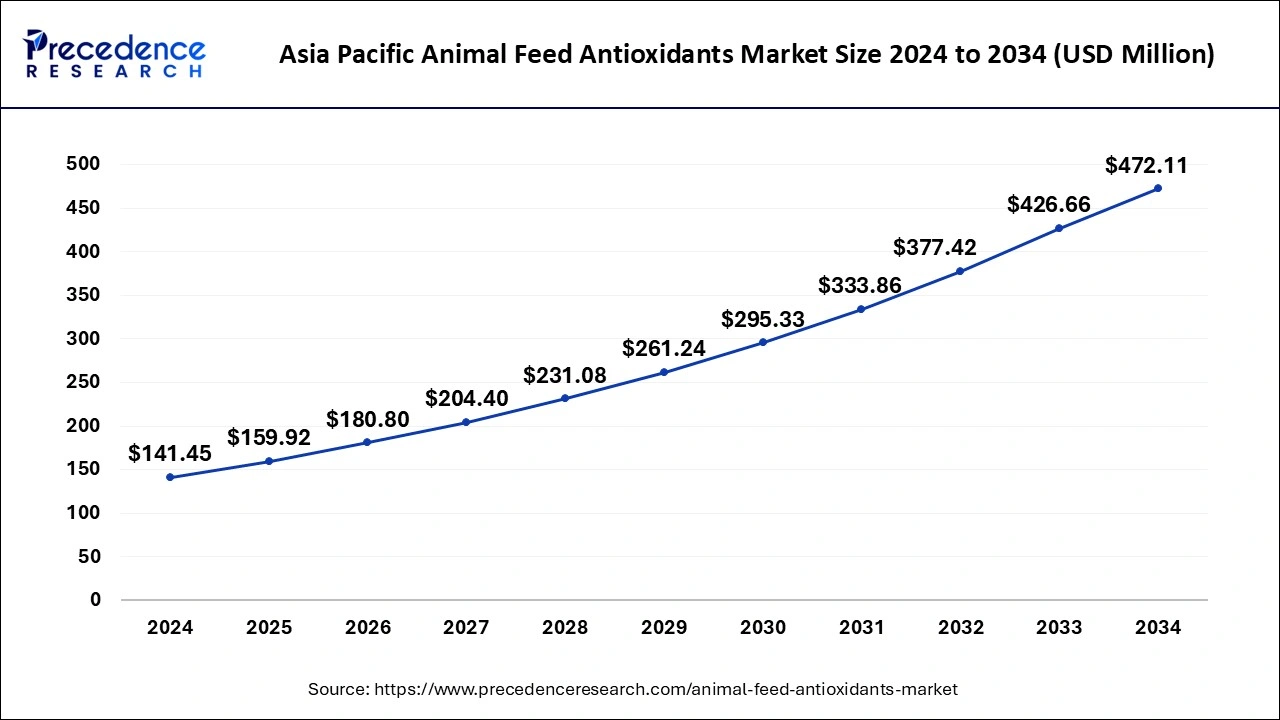

The Asia Pacific animal feed antioxidants market size was estimated at USD 141.45 million in 2024 and is predicted to be worth around USD 472.11 million by 2034, at a CAGR of 12.80% from 2025 to 2034.

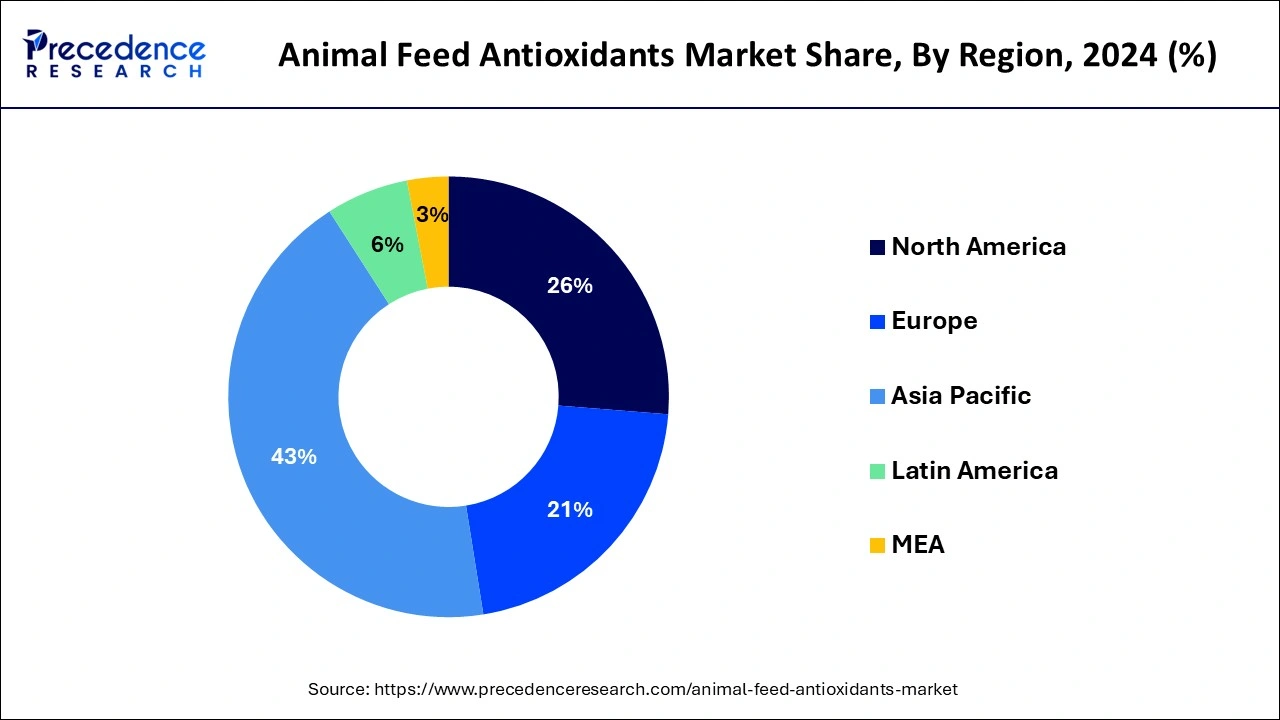

It is possible to further divide the animal feed antioxidants market by geography into North America, Europe, Asia-Pacific, South America, and the Rest of the World. Due to the enormous population density on the Asian continent, there is a growing demand for dairy products and meat, which is one of the reasons this market is expanding. In the world, China is where the majority of meat eaters reside. Pork, shellfish, and fowl from chicken and turkey make up the diet of the majority of Asian people. In China, Japan, and Indonesia, seafood including tuna, salmon, and shrimp are in practically every home. Therefore, to meet this enormous demand, meat producers are implementing modern techniques that use feed antioxidants to ensure the quality of the meat and prevent the development of disease. Asia–Pacific is also anticipated to present profitable growth prospects. This increase is the result of developing countries' booming economies, which have increased peoples' disposable income and, in turn, increased their desire for wholesome food. Over the projected period, North America is anticipated to continue to be one of the top markets, with revenue exceeding USD 40 million in 2014. High demand for these chemicals is anticipated as a result of the U.S.'s strong meat manufacturing base, which mostly consists of JBF, Tyson, Cargill, and National Beef. Rising red meat consumption in Mexico is anticipated to have a positive effect due to the expansion of stores that deliver frozen meals.

Over the next seven years, it is anticipated that the strong industrial bases for hog meat in European nations like Germany, France, and Russia will increase the supply of cattle. This would in turn spur industry expansion.

With an estimated 25,065 kilotons of meat produced worldwide in 2013, Brazil ranked fourth. As a result of impending sporting events like the Rio 2016 Summer Olympics, demand is also anticipated to increase for meat as a source of protein and retail food establishments.

Antioxidants for animal feed had a sizably large market in 2023, and it is anticipated that revenue will grow at a consistent CAGR during the projection period. Demand for premium feed is rising, feed production methods are getting better, and meat products are becoming more uniform, which are the main drivers influencing market revenue growth. One of the key elements driving an increase in demand for animal feed antioxidants is a growing concern about animal health and feed safety. Animal performance suffers as a result of oxidized feeds' lack of nutrients, which can cause several health problems. The feed's shelf life will be increased by adding antioxidants, protecting the feed's nutritional integrity. The inherent qualities of animal feed are impacted by several chemical changes that take place when it is being stored. The feed's antioxidant content is utilized to extend the feed's shelf life by minimizing lipid oxidation-related degradation. Antioxidants in the feed prevent autoxidation or hydrolysis from causing an oxidative reaction. As livestock farmers try to reduce feed costs to cut costs and maintain profitability, antioxidants have grown to be quite significant. The majority of antioxidants are synthesized and extracted naturally.

| Report Coverage | Details |

| Market Size in 2025 | USD 368.41 million |

| Market Size by 2034 | USD 1,058.71 million |

| Growth Rate from 2025 to 2034 | CAGR of 12.47% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Livestock, and Farm |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for the product is anticipated to increase due to rising demand for foods high in protein.

Product demand is anticipated to increase as a result of quick modernization, rising economies that increase disposable money, and the growing threat of animal diseases.

Lockdowns being reinstated and the rising veganism trend are expected to restrain market expansion.

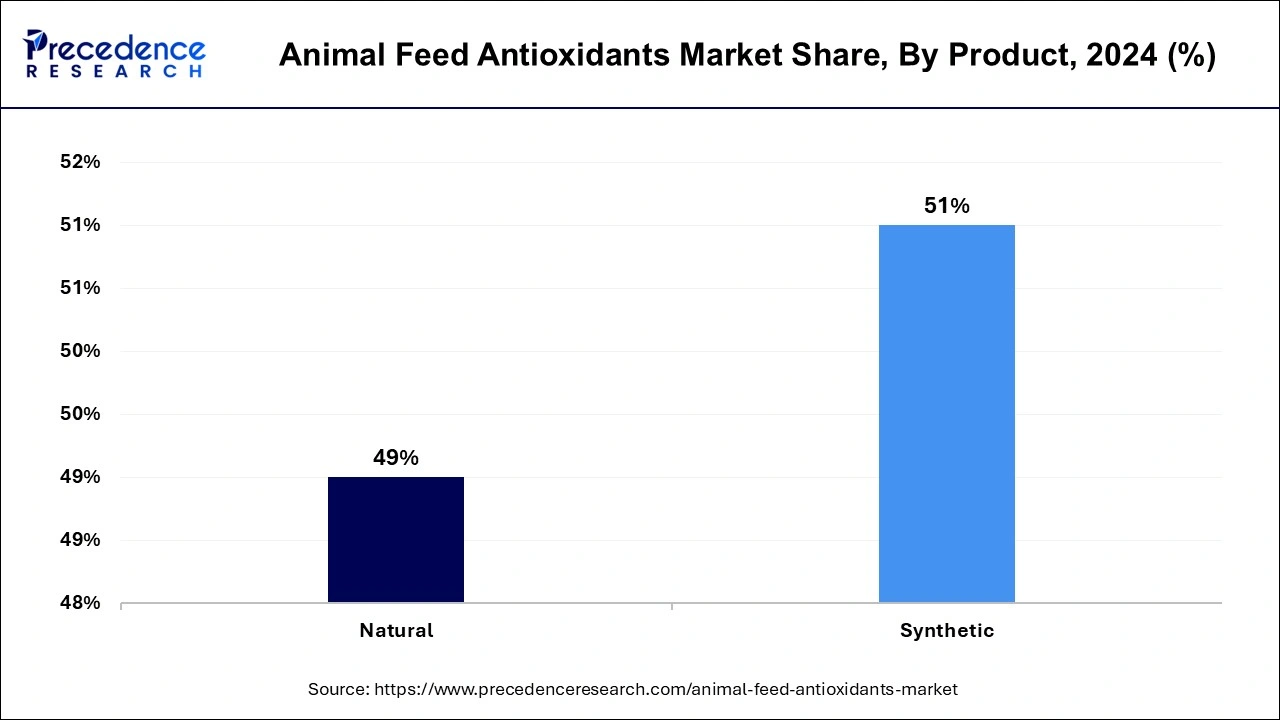

The market for animal feed antioxidants is further divided into two categories: natural (Vitamins, Botanical Extracts, and others) and synthetic (Propyl Gallate, Butylated Hydroxyanisole, and others). The synthetic segment dominated the market in 2024 and contributed more than 51% revenue share. In order to address the growing demand for antioxidants in animal feed, a requirement that can't be fully met by natural antioxidants, antioxidants that are synthetic are extracted on a wide scale from plant materials such as vegetables using extractions that are enzyme-assisted and ultrasound-assisted. These antioxidants that are synthetic have become a popular choice for many poultry and farm owners due to their dependability, cost, and wide availability.

The adverse effects of using synthetic antioxidants excessively are to blame for this rise. Antioxidants often have negative impacts on an animal's liver and DNA deterioration when they are removed chemically. In both monogastric (such as pigs and rabbits) and ruminant species under moderate stress circumstances, which are common in intensive livestock production, PFA (natural or plant feed additives) and Vit have a similar impact on alleviating oxidative stress. PFA delivery technique or amount can affect how the substance affects antioxidant enzyme activity.

The dry category is anticipated to account for a consistent revenue share during the projected period, based on form type. Dry feed antioxidants are highly sought after by livestock farmers because they are easy to handle, store, and blend with feed. The majority of feed antioxidant manufacturers on the market offer feed in dry forms such as powders, pellets, and granules due to the increased demand from numerous end-use applications.

Poultry, dairy cattle, aquaculture, swine, and others can be used to further segment the animal feed antioxidants market based on conveyance mode. The massive consumption of poultry meat around the world is responsible for the growth. According to a survey, chicken is the tastiest and most economical meat in the world, consuming more than 116 million tonnes annually. Therefore, poultry owners utilize feed additives like antioxidants and traces to meet the requirement. Utilizing food additives reduces overall costs and increases revenue. Additionally, the poultry and cattle dairy industry is predicted to develop at the quickest rate. This increase in demand for meals high in protein is due to increased health awareness among consumers. As a result, people now prioritize eating meat, milk, and related goods.

Over the next seven years, it is anticipated that the strong industrial bases for hog meat in European nations like Germany, France, and Russia will increase the supply of cattle. This would in turn spur industry expansion.

By Product

By Livestock

By Form

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024

August 2024

January 2025