September 2024

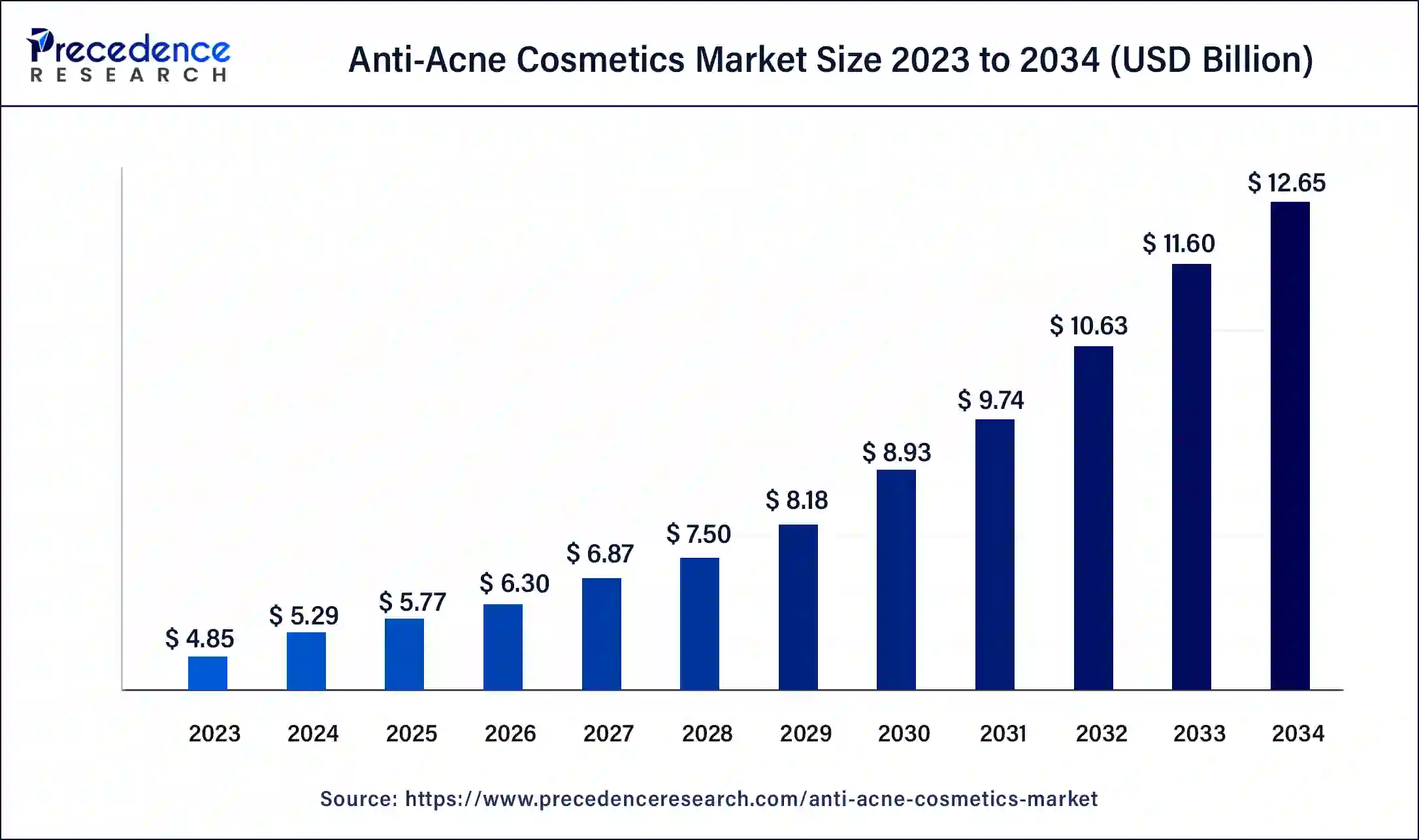

The global anti-acne cosmetics market size surpassed USD 4.85 billion in 2023 and is estimated to increase from USD 5.29 billion in 2024 to approximately USD 12.65 billion by 2034. It is projected to grow at a CAGR of 9.11% from 2024 to 2034.

The global anti-acne cosmetics market size is projected to be worth around USD 12.65 billion by 2034 from USD 5.29 billion in 2024, at a CAGR of 9.11% from 2024 to 2034. The rise in the anti-acne cosmetics space follows an overall increase in demand in the anti-acne cosmetics market globally.

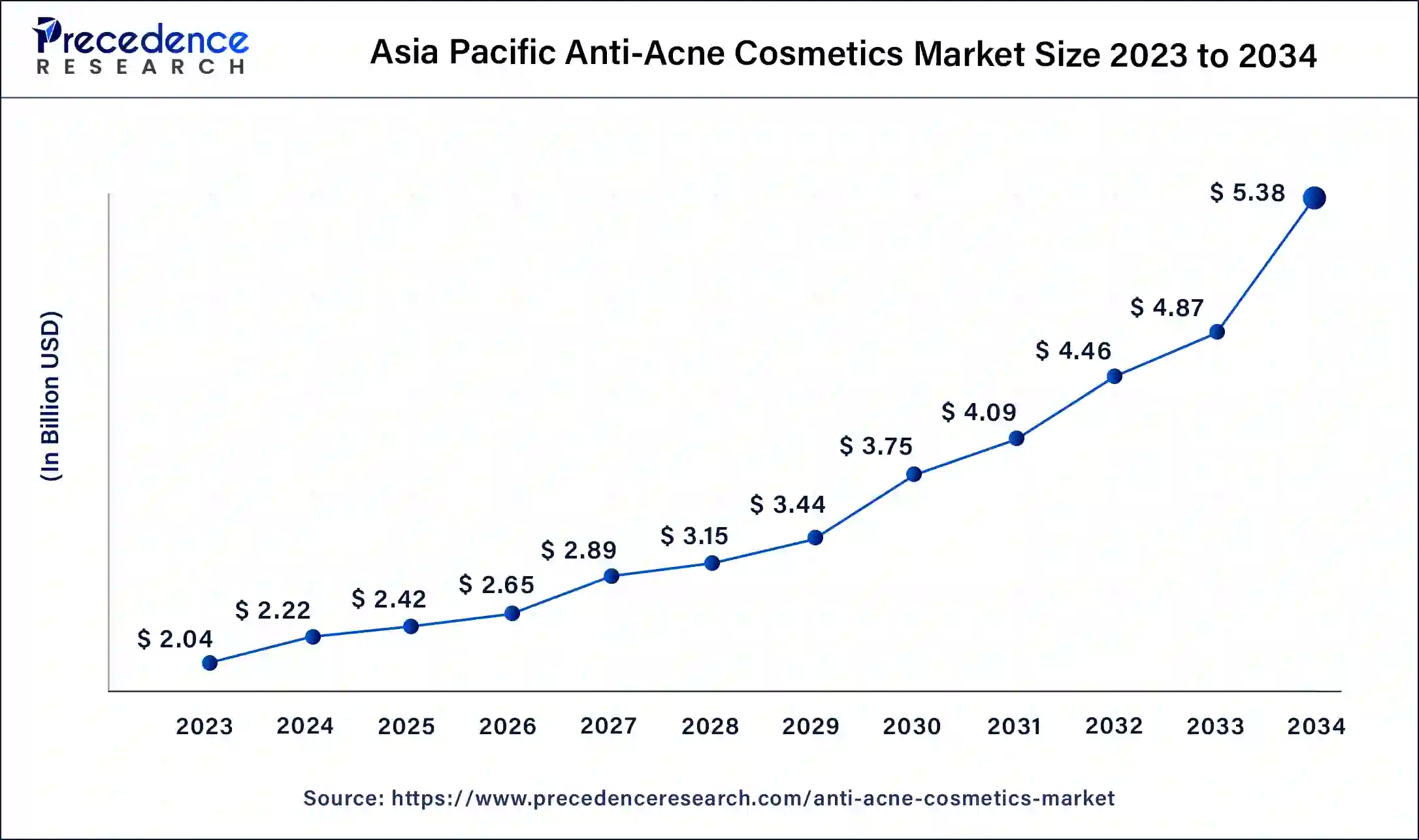

The Asia Pacific anti-acne cosmetics market size was exhibited at USD 2.04 billion in 2023 and is projected to be worth around USD 5.38 billion by 2034, poised to grow at a CAGR of 9.21% from 2024 to 2034.

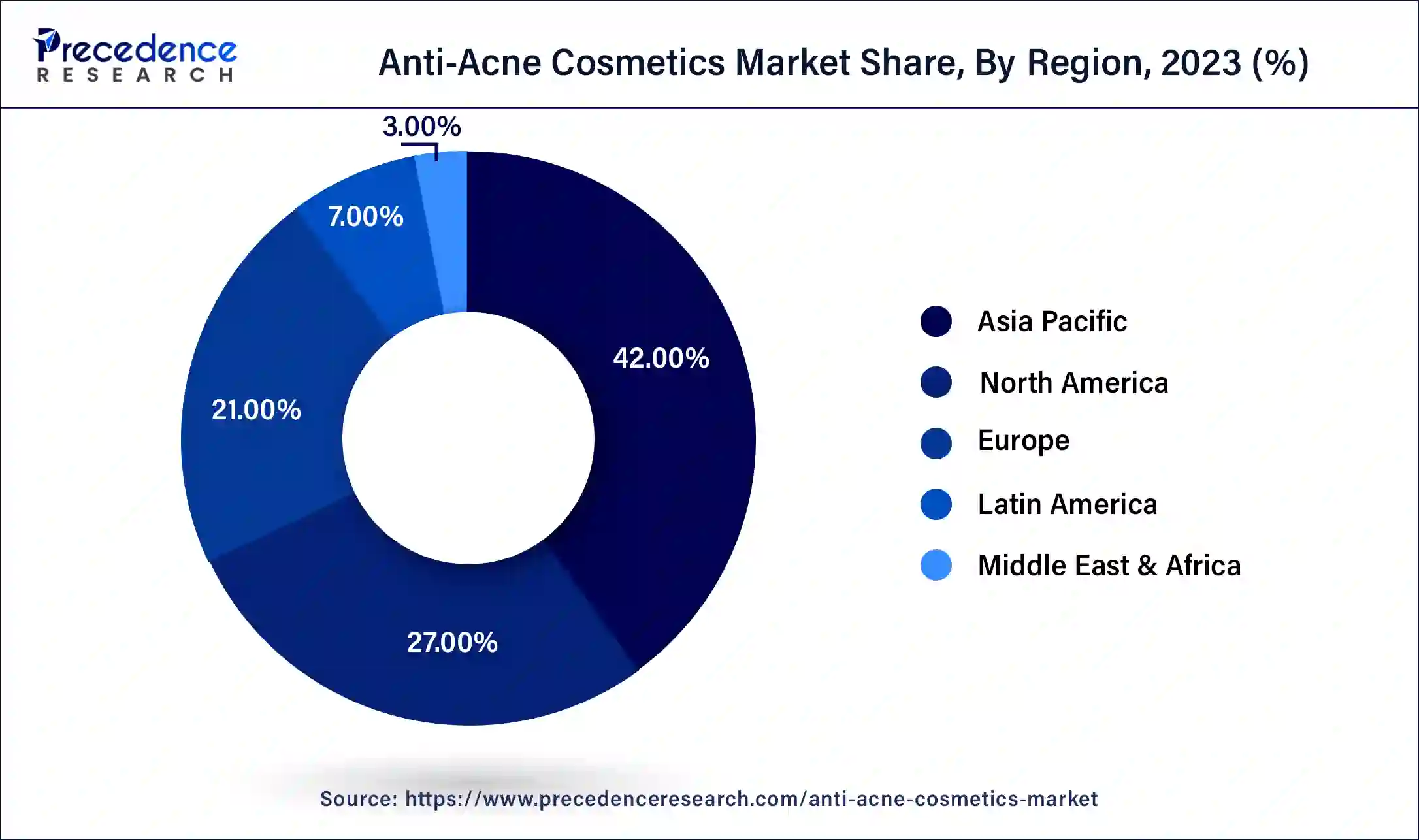

Asia Pacific accounted for the largest share of the anti-acne cosmetics market in 2023. Asia Pacific is a large export market for U.S. and Europe-based products. Vietnam, Indonesia, and Malaysia are expected to see strong demand for anti-acne cosmetic products. Countries like South Korea, Japan, and China have some of the largest consumer bases for U.S. based products. North America has several established cosmetics and pharmaceutical companies which are increasingly exporting products to Asia Pacific. The robust research and development infrastructure in the region is giving rise to new and innovative treatments for acne. However, products from Asia Pacific are also gaining traction in the space, with a large ecosystem of skincare start-ups cropping up to meet the rising demand in the region.

Europe is expected to host the fastest-growing anti-acne cosmetics market in the upcoming years, with France and Germany leading the region's growth. France has a long-standing skincare culture with an emphasis among French consumers on maintaining healthy, blemish-free skin. Skincare is deeply rooted in French culture, and consumers are becoming aware of a variety of products.

Fashion and beauty brands are also a prominent part of French culture, with Paris still considered the global fashion and beauty hub. On the other hand, Germany has a sizeable presence in this market due to the country’s status as the world leader in clinical trials and high R&D investment and patent applications. Germany leads pharmaceutical innovation in Europe.

Anti-acne cosmetics help prevent acne or alleviate the symptoms of acne on the skin. Anti-acne cosmetics include a variety of products like creams, cleansers, toners, face masks, spot treatment products, and more. Genetic factors, diet, certain endocrine disorders, pollution, stress, and even some skincare products can lead to acne, making it one of the leading dermatological issues globally.

Acne is a skin condition that occurs when hair follicles in the skin become clogged with oil, dead skin cells, and/or bacteria, causing inflamed, raised bumps. It has a high prevalence among adolescents, with nearly everyone having experienced acne at some point in their lives. Acne can frequently occur on the face, neck, shoulders, chest, and upper back. The development of organic anti-acne cosmetics made from natural ingredients that can cause less severe side effects is a great opportunity for growth in the anti-acne cosmetics market.

According to Yale Medicine, acne affects close to 85% of people between the ages of 12 and 24. As people age, acne tends to disappear by mid-20s. However, some may continue to experience it into adulthood. Over 25% of women and 12% of men in their 40s have also reported having acne.

Anti-acne cosmetics have become ubiquitous due to rising levels of pollution and overall environmental stressors, leading more people to have acne breakouts. Growing internet penetration, the rise of e-commerce, and increasing disposable incomes in emerging economies are driving demand for more skincare products. Innovations in the dermatological sector have led to the development of state of the anti acne cosmetics. Innovative delivery methods such as pimple patches and products tailored to various skin types are driving growth in the anti-acne cosmetics market.

How AI is Being Used in Beauty and Cosmetics Industry?

AI tools analyze individual skin types, tones, and conditions using selfies or images uploaded by users. Based on this analysis, artificial intelligence (AI) algorithms recommend personalized skincare routines and products, ensuring that customers receive solutions tailored to their specific needs. Companies are using AI to create custom makeup products, such as foundations and lipsticks, by analyzing a user’s skin tone and preferences. AI-driven tools suggest shades and formulations that match the user’s unique complexion, enhancing the personalization of beauty products.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.65 Billion |

| Market Size in 2023 | USD 4.85 Billion |

| Market Size in 2024 | USD 5.29 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.11% |

| Largest MarketProduct | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Gender, Formulation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dietary changes, stress, and endocrine disorders are increasing the prevalence of acne.

Dietary changes, stress, and endocrine disorders are increasing the prevalence of acne and have led to a spike in pollution, changing diets, and a rising incidence of endocrine disorders. The increasing consumption of processed foods with a high glycemic load contributes to the development or worsening of acne.

The presence of certain endocrine disorders, such as polycystic ovary syndrome and congenital adrenal hyperplasia, raises androgen levels, which leads to more cases of acne. Increasing prescriptions for corticosteroids and anabolic steroids for various health conditions is also leading to a spike in the incidence of acne.

Rising disposable income and changing beauty standards

Countries in the Asia Pacific, like China, have been among the fastest-growing economies globally, and various other emerging economies, such as India, Singapore, Thailand, and Vietnam, are also seeing significant growth in the anti-acne cosmetics market. This growth is leading to a rise in middle-class populations.

The rise of media and celebrity influencers, the prevalence of filters and airbrushing on social media, and ever-evolving makeup trends are changing beauty standards. Unblemished, flawless skin is now a universal ideal, with regimented skincare routines becoming popular. This push, coupled with higher spending power, is driving demand in the anti-acne cosmetics market.

Advances in skin pharmacology and new treatments for acne

Growing investment in healthcare worldwide has led to rising expenditure in dermatological research and development. The presence of acne can lead to anxiety, depression, low self-esteem, and thus, a lowering in overall quality of life due to emotional and mental associations with an individual’s appearance. This has led to the development of new treatments and paved the way for advanced studies that will enable the further evolution of the anti-acne cosmetics market.

Side effects, especially on sensitive skin

Although anti-acne products are growing in popularity worldwide, there are some noticeable side effects. Anti-acne cosmetics containing isopropyl myristate and its derivatives can cause skincare issues like irritation of the skin if overused. Adverse side effects like dryness, peeling, and increased photosensitivity from some ingredients like benzoyl peroxide and salicylic acid used in anti-acne products discourage consumers. The overuse of anti-acne cosmetics can cause skin irritation or allergic reactions. This restricts appeal and usage in the anti-acne cosmetics market.

Varying skin sensitivity among consumers

The efficacy of anti-acne cosmetics varies according to skin type, acne severity, and other genetic predispositions. This brings several complexities into treatment selection, with very few one-size-fits-all options available. This can lead to frustration among consumers and discourage them due to uncertainty of results. This can hinder the growth of the anti-acne cosmetics market.

Shift to organic ingredients

Consumers are becoming increasingly aware of the side effects of many of the chemicals used in the anti-acne cosmetics market. This has led to growing demand for organic products to treat conditions like acne. This provides a great opportunity for businesses to tailor their products to the demand for products with more natural ingredients.

Cannabidiol-based (CBD) products are becoming a popular ingredient in the anti-acne cosmetics market. CBD is derived directly from the hemp plant but is non-psychoactive. It has been linked to several beneficial pharmacological effects, including anti-inflammatory and antioxidant properties. Probiotics are also increasingly being incorporated into anti-acne treatments to promote skin health and reduce inflammation.

The creams & lotions segment dominated the anti-acne cosmetics market in 2023. Creams and lotions made for acne promote hydration, soothe inflamed skin, and mitigate excess oil production. Topical treatments are more readily available over the counter compared to oral medication. Consumers look for lightweight, non-greasy formulations that act as humectants and bind hydration to the skin. Some creams and lotions are also medicated, protecting the skin from skin conditions like psoriasis and eczema.

The others segment is set to grow at the fastest rate in the anti-acne cosmetics market in the forecast period. Face cleansers, gels, serums, and essential oils are included in the other segment. These products are tailored to a variety of skin types and provide better skin absorption. They also help unclog pores and slow down the development of sebum, preventing the formation of acne.

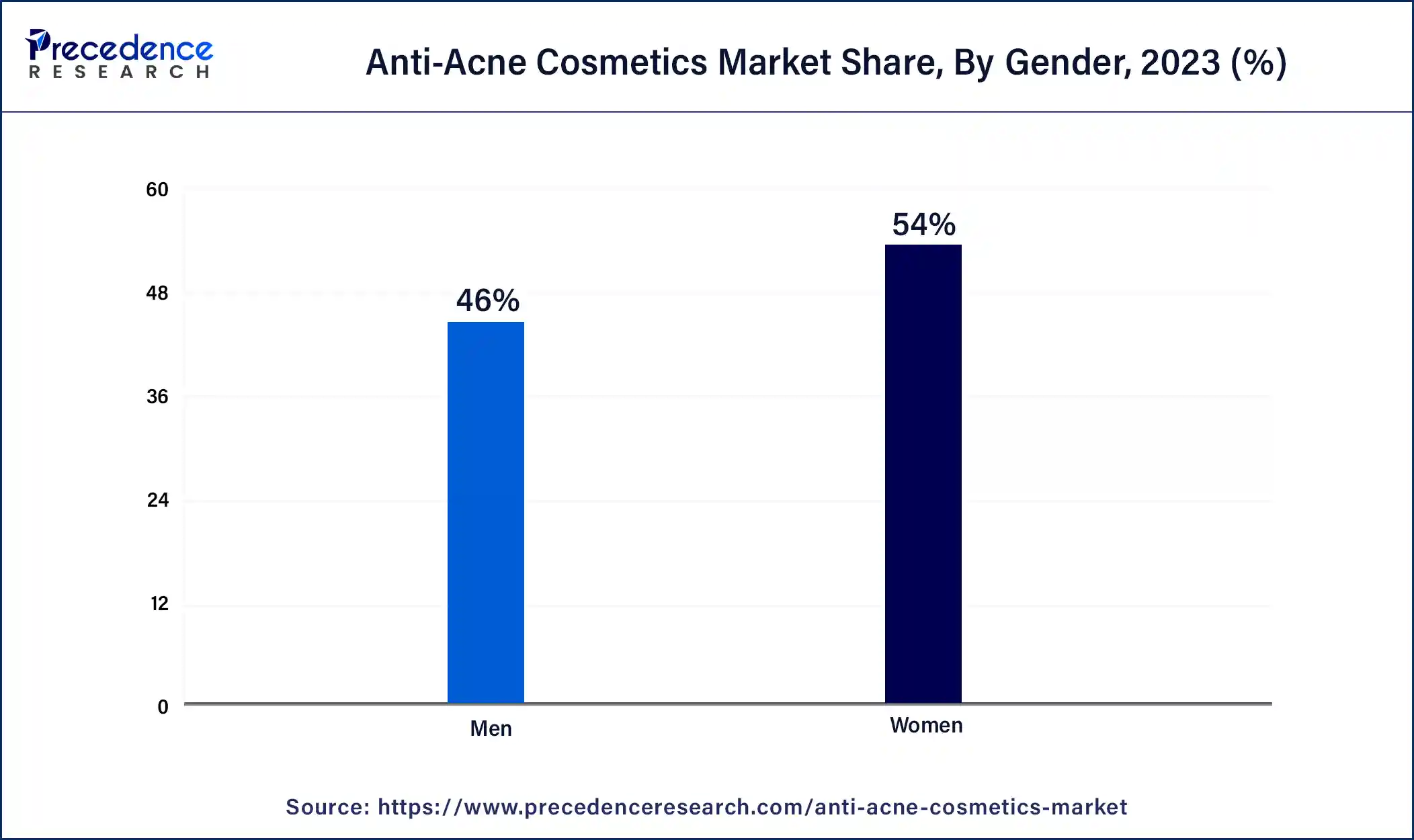

The women segment led the global anti-acne cosmetics market in 2023. Women dominate the consumer base in the anti-acne cosmetics market. There has been a perpetually high demand among women for anti-acne treatments. A long-standing focus on aesthetics and appearance, as well as the rising frequency of skin disorders among women, are factors leading to their large share in the segment. Increasing use of various cosmetic products also leads to clogged pores and more sebum production, leading to more cases of harsh and irritable acne. These factors also contribute to the female consumer base being the fastest-growing in the anti-acne cosmetics market.

Acne is also more prevalent in women compared to men after adolescence since it is linked to hormonal changes occurring around the menstrual cycle. Premenstrual acne is common as estrogen and progesterone levels fluctuate, triggering a release of excess sebum (oil) from the sebaceous glands, which clogs pores and causes skin inflammation.

The inorganic segment captured the largest share of the global anti-acne cosmetics market in 2023. Inorganic ingredients have become an industry standard with an established base in the market.

The organic segment is expected to grow at the fastest rate in the anti-acne cosmetics market in the forecast period. The growing negative associations in consumer consciousness around artificial smells, sulfates, parabens, phthalates, petrochemicals, and synthetics have led to a push toward organic and natural products to treat conditions like acne.

Segments Covered in the Report

By Product

By Gender

By Formulation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

February 2025

November 2024