January 2025

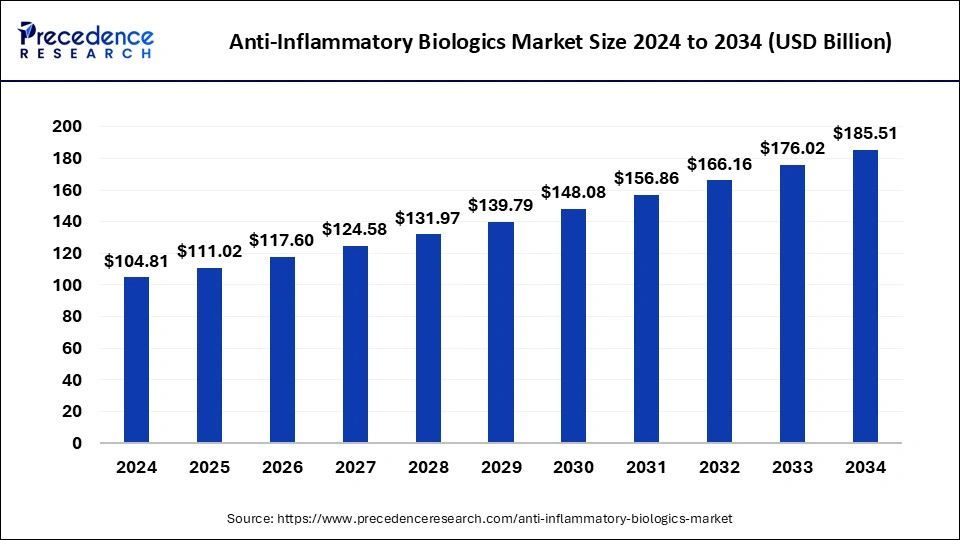

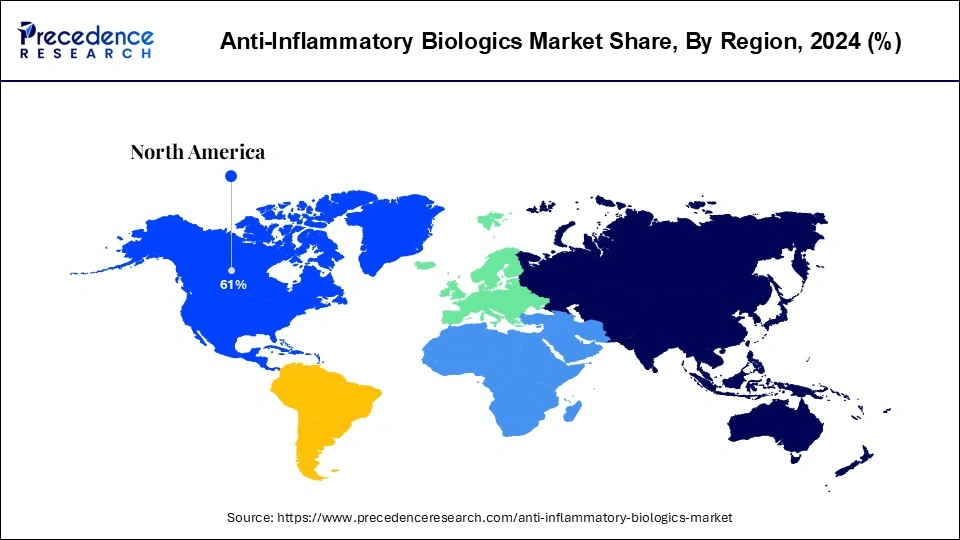

The global anti-Inflammatory biologics market size is calculated at USD 111.02 billion in 2025 and is forecasted to reach around USD 185.51 billion by 2034, accelerating at a CAGR of 5.88% from 2025 to 2034. The North America anti-Inflammatory biologics market size surpassed USD 63.93 billion in 2024 and is expanding at a CAGR of 5.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global anti-Inflammatory biologics market size was estimated at USD 104.81 billion in 2024 and is predicted to increase from USD 111.02 billion in 2025 to approximately USD 185.51 billion by 2034, expanding at a CAGR of 5.88% from 2025 to 2034. The rising prevalence of Alzheimer’s disease can boost the anti-inflammatory biologics market.

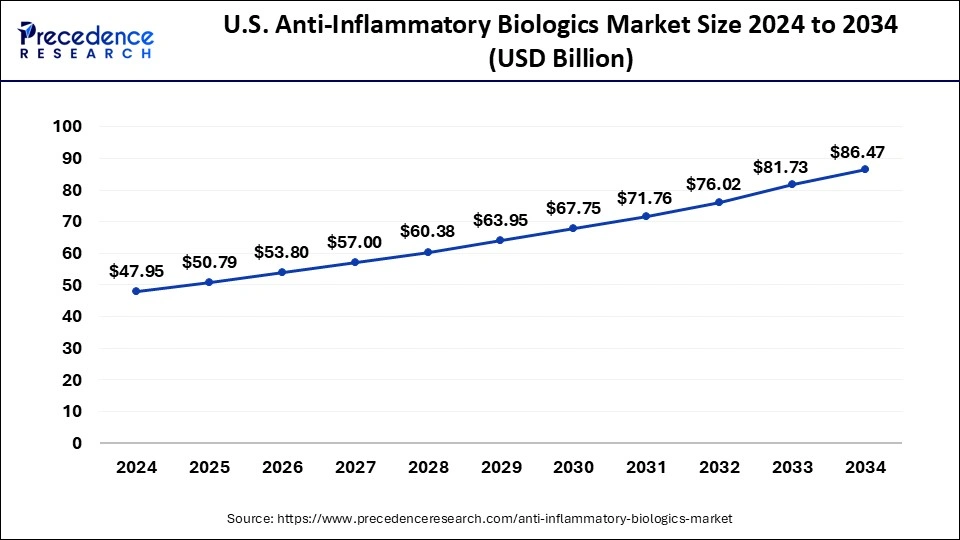

The U.S. anti-inflammatory biologics market size surpassed USD 45.27 billion in 2024 and is projected to attain around USD 81.73 billion by 2034, poised to grow at a CAGR of 6.08% from 2025 to 2034.

North America dominated the anti-inflammatory biologics market in 2024. The highly established healthcare infrastructure in North America, especially in the U.S. and Canada, facilitates the discovery, creation, and use of cutting-edge biological medicines. This produces a large need for biological therapies that work. Many of the top pharmaceutical firms that are pioneers in the development of biologic drugs are based in North America. These businesses make significant investments in R&D, which results in the release of novel and potent biologics.

North American regulatory bodies, including the Food and Drug Administration (FDA) in the United States, have put in place supportive and unambiguous frameworks for the approval and oversight of biologic pharmaceuticals. This makes it easier for innovative medicines to be introduced to the market on schedule.

Europe is expected to host the fastest-growing anti-inflammatory biologics market during the forecast period. Chronic inflammatory disorders, including psoriasis, inflammatory bowel disease, and rheumatoid arthritis, are becoming more common in Europe. Biologics are among the effective medicines that are in high demand due to the rising burden of disease. The aging population in Europe makes them more vulnerable to long-term inflammatory diseases. It is anticipated that the aging population will increase the demand for biologic therapies. European nations are consistently allocating resources towards enhancing their healthcare infrastructure, encompassing the integration of cutting-edge medical technology and treatments. This infrastructure supports biologics management and administration.

The anti-inflammatory biologics market refers to a class of biologics derived from biological sources and works by targeting particular immune system components to lower inflammation. These medications are used to treat ankylosing spondylitis, psoriasis, inflammatory bowel disease including Crohn’s disease and ulcerative colitis, rheumatoid arthritis, and other autoimmune and inflammatory diseases. The biologics, as opposed to conventional anti-inflammatory medications, are made to specifically target molecules connected to the inflammatory process.

The anti-inflammatory biologics market is fragmented with multiple small-scale and large-scale players, such as Amgen Inc, Novartis AG, AstraZeneca PLC., Johnson & Johnson, PFIZER INC., GlaxoSmithKline plc, F. Hoffmann-La Roche AG, Merck & Co., Inc., Eli Lily and Company.

| Report Coverage | Details |

| Market Size by 2034 | USD 185.51 Billion |

| Market Size in 2025 | USD 111.02 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.88% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Application, Route of Administration, Distributional Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for anti-inflammatory biologics

The rising demand for anti-inflammatory biologics can boost the anti-inflammatory biologics market. A number of factors, including increased illness incidence, technological improvements, changing demographics, healthcare spending, better diagnostics, and patient preferences, are contributing to the growing need for anti-inflammatory biologics. All of these elements work together to support the market for biologics that reduce inflammation.

Rising prevalence of inflammatory diseases

The rising prevalence of inflammatory diseases increases the demand for the anti-inflammatory biologics market. Effective and long-lasting therapies are becoming more and more necessary as inflammatory disorders become more common. Anti-inflammatory biologics are becoming more and more in demand, which is propelling market expansion due to their effectiveness, focused action, and capacity to enhance patients' quality of life.

Side effects of anti-inflammatory biologics

The side effects of anti-inflammatory biologics may slow down the anti-inflammatory biologics market. In spite of anti-inflammatory biologics having many therapeutic advantages, their side effects can cause anxiety in patients and healthcare professionals, as well as regulatory issues, increased prices, bad press, and competition from other products. The expansion of the market may be slowed down by these variables taken together.

Increasing healthcare infrastructure

The increasing healthcare infrastructure may be the opportunity to boost the anti-inflammatory biologics market. The increased healthcare spending by the public and commercial sectors has improved access to cutting-edge therapies like biologics. This investment makes biologics more widely available and reasonably priced by providing money for research and development in addition to insurance coverage and subsidies.

The anti-tumor necrosis factor (TNF) segment dominated the anti-inflammatory biologics market in 2024. The effectiveness of anti-TNF biologics in treating a variety of inflammatory diseases, including psoriasis, ankylosing spondylitis, rheumatoid arthritis, and Crohn's disease, has long been recognized. They are a popular option for both patients and healthcare professionals due to their efficaciousness in decreasing inflammation and enhancing patient results. The biologics targeting TNF have approvals for a number of inflammatory conditions. Their wide variety of indications makes them suitable for a greater number of patients, which adds to their market domination.

Their ability to treat a wide range of illnesses boosts their market share and utilization. Due to its established efficacy, a wide range of indications, well-known brands, robust research and development, availability of biosimilars, advantageous reimbursement policies, favorable patient outcomes, regulatory support, and long-term safety data, the anti-TNF segment is expected to dominate the market by drug class in 2023. Taken together, these elements guarantee that anti-TNF biologics will always be a mainstay in the management of inflammatory disorders.

The interleukin antagonists segment is expected to grow at the highest CAGR in the anti-inflammatory biologics market during the forecast period. The wide range of inflammatory disorders have demonstrated excellent response to interleukin antagonist treatment. They target and neutralize interleukins specifically, which are essential for the inflammatory response. Compared to anti-inflammatory medications with a wider range of effects, their tailored action may produce greater results and fewer adverse effects.

A growing variety of indications are being approved for interleukin antagonists. They were originally used to treat ailments including psoriasis and rheumatoid arthritis, but their usage is now being extended to include atopic dermatitis, asthma, and inflammatory bowel illness. Their business potential is greatly increased by this expansion of indications. The section of interleukin antagonists is expected to rise quickly because of its excellent clinical effectiveness, growing indications, stable pipeline, positive trial results, opportunity for customized therapy, capacity to address unmet medical requirements, rising disease prevalence, supporting market dynamics, improved patient compliance, rising awareness, and advantageous reimbursement policies, the interleukin antagonists segment is expected to grow rapidly. The market for anti-inflammatory biologics is anticipated to see a high compound annual growth rate (CAGR) for IL antagonists due to the combined effect of these factors.

The rheumatoid arthritis segment dominated the anti-inflammatory biologics market in 2024. One of the most prevalent chronic inflammatory illnesses in the world is rheumatoid arthritis. Due to the high incidence, there is a substantial need for anti-inflammatory biologics as a large patient population will need long-term, effective treatment. TNF inhibitors, interleukin inhibitors, and other targeted biologic treatments are examples of anti-inflammatory biologics that have demonstrated significant success in the treatment of RA.

They are a favored course of therapy because they lessen inflammation, shield joints from injury, and enhance patients' quality of life generally. Among the first inflammatory disease medicines to be developed and authorized were biologics for RA. Its dominance has been aided by established use among patients and healthcare professionals as a result of its early acceptance and extended market presence.

The psoriasis segment is expected to grow at the highest CAGR in the anti-inflammatory biologics market during the forecast period. Psoriasis is becoming more commonplace worldwide, which means that there are more people with the condition who require effective therapies. There will likely be an increase in demand for biologics that can successfully treat symptoms and enhance the quality of life as more people are identified with this chronic and frequently crippling ailment.

The treatment for moderate-to-severe psoriasis with biologic treatments has demonstrated notable effectiveness. TNF inhibitors, IL-17 inhibitors, IL-23 inhibitors, and IL-12/23 inhibitors are a few examples of these medications that work by targeting particular immune system pathways, leading to significant increases in skin clearance and symptom reduction. The increased incidence of psoriasis, the proven efficacy and ongoing innovation of biologic therapies, the expansion of indications, patient desire for better quality, and other factors are driving the predicted high compound annual growth rate (CAGR) for the psoriasis category in the market.

The injection segment dominated the anti-inflammatory biologics market in 2024. The large, complex molecules known as biologics are frequently unstable or ineffective when given orally because of gastrointestinal system breakdown. By injecting these medications directly into the circulation or tissues, their stability and bioavailability are guaranteed. Compared to other delivery methods, injections offer a quick start of the effect.

This is especially crucial for illnesses like acute inflammatory disorders that call for immediate symptom alleviation. Injectable anti-inflammatory biologics, such as TNF inhibitors and interleukin inhibitors, are among the many well-known and often-used types. The drugs like adalimumab (Humira), etanercept (Enbrel), and infliximab (Remicade) are among them; they have proved crucial in the management of ailments like psoriasis and rheumatoid arthritis.

The oral segment is expected to grow rapidly in the anti-inflammatory biologics market in the upcoming years. Patients often choose oral delivery to needles since pills and tablets are non-invasive, easy to use, and convenient. Oral biologics are in higher demand as a result of this choice, which also leads to greater compliance and adherence to treatment plans. The developments in drug delivery methods in recent times have made it possible to manufacture oral formulations of biologics, which were previously exclusively available as injections.

The advancements in formulation methods, protease inhibitors, and permeation enhancers have allowed for the preservation of biologics' stability and effectiveness when taken orally. Because oral biologics are convenient and simple to administer, patient compliance is enhanced. When a patient can take their medicine orally, they are more likely to follow their treatment plans, which is especially crucial for treating chronic inflammatory conditions.

The hospital pharmacy segment dominated the anti-inflammatory biologics market in 2024. Anti-inflammatory biologics frequently need to be handled, stored, and administered with care, which is usually given in a hospital environment. Since many of these therapies are given intravenously or by injections, supervision by medical professionals is required. Hospitals offer a setting where patients may be closely watched for biological side effects and effectiveness. This is particularly important for biologics, as they can have serious adverse effects and may need to be taken at different doses depending on how the patient reacts. Acute flare-ups that need hospitalization can occur in many illnesses treated with anti-inflammatory biologics, including severe arthritis, inflammatory bowel disease, and several dermatological disorders.

The retail pharmacy segment is expected to grow at the fastest rate in the anti-inflammatory biologics market during the forecast period. Hospital pharmacies are less accessible than retail pharmacies to a wider range of people. Patients enjoy the ease of getting their prescriptions filled at local retail pharmacies as biologics become more widely used for treating chronic diseases. For chronic illnesses, there is a rising tendency toward home-based treatment and outpatient care.

Due to this change, patients are now more likely to buy their drugs from retail pharmacies than from medical facilities. More complete patient care services, such as vaccines, health screenings, and specialty medicine dispensing, are being added by retail pharmacies to their repertoire. Their market share will rise as a result of this expansion, which involves managing sophisticated biologics.

By Drug Class

By Application

By Route of Administration

By Distributional Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

October 2024

March 2025