February 2025

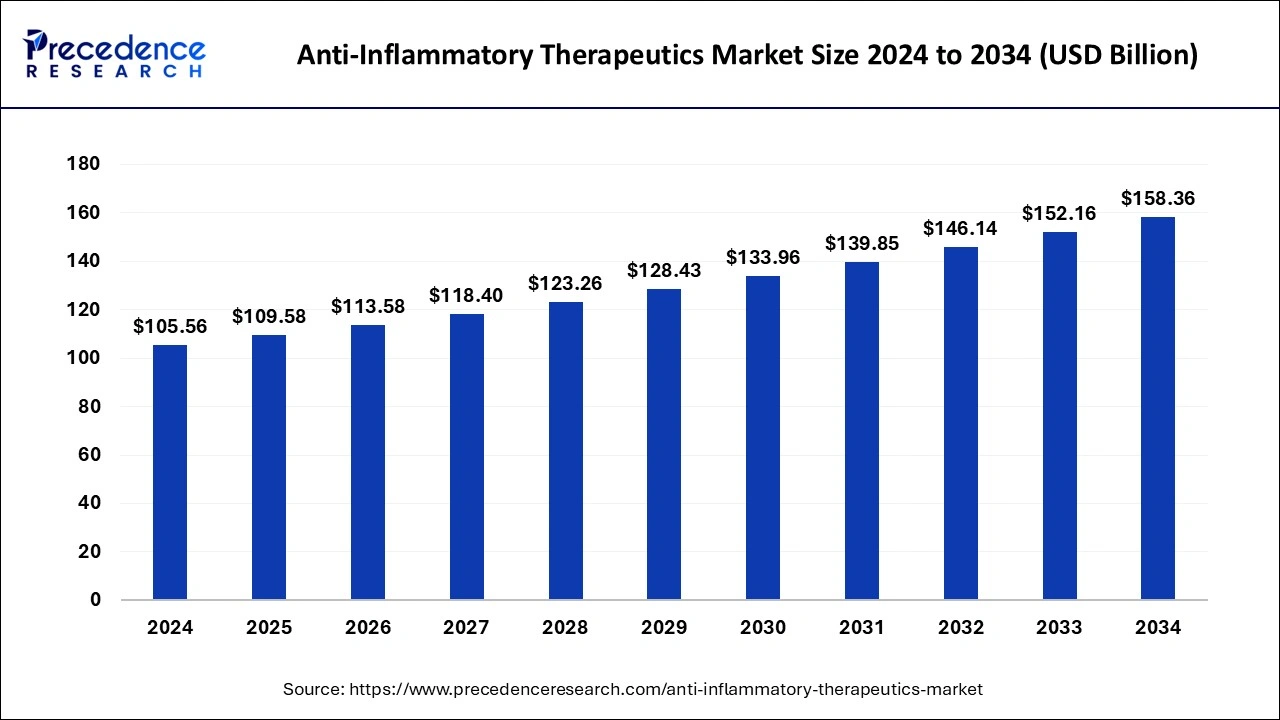

The global anti-inflammatory therapeutics market size is estimated at USD 109.58 billion in 2025 and is forecasted to worth around USD 158.36 billion by 2034, accelerating at a CAGR of 4.14% from 2025 to 2034. The North America anti-inflammatory therapeutics market size crossed USD 39.06 billion in 2024 and is expanding at a CAGR of 4.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global anti-inflammatory therapeutics market size was estimated at USD 105.56 billion in 2024 and is expected to hit USD 158.36 billion by 2034, with a registered CAGR of 4.14% from 2025 to 2034.

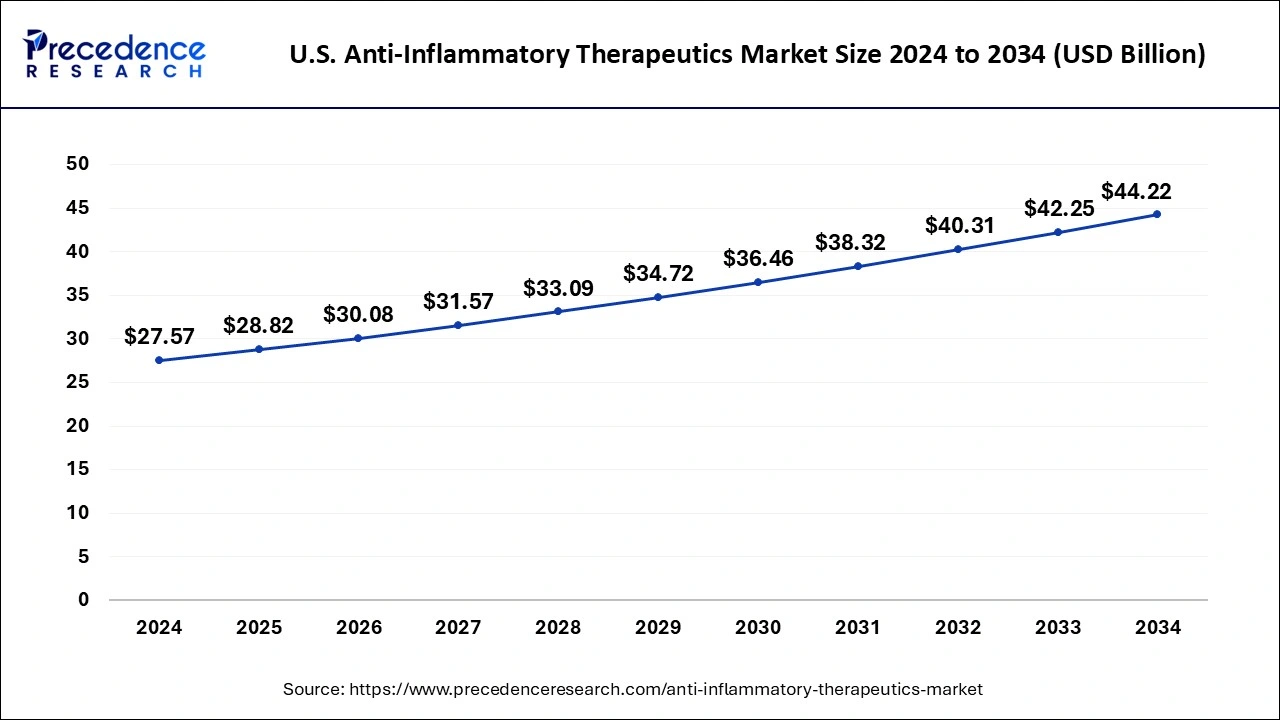

The U.S. anti-inflammatory therapeutics market size reached USD 27.57 billion in 2024 and is anticipated to reach around USD 44.22 billion by 2034, poised to grow at a CAGR of 4.84% from 2025 to 2034.

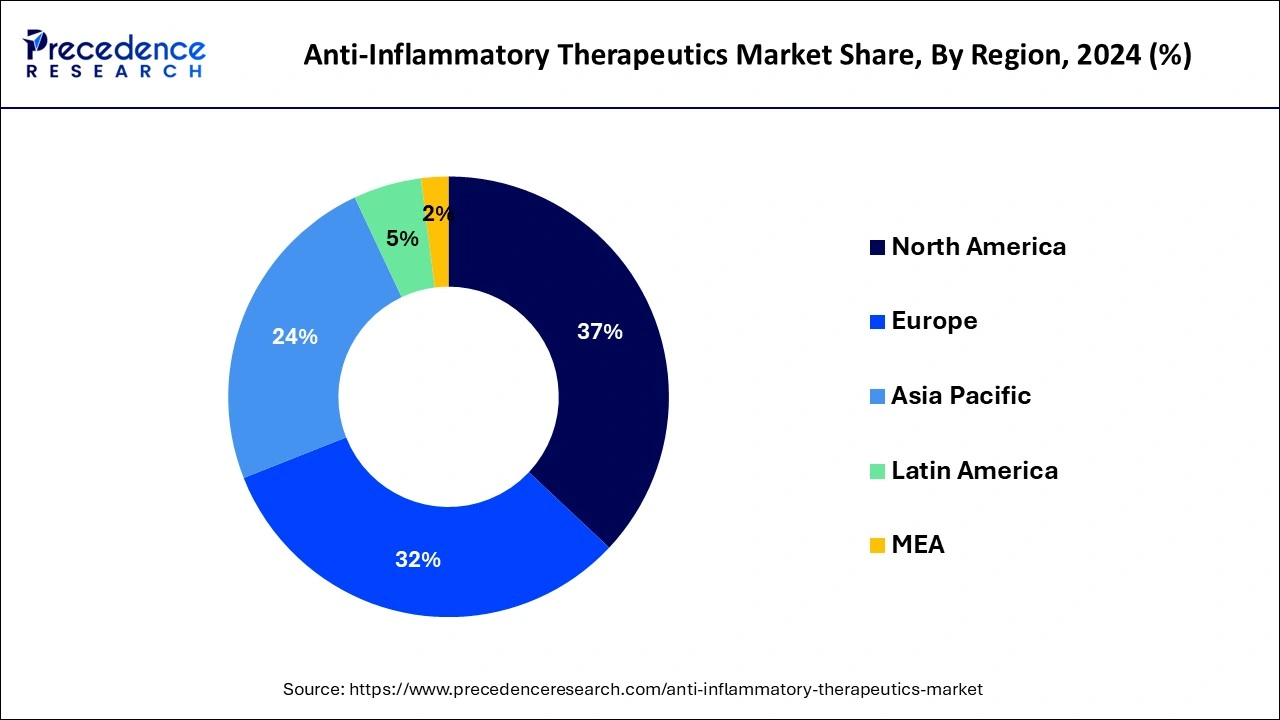

In 2024, the North American region dominated the market for anti-inflammatory with a market share of 37.00%. The main causes of the market's rise in North America include rising demand for anti-inflammatory biologics, government backing for the introduction of biosimilars, and large research expenditures. The market will also benefit from rising sales of Humira, Ramicade, and Enbrel as well as advice from the Centers for Disease Control and Prevention about the use of non-opioid medications. Due to active government support for the introduction of biosimilars and attractive health reimbursement regulations, the market for anti-inflammatory medicines is anticipated to increase in Europe. Amgen announced the release of Amgevita, a biosimilar of adalimumab, in Europe in October 2018. It is predicted that this would help the European market.

An exponential rise in population, increased healthcare spending, and an increase in the prevalence of chronic, lifestyle-related, respiratory, and infectious illnesses are the main drivers of the anti-inflammatory therapeutic market in Asia-Pacific. Branded generics are gaining market share thanks to more effective therapy, strong marketing tactics, and promotions.

Anti-inflammatory treatments aid in the reduction of both acute and chronic pain, such as that caused by sprains, menstrual pain, rheumatoid arthritis, migraines, and headaches. Compared to conventional medications, these therapies offer quicker relief. Additionally, they are able to lessen pain and swelling as well as prostaglandin levels and the substances that cause inflammation.

The alarming rise in autoimmune and respiratory disease incidence, the development of novel therapies, and the rapid uptake of anti-inflammatory medications are the main drivers propelling the growth of the worldwide anti-inflammatory market. Due to the development of anti-inflammatory biologics, which are more focused, effective, and have less adverse effects than traditional pharmaceuticals, the demand for anti-inflammatory medications has also been rising noticeably. Additionally, throughout the study period, it is anticipated that increased government activities to promote the use of nonsteroidal anti-inflammatory medications in Asia-Pacific and LAMEA would boost market growth. It is recognized that the patent expiration problems with blockbuster medications (like Remicade) and the negative effects of anti-inflammatory medications restrict the market's expansion.

Due to the inflammation brought on by SARS-COV 2, the COVID-19 pandemic is anticipated to have a beneficial effect on the market for anti-inflammatory therapeutics. Like COVID-19, SARS-CoV-2 is a beta coronavirus that can cause severe anti-inflammatory pneumonia in susceptible individuals. According to studies, cytokine storm has a significant role in these individuals' deaths. Acute respiratory distress syndrome, acute lung injury, and multiple organ dysfunction syndromes are a few of the side effects of severe inflammation and cytokine storms. As a result, research on and development of anti-inflammatory drugs for the treatment of inflammation brought on by COVID-19 have increased. For instance, several clinical trials are presently being conducted to reduce this harmful inflammation. The NLRP3 inflammasome is one of them; it targets a number of processes linked to COVID-19 excessive inflammation. Thus, amid the global health crisis, these variables have had a favourable effect on market growth.

Increased government attempts to treat inflammation with non-steroidal anti-inflammatory medications in Asia-Pacific and LAMEA as well as rising public awareness of anti-inflammatory treatments are anticipated to fuel market expansion. As a result, this accelerates market expansion.

The market may expand as a result of the increased prevalence of chronic illnesses. In 2018, over 51.8% of individuals in the United States had at least one chronic ailment, while approximately 27.2% had several chronic disorders. Women, seniors 65 years of age and older, and residents of rural regions had the greatest incidence rates.

An increase in the prevalence of autoimmune and respiratory disorders, new medications under development, and a rise in the use of anti-inflammatory pharmaceuticals are all driving factors in the global market for anti-inflammatory treatments. The development of anti-inflammatory biologics, which are more targeted, efficient, and have less side effects than conventional pharmaceuticals, has also contributed to a considerable increase in the demand for anti-inflammatory medications. Additionally, growing public knowledge of anti-inflammatory treatments has a considerable impact on market expansion.

| Report Coverage | Details |

| Market Size in 2025 | USD 109.58 Billion |

| Market Size by 2034 | USD 158.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Indication, Application, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Candidates for the pipeline that could boost the market

Increased inflammatory disease prevalence to benefit the market

Side effects of anti-inflammatory drugs

Impending drug approvals

Introduction of innovative anti-inflammatory medications

The market is divided into corticosteroids, non-steroidal anti-inflammatory drugs (NDAIDs), and anti-inflammatory biologics based on medication class. In 2024, the anti-inflammatory biologics sector had the largest share. The introduction of biosimilars, the growing uptake of monoclonal antibodies, and new product releases are the main drivers of this market's expansion. RINVOQ, a janus kinase inhibitor for the treatment of rheumatoid arthritis, was introduced by AbbVie in August 2019. Due to the increased incidence of inflammatory illnesses, expanding NSAID usage, and rising demand for over-the-counter (OTC) anti-inflammatory medications, it is projected that the NSAIDs market would grow.

The demand for NSAIDs is also increasing as a result of government recommendations to use them as the first line of therapy for pain and inflammation. Due to the growing incidence of COPD, more research, and prospective pipeline candidates, the corticosteroid market is predicted to expand.

The market is divided into autoimmune inflammatory disorders, respiratory illnesses, and other diseases based on application. Rheumatoid arthritis, psoriasis, and other autoimmune inflammatory illnesses fall under this category. In 2024, it is predicted that the autoimmune inflammatory illness sector will produce the most money. Rising rates of psoriasis, inflammatory bowel illnesses, and rheumatoid arthritis are the main causes of the segment's expansion. Due to a sharp rise in COPD patients and growing inhalation of corticosteroids, the respiratory diseases market is anticipated to grow throughout the forecast period.

The market is divided into hospital pharmacies, retail pharmacies, and internet pharmacies in terms of distribution channels. Due to the expanding demand for anti-inflammatory medications, advantageous health reimbursement, and the rising frequency of inflammatory illnesses, the hospital pharmacy sector led the market in 2024. The over-the-counter (OTC) medicine market is expected to expand due to rising ibuprofen and diclofenac demand as well as increased OTC drug availability.

Ibuprofen OTC capsules manufactured by Strides Pharma Inc. were approved by the US FDA in April 2018. These products are anticipated to grow the retail pharmacy market. Due to increasing e-commerce usage, improved patient convenience, and alluring discounts and coupons on online purchases, the online segment is expected to expand.

By Drug Class

By Indication

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

August 2024

October 2024