December 2024

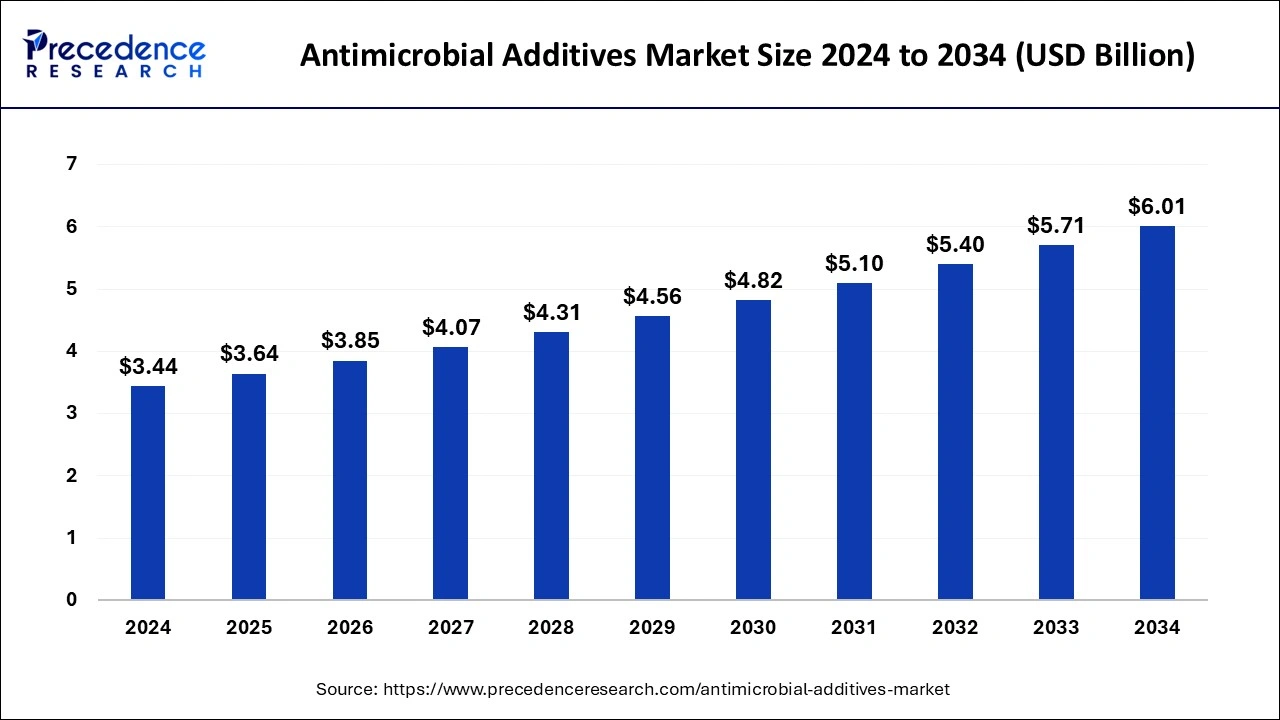

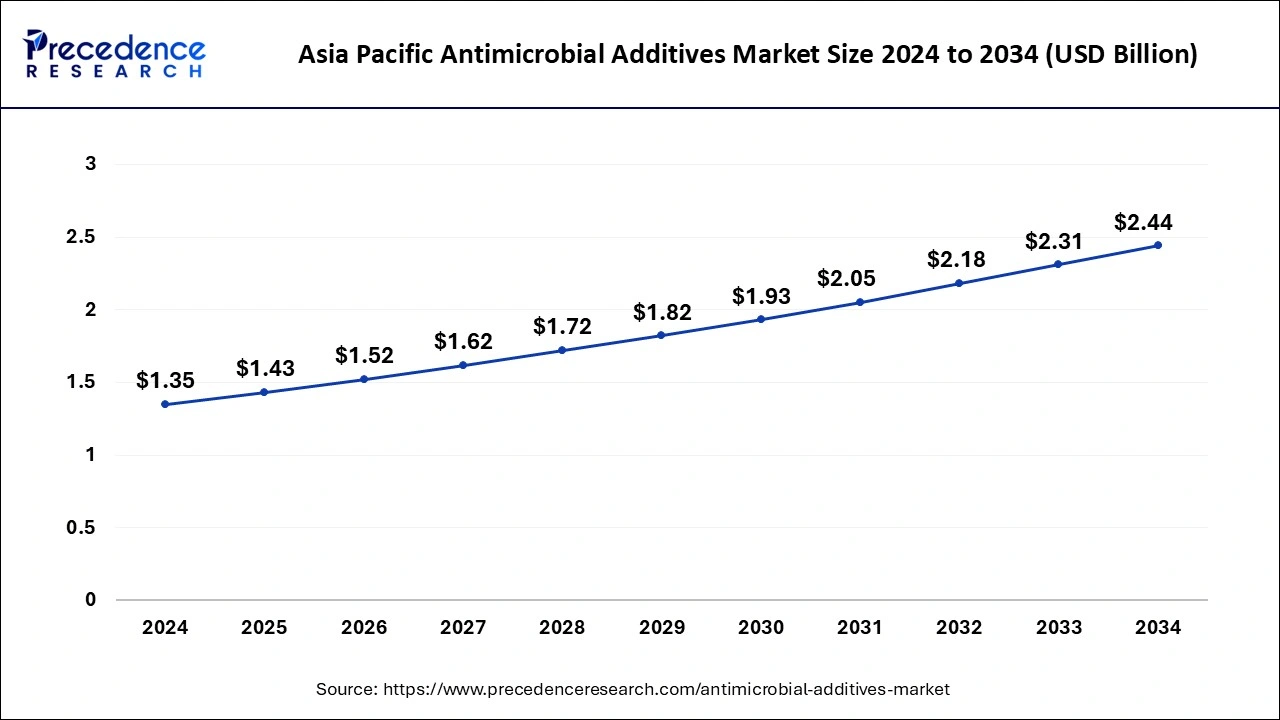

The global antimicrobial additives market size is evaluated at USD 3.64 billion in 2025 and is forecasted to hit around USD 6.01 billion by 2034, growing at a CAGR of 5.74% from 2025 to 2034. The Asia Pacific market size was accounted at USD 1.35 billion in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global antimicrobial additives market size accounted for USD 3.44 billion in 2024 and is expected to exceed around USD 6.01 billion by 2034, growing at a CAGR of 5.74% from 2025 to 2034.

The Asia Pacific antimicrobial additives market size was exhibited at USD 1.35 billion in 2024 and is projected to be worth around USD 2.44 billion by 2034, growing at a CAGR of 6.10% from 2025 to 2034.

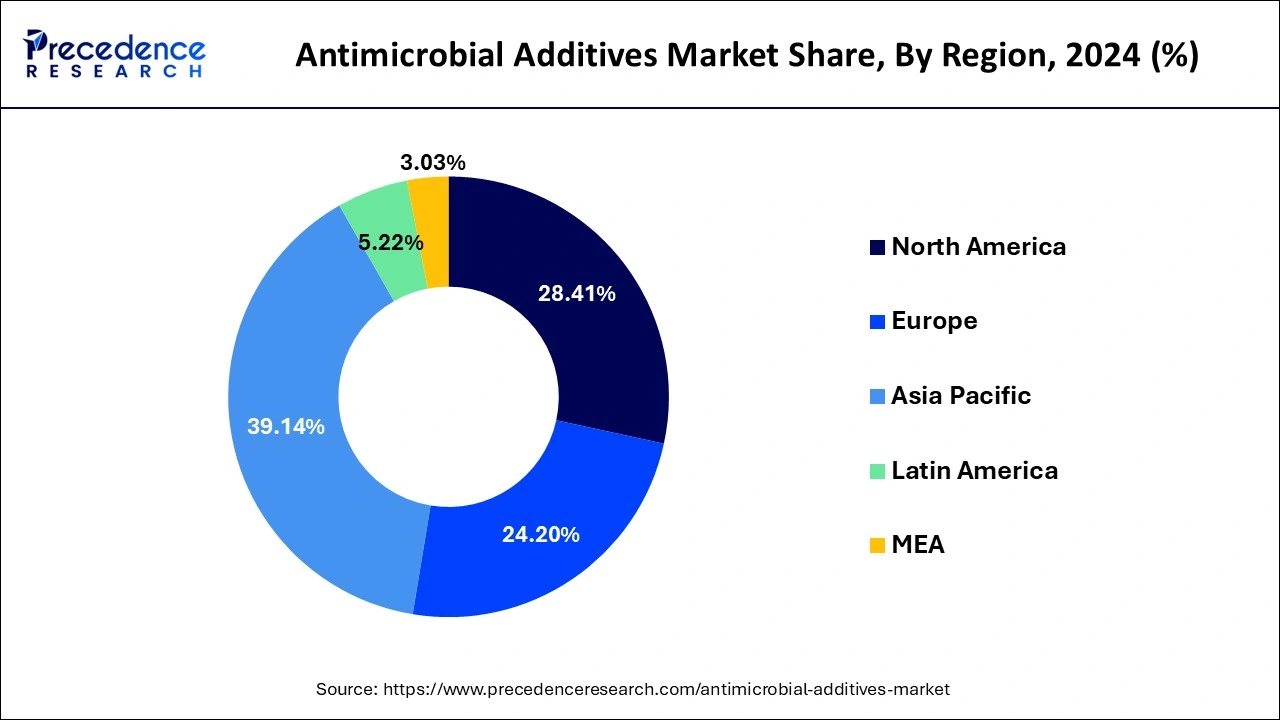

Asia Pacific is expected to grow at a CAGR of 6.2% during the projected period. The rising investments in the pharmaceutical and healthcare sectors have fueled the market’s growth in the region. Moreover, the availability of raw materials at affordable prices and increased consumer awareness regarding hygiene, especially after the coronavirus outbreak, have boosted the demand for antimicrobial additives in the market. The sale of silver and copper antimicrobial additives has increased dramatically in Asia Pacific. The improving healthcare sector in developing countries in the Asia Pacific has enormous potential to boost the growth of the antimicrobial additives market during the forecast period.

The European antimicrobial additives market is expected to grow at a CAGR of 6.0% during the projected period. The rapid expansion of the healthcare sector is propelling the market’s growth in Europe. Germany and the UK are expected to increase significantly during the projected period. The rising demand for high-quality personal care products is boosting the development of the antimicrobial additives market in the region.

The antimicrobial additives market in North America is expanding at a noticeable pace. The emerging food and beverage industry has the highest demand for antimicrobial additives in North America, and rising preferences for packaged food products fuel the market’s growth.

An antimicrobial additive is a substance added to any material during its manufacturing process to stop or reduce the growth of bacteria and viruses in the track. Numerous microorganisms, including bacteria, mold, fungi, algae, and even viruses, might be considered to be microbes; their presence on any surface can be dangerous for human health.

An antimicrobial additive effectively penetrates bacteria when they come into touch with a treated surface, disrupting their essential life processes. Antimicrobials fight a broader spectrum of germs. They also address concerns about freshness and stains.

Antimicrobial additives resist the growth of odor-producing bacteria by making the production of material cleaner. Antimicrobial additives offer incomparable benefits to hygiene-critical and high-traffic environments, including research institutions, laboratories, hospitals, schools, and even for food processing plants.

The rising awareness for cleaner surfaces to prevent the contamination of bacteria and viruses has boosted the demand for antimicrobial additives in the market. Antimicrobial additives are widely used as an antiseptic coating material. Typical applications of antimicrobial additives include plastic, coatings, ceramics, and textiles.

The global antimicrobial additives market is expected to witness robust growth during the forecast period. The rising awareness among people about healthcare-associated infections and diseases has boosted the development of the antimicrobial additives market in recent years. Antimicrobial additives are used for vehicle parts. Thus, the booming automotive industry is another potential driver for the market’s growth.

Growing end-use industries that require antimicrobial additives for various applications are observed to propel the development of the market globally. In recent years, the food industry has started utilizing antimicrobial additive material for food packaging; this factor will open lucrative opportunities for manufacturers.

Increased application of plastic packaging for numerous products in diverse sectors will fuel the demand for antimicrobial materials. Moreover, factors such as rising product innovation, increasing investments in the healthcare sector, emerging economies and growing research activities to develop new additive materials are fueling the market’s growth.

However, the emission of VOC during the manufacturing process of antimicrobial additives may cause severe side effects; this factor is considered a significant restraint on the market’s growth. Considering the same, stringent policies to reduce the emission of VOC may hinder the development of the global antimicrobial additives market.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.64 Billion |

| Market Size in 2024 | USD 3.44 Billion |

| Market Size by 2034 | USD 6.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.74% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising utilization of antimicrobial additives in the food industry

The food and beverage segment is among the most significant in the global antimicrobial additives market. The utilization of antimicrobial additives in food products has immense benefits, from increased shelf life to reduced risk of spoilage. The global food industry is focused on developing packaged food products due to changed lifestyles. Packaged food products or ready-to-eat foods require a long shelf life to prevent spoilage.

Antimicrobial compounds, including lysozyme, lactoferrin, nisin, nitrate and parabens, are widely used in preserving food products. Antimicrobial additives are capable of preventing the growth of yeast, fungi and other bacteria in food products. Moreover, antimicrobial additives can preserve other characteristics of food products, such as texture, color and taste. Considering all these advantages of antimicrobial additives, the rising utilization of additives in the food industry will boost the growth of the global market.

Side effects of antimicrobial additives on health during the manufacturing process

Antimicrobial additives release volatile organic compounds during the manufacturing process. Prolonged contact with VOCs may result in serious health issues such as respiratory problems, eye irritation, skin infections, loss of coordination, and throat infection. Such side effects of a manufacturing process for antimicrobial additives limit the involvement of key players in the market by acting as a restraint for the market’s growth. However, improvements in infrastructure for manufacturing additives may combat this restraint.

Product innovation through the fused filament fabrication

The technological advancement in the antimicrobial additive market opens the door for critical players/manufacturers to develop antimicrobial biomedical materials. The deployment of fused filament fabrication will offer complex structure, rapid development, and enhanced properties for antimicrobial materials.

The fused filament fabrication technique easily allows product innovation; this can provide lucrative opportunities for manufacturers to expand their production capabilities. moreover, fused filament fabrication technology drastically reduces the time and cost of additive manufacturing.

Covid-19 Impacts:

The outbreak of coronavirus has shown severe negative impacts on the global economy by disrupting operations in various industries. Although, the global antimicrobial additives market has mixed impacts due to the Covid-19 pandemic.

In the initial phase of the Covid-19 pandemic, the market was severely affected due to the closure of various industries which require antimicrobial additives. Fluctuations in raw material prices, unavailability of raw materials, disrupted supply chain, and declined demand for additives negatively impacted the global antimicrobial additives market.

However, the market recovered with the sudden growth in the development of antimicrobial additive-based products in the healthcare sector. The rising demand for surgical masks, PPE gowns and even drugs packaging helped the market to recover. Antimicrobial additives prevent the spread of bacteria and viruses; this acts as an excellent coating material for numerous medical equipment and surgical products. Hence, critical players invested in the development of such products during the pandemic.

The utilization of antimicrobial coating technology has gained immense importance, and the demand for the same is boosting even after the pandemic. For instance, in September 2022, Zentek announced that it had entered into a manufacturing agreement with Viva Healthcare Packaging to manufacture and sale surgical masks enhanced with Zentek’s antimicrobial coating. Even during the pandemic, Viva Healthcare kept manufacturing surgical masks; the company produced up to 15 million masks every month to meet global requirements.

The inorganic antimicrobial additives segment dominates the global market; the segment is projected to grow at a CAGR of 7.1% during the forecast period. The rising demand for inorganic antimicrobial additives such as silver and copper has boosted the growth of the inorganic antimicrobial additives segment. Silver and copper inorganic antimicrobial additives can be easily incorporated into plastic products, benefiting plastic or polymer materials. Inorganic antimicrobial additives have excellent efficacy against bacteria. Organic antimicrobial additives are widely used in household products such as filtration systems, laundry care products, wet wipes, disinfectants and floor cleaners. Organic antimicrobial additives are less tolerant to the high-temperature range. This factor limits the utilization of organic additives.

The plastic segment acquires the largest share of the antimicrobial additives market. Bacteria and germs are more likely to be present on the plastic surface. Antimicrobial additives are used on various plastic applications, including pipes, automotive interiors, sports equipment, electronic devices, and healthcare equipment. To increase product lifetime and surface cleanliness, antimicrobial additives can be effortlessly included in plastic substrates.

Furthermore, the paint segment is projected to increase significantly during the forecast period. Antimicrobial paints or coatings are gaining importance, especially in urban areas, as they offer an additional layer of protection from algae and black mould. Antimicrobial additives are directly added to the paints or coatings to achieve a long-lasting effect.

The healthcare segment generated the largest share of more than 27% in 2023. Antimicrobial additives for plastic or polymer provide ample protection against healthcare-associated infections. Numerous medical equipment come in direct contact with skin, and many of them are even inserted into the body; this creates a potential risk of passing infections. Considering this significant concern, the healthcare industry is increasingly utilizing antimicrobial plastic equipment.

The food and beverage segment is expected to acquire the largest share of the market during the projected period. The growth of the food and beverage segment is driven by the rising incorporation of antimicrobial additives in food products to enhance their shelf life and increase food safety. The food and beverage segment shows requirements for organic antimicrobial additives.

Furthermore, automotive is another segment of the antimicrobial additives market. Antimicrobial additives are utilized in the automotive industry to keep the touchpoints such as steering, seats, windows, fuel tank, and door handles clean and clear. However, the segment shows steady growth in the global antimicrobial additives market.

By Product Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

July 2024

February 2025